Binance announces new feature to bolster trading as BNB continues to record losses

- BNB’s price witnessed the biggest drop in nearly two months.

- The daily active users rebound to a 5-week high in the last 24 hours.

The FUD induced by false alarm of U.S. government selling its Bitcoin [BTC] holdings took a profound impact on the exchange token of the Binance[BNB] ecosystem as well. At one point, BNB plunged to $301, recording the biggest drop in nearly two months.

Is your portfolio green? Check the BNB Profit Calculator

The coin regained some lost ground as it reached $305 at the time of writing, still 1.98% down in the last 24 hours, as per CoinMarketCap.

What could possibly aid BNB on its way to normalcy was the new feature Binance unveiled to improve strategy trading on the platform.

Introducing #Binance's updated Trading Bots.

Automate trades using a number of strategies including:

? Spot Grid

? Futures Grid

? Rebalancing Bots

? Auto-InvestAnd more!

Get all the details here ?

— Binance (@binance) May 11, 2023

Binance’s trading bots

Binance, the world’s largest cryptocurrency exchange, announced the launch of Trading Bots. This signaled a shift away from traditional trading strategies and towards automated trading.

Crypto trading bots are automated software that helps you buy and sell cryptocurrencies at the correct time.

Binance also listed out functions that will be released to users by June 2o23 as part of the implementation.

In addition, Binance said that the Rebalancing Bot account will be renamed as Trading Bots. Under Trading Bots new spot and futures grids could be created.

Furthermore, users will have the option of running futures grids through their Trading Bots account while trading on the same symbol through their futures account at the same time.

Moreover, users will earn hourly trading fee savings for the Trading Bots account when they use their BNB balances.

On-chain activity shoots up

The announcement of the new trading feature catalyzed trading activity on the BNB Chain. After the dip recorded on 10 May, daily active users rebounded to a 5-week high in the last 24 hours.

The surge in the number of users boosted the number of transactions processed on the chain.

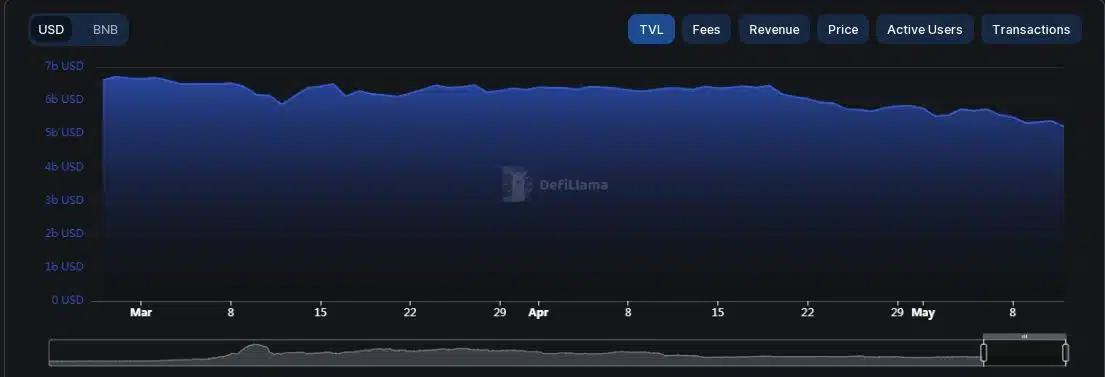

While increased network traffic was a matter of joy for BNB enthusiasts, the chain’s liquidity continued to tumble.

The total value locked (TVL) on the BNB Chain fell by more than 3% in the last 24 hours to $5.22 billion, extending its month-long winless streak.

How much are 1,10,100 BNBs worth today?

Investors turn pessimistic

The development activity on the chain remained tepid after recording a steep fall earlier in the week. This was a worrying sign as it indicated that future enhancements on the chain might be delayed.

Unsurprisingly, this impacted the sentiment of investors as they turned strongly bearish on BNB. However, the supply held by large addresses, which was stagnant until 10 May, showed an uptick in the last 24 hours.