Big bets on Bitcoin – Options traders gear up for potential post-election surge

- Large funds expected wild price swings but were bullish on BTC potential.

- However, analysts foresaw BTC sinking lower before a potential rebound.

The outcome of the US election is expected this week, and the market positioning of hedge funds in Bitcoin [BTC] remains arguably bullish despite overall caution.

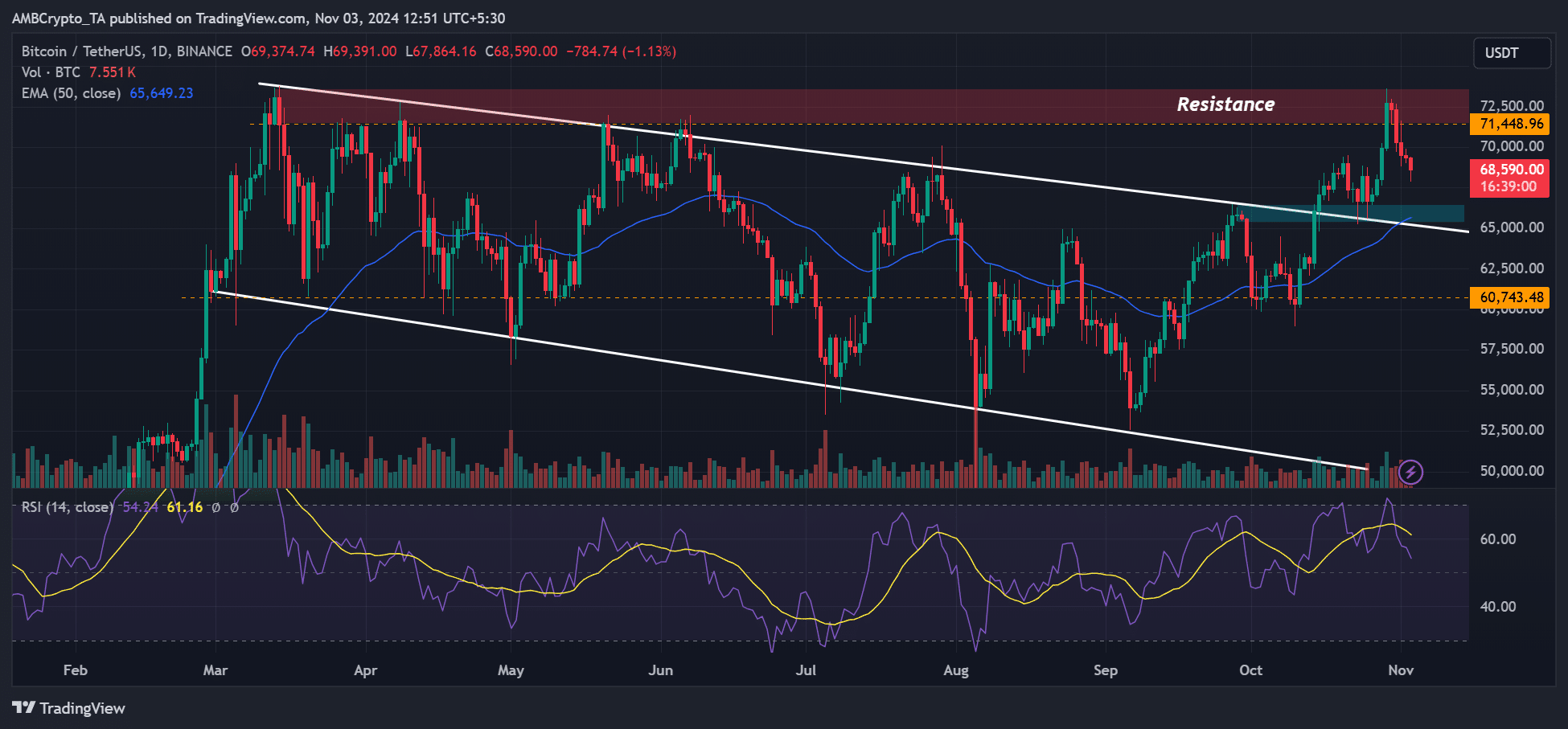

Last week, BTC teased an all-time high (ATH) after surging above $73K on strong BTC ETF demand and increasing odds of Trump winning.

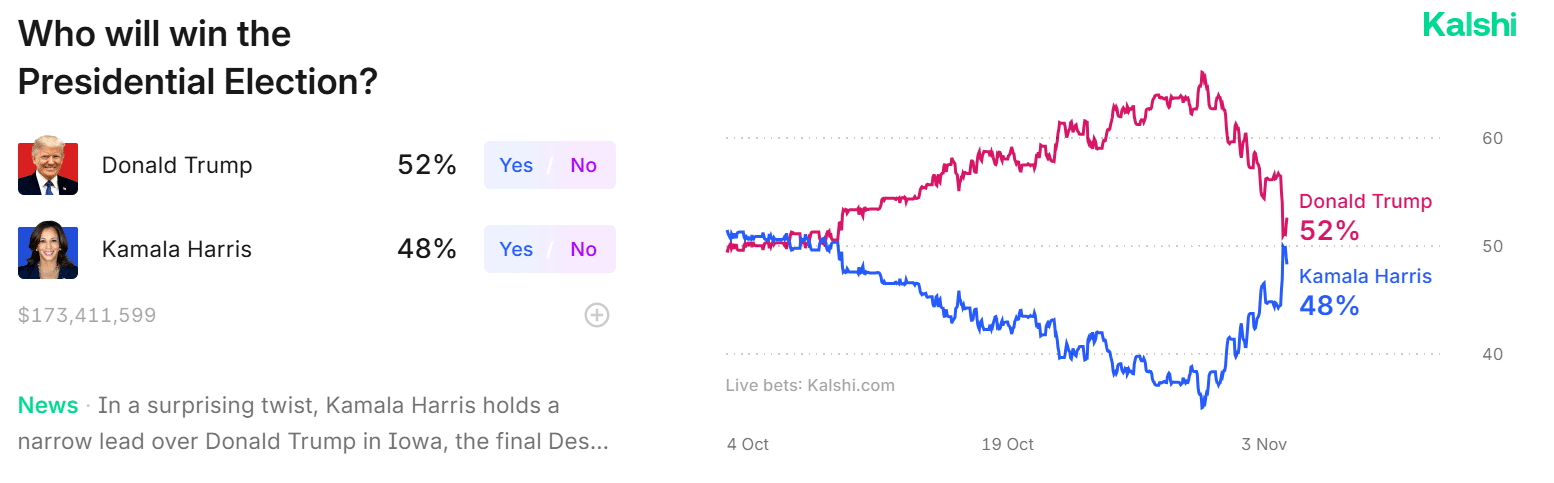

Things were different in the election week. As of the 3rd of November, Kamala Harris had closed in on Trump’s odds on Polymarket and was almost at 50/50 on Kalshi, another prediction site. In short, it was a tight race, and any candidate could win.

Large funds eye $70k-$85k for BTC

Despite the tight race, hedge funds were overwhelmingly bullish, but with covering on either side of the market direction as a precaution.

According to the latest Deribit data, the options market saw massive buying of calls (betting on price upside) for $70K-$85K targets by November. Part of the firm update read,

“Overwhelming Option buying in the Election runup. Large Fund buying echoing (covering?) CME Nov 70+80+85k Call buying with Nov 74-85k Calls +Nov 70k Straddles.”

Additionally, the massive bids on straddles (betting huge price swings) signal expected wild volatility around election day. Large funds bought both calls (upside protection) and put (downside protection) to cover for potential price swings in either direction.

Likely election outcome delay?

However, perhaps the most important piece of the Deribit data was that traders were shifting their focus from 8th November option expiries to 29th November. This signaled an expected prolonged election outcome delay, probably due to controversies or rigging claims.

“Nov 8 still has the bump, but larger flows in Nov 29, perhaps due to less theta decay in case of a prolonged result, have dominated over the week.”

This short-term cautious stance was perhaps what led to the recent de-risking seen in the spot market towards the end of last week.

BTC dropped from last week’s high of $73.6K to below $68K, and some analysts expected it to drop even lower, citing historical patterns around election day.

One of the analysts, Eugene Ng Ah Sio, a crypto trader, said,

“Seeing constructive derisking happen just at the right time. The plot thickens…”

Eugene added that he would avoid the markets until the election outcome is known.

The cautious approach was echoed by crypto trading firm QCP Capital, warning that the election outcome could be a sell-the-news event. It said,

“Regardless of the outcome, we believe the Elections will be another sell-the-news action, replicating the Nashville Bitcoin conference.”

Another market observer and investor, Mike Alfred, shared a similar sentiment but pointed out that this might be the last week to buy BTC below $70K.

“Every previous cycle, Bitcoin has made a low price the week of the US election that has NEVER been revisited again… This week will be the last time you can ever buy Bitcoin below $70,000.”

On the price charts, $65K remained a key level (confluence area) should the pullback extend lower.

However, the positioning of large funds was a tell-tale sign of potential recovery for BTC despite the uncertainty of the election outcome.