Can BNB bulls clear this major obstacle to hit $257.4?

- BNB was in an uptrend since 17 December.

- It could reach $257.4, according to RSI and DMI metrics.

- However, the active hourly addresses could complicate matters as they could undermine buying pressure in the short run.

Binance Coin [BNB] faced a massive dump last week as the FUD over Mazar’s suspension of its audits and opaque internal organization structure jilted investors. However, bulls found sturdy ground on 17 December and were rallying since.

At press time, BNB was trading at $248.8, up by 50 basis points in the last 24 hours. The asset was poised to regain its lost ground but faced a key obstacle around this level.

Will bulls overcome this short-term obstacle?

The recent uptrend also saw bulls take a breather before continuation. So far, the immediate price pullbacks also set a key resistance area that doubled as a bearish order block around the $250 level.

So, can the bulls overcome the obstacle and move upwards? Technical indicators and on-chain metrics suggest that the bulls could do so.

Notably, the Relative Strength Index (RSI) pivoted to the upside, indicating increased buying pressure. But at press time, it was resting near the neutral-50 mark. This showed that the bears lost considerable leverage as buyers opposed their actions.

In addition, the Directional Movement Index (DMI) showed buyers (green line) had gained ground, indicated by the uptick. Moreover, the sellers (red line) lost ground, as indicated by the downtick. Both had almost equal influence on the current market structure, at the time of writing.

BNB saw an improved outlook in the derivatives markets

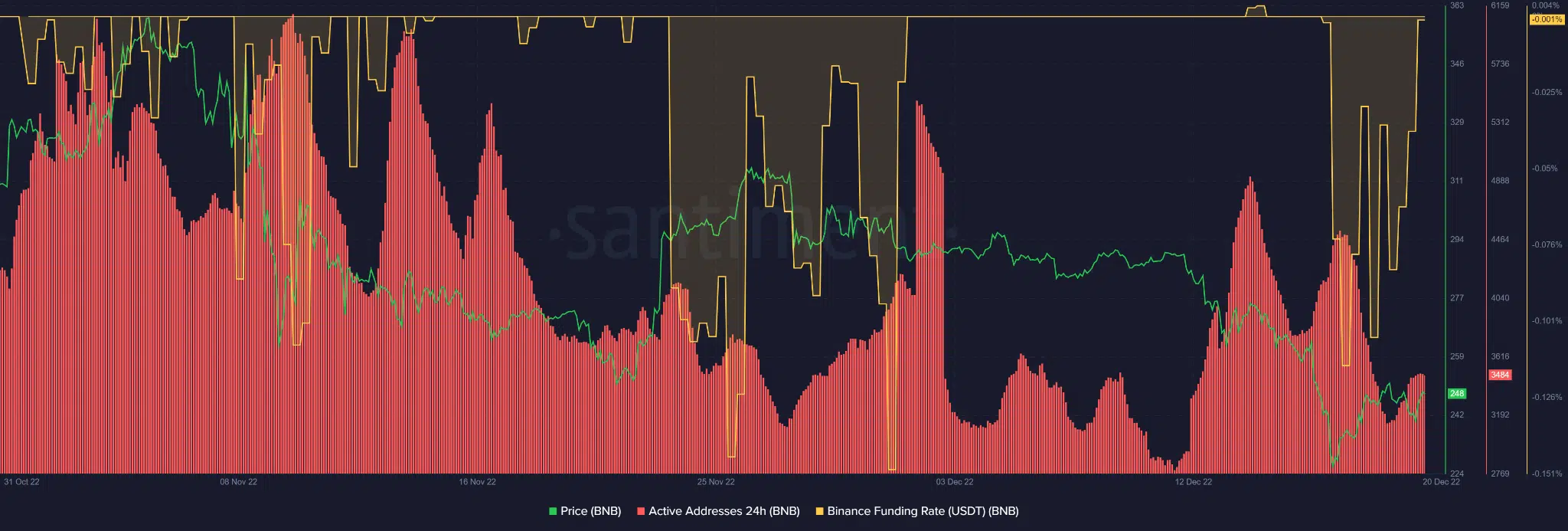

Source: Santiment

On-chain metrics by Santiment suggested that the uptrend could continue. The Binance Funding Rate for USDT/BNB pair increased incredibly, pulling it from the negative zone. At press time, the indicator was almost resting on the neutral zone, showing improved derivatives markets for BNB.

There was also an increased number of active addresses in the past 24 hours. This could imply increasing buying pressure as volume rose. Such an uptrend could see BNB overcome its hurdle and hit the 50-period Moving Average (MA) target at $257.4.

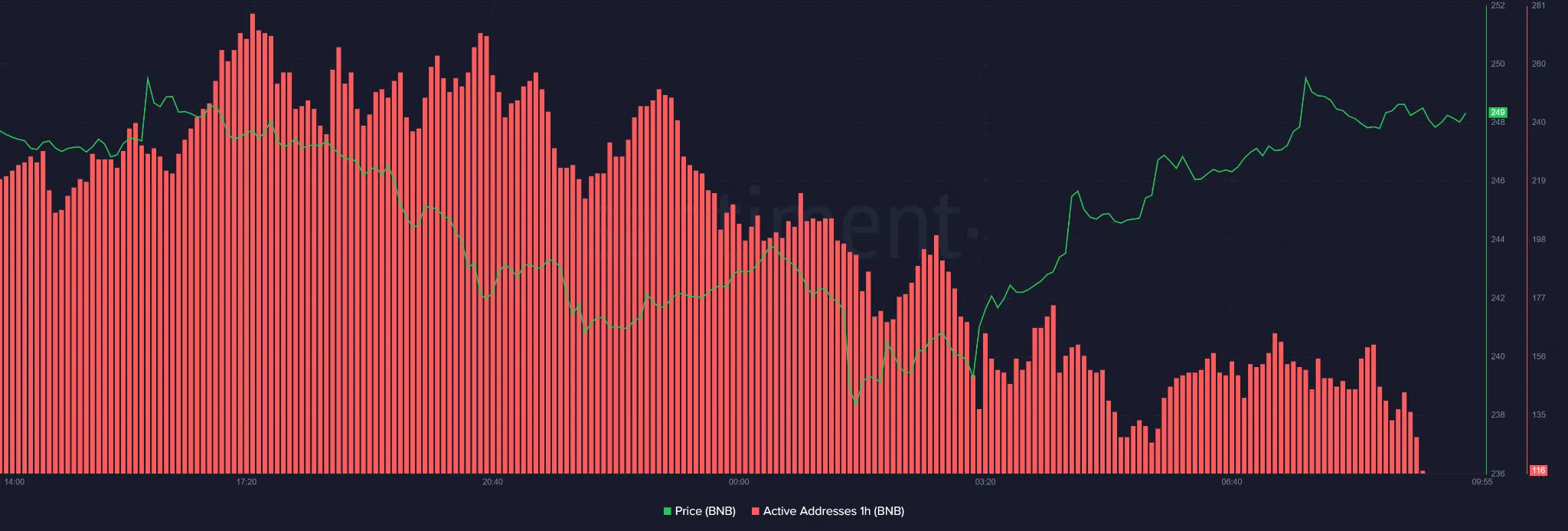

However, the active hourly addresses could complicate things for BNB bulls in the short term. It had dropped significantly and could undermine buying pressure.

Besides, a bearish Bitcoin [BTC] could make the immediate resistance an even bigger obstacle in the next few hours. It could give bears leverage to push BNB toward $245.4 or the 20-period Moving Average (MA) level at $243.5.

So, short-term BNB investors should monitor BTC sentiment to gauge whether BNB can overcome the hurdle.