Babylon staking launch takes Bitcoin transaction fees to 60 BTC: What now?

- Bitcoin’s transaction fee has increased from 0.5 to 60.

- Miners also saw a spike in revenue due to the fee spike.

Bitcoin [BTC] transaction fees have spiked to their highest level in over two months, leading traders to question the sudden cost increase.

This surge in fees is largely due to the recent launch of the Babylon staking service, which has significantly increased network activity and demand for transactions, driving up the fees.

Babylon staking causes fee spike

On the 22nd of August, traders observed a sharp spike in Bitcoin transaction fees, with fees soaring from 0.5 to 60 Bitcoin per hour.

Analysis revealed that this increase was driven by the Babylon staking activities following its mainnet launch.

Babylon introduced a staking protocol allowing Bitcoin holders to lock their assets using a self-custodial script. It is designed to enhance the security of Proof-of-Stake (PoS) networks.

The initial phase of this launch capped the staking supply at 1,000 Bitcoins. It is supported by over 200 finality providers, similar to PoS validators.

Now that the staking limit has been reached, Bitcoin transaction costs have returned to their normal trend.

Winner of the Babylon staking spike

Analysis of Bitcoin’s fee trend revealed a significant spike on the 22nd of August, coinciding with the launch of the Babylon staking service.

Data from CryptoQuant showed that transaction fees surged to over 100 BTC, equivalent to more than $6 million.

This is a substantial increase compared to the daily fees earlier in the month, which typically hovered around eight BTC, with the previous high being 10 BTC.

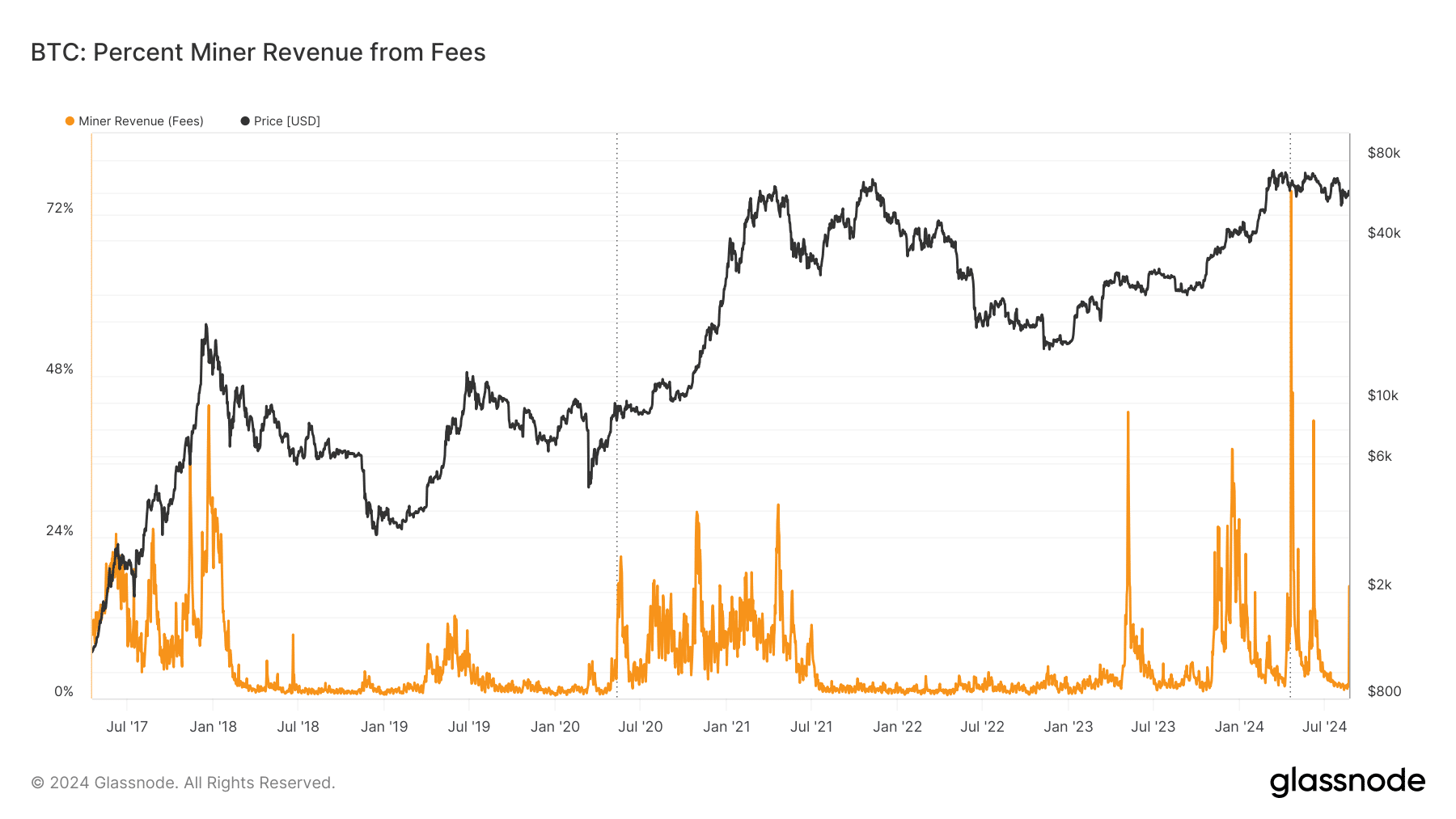

Further analysis of miner fees indicated a similar spike. According to a chart from Glassnode, miner fees jumped to over 16.7%, marking the highest level seen this month after a period of decline.

Before this spike, miners were grappling with reduced profitability due to the halving of rewards, increased network difficulty, and a decline in Bitcoin’s price.

The Babylon staking launch provided a temporary boost to miner revenue, offering some relief amidst the challenging conditions.

More interest in Bitcoin

Following the spike in Bitcoin transaction fees triggered by the Babylon staking launch, BTC’s Open Interest also experienced an uptrend.

Analysis from Coinglass indicated that the BTC’s Open Interest has risen slightly over the past 24 hours. As of this writing, Open Interest stood at over $31 billion.

Read Bitcoin’s [BTC] Price Prediction 2024-25

This marked a significant uptick, as just a few days ago, Open Interest was around $30 billion. The trend indicates that nearly $1 billion has flowed into the market within a few hours.

Furthermore, this surge reflected growing trader engagement and activity in the Bitcoin market amidst the recent developments.

![Sonic [S] sees $1.4 billion liquidity surge as network upgrade sparks investor interest](https://ambcrypto.com/wp-content/uploads/2025/03/F0D8CF78-0B88-471B-BD85-84A9F049FDBA-400x240.webp)