Bitcoin: 172K BTC acquisition could trigger a bullish trend – How?

- Increased BTC acquisitions suggested rising demand, potentially pushing Bitcoin to new highs.

- Bitcoin’s breakout potential and growing network activity indicated a bullish trend ahead.

The acquisition of over 172,705 BTC since the 23rd of February signals a significant shift in market dynamics. This increase in demand mirrors similar activity seen after the FTX collapse when the market reached its bottom.

New investor interest is growing steadily, which could indicate a major turning point for Bitcoin [BTC]. Therefore, it’s likely that this accumulation phase will push Bitcoin’s price upward, potentially leading to a new bullish market phase.

What does Bitcoin’s current price action reveal?

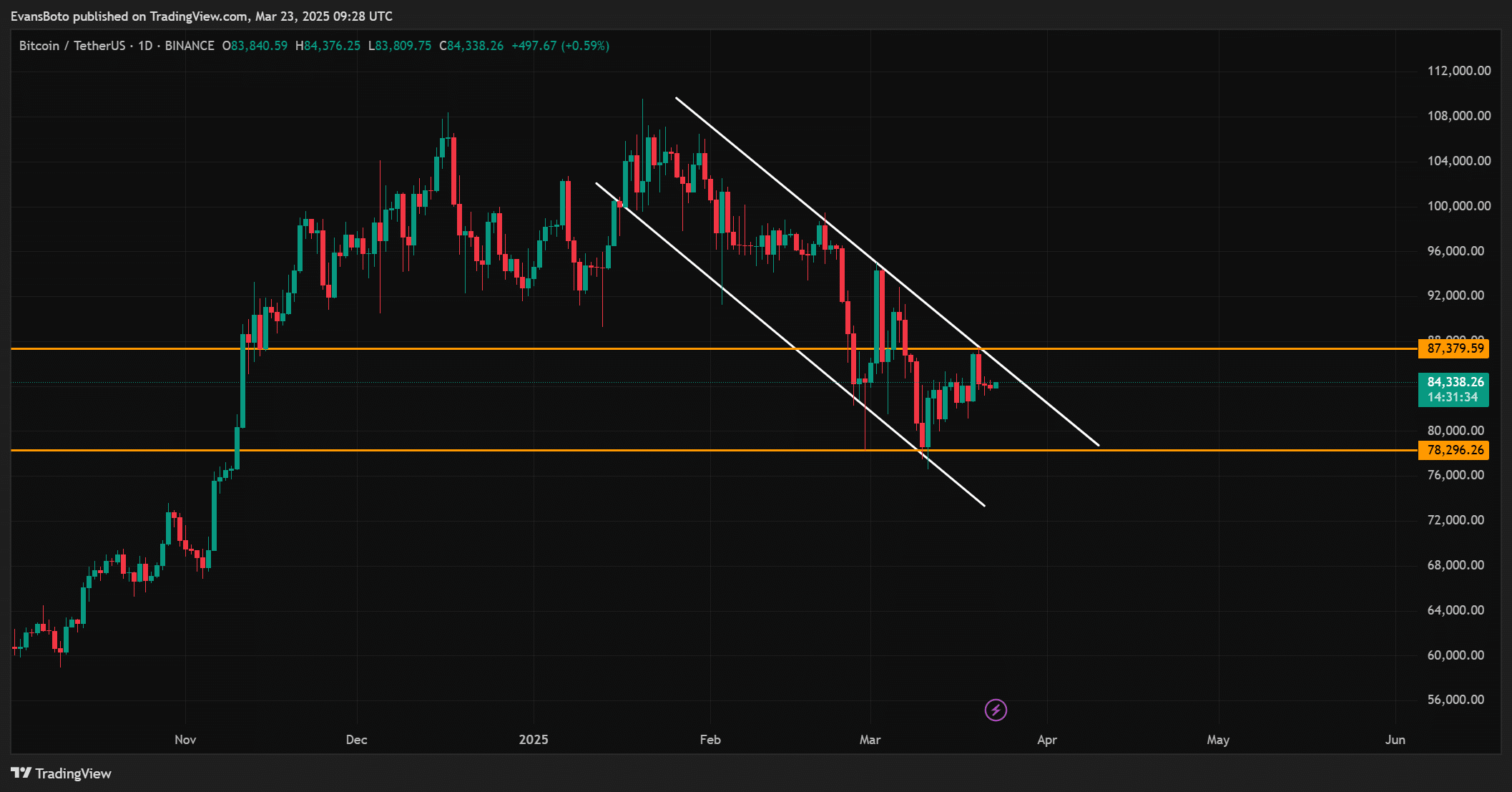

At the time of writing, Bitcoin was priced at $84,347.65, a minor drop of 0.02% in the last 24 hours. Despite this slight dip, Bitcoin is on the verge of breaking out of its descending wedge channel, which has been constraining its price since the start of this year.

This technical pattern indicates a breakout may be imminent. If Bitcoin surpasses the $87,379.59 resistance level, it could confirm the beginning of a bullish upward trend.

Alternatively, failure to break out could push Bitcoin down to its lower support level of around $78,296.26, signaling possible short-term weakness in the market.

BTC address stats and transaction count: What are the numbers saying?

According to CryptoQuant data, Bitcoin’s address activity shows encouraging growth. Active addresses have risen by 0.96%, reaching a total of 8.7151 million. This increase highlights growing user engagement and reflects significant interest in BTC from both retail and institutional investors.

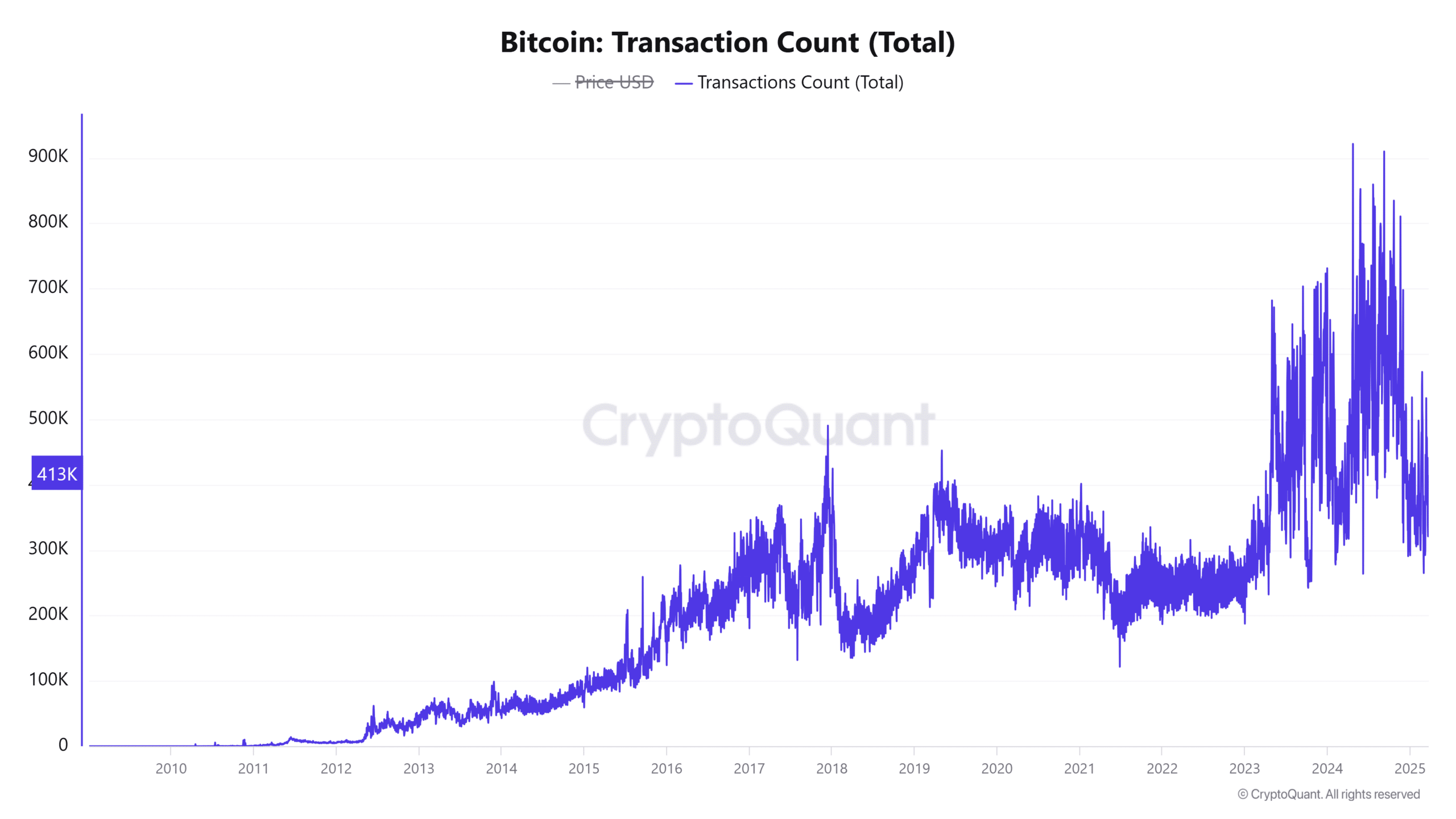

Additionally, transaction counts have surged by 1.66%, totaling 498.797K transactions. This rise in transactions underscores strong demand for Bitcoin, which could potentially drive an upward price movement.

These positive metrics indicate robust network activity, further supporting the possibility of a price rally.

The significance of the BTC NVT Golden Cross

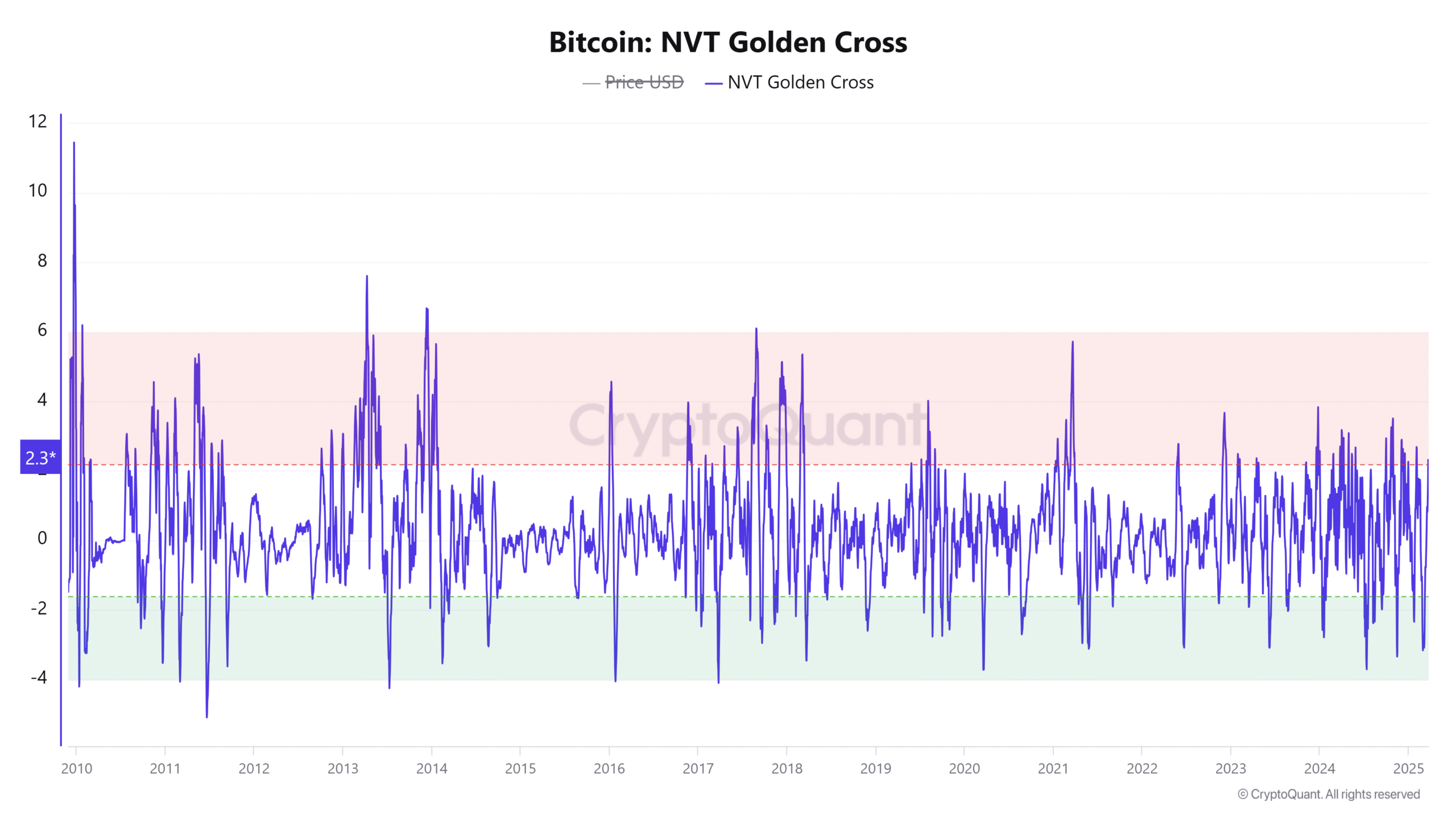

The NVT Golden Cross has surged by 34.58%, indicating a bullish shift in Bitcoin’s fundamental outlook. This metric analyzes the relationship between Bitcoin’s network value and transaction activity, assessing whether the asset is overvalued or undervalued.

The recent increase signals strengthening network fundamentals, reflecting growing investor confidence. As a result, the NVT Golden Cross suggests that Bitcoin is well-positioned for potential price growth.

What next for BTC

The combined factors of rising BTC acquisitions, growing network activity, technical breakout potential, and a favorable NVT Golden Cross indicate that BTC is nearing a bullish phase.

With new investors fueling demand and technical indicators pointing to a breakout, BTC appears poised for near-term growth. The recent surge in acquisitions suggests that BTC could potentially reach new highs.

![Polygon's [POL] short-term momentum faces strong resistance HERE](https://ambcrypto.com/wp-content/uploads/2025/03/Polygon-Featured-400x240.webp)