PEPE, WIF prices fall by 10% – Here’s what your next move should be

- PEPE and WIF noted some bearish sentiment over the previous day

- Their market structure was firmly bullish

Pepe [PEPE] reached a new local high at $0.0000108, as did dogwifhat [WIF] which touched the $3.56 mark. However, the higher timeframes showed that the trend remained bullish.

Yet, with Bitcoin [BTC] down 7% from $73.7k to $68.4k at press time, fears of a market correction had some grounds. Here’s what technical analysis of the meme coin revealed.

The lower timeframe momentum is bullish for both coins

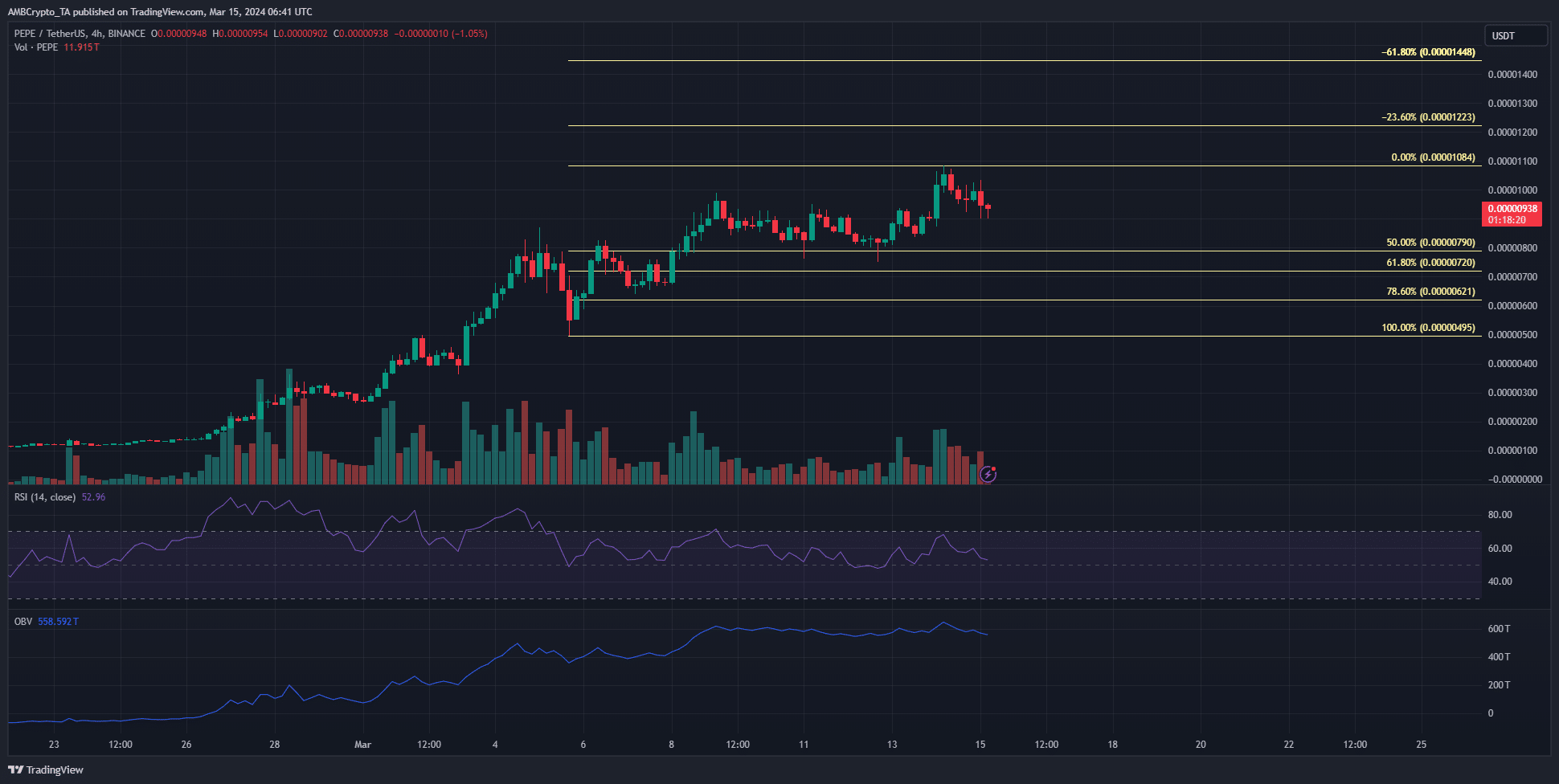

The RSI of PEPE on the 4-hour chart remained above the neutral 50 mark throughout March. This showed that the momentum continued to favor the bulls. The market structure was also bullish.

The Fibonacci retracement levels showed that a move to the 61.8%-78.6% region was possible. The OBV has remained flat over the past week to indicate a lack of buying volume. Hence, neither side had control over the market in recent days.

If PEPE begins to drop below the $0.0000079 support zone, buyers could look to re-enter the aforementioned demand zone based on the Fibonacci retracement levels.

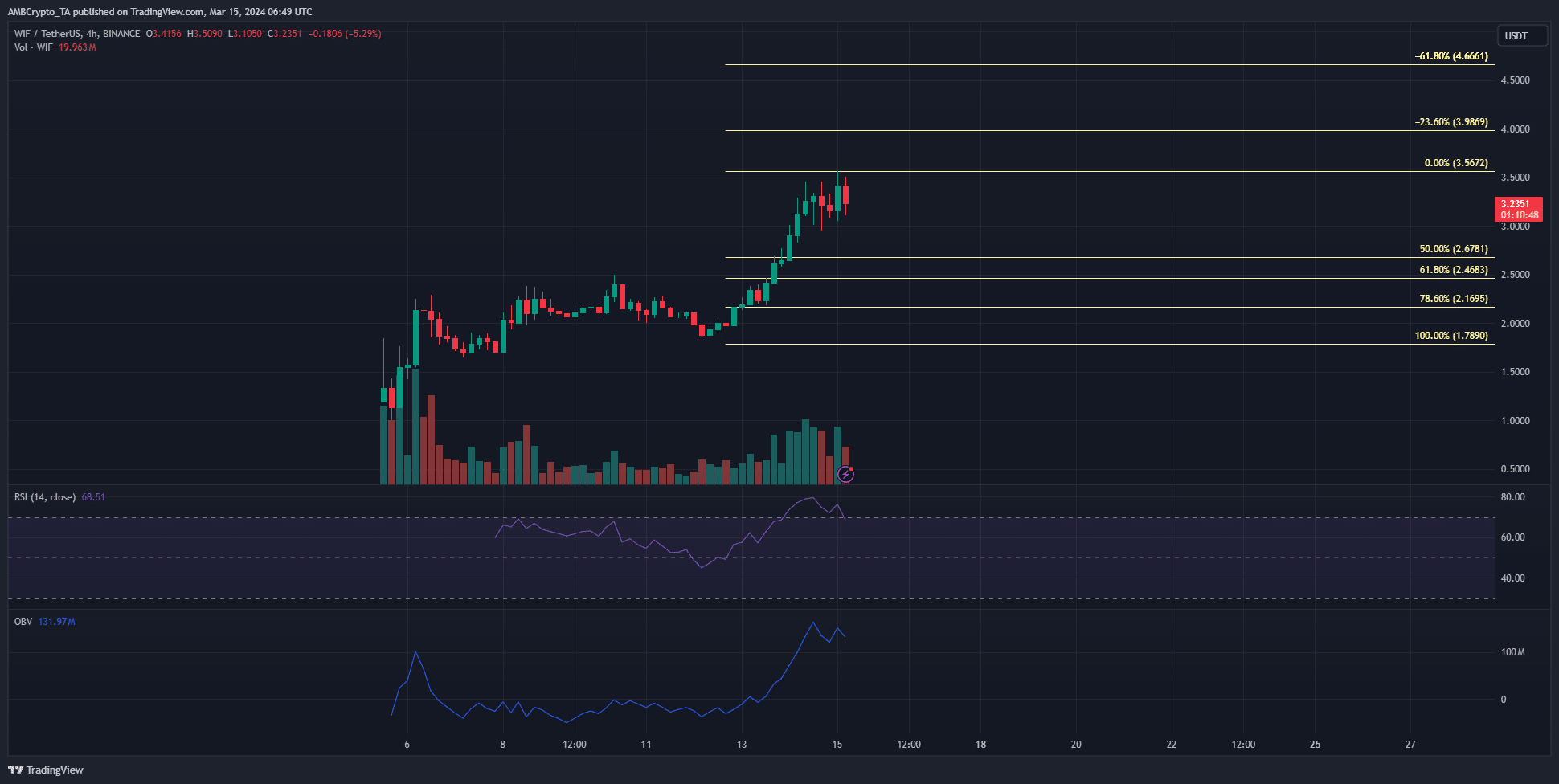

The chart of WIF showed that the memecoin has a bullish trajectory. The trading volume has been high over the past couple of days and the OBV soared upward. This indicated that demand far outweighed the selling pressure.

The RSI was falling below the overbought territory. The momentum has slowed down but was still strongly bullish. The Fibonacci levels plotted were tentative, as the move upward has not yet finished.

The $3 psychological support zone has held firm thus far, but a drop below this level could see the $2.17-$2.46 area retested. This would likely provide a bullish reaction.

Speculative bullish conviction for WIF stood firm, but not PEPE

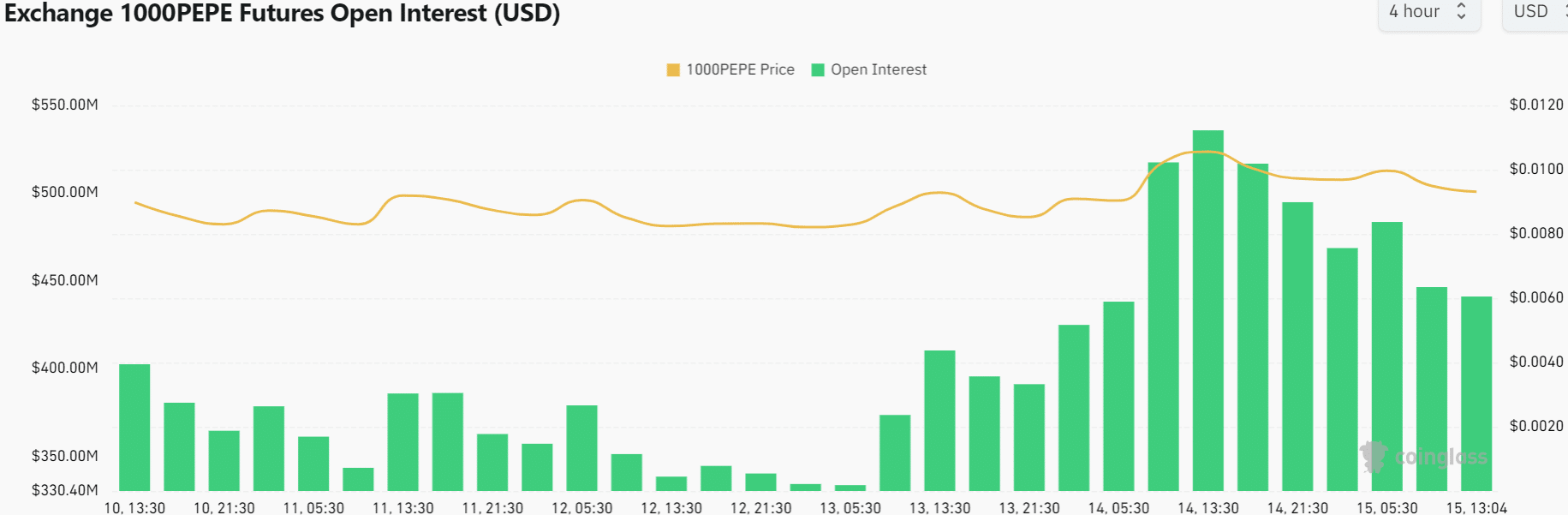

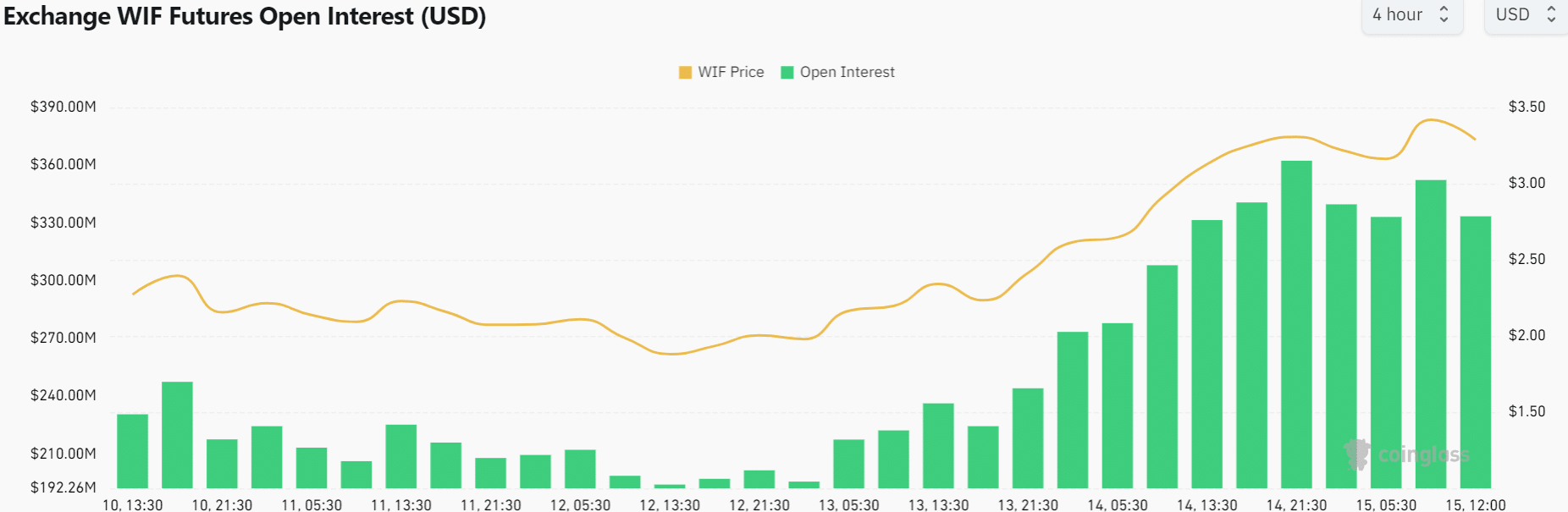

Combining the price action with the Open Interest charts of the meme coins gives insights into what the speculators feel. While WIF showed bullishness, PEPE traders were not as optimistic.

Source: Coinglass

Since the 14th of March, the OI has begun to decline. During that time the price of PEPE declined by more than 10%. The drop in prices and OI highlighted a shift in short-term conviction.

Source: Coinglass

On the other hand, the WIF OI did not drop as sharply. Alongside it, the prices have also trended higher, but OI has not kept pace. Once again, this outlined a weak bearish outlook in the near term.

Realistic or not, here’s PEPE’s market cap in BTC’s terms

Together with Bitcoin’s drop in prices, the possibility of a continued slump if prices were present for both meme coins. Yet, their higher timeframe charts were strongly bullish.

Therefore, buyers could look to add more of these tokens if they revisit key support levels.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.