Binance Coin, Dogecoin, SushiSwap Price Analysis: 04 April

Binance Coin projected fresher record levels over the coming days on the back of strong technicals. Dogecoin found support at $0.055 following a pullback from $0.07. Lastly, SushiSwap oscillated within a range and a breakout looked unlikely in the short term.

Binance Coin [BNB]

Source: BNB/USD, TradingView

While the broader market pullback in late February did halt Binance Coin’s uptrend, it was a minor dent when compared to the crypto-asset’s strong start to 2021. Support at $230 once again fueled a rally on the 4-hour timeframe and saw newer record highs for BNB as it touched north of the $350-mark. The OBV formed higher highs and showed healthy buying pressure behind BNB’s bullish movement. However, the index did settle at the time of writing.

While the MACD showed some bearish conditions in the market, the fast-moving line closed in on the Signal line. BNB’s strong technicals, coupled with a bullish broader market could see the price surge towards $450 over the coming weeks.

Dogecoin [DOGE]

Source: DOGE/USD, TradingView

The Dogecoin market has been susceptible to social media trends, and the same was noticed after Elon Musk’s latest tweet regarding the cryptocurrency. While the 4-hour chart noted a spike of 21% in a single session, the price reversed its trajectory almost instantly. The outcome was that DOGE managed to find support at a higher level of $0.055, a region that has boosted the price on previous occasions.

A bullish crossover saw the Stochastic RSI move above the oversold region. On the other hand, the ADX pointed south from 36 and showed a weakening trend. The 24-hour trading volumes slashed by 43% and showed that interest was waning in the DOGE market.

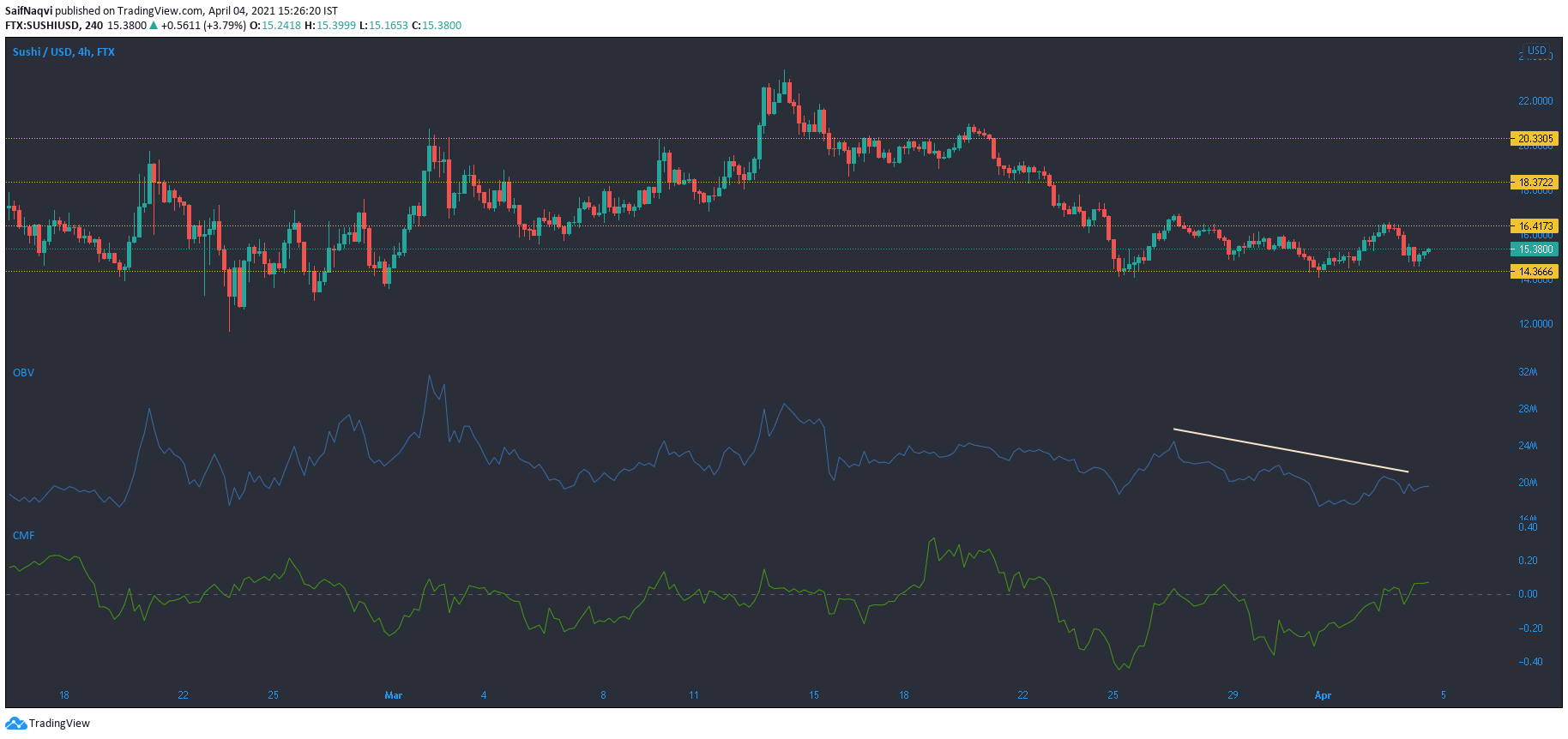

SushiSwap [SUSHI]

Source: SUSHI/USD, TradingView

SushiSwap had its ups and downs during the month of March. While the first half of the month saw the price touch record levels, it retraced towards $14.3-support during the latter half. Since that point, SUSHI largely traded between the channel $16.4-$14.3. Lower highs on the OBV were not a positive sign for SUSHI’s short-term trajectory, and the price would remain subdued without a pickup in buying activity.

On the positive end, the Chaikin Money Flow rose above the half-mark as capital moved back into the SUSHI market. However, stronger signals were needed for a breakout from the present channel. A broader market rally could be one such signal, but some resistance is expected at the $18.3-mark.