Binance Coin dips under key support level, can bulls rally again

- A bearish order block pushed the price below the $318 support level.

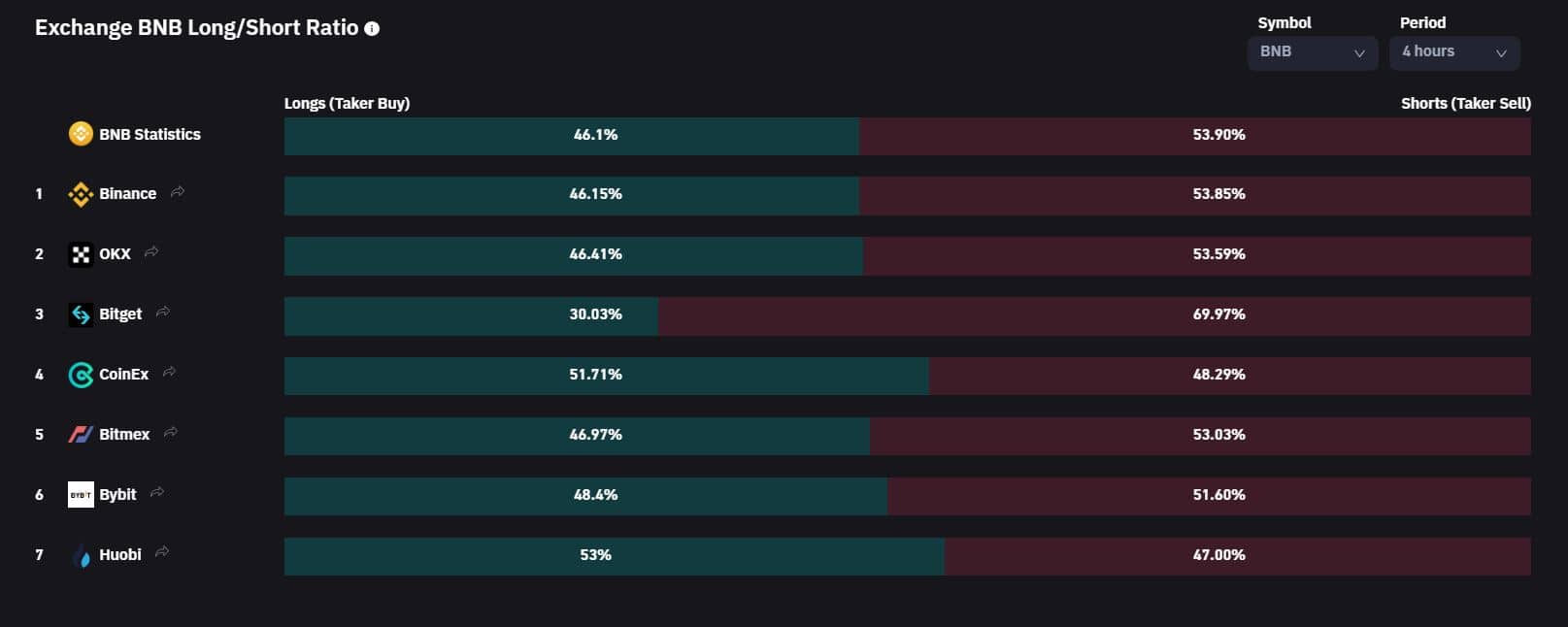

- BNB shorts retained a 53.9% advantage in the longs/shorts ratio.

The general slump in the crypto market over the last 24 hours saw Binance Coin [BNB] dip by 2.4%. This pushed the price of the fourth-largest cryptocurrency by market cap under a key support level.

Read Binance Coin’s [BNB] Price Prediction 2023-2024

With BTC experiencing a correction and dipping under the $28k price area again, this might lead to more selling pressure for BNB.

Market sentiment showed investors uncertainty

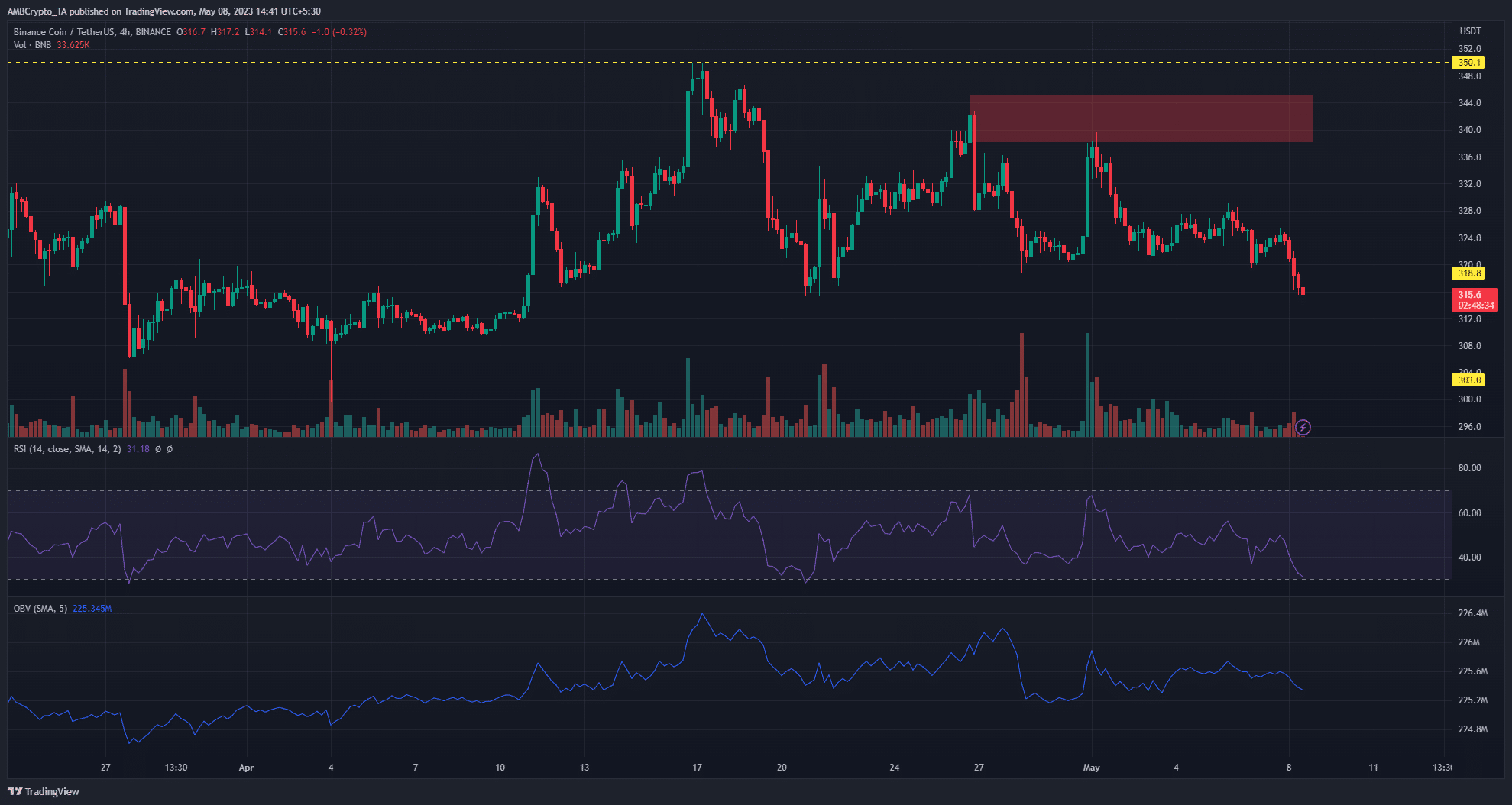

BNB’s price has been choppy over the past month. The price has oscillated between the $318 support level and the $350 resistance level.

BNB formed a bearish order block (cyan) on the four-hour timeframe at the $338-$345 region on 26 April. This forced a dip to the $318 support level.

A retest of the bearish order block on 1 May saw another dip to that support level. This prompted a bullish retreat with price dipping below the $318 support level to trade at $315, as of press time.

With the bearish order block just under the $350 resistance level, it highlighted the significance of this zone on the price charts. The price dip was also reflected in the chart indicators. The RSI hovered just above the oversold zone while the OBV also posted a slight dip.

Traders looking to short BNB can look out for a four-hour candle close beneath $318. The mid-term target should be the next support level at $303 while the $285 support level could serve as a long-term target

Is your portfolio green? Check the Binance Coin Profit Calculator

Shorts reigned supreme in the futures market

According to data from Coinglass, the long/short ratio showed sell positions had the upper hand on the four-hour timeframe with 53.9%. This suggested that BNB’s mid-term outlook still remained bearish.

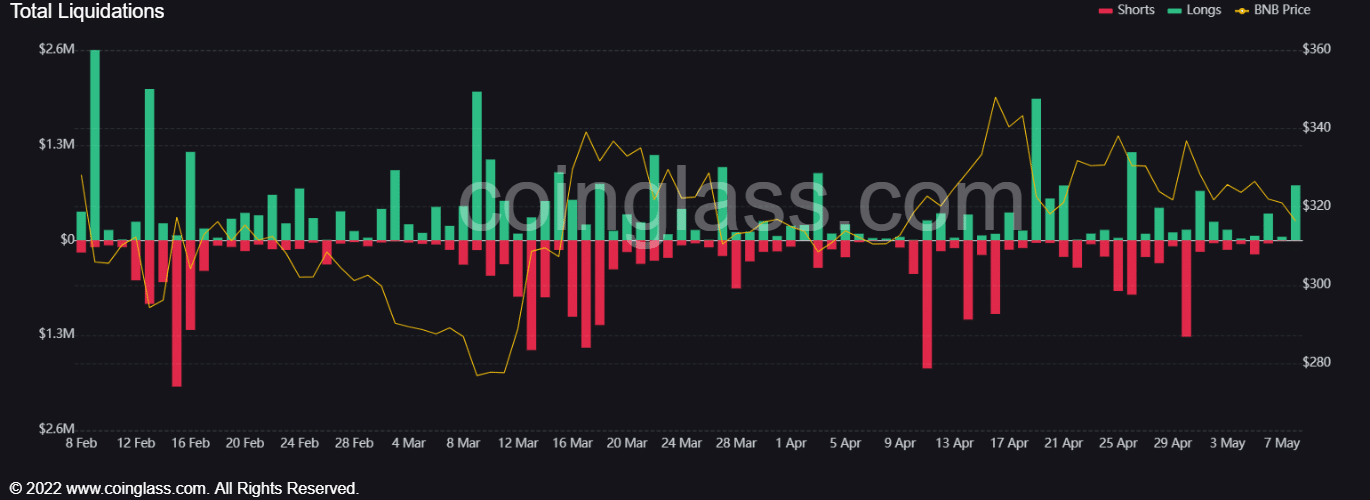

BNB Longs also suffered huge losses over the past three days. A total of $1.16M worth of longs were liquidated, representing 95% of the total liquidations.