Binance takes aim at CFTC’s jurisdiction in latest filing

- Binance submitted its filing in response to the CFTC’s September filing.

- The regulator had sued the exchange in March for offering unregistered derivatives.

Leading crypto exchange Binance [BNB] sharply criticized the overreaching jurisdiction of the US Commodity Futures Trading Commission (CFTC) in its latest filing. It said,

“U.S. law governs domestically but does not control the world. Congress did not make the CFTC the world’s derivatives police.”

Binance argued the agency was trying to regulate an entity that has sought to avoid U.S. business on paper. The CFTC was allegedly using “broad arguments” to tighten its grip on any derivatives-related crypto activity around the world.

The exchange also asked the court to take notice of the “incendiary language” the commodities regulator employed in its lawsuit against Binance and its CEO Changpeng Zhao, aka “CZ.”

It submitted its latest filing in an Illinois court on 23 October in response to the CFTC’s filing from last month.

Binance a haven for criminals, CFTC claims

The CFTC submitted a court filing in September, claiming CZ had “deliberately targeted” the U.S. market. The U.S. commodities law anyway explicitly governed foreign conduct; the filing argued. It made another damaging claim, saying,

“Binance and Zhao’s fetish for secrecy and refusal to comply with regulatory requirements have made Binance a haven for dark net users, criminals and terrorists that wish to move their assets around the globe.”

However, the CFTC was only reiterating the charge it had made previously when it first sued Binance in March. The agency had alleged that the exchange was knowingly offering unregistered crypto derivatives products in the U.S. against federal law.

At that point in time, the CFTC had also alleged that Samuel Lim, Binance’s compliance officer between 2018 and 2022, was aware of the Gaza-based Hamas executing transactions on the exchange in February 2019.

After Hamas’ recent terror attack, Binance joined forces with Israeli authorities to freeze multiple accounts allegedly tied to Hamas. In May 2022, Israeli authorities had also taken action against nearly 190 crypto accounts—many allegedly belonging to Hamas—on Binance.

Derivatives trading volume back to previous level

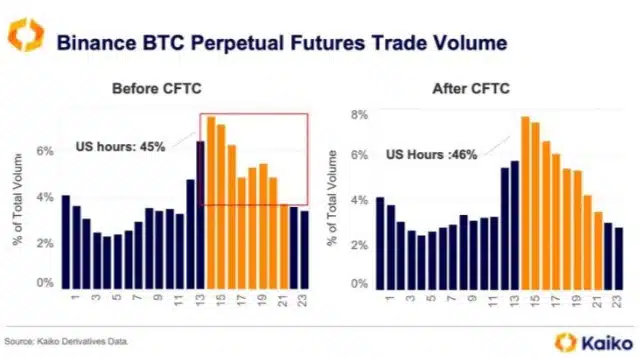

Nonetheless, Binance’s derivatives trading volume remains strong despite the regulatory action by the CFTC. A recent report by the crypto intelligence firm shed light on the phenomenon.

As per the report, Binance’s perpetual futures trading volume accounted for 45% of its daily average volume in the months prior to the lawsuit in March. Though it did slide down after the CFTC’s action, the activity has come back to the previous level.

As of now, Binance’s perpetual futures trading volume contributed 46% of its daily average volume.