Binance Coin [BNB] ready to rebound? Buying opportunity arises

![Binance Coin [BNB] ready to rebound? Buying opportunity arises](https://ambcrypto.com/wp-content/uploads/2025/03/BNB-Featured-2-1200x675.webp)

- Binance Coin likely offered a good buying opportunity for investors who believe the cycle isn’t over.

- The on-chain metrics showed accumulation and an influx of new buyers.

The all-time high for Binance Coin [BNB] was at $788, set on the 4th of December 2024. The exchange token is down roughly 20% since then, compared to the 22% that Bitcoin [BTC] has shed since its all-time high at $108.7k.

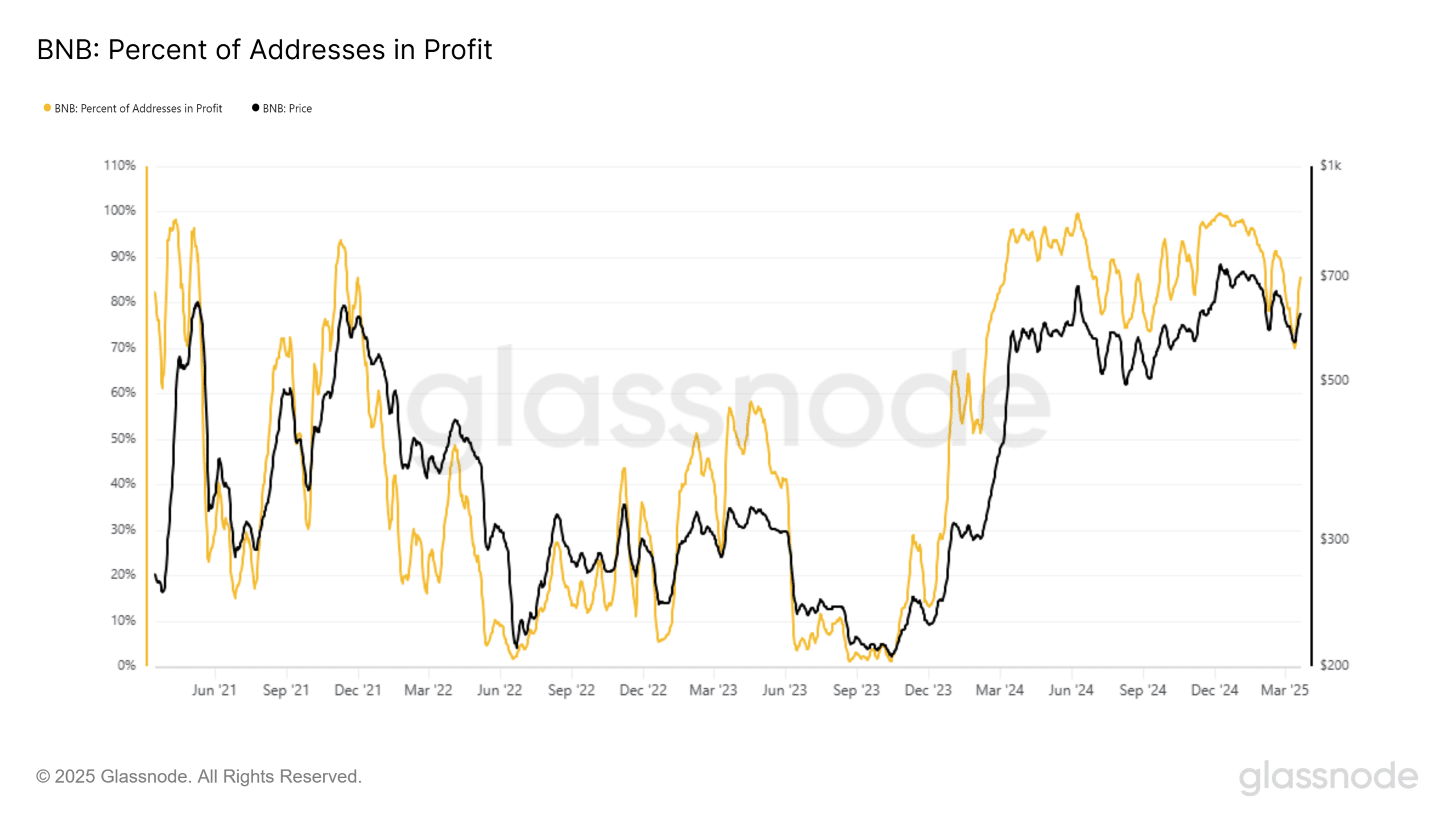

Source: Glassnode

A look at the 7-day moving average percentage addresses in profit metric showed that 85.8% of addresses were in profit. The metric’s 7DMA has been above 75% since February 2024.

This seemed to suggest that a prolonged distribution phase was in play. Could BNB be preparing to move down, or should investors remain patient?

Is BNB undergoing consolidation or accumulation?

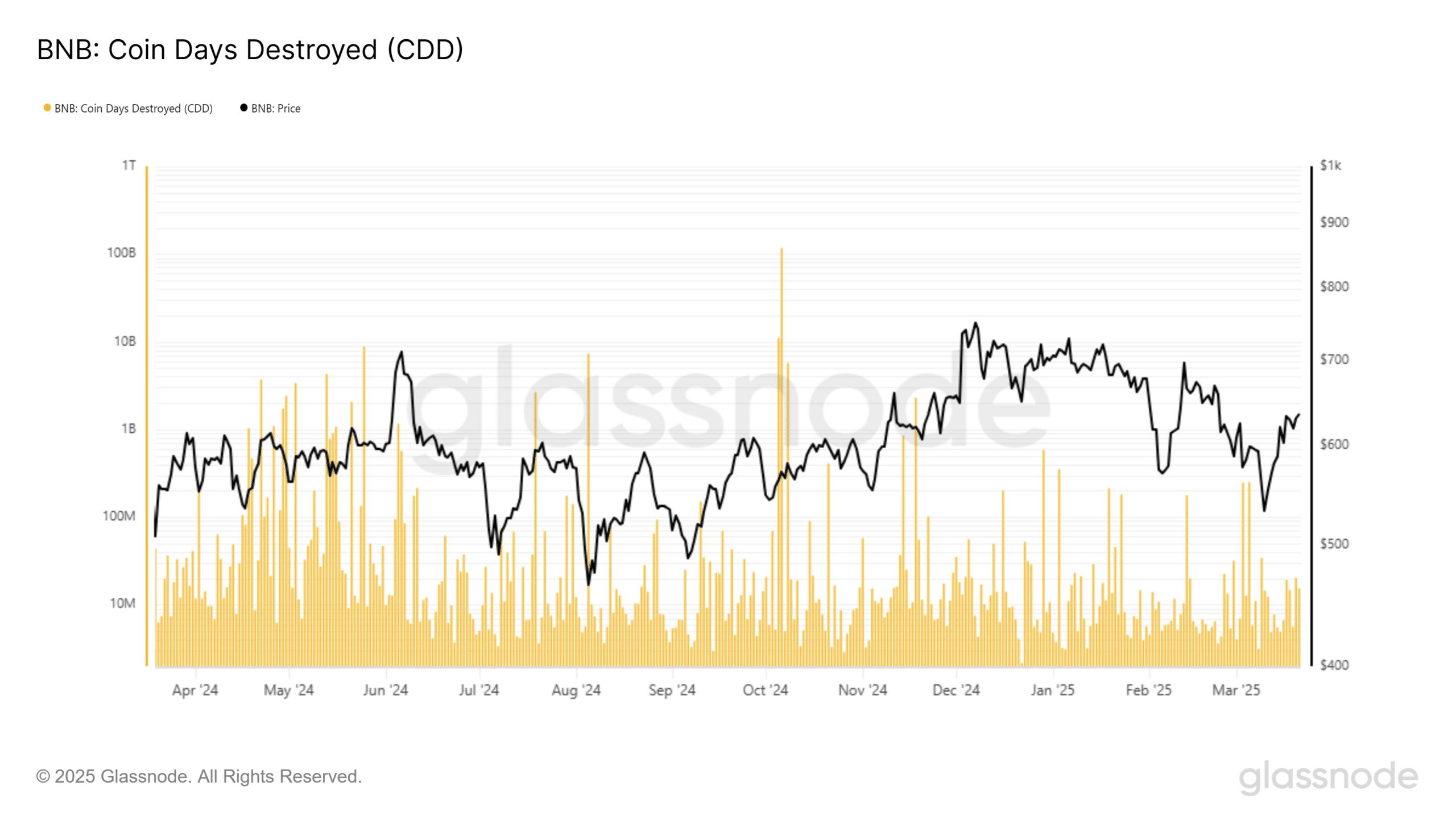

Source: Glassnode

The log chart of the coin days destroyed showed that the last time the metric had a significant spike in CDD was early March, showing brief distribution.

The metric tracks the movement of older coins — higher CDD values are indicative of distribution.

The metric has only sporadically shown high values, such as in early March, early January, and late November. However, it did not resemble the frantic movement from May and early June 2024.

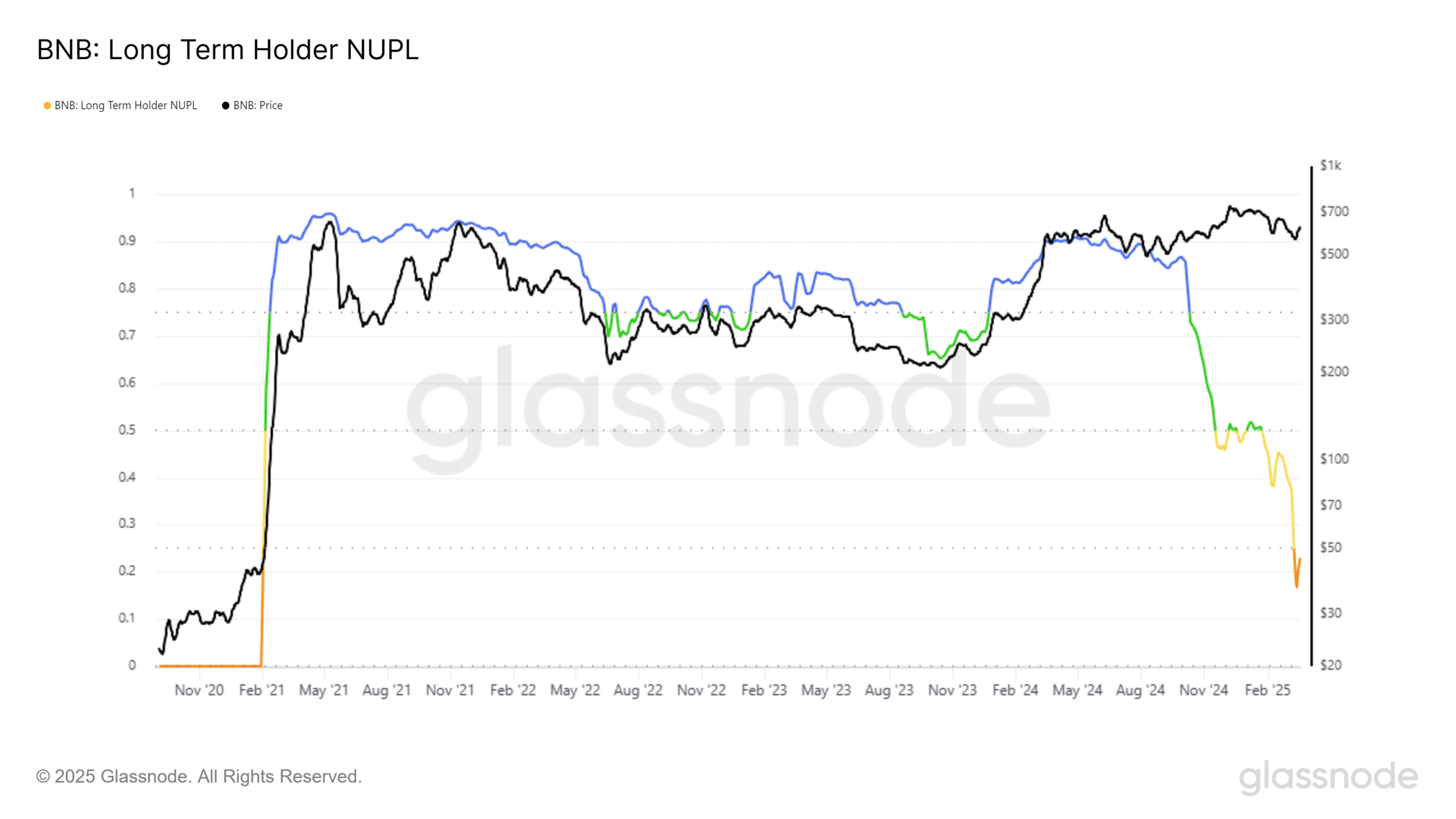

Source: Glassnode

The long-term net unrealized profit-loss (LTH NUPL) metric value corresponded to “fear.” This has not been seen since February 2021.

The long-term investors saw their unrealized losses rising, even as the price remained around $600.

Yet, BNB has not embarked on a long-term downtrend. It was likely that the drop in NUPL in the past two months could mark a local bottom for the token.

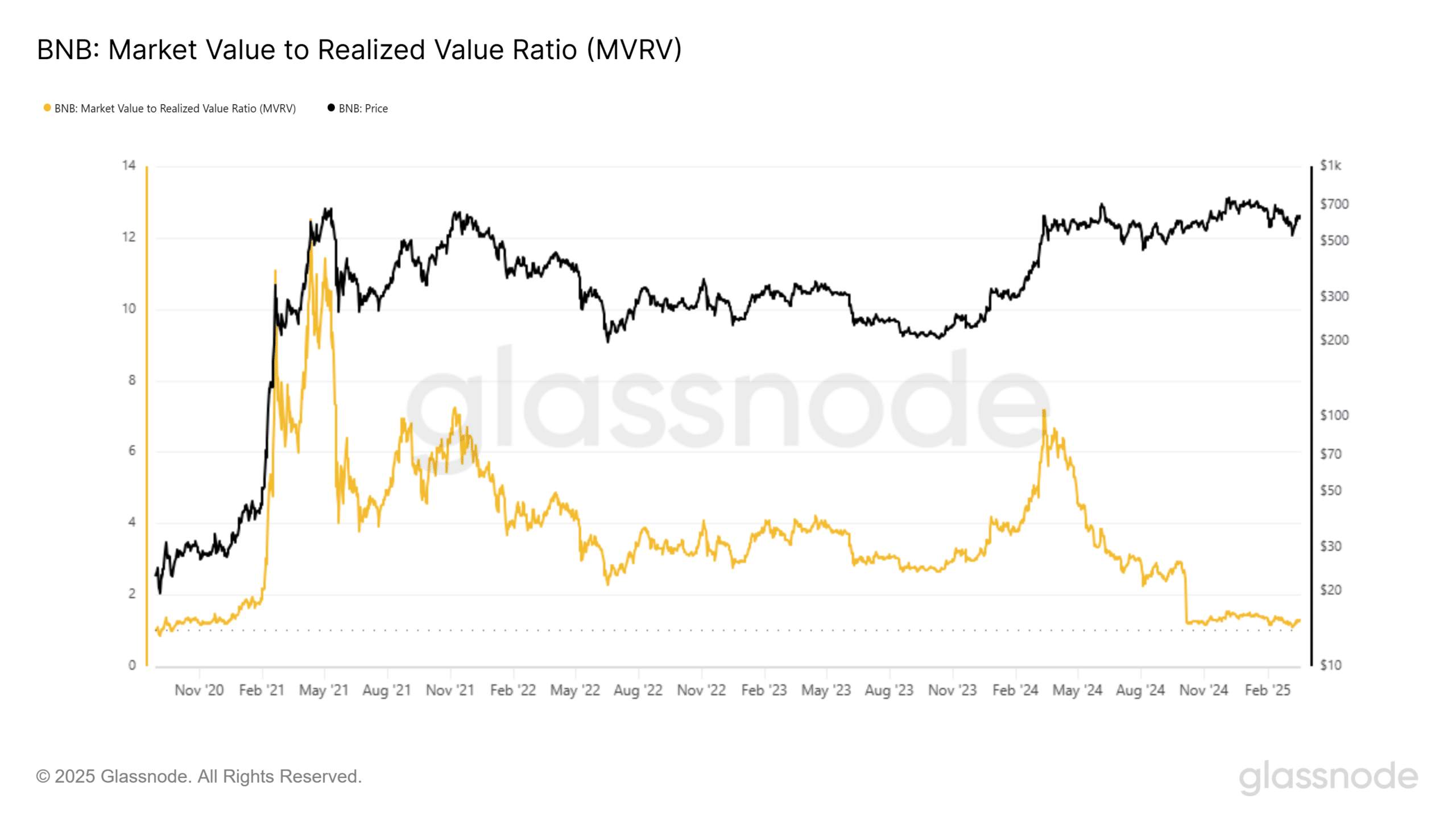

Source: Glassnode

The MVRV ratio has hovered around the 1.2 level since October 2024. Even the steady gains up to December did not push the metric higher.

This indicated new buyers entering the market, keeping the realized value high and the MVRV ratio stable.

Therefore, there was evidence that new buyers entering, and long-term holders weren’t taking profits in large numbers. If they had been, the MVRV would be falling, and the CDD would reflect it.

Overall, the long-term metrics outlined bullishness for Binance Coin. Investors who believe the broader market cycle has not ended could find a favorable entry in BNB.