Bitcoin accumulation addresses surge 93% to nearly $194B – Bullish cue?

- Balance on BTC accumulation addresses surged 93% in 2024, now holds $194 billion.

- Does the massive holding strategy signal a further price rally for BTC?

Based on 2024 investors’ behavior, the HODLing strategy seems to have become the most preferable Bitcoin [BTC] investment approach.

According to data by CryptoQuant’s analyst Burak Kesmeci, BTC accumulation addresses now hold 2.9 million coins. That’s worth over $194 billion, a nearly 2x (93%) increase from January holdings.

“In January 2024, these addresses held only 1.5 million Bitcoins, yet within 10 months, that amount nearly doubled. They continue to accumulate patiently and boldly without selling off their holding”

Is it a bullish cue?

To put the massive accumulation spree in perspective, in 2018, BTC accumulation addresses only held 100K coins. Fast-forward to the 2021 bull run, the addresses topped 700K coins.

However, Kusmeci noted that real growth occurred in 2024, with a whopping 93% jump from 1.5 million in January to 2.9 million.

Is it a bullish cue, perhaps signaling that holders expected a further BTC price appreciation?

It’s worth noting that the U.S. spot BTC ETFs debuted in January 2024, and the ensuing optimism might have led to the surge in BTC accumulation addresses holding.

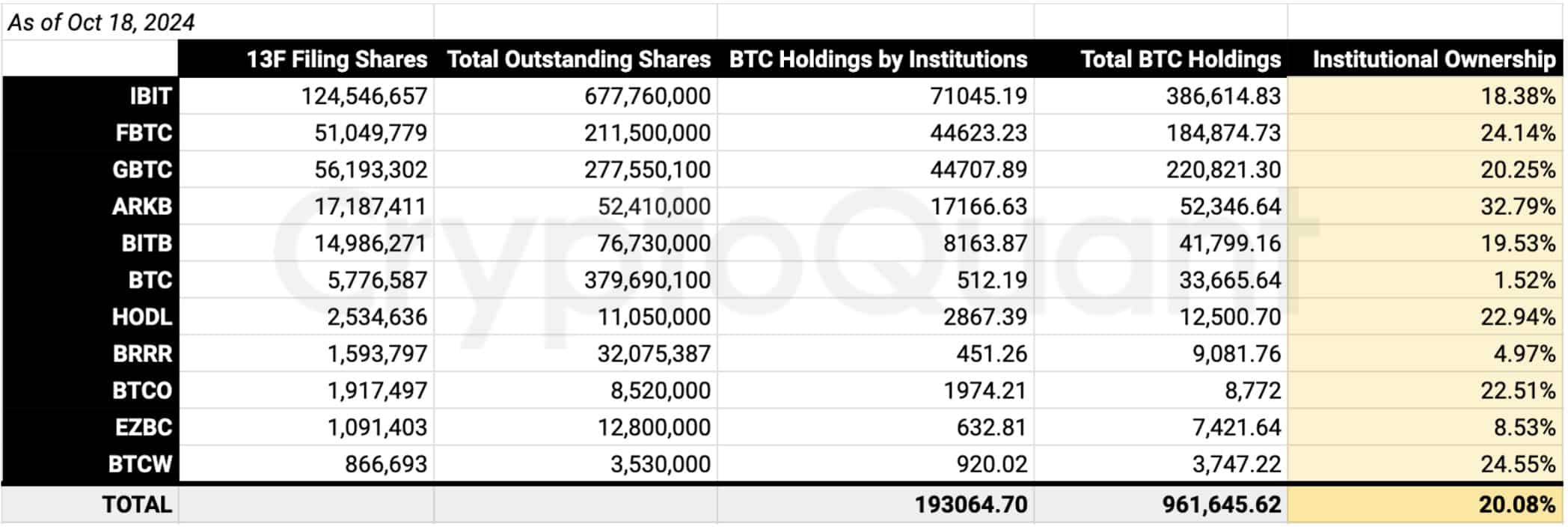

As of the 18th of October, the products held 961K BTC, worth over $65 billion.

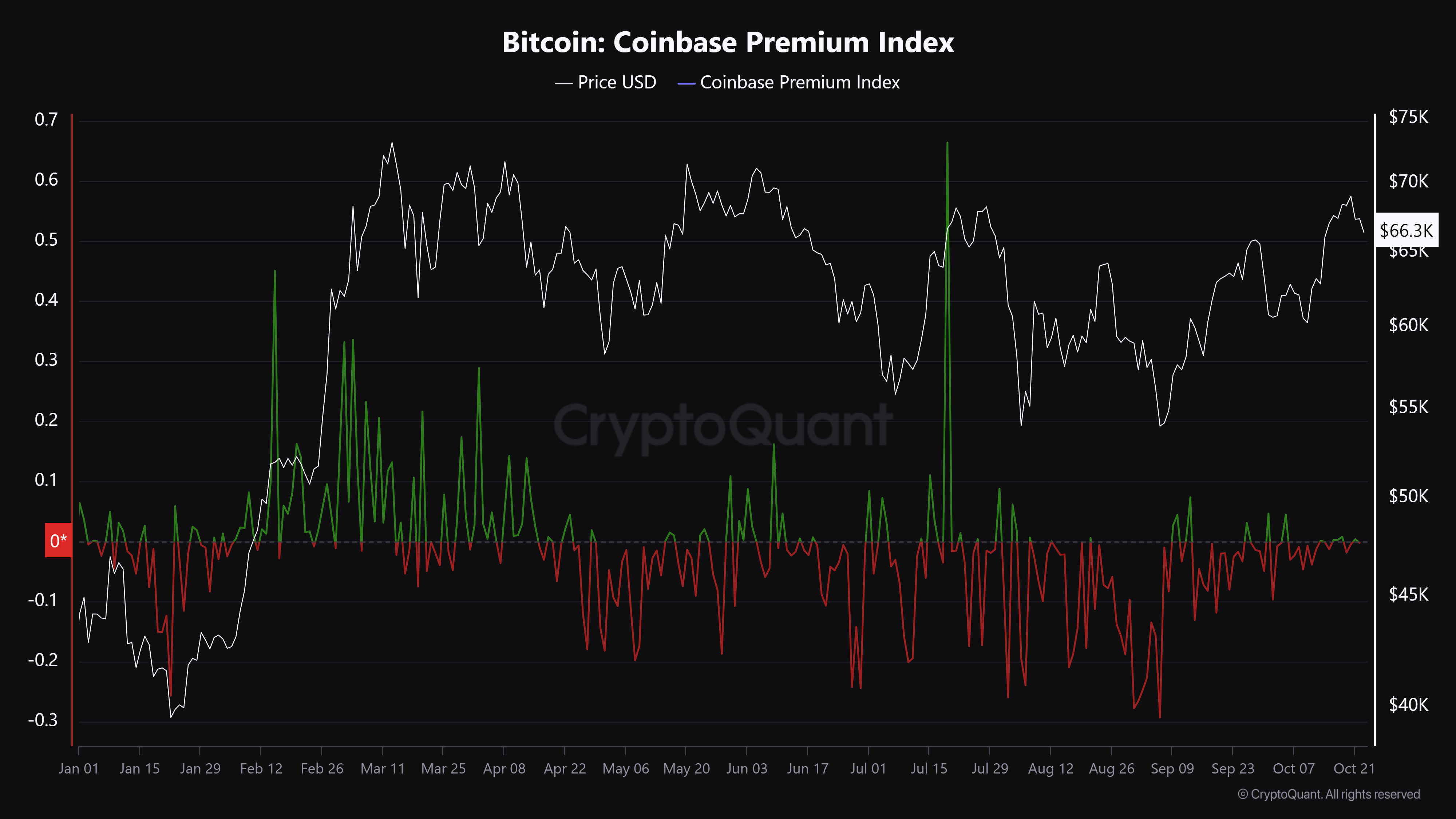

The optimism after the approval of the U.S. spot BTC ETF was evident by a surge in U.S. investor demand for the asset in Q1 2024, as shown by the spikes (green) in the Coinbase Premium Index.

The renewed optimism saw BTC hit an all-time high (ATH) above $73K in March. Will the trend repeat?

At the time of writing, the investor interest in Q4 was lower than the huge demand seen in Q1. That said, BTC was valued at $66.3K, about 11% from the March’s ATH.