Altcoin

Baby Doge coin price prediction: Is a pullback likely after 115% rally

Baby Doge bulls aim to restest key resistance levels but consolidation at current levels could stall the rally as traders anticipate a potential pullback.

- Baby Doge’s impressive recovery has positioned the meme coin above key moving averages.

- The memecoin was now in a relatively high liquidity zone, signaling chances of near-term consolidation in its newly found oscillation range.

At the time of writing, BABYDOGE was trading near $0.0000000018 after struggling to maintain the momentum it picked up during the recent surge.

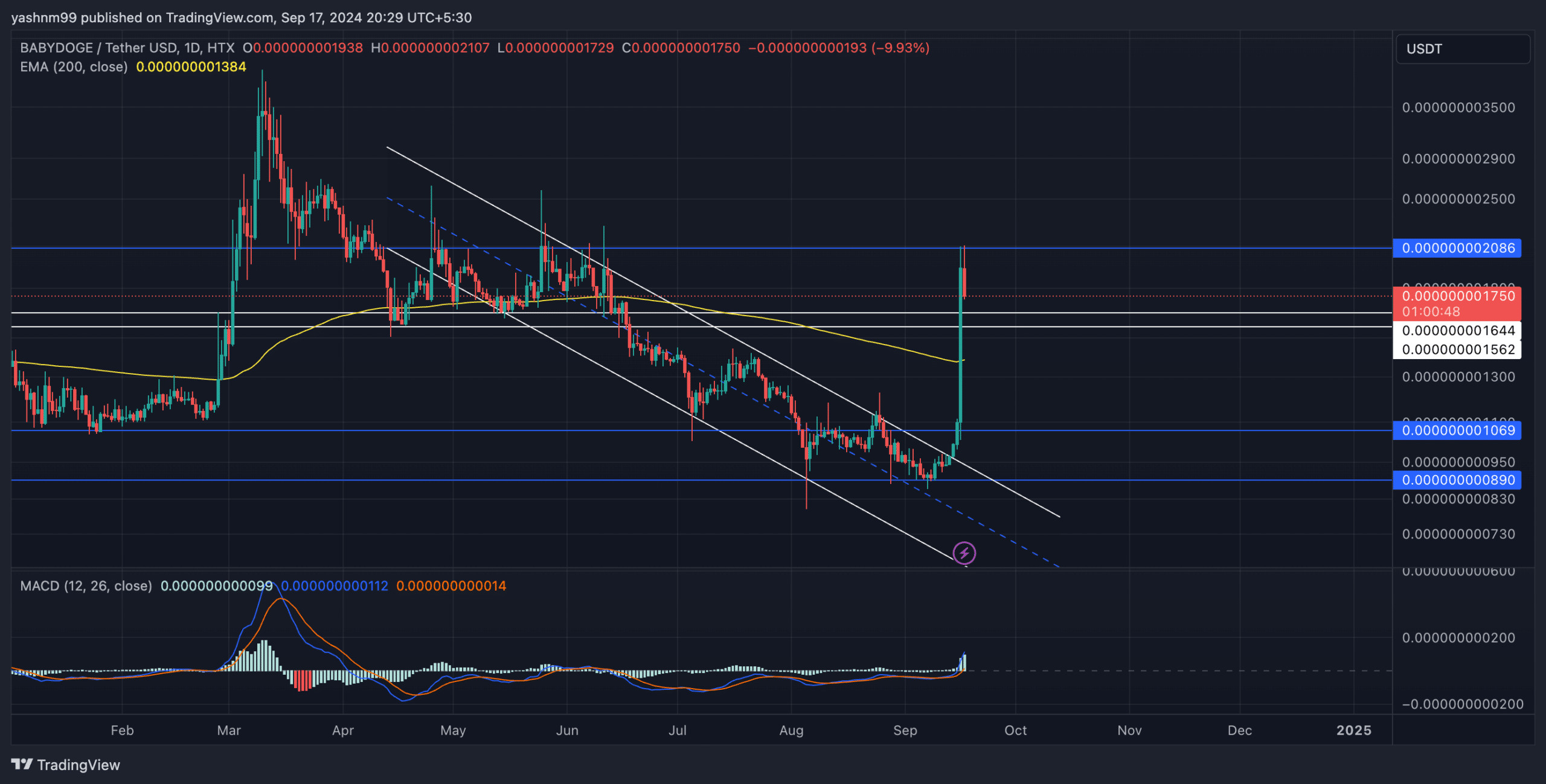

The price action recently saw the meme coin leap above its 200-day EMA, signaling that bulls regained control.

Baby doge coin price prediction: Will consolidation follow the breakout?

The recent sharp rebound has placed Baby Doge in a high-liquidity zone, where some consolidation between $0.0000000015 and $0.000000002 could be expected. A likely pullback toward the $0.0000000015 baseline may be on the horizon, especially if profit-taking kicks in.

If Baby Doge manages to stabilize above $0.0000000015, a retest of the $0.000000002 resistance level could follow soon after. A sustained close above this resistance could allow the bulls to aim for $0.0000000024 in the next leg up.

However, if sellers reclaim control, the price may revisit the $0.0000000013 support level near the 200 EMA before making another attempt at the upside.

The MACD indicator showed that the MACD line is above the signal line after a bullish crossover. This momentum shift aligned with the recent breakout but could also hint at some cooling off in the short term as the rally seems to be losing steam.

It’s also worth noting that the price was in a high-liquidity zone at the time of writing, where consolidation or a minor retracement could be likely.

Derivates data shows…

The long/short ratio over the last 24 hours stood at 0.6166, indicating a stronger preference for short positions across exchanges like Binance and OKX.

This suggested that traders were cautious, possibly anticipating a near-term pullback. However, the liquidation data revealed that a few long positions were rekt in the past 12 hours, while no significant short liquidations were observed.

If buyers manage to defend the $0.0000000015 support, Baby Doge could target $0.000000002 and potentially break higher toward $0.0000000024. On the flip side, a decisive break below $0.0000000015 may slow down the bullish momentum and bring back consolidation.

Traders should monitor the MACD and derivatives data closely to gauge whether the bulls will maintain their lead or if the bears are set to make a comeback.