Binance Coin: Is BNB setting the stage for a rebound

- If the Funding Rate remains negative, BNB could bounce in the mid-term.

- A break above the $309.5 resistance could push the price toward $320.

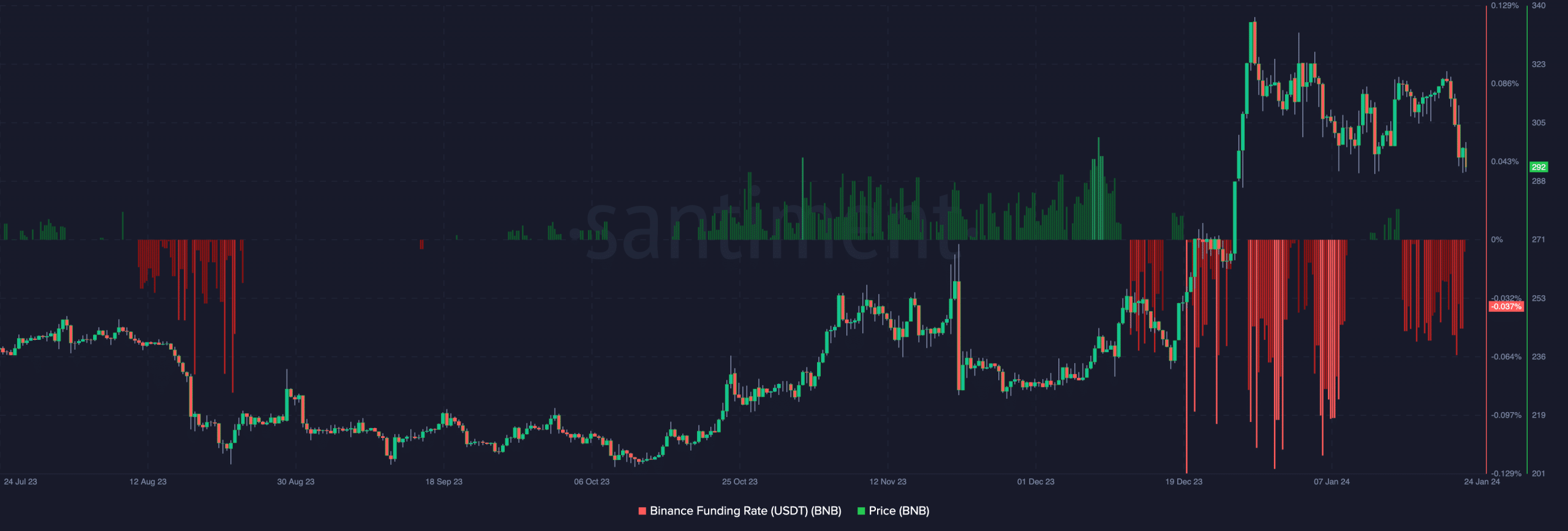

AMBCrypto’s analysis of Binance Coin’s [BNB] Funding Rate showed that the coin could be ready for a bounce if history is any guide. Like other cryptocurrencies, BNB experienced a setback as the price fell from $334 to $291. This dump represents a 6.14% decrease in the last seven days.

When compared to other altcoins, Binance Coin seemed to have shown better strength. This was because many other top altcoins dropped by double-digits within the same period.

Regarding the Funding Rate, on-chain data assessed from Santiment revealed that it was deep in the negative area. At press time, the metric was -0.037%.

If the Funding Rate is positive, it means that the perp price is trading at a premium compared to the spot value. If it is negative, it means that the perp price trades at a discount compared to the index price.

A possible recovery requires caution

Concerning the price action, a high negative Funding Rate is a potentially bullish sign. This is because shorts are aggressive, and are not getting rewards for it. Hence, the price could key into support.

This assertion was evident in BNB’s historical performance. For instance, the Funding Rate was at a similar state on the 18th of December.

At that time, BNB’s price was $243. But by the 26th of December, the coin value had risen to $305.

A similar scenario also played out in August 2023 as shown above. However, it is uncertain if the bounce would occur within a short period or if it could take longer.

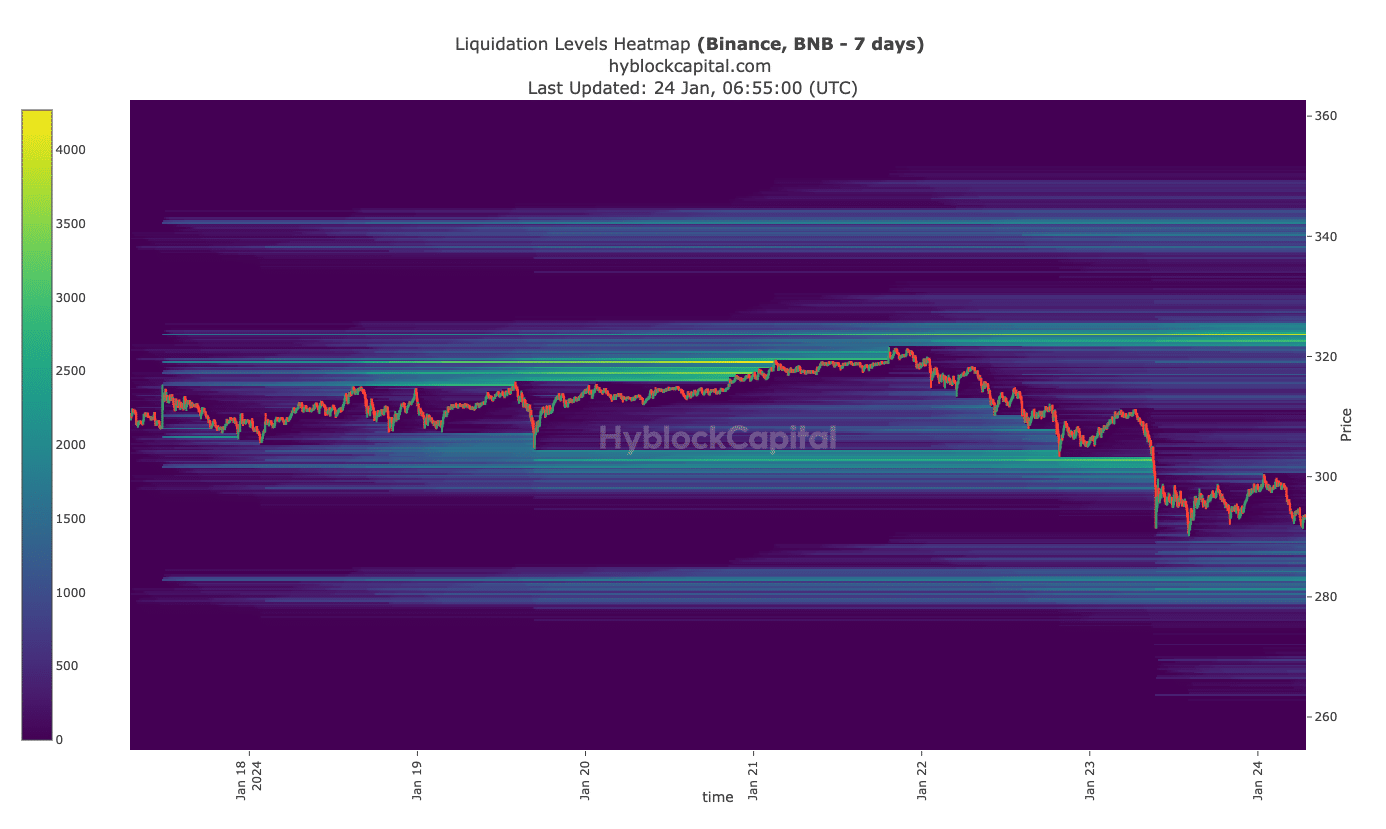

This led AMBCrypto to check the Liquidation HeatMap.

Liquidation HeatMap predicts price levels where traders’ positions could be closed due to price fluctuations and inadequate margin balance to cover open positions.

As of this writing, HyblockCapital’s data showed that large-scale liquidations could occur between $320 and $325. So, long-positioned traders looking to profit from these targets might need to be wary.

Should a position with high leverage and less margin hit any of these areas, it could lead to a forceful closure. On the other hand, traders with positions eyeing lower prices could profit but not less than $290 from the potential price increase.

Lows, then another high

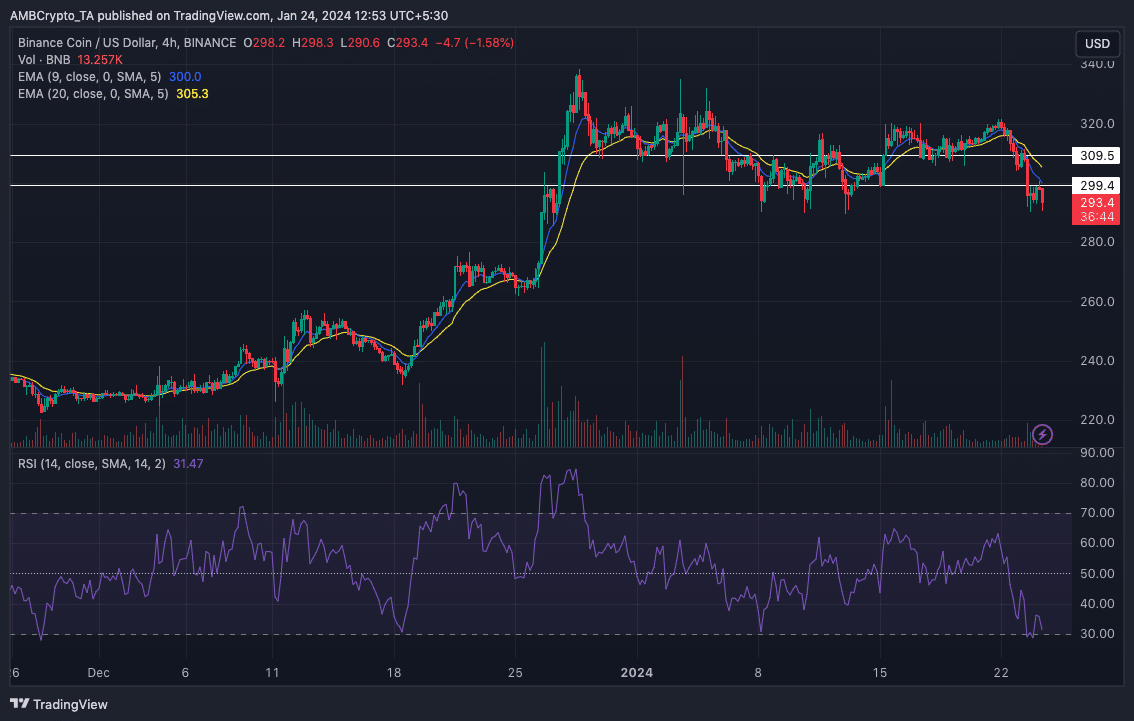

On the 4-hour chart, bears seemed to be controlling the narrative. However, bulls were making attempts at retesting the support at $299.4. If the breakout occurs, it could help to flip the resistance at $309.5.

Furthermore, the Relative Strength Index (RSI) could support the upward move. This was because the reading at press time, was 31.47, indicating that Binance Coin was oversold.

If bulls overcome bears, then the oversold state could trigger a rebound, and possibly lead BNB in the $320 direction.

Read Binance Coin’s [BNB] Price Prediction 2024-2025

But the 9 EMA (blue) and 20 EMA (yellow) were above BNB’s price. This suggests a possible decline.

However, BNB’s recovery remains an option. The only issue is it might not occur over the next few days. But it looks likely to happen in the mid-term.