Bitcoin Halving countdown – Why this 20-month high is sign of things to come

- Supply held by wallets with 10 – 10k coins surged to a 20-month high.

- An analyst noted higher chances of Bitcoin hitting $72.8k in the days ahead.

Investors started to increase Bitcoin [BTC] exposure in their portfolios as the countdown to the economically-significant halving event began.

Pre-halving bullishness takes shape

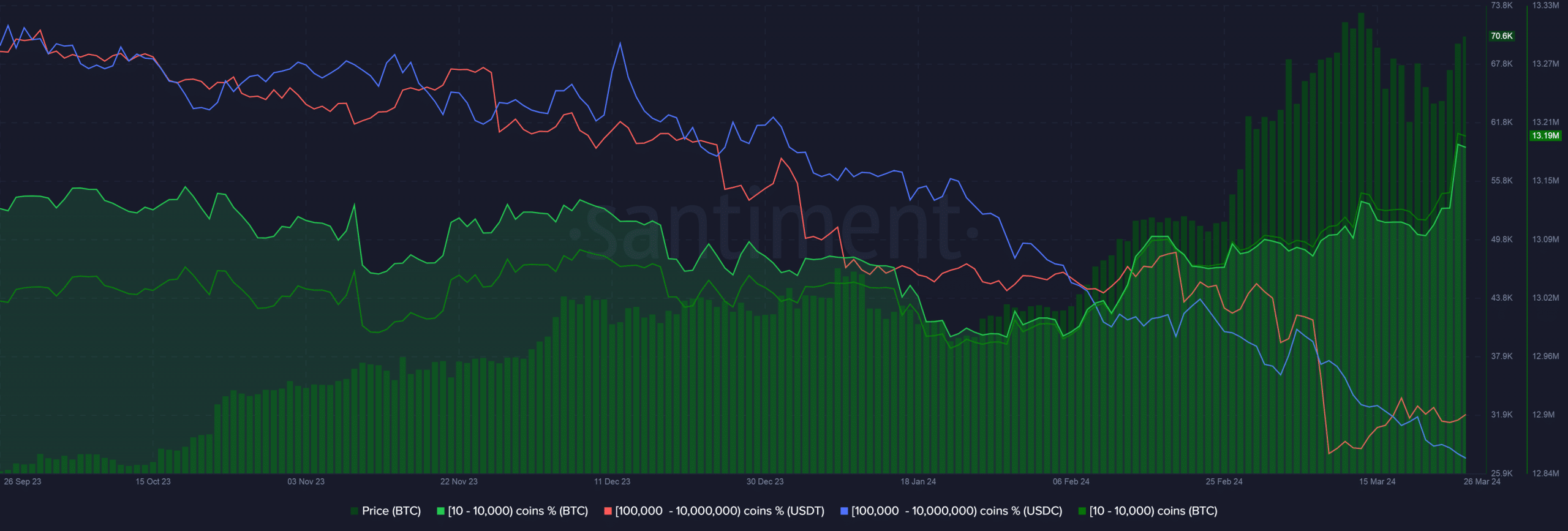

According to on-chain analytics firm Santiment, wallets holding between 10 – 10k coins amassed a total of 51,959 BTCs on the 24th of March, representing one of the largest accumulation days in recent memory.

To put this in perspective, nearly 0.263% of BTC’s total circulating supply was scooped up by this cohort in just one day.

With the latest grab, the total supply held by the aforementioned group surged to a 20-month high of 13.19 million. Additionally, the ratio of supply held by the cohort reached 67%, highest since July 2023.

Santiment stated that it would be “unsurprising” to see more accumulation activity from these wallets, considering that halving was around the corner.

The quadrennial event, which reduces block rewards by half and slows the creation of new coins, could be a significant bullish trigger for the world’s largest digital asset.

The supply squeeze, coupled with growing demand from the new U.S. spot ETFs, had the potential to inflate Bitcoin’s price further.

Stablecoin holdings drop sharply

Interestingly, the stablecoin reserves held by these whales and sharks plunged sharply. Wallets with 100k – 10 million USDTs saw their holdings drop to lows not seen since January 2023.

Similarly, the 100k – 10 million USDC cohort held the lowest amount since March 2023.

This implied that any future accumulation activity would not be completely driven by stablecoins. Rather, they could be used as dry powder, allowing investors to use them for strategic investments or emergencies.

Next target — $72,800

As of this writing, BTC was exchanging hands just a little over $71k, per CoinMarketCap.

Read Bitcoin’s [BTC] Price Prediction 2024-25

According to popular technical analyst Ali Martinez, the king coin could rise up to $71,800 in the short term, provided the support at $70,400 holds.

Moreover, in one of his earlier forecasts, he anticipated it would hit $72,880 once it emerged from its corrective phase. It would be interesting to see how accurate his forecasts turn out to be.