Here’s the caveat to Binance recovering lost ground

- There was a significant drop in Binance’s spot trading volume, nearly 30%, over the last month.

- Binance seemed to be feeling the strain of lower demand and planned to downsize its workforce by 20%.

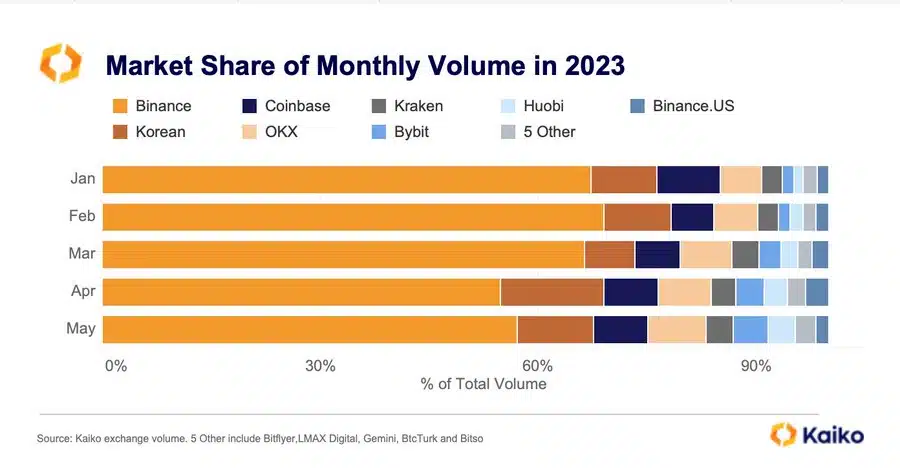

Plagued by regulatory setbacks and increasing competition, the world’s largest crypto exchange Binance [BNB] has had a rough 2023. The crypto exchange lost a significant portion of its market share since it halted its no-fee trading program on 22 March.

However, May provided some relief as Binance bounced back to regain a portion of its lost market share, according to digital assets data provider Kaiko.

But despite the rise, Binance’s share of monthly volume remained significantly low from the highs seen in February.

This could be the primary reason

On further examination of the data, it was found that most of the gains made by Binance were due to falling trade volumes on Korean exchanges. It should be recalled that Korean exchanges saw a dramatic jump in trading volumes in March and April and these platforms were preferred for altcoin trading.

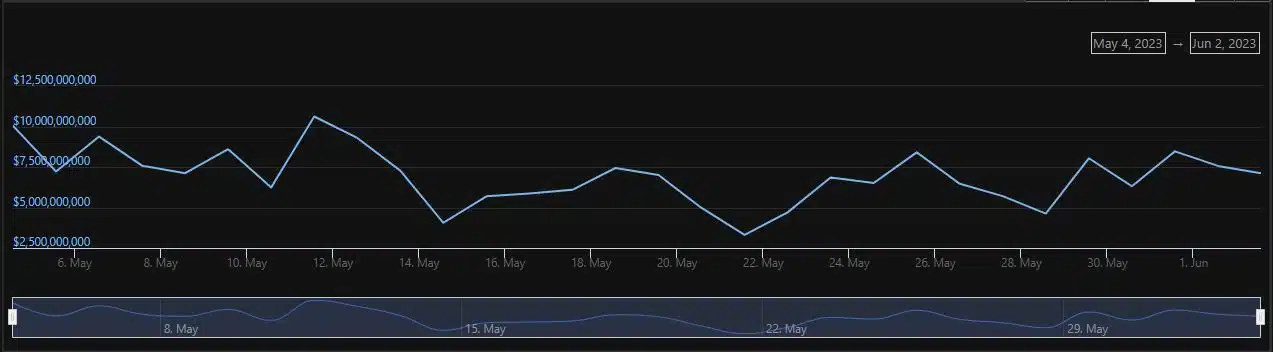

However, their market share shrank as the weekly transaction volume in Korean markets fell to its lowest level since 2023.

Weekly trade volume on Korean markets hit a yearly low last week on falling altcoins volume. pic.twitter.com/xdug9KRvxq

— Kaiko (@KaikoData) May 31, 2023

Binance in financial trouble?

Though Binance increased its dominance among its competitors, it couldn’t insulate itself from the ongoing bearish sentiment. Data from CoinGecko highlighted a significant drop in its spot trading volume, nearly 30%, over the last month.

Investors’ propensity to hoard coins rather than trade them on exchanges was the reason behind the slump.

At the time of writing, assets worth more than $63 billion were locked on the exchange, as per data from DeFiLlama. Net inflows of $1.431 billion were recorded over the last month, meaning that more assets moved out of the exchange than deposited. This lent credence to the observation made earlier.

Is your portfolio green? Check the Binance Coin [BNB] Profit Calculator

According to prominent crypto journalist Colin Wu, Binance was feeling the strain of lower demand and planned to downsize its workforce by 20% in June. Binance CEO Changpeng Zhao (CZ) refuted claims that the exercise was a cost-cutting measure and instead stated that it was a part of the organization’s routine talent density audit.

As far as things on the BNB Chain were concerned, a surge in the active user count was observed over the last few days, snapping the downward trajectory witnessed since 20 May. However, the activity of users failed to boost liquidity on the layer-1 blockchain as the total value locked (TVL) declined further.