Binance Coin: Bullish reversal imminent for BNB? Here’s what the indicators say

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- The lower timeframe market structure was bearish.

- The futures traders also expected more losses for BNB.

Binance Coin saw a sharp northward move after 14 February and reached the $325 mark on 16 February. Since then the price has sunk downward once again, wiping out most of the gains from the move.

Read Binance Coin’s [BNB] Price Prediction 2023-24

Bitcoin has also seen losses in recent days, but it had some support at the $22.5k level, and further south at $21.6k. Over the next week, can Binance Coin bulls force the short-term downtrend to end?

Can bulls expect a retest of the $290 order block to produce strong gains over the next two weeks?

A fast pump followed by a slower retracement can mean that, once the retracement was done, the price can begin to ascend and break past the previous resistance once more.

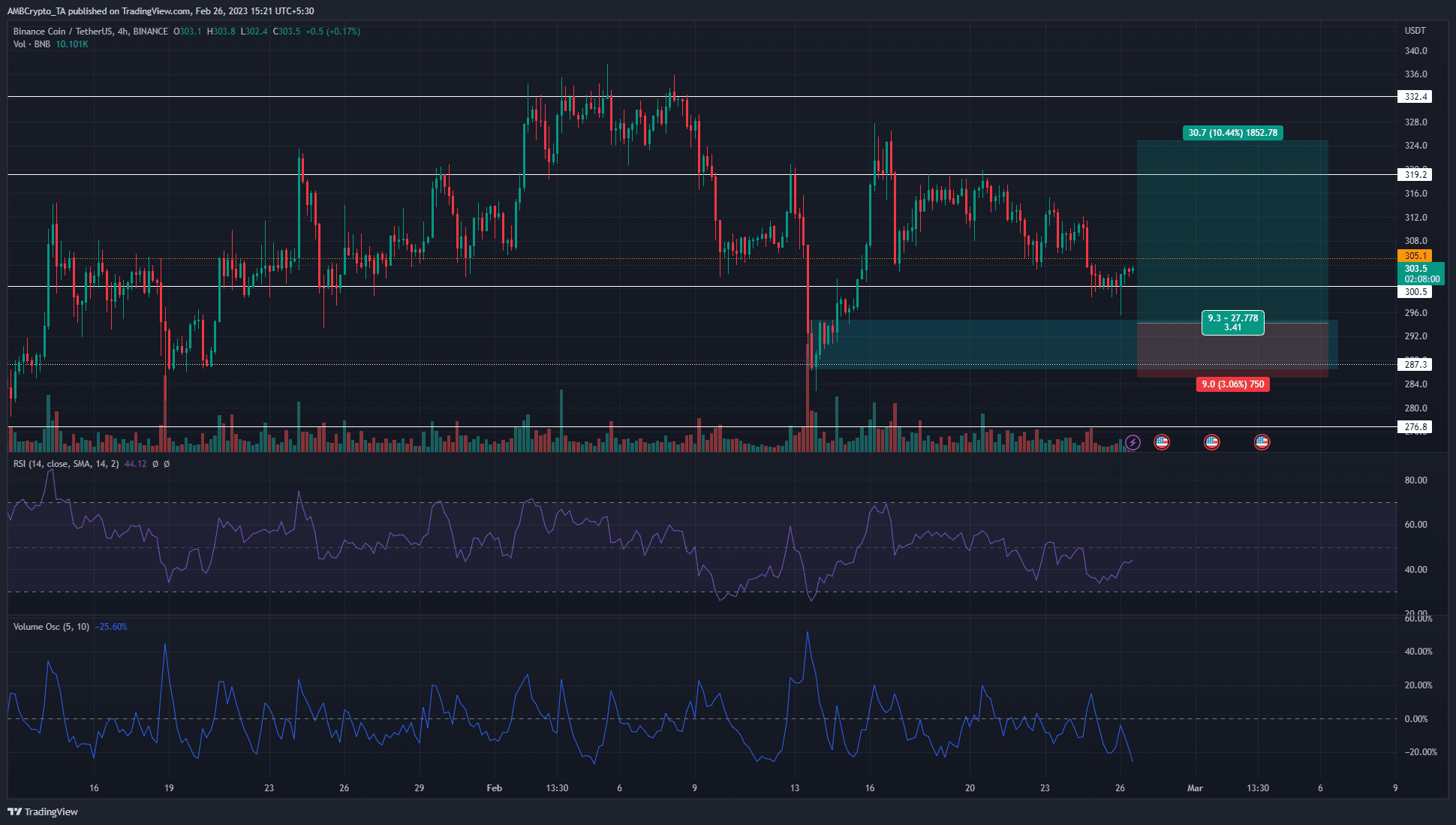

The strong rally on 14 February set a bullish order block at the $286-$294 area. Highlighted in cyan, this H4 order block could present a buying opportunity in the coming days.

The RSI was beneath neutral 50 to show strong bearish momentum behind Binance Coin. The volume oscillator did not show a large spike in trading volume. Instead, the volume has been low, which was expected over the weekend.

Is your portfolio green? Check the Binance Coin Profit Calculator

Monday’s high and low could establish critical levels to watch out for the next week. Bulls can wait for a move into the aforementioned order block and a bullish market structure break on lower timeframes such as 1-hour to look for buying opportunities.

A descent beneath the $283 mark would invalidate this bullish idea.

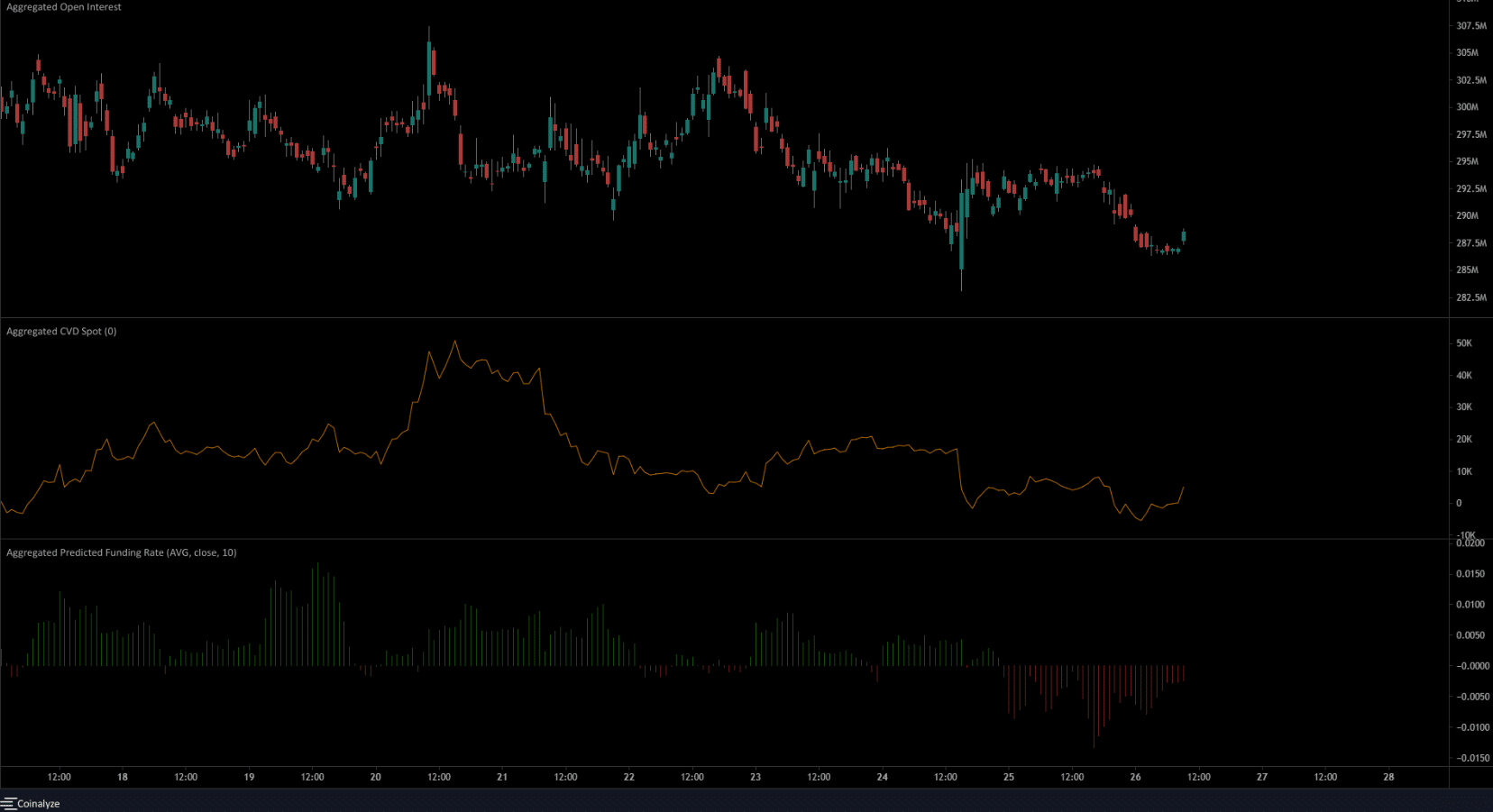

The fall in Open Interest suggested bearish sentiment remained dominant

Source: Coinalyze

The futures market did not inspire bullish sentiment. Alongside the sinking prices, the Open Interest has also declined. This meant that long positions were discouraged, and the sentiment was bearish. The predicted funding rate was also in negative territory to show short positions were dominant.

The spot CVD was also in a downtrend, although it did see an uptick in recent hours. This would not be sufficient to shift the trend. Traders can wait for a surge in OI for an indication that sentiment was particularly strong in one direction.