BERA gains 14% despite $19.4M outflow, but OKX traders bet against the rally

- BERA recorded significant net outflows on-chain, but spot and derivative traders have been accumulating.

- OKX traders remain resistant, with selling volume continuing to outweigh buying pressure.

Berachain [BERA] has emerged as one of the top gainers, rising 14% in the past 24 hours and pushing its weekly gain above 30%, in contrast to other tokens struggling to record gains.

Analysis suggests that the asset still has a clear path to further gains as buying pressure from spot and derivative traders begins to increase.

Spot traders seek to reverse losses

In the past week, Berachain has seen a massive liquidity outflow, as indicated by Artemis, with $19.4 million removed from the chain, which is typically a bearish signal.

However, the recent surge in BERA’s price contradicts this trend.

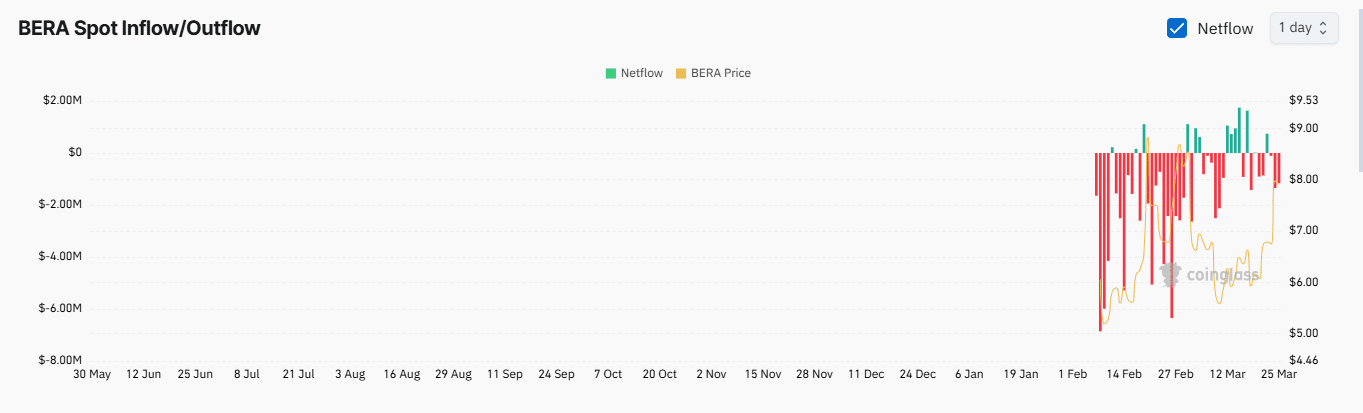

At the time of writing, spot traders have begun stepping in, purchasing $2.8 million worth of BERA in the past three days, as shown by exchange netflow data.

If buying activity extends into the week, it would indicate increased trader optimism, potentially driving BERA to further gains.

Derivatives traders could fuel BERA’s rally

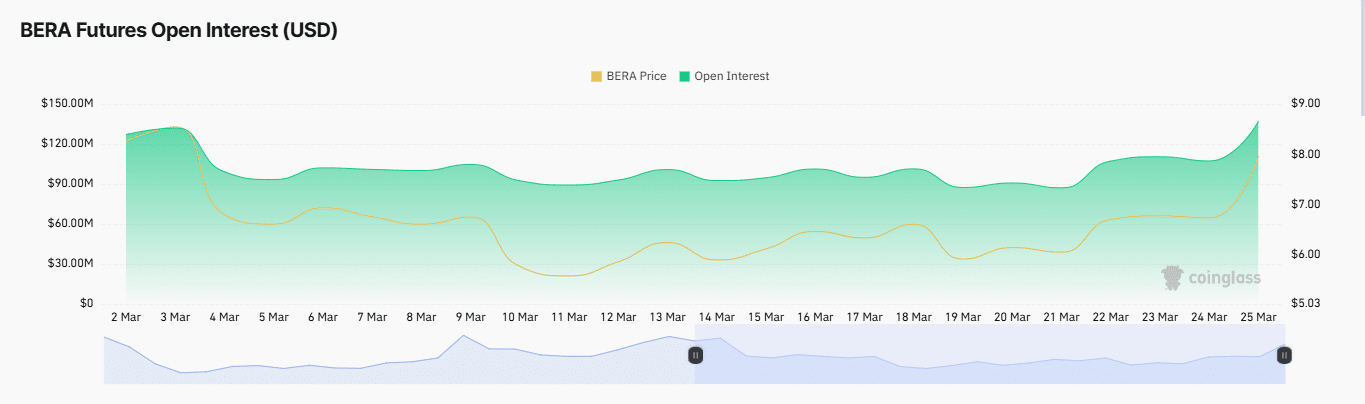

Derivative traders may act as a catalyst for a potential BERA rally. Currently, key indicators suggest a shift in momentum.

In the past 24 hours, BERA’s Open Interest has surged 202.2% to $136.79 million, signaling a notable increase in unsettled derivative contracts.

These contracts could favor either bulls or bears, but rising volume and short liquidations confirm a bullish trend.

BERA’s trading volume has also climbed over 262% to $595 million in the past 24 hours, reflecting heightened market activity that has positively impacted its price.

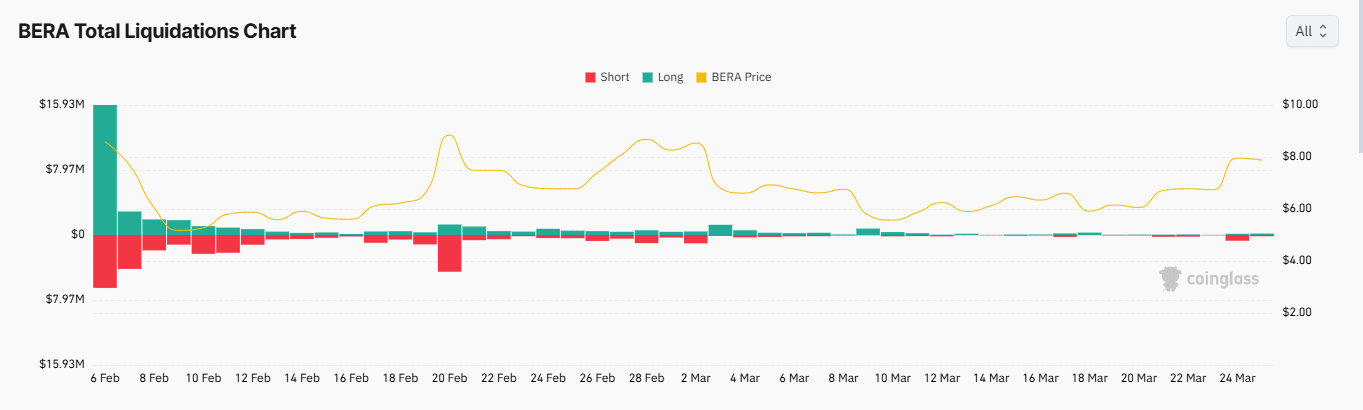

Meanwhile, short liquidations have increased, with traders betting against BERA losing $769,000 as the market moved against them.

When short liquidations outpace long liquidations, it signals strong bullish sentiment, forcing traders to exit their positions at stop-loss levels.

Despite the overall bullish outlook, AMBCrypto found that not all market segments align with BERA’s potential for further gains.

OKX traders resist buying, continue selling BERA

Selling pressure from derivative traders on OKX has intensified over the past day.

According to Coinglass data, the long-to-short ratio, a metric that indicates buying vs. selling activity, currently stands at 0.76 on OKX.

A ratio below 1 suggests selling pressure dominates, and the further it is from 1, the stronger the bearish momentum.

With OKX traders heavily bearish, sustained selling could hinder BERA’s chances of an immediate rally.