Base outage: Examining the impact on TVL and volume

- Base saw a network outage on 5 September that lasted over an hour.

- The TVL seemed to drop due to the downtime experienced.

On 5 September, Base made a public announcement acknowledging a network outage that resulted in delays in block production. According to their statement, this downtime was primarily attributed to the need for a refresh in their internal infrastructure.

Earlier today we had a delay in block production due in part to our internal infrastructure requiring a refresh.

The issue has been identified and remediated. No funds are at risk.

To stay updated, check https://t.co/ipa94DPBLq

— Base ?️ (@BuildOnBase) September 5, 2023

Importantly, they assured customers that no funds were at risk during this incident.

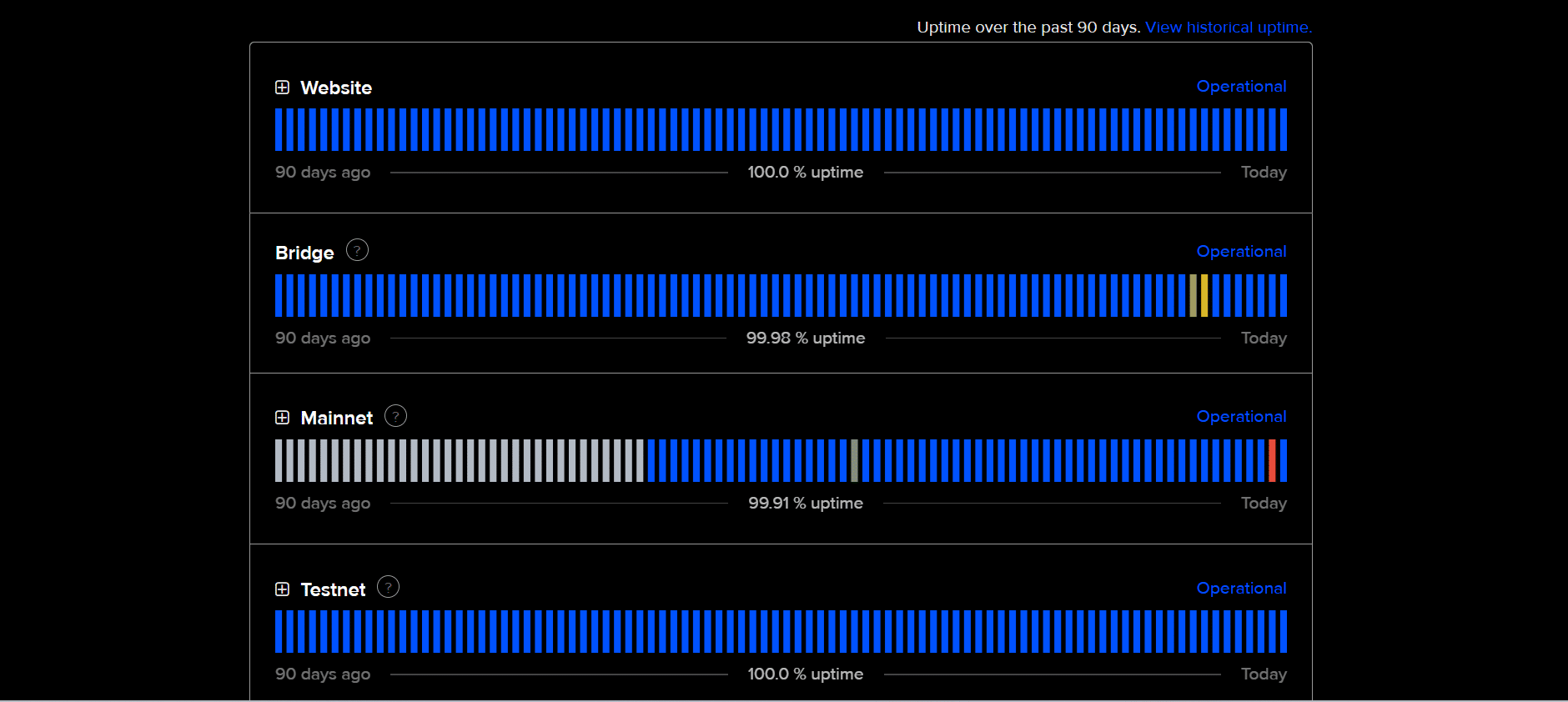

During the outage on 5 September, the network was down for more than an hour. Additionally, the status checker indicated that five network components experienced major outages, while one component had a partial outage.

However, as of this writing, the status reflected a 100% uptime, indicating that all these issues have been successfully resolved.

A broader look at the network’s performance over the past 90 days showed that the mainnet experienced a partial outage on 30 July. Furthermore, the bridge component had outages on 29 and 30 August, lasting for 20 and 51 minutes, respectively.

Nevertheless, as of this writing, all system components were operating at 100% uptime, suggesting that any previous issues have been effectively addressed and resolved.

Source: status.base

Impact on TVL and volume?

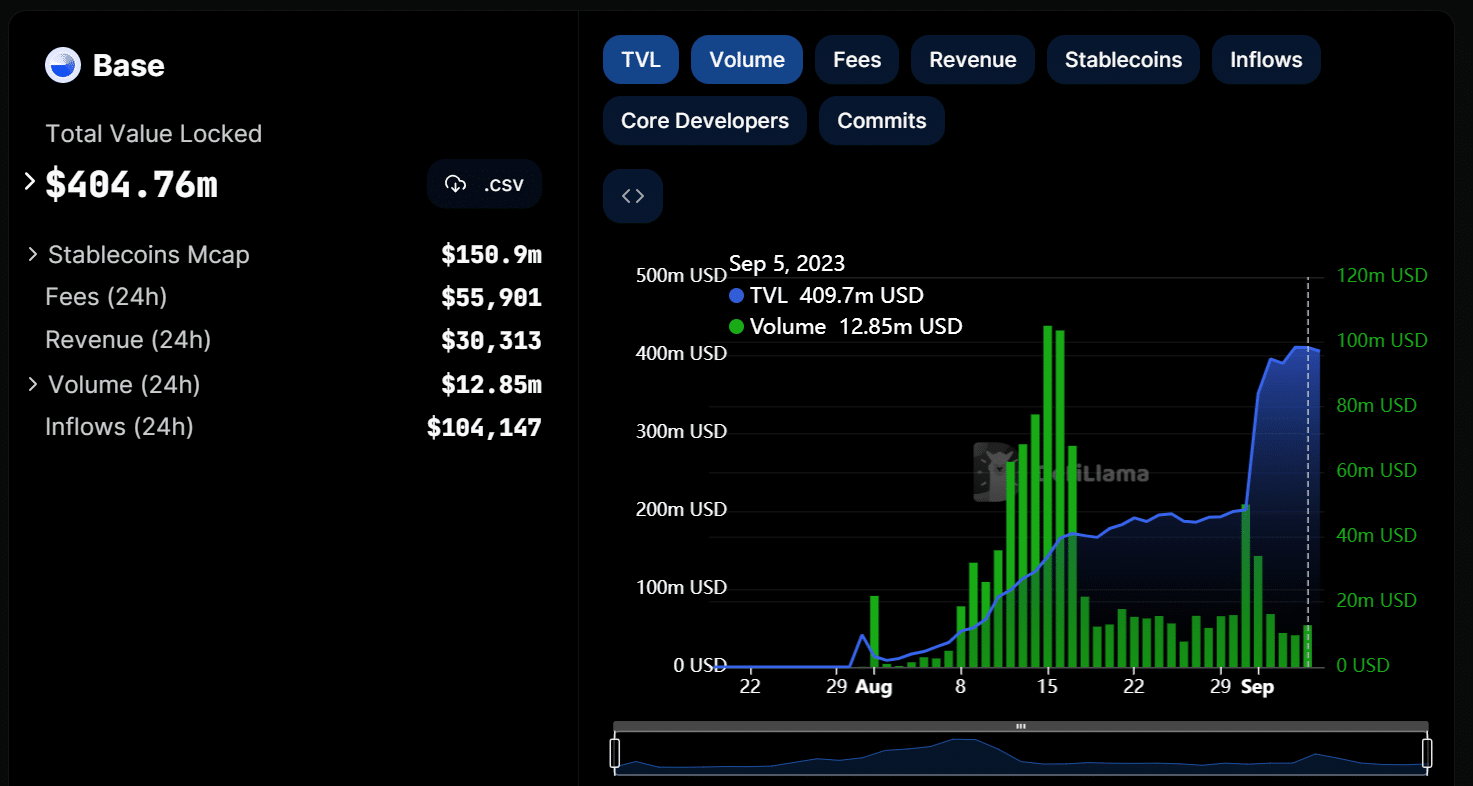

Data from DefiLlama revealed a minor decrease in the Total Value Locked (TVL) on Base since the beginning of September. Nevertheless, it’s important to note that the overall trend for TVL has been significantly positive in the same period.

Notably, it has experienced substantial growth, approximately doubling in value compared to the end of August.

Source: DefiLlama

As of 5 September, the TVL stood at approximately $410 million, but as of this writing, it had declined slightly to around $405 million. However, it’s worth highlighting that the recorded trading volume did not display any signs of decline.

Specifically, the volume was approximately $13 million at press time.

State of Base stablecoin market cap after native USDC integration

The integration of the native USD Coin [USDC] stablecoin on Base has positively impacted the stablecoin market cap, as evident from data on DefiLlama. The chart demonstrated a significant surge in the market cap at the start of September, reaching a peak of over $159 billion.

In contrast, by the end of August, the market cap stood at around $67 billion. This indicated a nearly 50% increase in value during September. As of this writing, the stablecoin market cap was approximately $151 billion.

![Dogecoin [DOGE] drops 16% – But is a $0.25 rally now loading?](https://ambcrypto.com/wp-content/uploads/2025/06/08519350-41B0-4D47-8530-DADB272A4AD3-400x240.webp)