Binance hits record $1.2B inflows in 24 hours: What’s in it for BNB?

- Binance recorded $1.2 billion in inflows, following a major market recovery.

- Bitcoin and Ethereum prices surged, indicating renewed investor confidence in cryptocurrencies.

Following the global crypto market downturn on the 5th of August, the market appeared to be seeing a notable rebound, with several cryptocurrencies now seeing a rise in prices.

Over the past 24 hours, Bitcoin [BTC] and Ethereum [ETH] have surged, increasing by 4.6% and 3% respectively.

Interestingly, on the 5th of August, during one of the most volatile trading days of the year, Binance Coin [BNB] recorded a surge of $1.2 billion in net inflows.

Binance record inflows

According to Binance CEO Richard Teng, the significant inflows on the 5th of August—totaling $1.2 billion—marked one of the highest net inflow days for Binance in 2024.

This signaled strong investor confidence amidst market uncertainties.

Richard Teng highlighted the importance of these inflows in a recent post, stating that such strong engagement from traders reflected bullish sentiment, despite preceding market shocks.

The inflows into Binance were not just isolated instances but part of a broader pattern of heightened trading activity and liquidity injections across various platforms.

The dynamics of these inflows are multifaceted, involving direct trading activities, transfers from external wallets, and substantial fiat deposits, all converging to boost cryptocurrency purchases.

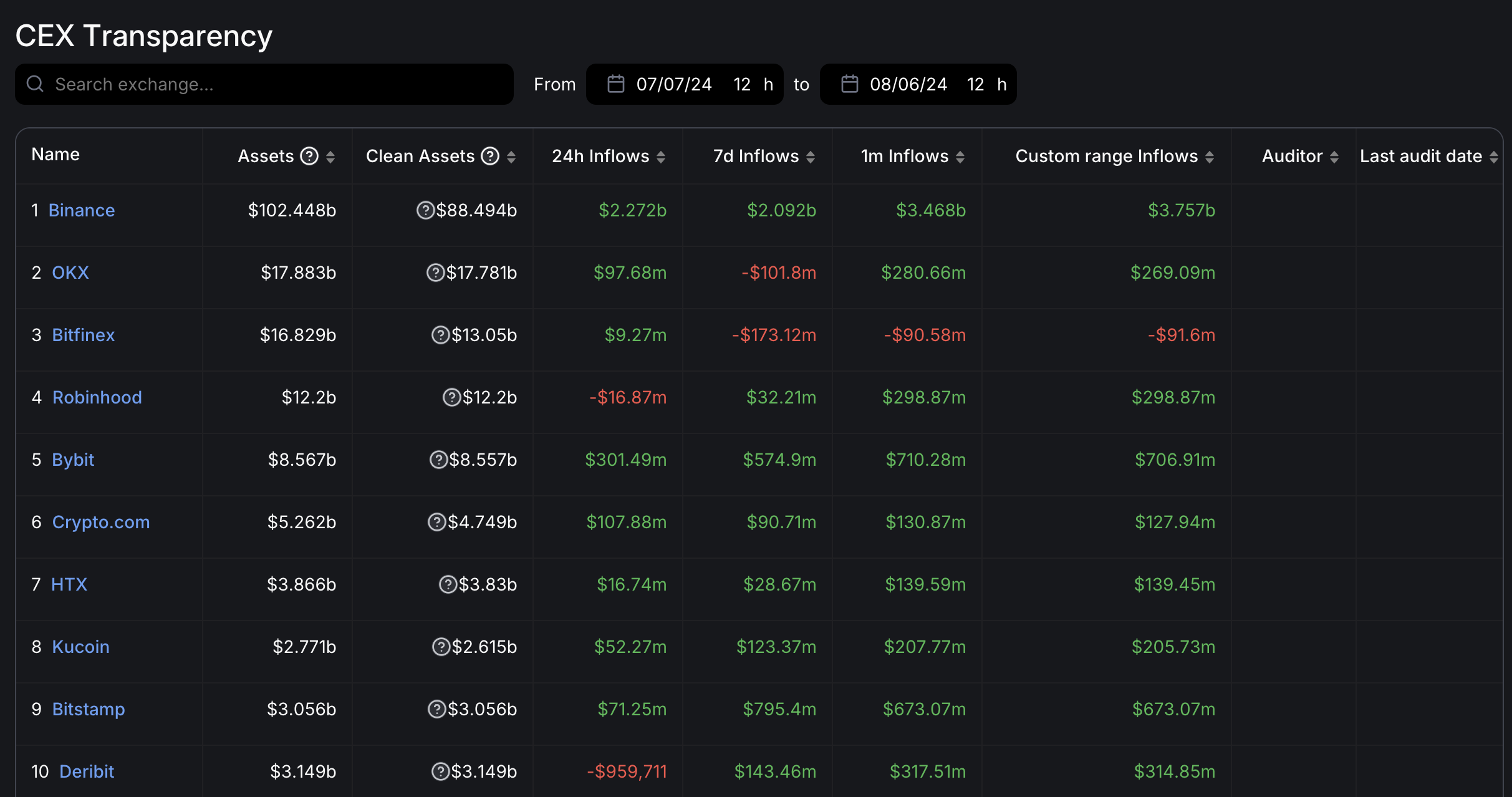

DeFiLlama’s CEX transparency dashboard revealed that Binance’s net inflows soared by over $2.27 billion in the past 24 hours, with total assets under management climbing to $102.44 billion.

This spike in inflows is not exclusive to Binance; other exchanges like Bybit, Crypto.com, and OKX also reported significant increases in their respective inflows.

For context, Bybit saw—$301.49, Crypto.com—$97.68 million, and OKX—$97.68, all in the past 24 hours, according to the data.

However, not all platforms experienced positive flows. Robinhood, for example, witnessed outflow of roughly $16.87 million coinciding with its suspension of the 24-hour market execution venue, Blue Ocean ATS.

Bitcoin as a case study

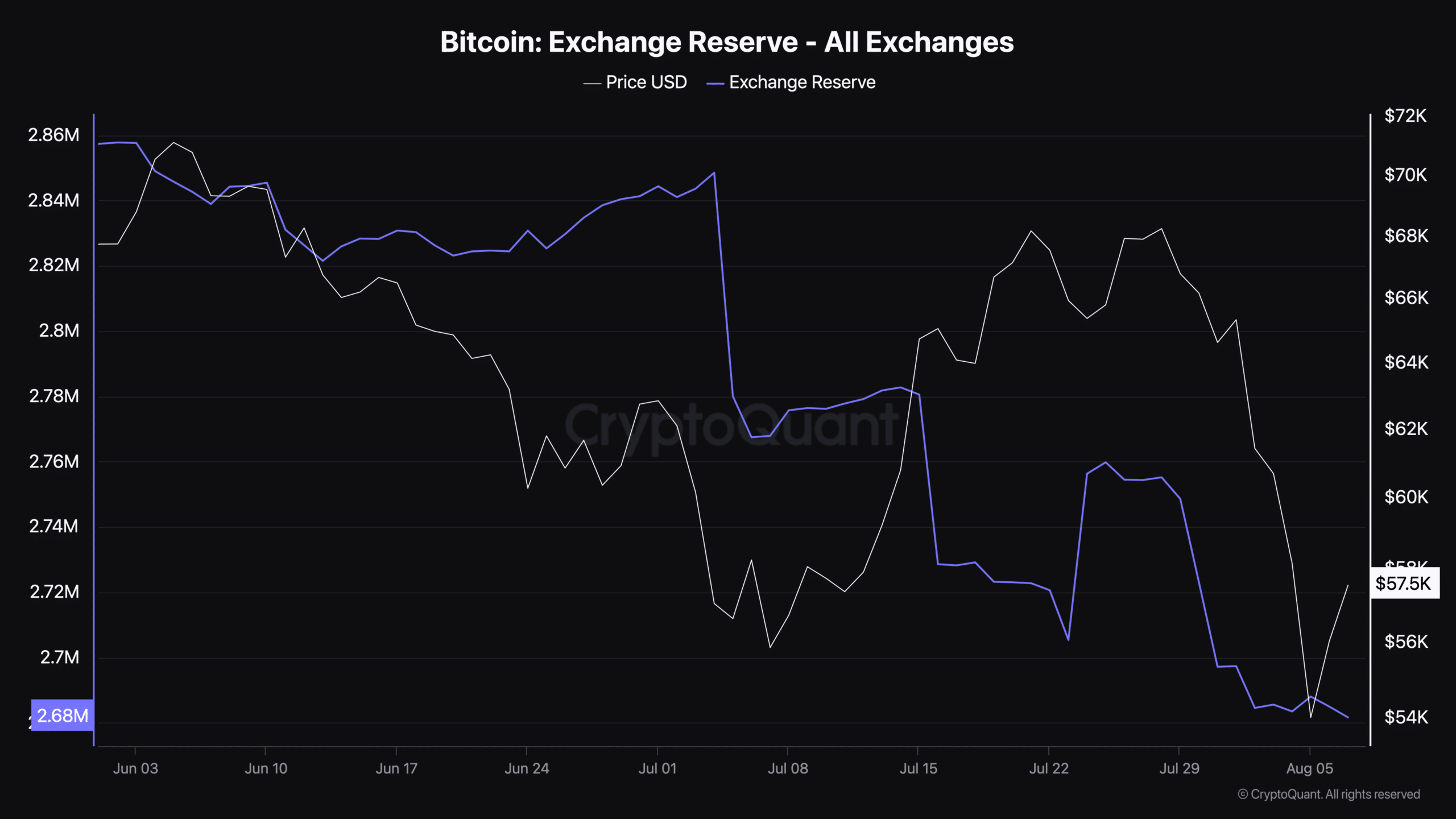

Furthermore, the overall health of the crypto market can also be gauged by examining Bitcoin’s exchange reserve trends.

Recent data from CryptoQuant showed a noticeable decline in Bitcoin exchange reserves, dropping from 2.8 million BTC in early July to 2.6 million BTC, indicating a decrease in available supply on exchanges.

This trend suggested that despite the market’s initial shocks, the subsequent investor behavior has leaned towards holding rather than selling, leading to tightening of liquidity and potential upward pressure on prices.

Read Binance Coin’s [BNB] Price Prediction 2024-25

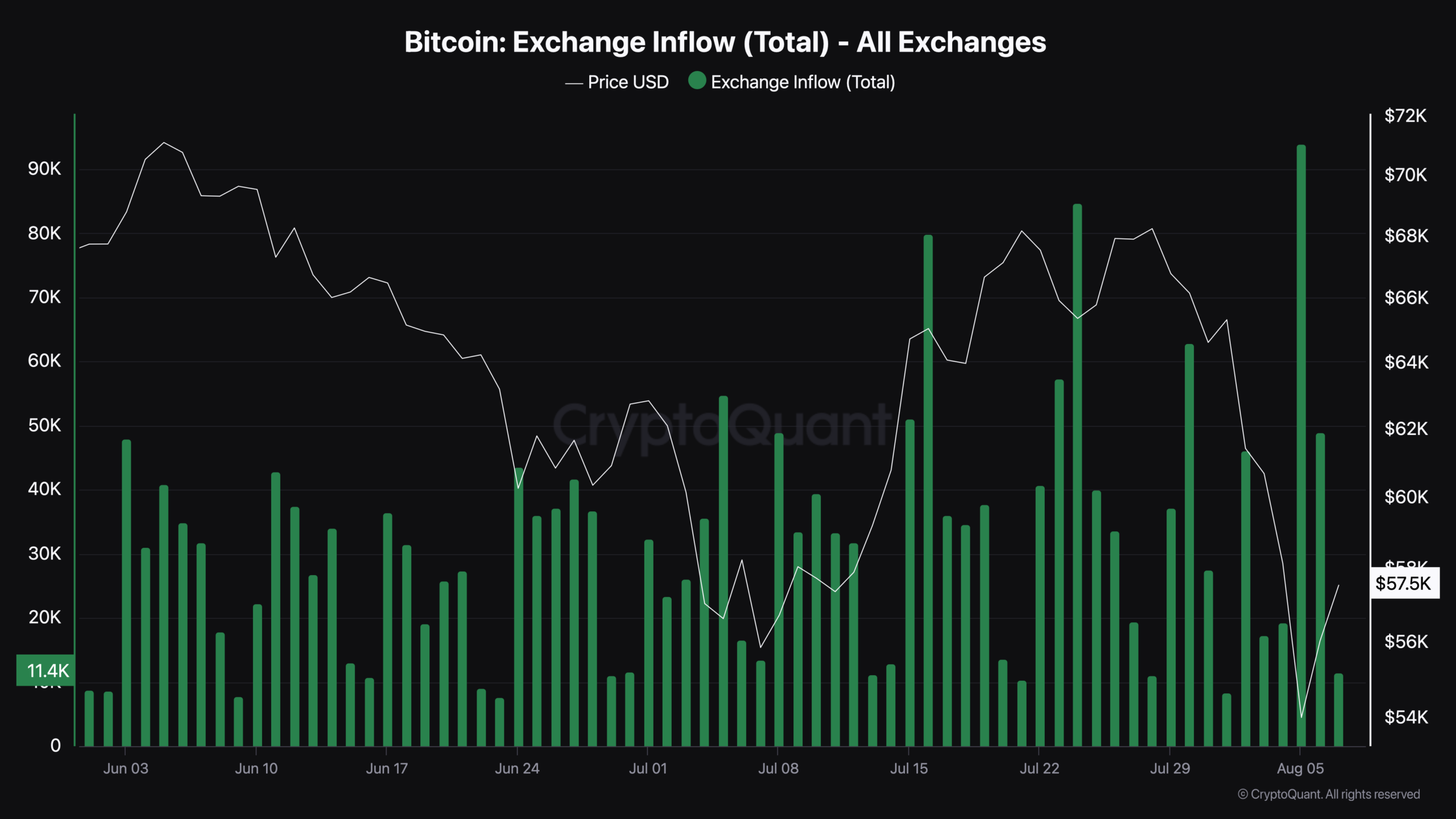

In contrast, Bitcoin exchange inflows have seen a resurgence, with figures rising from below 40,000 BTC to nearly 94,000 BTC on the 5th of August.

This increase in inflows reflected a renewed interest in trading and could signify a strategic accumulation of assets by traders anticipating future price increases.

![Bitcoin [BTC]](https://ambcrypto.com/wp-content/uploads/2025/08/Bitcoin-BTC-400x240.webp)