BCH faced rejection at $250; here’s why the bulls can try again and succeed

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Bitcoin Cash has a solid support zone just below the $230 mark

- Although it offers a good risk-to-reward buying opportunity, short-term market sentiment could dissuade BCH bulls

Bitcoin Cash [BCH] bulls forced a breakout past $230 last week and propelled prices as high as $256. Yet, their momentum waned on Monday, 2 October and the price was swift to slump toward the $230 support zone.

Read Bitcoin Cash’s [BCH] Price Prediction 2023-24

A previous analysis from AMBCrypto of Bitcoin Cash’s price action highlighted the bullish market structure shift. The article noted a push toward $250 and higher was possible. While we got the move to $250, the bulls couldn’t sustain further gains. Will they rest and recharge before forcing another move northward?

The bullish breaker block was key to the short-term bullish prospects

The $220.3-$228 region was a former bearish order block from 29 August. It was broken and retested as a bullish breaker block on 27 September. However, the market structure on the 4-hour chart was bearish as the recent low at $232.8 was cracked.

A set of Fibonacci retracement levels (yellow) was plotted based on the late September BCH rally. It showed the 61.8% and 78.6% retracement levels were at $222.7 and $213.5 respectively. The confluence of the breaker block with the 61.8% level meant that the $222-$230 region was a hefty demand zone that bears might not be able to fracture.

The shift in the H4 market structure was accompanied by a drop in the Relative Strength Index (RSI) below neutral 50. The On-Balance Volume (OBV), which had been trending higher, dived lower over the past two days. Despite these developments, it could be profitable to buy Bitcoin Cash at the $222-$230 region targeting the $256 and 23.6% extension level at $269 to take profit.

Does the shift in structure and bearish sentiment make buying BCH too risky to justify?

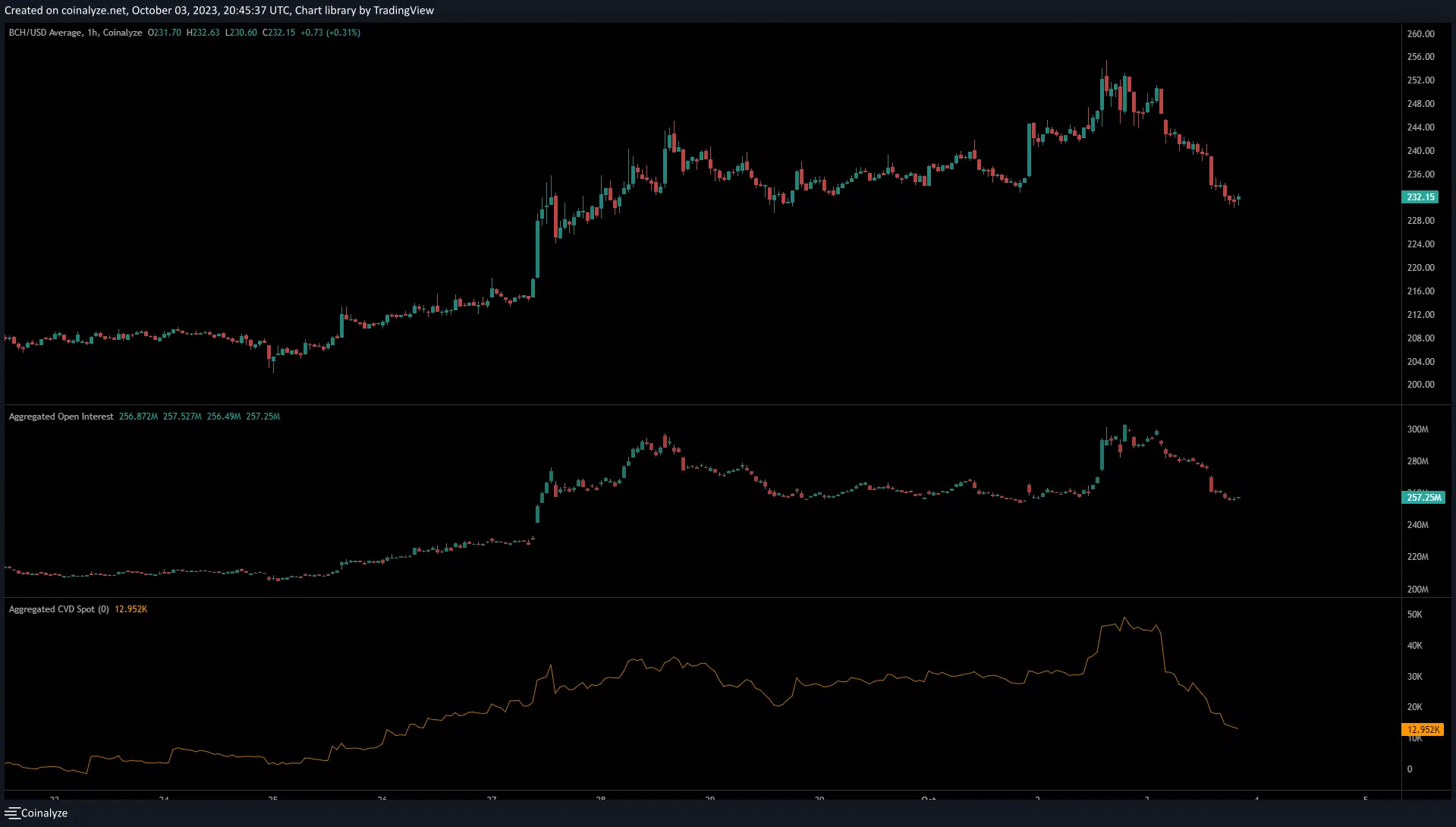

Source: Coinalyze

Not only was the market structure in the lower timeframes bearish, but the sentiment was as well and the pullback saw a drop in the Open Interest. Together the falling prices and OI signaled bearish sentiment.

Is your portfolio green? Check the Bitcoin Cash Profit Calculator

Moreover the spot Cumulative Volume Delta (CVD), like the OBV, also plummeted downward to indicate enormous selling pressure in the spot markets. This was an ominous sign for buyers, especially risk-averse ones. Hence, instead of buying BCH at the demand zone mentioned above, traders can also wait for the one-hour chart to flip its structure bullishly before looking to enter long positions.