Binance, Reuters, and CZ- Demystifying the allegations

A new story from Reuters was released on 17 October, where it was claimed that cryptocurrency exchange Binance had not been forthcoming with regulators in the United Kingdom and the United States.

A Reuters piece published earlier this year, in June, speculated that, following the United States’ lead, Binance had not done enough to prevent criminal activity and fraudulent activity involving cryptocurrencies.

What Reuters said

According to a report by Reuters, on 11 March 2020, Binance strategy officer, Zoe Wei, proposed retroactively enforcing a service agreement covering a wide range of activities between Binance’s United Kingdom subsidiary and Binance’s Cayman Islands parent company.

After the new regulations were implemented on 10 January 2020, businesses existing before that date were excluded from registering with the country’s Financial Conduct Authority for a period of one year. This Reuters claimed Binance attempted to take advantage of it.

Further, in November 2018, it was claimed that businessman Harry Zhou, who is connected to Binance, proposed shifting the focus of enforcement efforts away from Binance and onto a U.S. entity.

According to Reuters’s account, Binance’s idea came about because the company realized that traders in the region were still using the primary platform after the restriction on U.S. customers went into effect.

CZ’s rebuttal

The CEO of Binance, Changpeng Zhao (CZ), chimed in with a blog post in response. CZ elaborated on the company’s regulatory environment, saying that Binance’s market cap had grown tremendously in a short time. For this, there was no regulatory playbook on how to exactly go about it when a company scales overnight.

The CEO also responded to media reports that the exchange was trying to evade regulators by keeping the whereabouts of its several offices secret.

He assured the public that Binance’s local address and contact details were on file with regulators in every region in which the company did business.

Additionally, Binance had dedicated a section of its website to government agencies. Keeping the locations secret was more for security reasons according to Binance’s CEO.

Exchange and assets not impacted

According to evaluations and data from CoinmarketCap, Binance is, and still remains the largest cryptocurrency exchange in the world right now.

The regulatory scandal did not appear to have any effect on trading volume. An increase of 23% was observed over the last 24 hours, with the volume reaching over $12 billion in that time frame. Binance’s impact rating from Nomics stayed the same at 10.

The stablecoin of the exchange, BUSD, did not appear to have similarly been impacted by the Reuters report. Within 24 hours, more than $6.5 billion in transaction volume was reported, with decentralized exchanges (DEXs) accounting for more than $43 million of that volume according to Coinmarketcap.

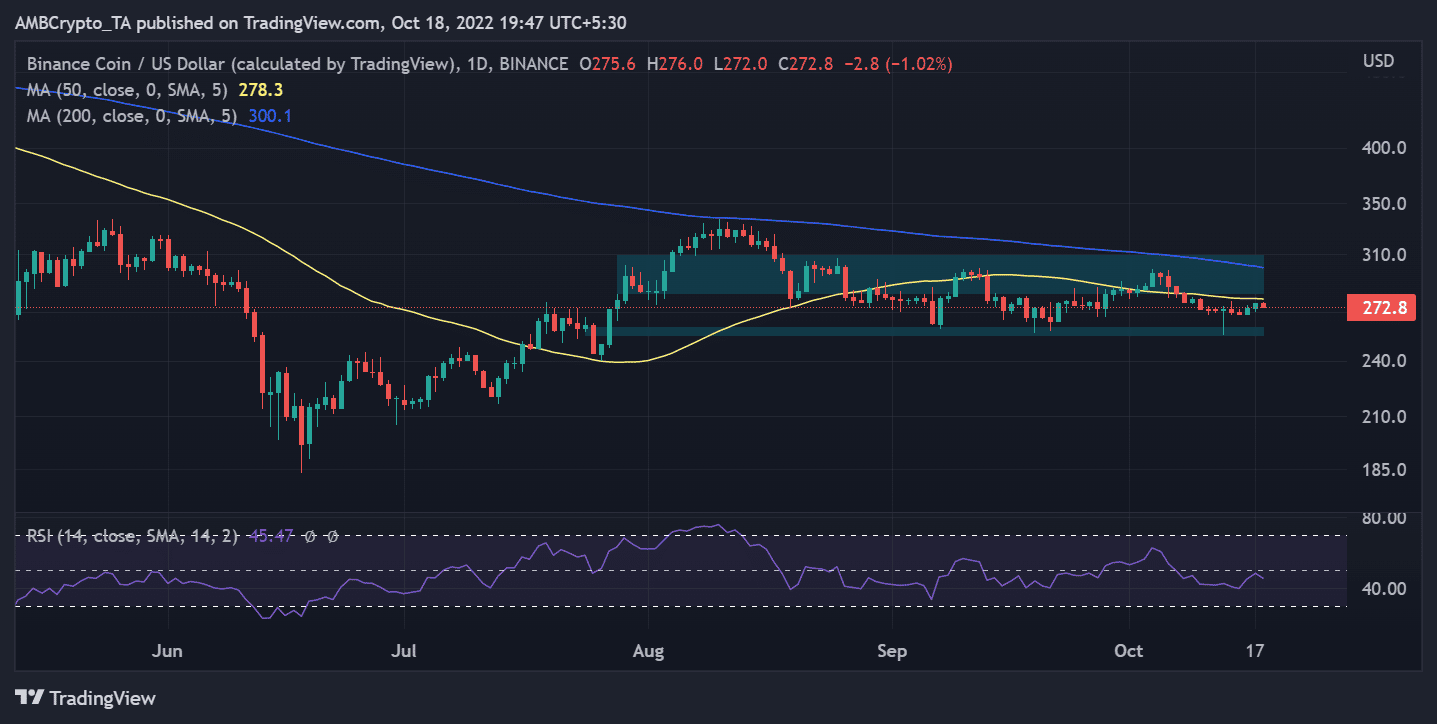

The price movement of BNB was essentially horizontal throughout a 12-hour period. According to the chart, there didn’t seem to be a surge or a decline in its price activity.

The support line was seen in the price range of $260 to $254.3. In addition, the 50 and 200 Moving Averages, which were represented by the yellow and blue lines, appeared to be acting as resistance at both of the levels, $281.9 and $309.1.

Dangers of the allegations sticking

The CEO of Binance has aggressively rejected any regulatory inadequacies that have been charged against the business, much like the recent charges.

Currently, BUSD is the seventh-largest cryptocurrency by market capitalization, BNB is the third-largest stablecoin, and Binance Chain has over $5 billion in total value locked (TVL).

If Binance is ever targeted by any regulatory body, the exchange and the asset could suffer, but as of now, all that exists are allegations.

![Ethereum's [ETH] 11% rebound - Is greed fueling a bottom or is fear driving a trap?](https://ambcrypto.com/wp-content/uploads/2025/04/Ritika-8-400x240.webp)