Binance faces turbulence in South Korea, how did BNB react?

- Binance’s push into South Korea got called out by regulators in the country.

- Binance Pay pushed into France while BNB attempted to fight off sell pressure.

According to South Korean news outlet Chosun, Binance [BNB] acquired a 50% stake in Gopax, a native crypto exchange, on 23 February. This is part of Binance’s strategy to gain a foothold into South Korea. In addition, Leon Gong, the former Asian Pacific representative of Binance recently took over as Gopax’s new CEO.

According to the Chosun Ilbo, after Binance acquired the South Korean exchange Gopax, regulators may require it to reapply for virtual asset operator certification; banks are considering whether to continue to provide accounts. But it could also be attacking information being… https://t.co/Xcgl3LwhA1

— Wu Blockchain (@WuBlockchain) February 23, 2023

Is your portfolio green? Check out the BNB Profit Calculator

Despite these calculated moves, South Korean financial authorities have expressed concerns about Binance taking over. Allegedly, the move will pave the way for money laundering and financial crimes through unverified coins that are listed on the exchange. They said:

“It is difficult to properly manage and supervise if the finance starts operating the exchange in the country. There is also the possibility of local outflows through the distribution of several unverified overseas listed coins.”

Binance faces regulation

The publication also revealed that South Korean financial authorities have reviewed alternative regulatory measures for Gopax after changes caused by Binance’s involvement. This hiccup might be a major hurdle for Binance, but it will have to conform to the regulatory requirements to maintain operations in the country.

South Korea is rapidly becoming one of the most attracting Asian jurisdictions for crypto startups and companies. But despite the challenges in the South Korean market, Binance is making headway elsewhere. The exchange recently announced the launch of Binance Pay in France through a collaboration with global payments provider, Ingenico.

Crypto payments just got easier in France ??

We've recently partnered with @ingenico, a global payment solutions provider, to enable users to pay in crypto through #Binance Pay.

Another milestone for global crypto adoption ? pic.twitter.com/S8f8Pab7nW

— Binance (@binance) February 22, 2023

How did BNB react?

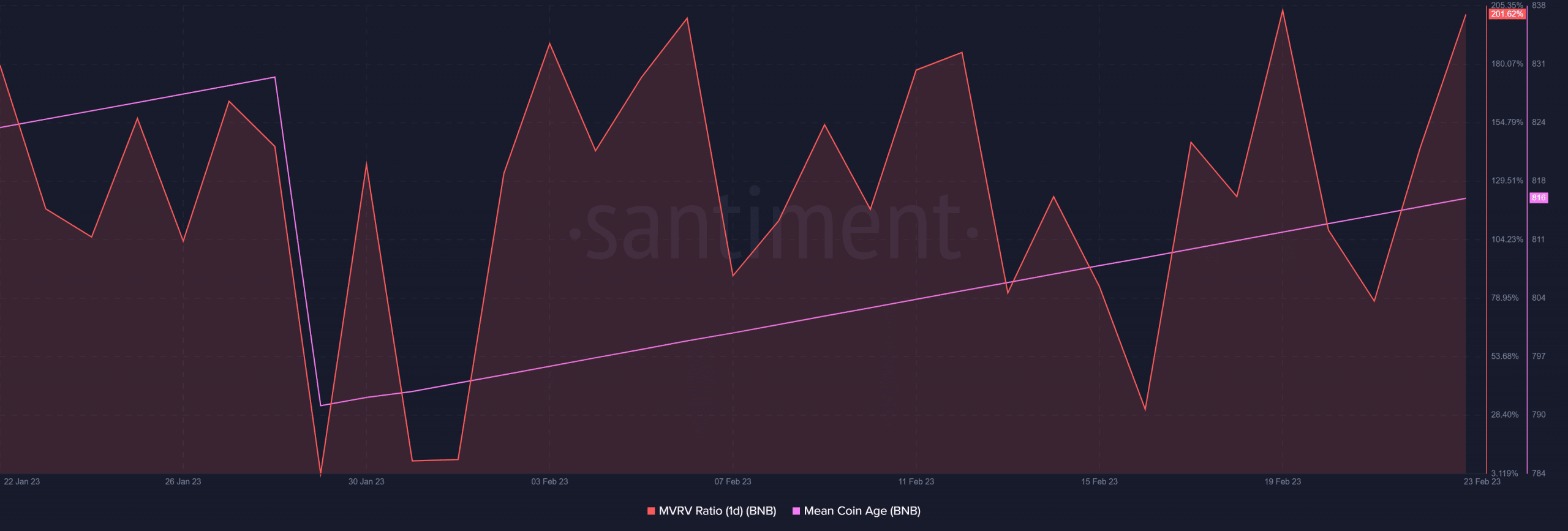

BNB struggled to bypass this week’s resistance at the $317 price range. On the other hand, existing sell pressure has also been limited, and this has allowed the price to stay above the $300 price range. BNB’s mean coin age metric has continued to go up despite the price outcome, confirming that most investors were holding on to their coins at press time.

Realistic or not, here’s BNB market cap in BTC’s terms

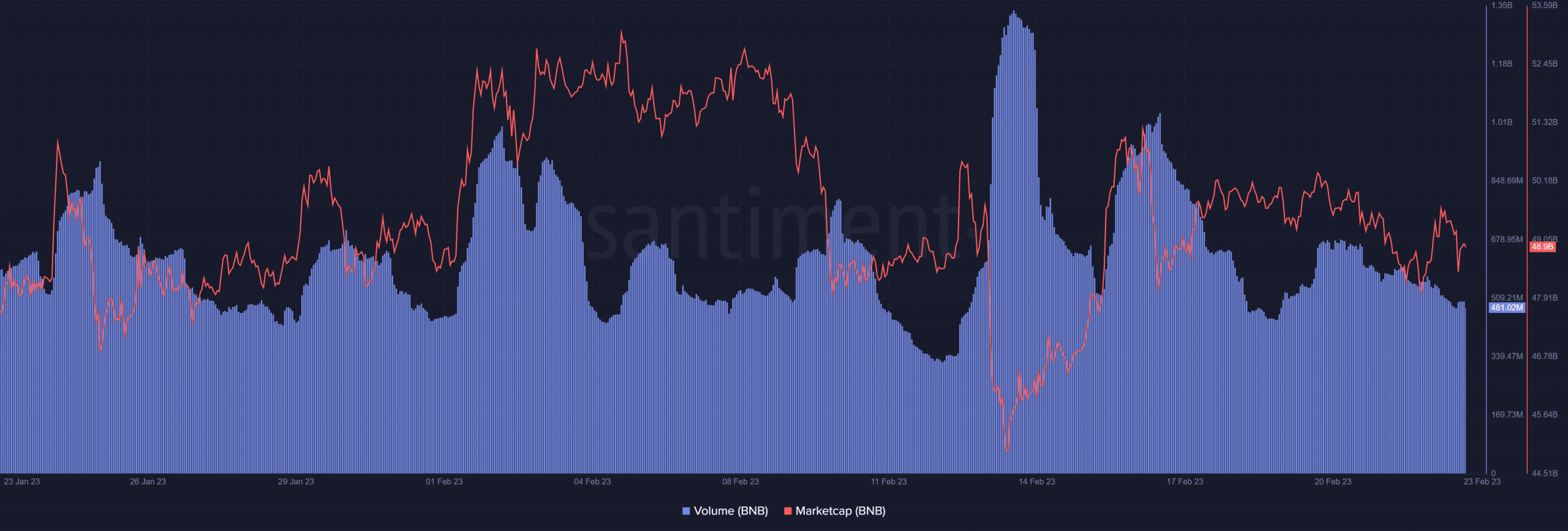

BNB’s MVRV ratio also confirmed that most of the buyers are in profit. Its volume has gradually dropped in the last two days, confirming that investors were still waiting on the sidelines for more directional clarity.

The market cap has declined gradually since mid-February, confirming that there have been significant liquidity outflows. However, the market cap did show some support at the $48.13 billion range.

![Lido DAO [LDO]](https://ambcrypto.com/wp-content/uploads/2025/08/Lido-DAO-DAO-400x240.webp)