Binance in 2023: The good, the bad and everything in between

- Binance added 40 million new users, representing a 30% increase from 2022.

- Binance made investments to the tune of $213 million in 2023 in its compliance program.

One of the biggest Web3 companies Binance [BNB] published its year-end report, digging into some of the main metrics, events, and investments that defined the crypto juggernaut in 2023.

Numbers speak for themselves

Perhaps the biggest takeaway was the addition of 40 million new users, representing an impressive 30% increase from the same time last year. With this, the total number of registered users swelled up to 170 million.

Apart from this, Binance significantly expanded its product offerings. The number of fiat currencies supported on the centralized exchange (CEX) rose to 69, with as many as 30 fiat channels across the globe.

Moreover, the P2P crypto trading, which involves trading cryptos without an intermediary, saw an 18% increase in trades and 39% more users when compared to 2022.

Performance of flagship products

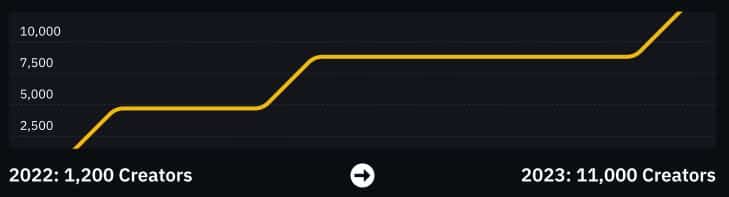

Binance then went on to talk about the growth of the newly-branded social networking content platform Binance Square. Since 2022, the number of creators has expanded ninefold, while the number of daily users has increased by orders of magnitude.

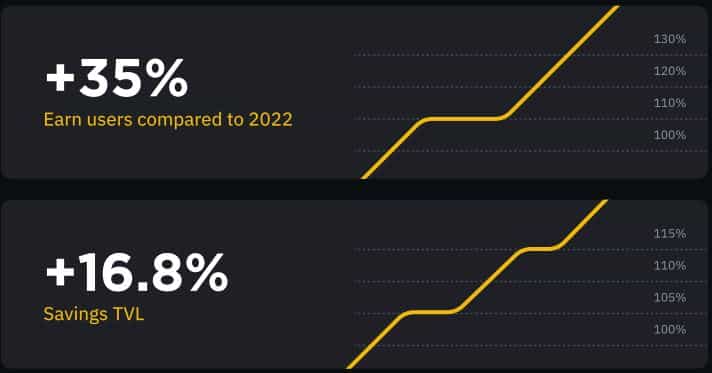

Binance Earn, a set of products that enables users to earn passive income on their crypto investments, also saw substantial growth. The number of users spiked 35% from 2022, while saving total value locked (TVL) increased 16.8%.

Binance also looked back at the launch of Binance Web3 wallet – a self-custodial solution – giving users full access to their funds. The exchange claimed that users created millions of Web3 wallets following the launch.

Binance increases compliance spending, transparency

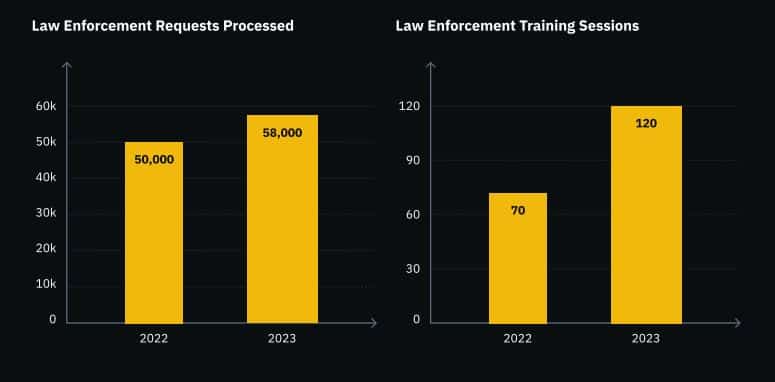

The report also delved into the company’s focus on compliance in what was a turbulent year. Binance made investments to the tune of $213 million in 2023, a jump of 35% from last year. It also detailed other steps taken to improve market surveillance.

Recall that Binance has been at the receiving end of unrelenting regulatory pressure in the U.S., with cases pertaining to violation of rules by both of its spot and derivatives trading operations.

Binance also took steps it claimed to maintain transparency of user funds. The proof-of-reserves (PoR) report supported 31 tokens in 2023, up from just 9 at the end of 2022.

It also improved the solution by implementing zk-SNARKs, a form of zero-knowledge proof.

Furthermore, Binance highlighted steps it took to combat criminal activity in the cryptocurency realm. During the year, Binance’s special teams handled over 58,000 law enforcement requests.

Read BNB’s Price Prediction 2023-24

As of this writing, the ecosystem’s native token BNB was exchanging hands at $319.32, having regained the fourth position in terms of market cap, per CoinMarketCap.

The coin has grown by 27.46% since the start of 2023 despite many hurdles in its way.