Analysis

BCH traders can make steady gains if they target these levels

Bitcoin Cash [BCH] may have to cross a major hurdle for traders to see some winds. Dwindling selling pressure at the critical $248 price level could offer a chance for a bullish rebound.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Bearish momentum stalled at key price level providing an opportunity for a bullish rebound.

- The rising mean coin age hinted at network-wide accumulation.

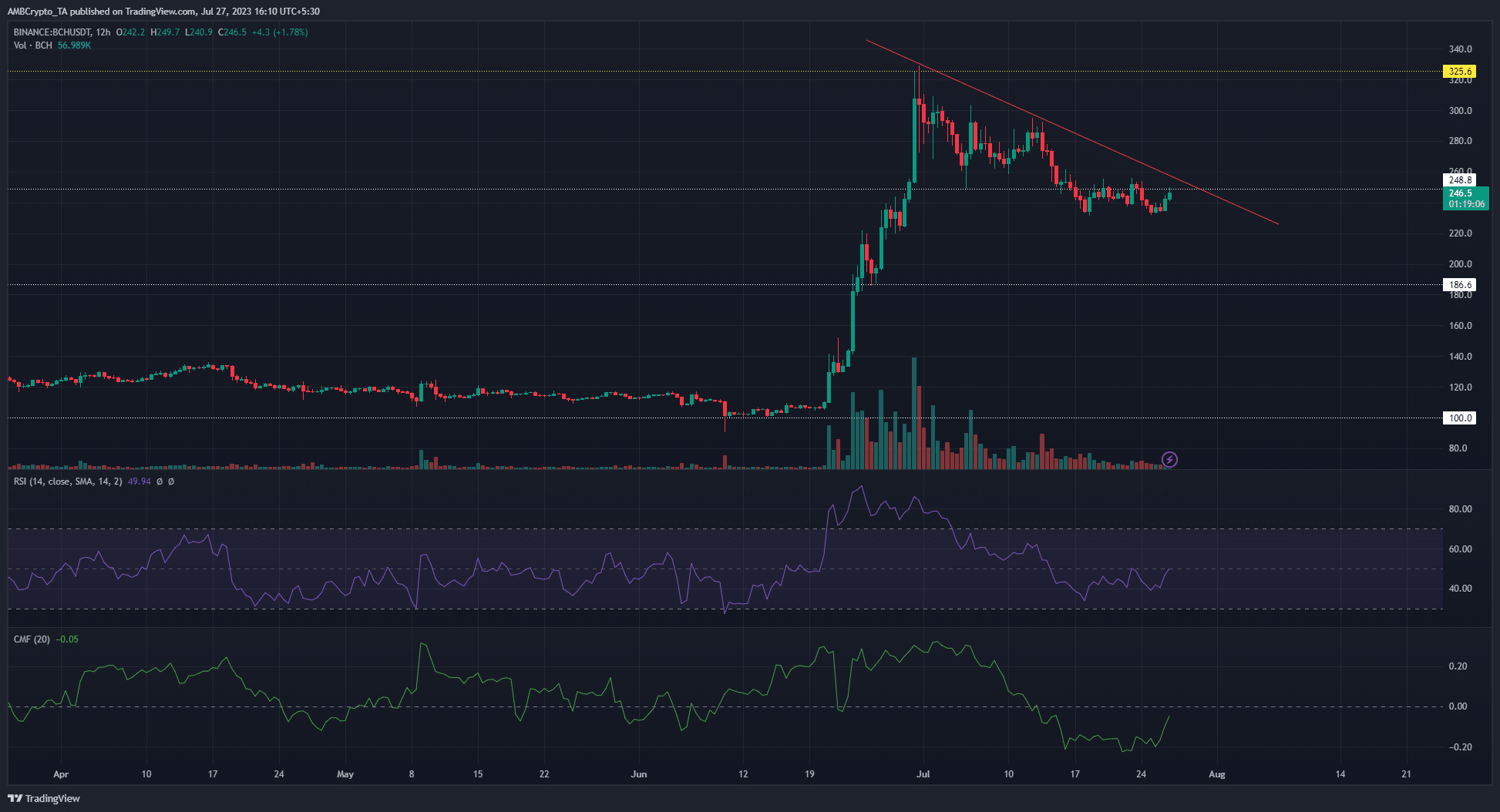

Bitcoin Cash’s [BCH] bullish rally reached its zenith at the $325 price zone. Since then, it has succumbed to the selling pressure on the higher timeframes. The bearish takeover has seen BCH register lower highs, as it dipped under the key $248 support level.

Read Bitcoin Cash’s [BCH] Price Prediction 2023-24

However, the altcoin’s recent price action pointed to a bullish comeback on the horizon. BCH pumped by 5% over the past day and on-chart indicators showed a bullish rally could be close.

Meanwhile, Bitcoin [BTC] rallied from $29.2k to $29.6k over the same period, although it eased to $29.5k, as of press time.

Critical price level holds the key to a bullish comeback

The 12-hour chart for BCH showed that price hovered around the $248 price level between 17 July to 27 July. This highlighted it as a critical price level for both bears and bulls. For bears, the level signaled a waning of the selling pressure while for bulls, it presented a strong level for a price reversal.

At the time of writing, the Relative Strength Index (RSI) climbed from the oversold region and stood at the neutral 50 mark. Similarly, the Chaikin Money Flow (CMF) moved from the negative territory toward the zero mark. Taken together, they pointed to increased buying activity.

While bulls signaled their intent, a major hurdle will need to be crossed for sustained gains. The confluence of the bearish trendline with the resistance level could be a major obstacle to a bullish comeback.

If bulls clear the confluence hurdle, buyers can target the $280 – $300 price zone for steady gains. An inability to surmount the hurdle could see aggressive bears aim for the $200 – $220 price zone.

Rising mean coin age suggested bulls have been active

How much are 1,10,100 BCH worth today?

Data from Santiment highlighted the bullish sentiment by market speculators. The mean coin age has been on a steady rise since 7 July. This hinted at an accumulation trend, due to the dwindling sell pressure.

Also, the 30d Market Value to Realized Value (MVRV) ratio revealed an undervalued asset with a reading of -8.07%. With the price at a critical level, both metrics suggested that buyers could rally BCH again.