Bitcoin: All factors leading up to the worst decline of 2023

- The crash was a reflection of the market’s insecurity that spot Bitcoin ETF approvals in the United States might not be immediate.

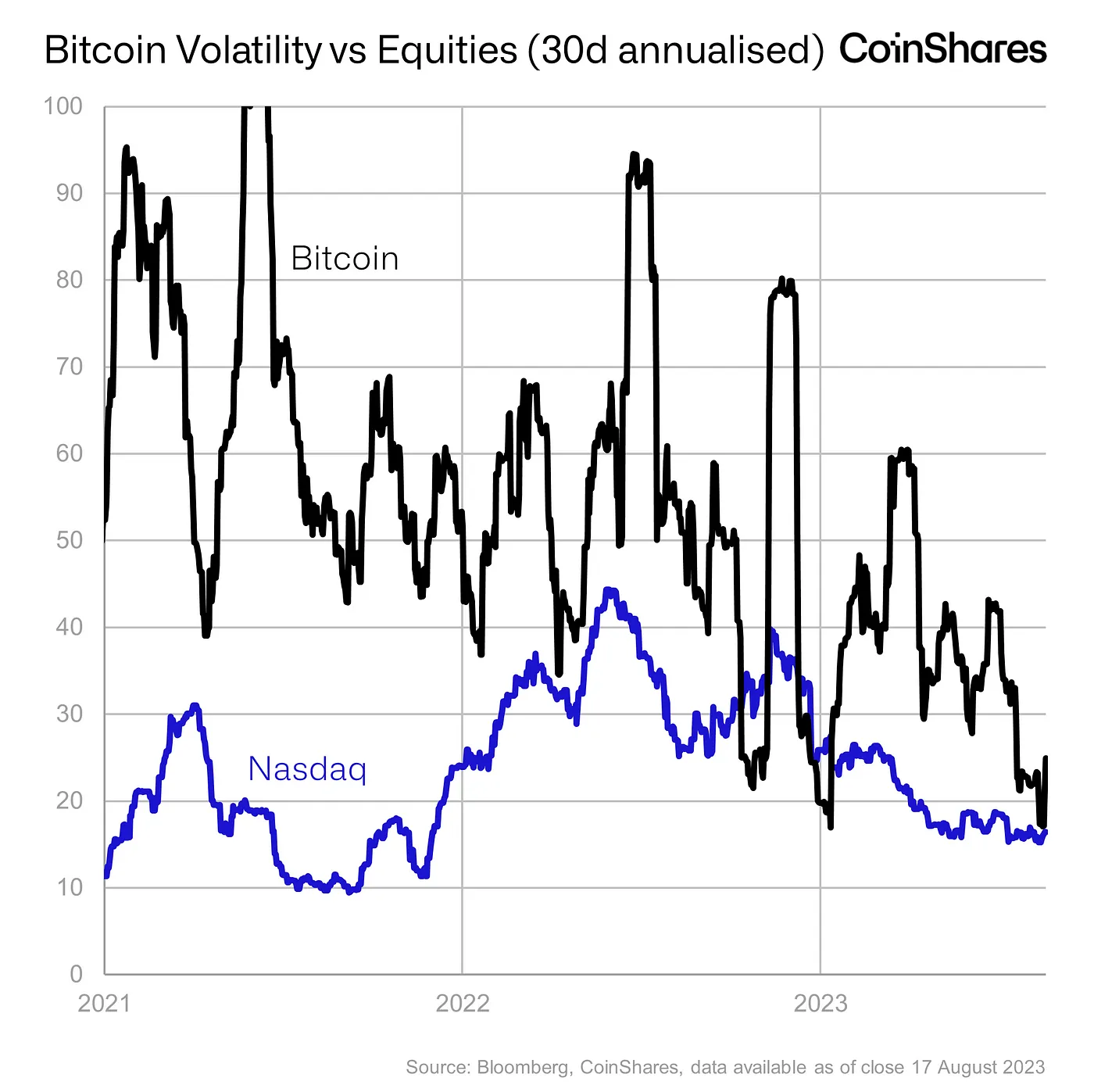

- The historical drop in BTC’s volatility has preceded violent moves in either direction.

Bitcoin [BTC] sank below $26,000 on 18 August, as the long-awaited volatility continued to bring more tears than cheers for a big chunk of market participants. The tumultuous week ended on a sad note for the bulls, with the king’s coin price plunging by more than 11% since the start of the week, data from CoinMarketCap revealed.

Is your portfolio green? Check out the BTC Profit Calculator

The sudden dip caused mayhem in the market, severely impacting investors’ portfolios. Experts and watchers began to look into the various circumstances that led to the rout. A recent investigation by digital asset investment firm CoinShares touched upon a few crypto-specific and macroeconomic triggers that contributed to the turn of events.

Low volatility makes market vulnerable

Bitcoin’s volatility has fallen sharply in recent weeks, comparable to historically low levels recorded in the late 2022 and early 2023 market. As evident from the graph below, such levels have invariably preceded big price fluctuations in either direction.

Furthermore, Bitcoin trading volumes on centralized exchanges have steadily declined over the recent weeks. The daily average volume has hovered in the range of $2 billion- $3 billion, compared to the yearly average of $7 billion and the 2022 daily average of $11 billion.

According to James Butterfill, Head of Research at CoinShares, a volume drought like this made the market more sensitive to larger traders.

Regulatory uncertainty

Bitcoin’s last bull rally in June was precipitated by growing optimism over interest shown by TradFi giants in the prospects of cryptocurrencies. A flurry of applications for a spot Bitcoin Exchange-Traded Fund (ETF), including the one by world’s largest asset manager BlackRock, led to hopes of digital asset investment products becoming more mainstream.

Cut to August, this euphoria has subsided to a great extent. The U.S. Securities and Exchange Commission (SEC) subjected the applications to stringent review, resulting in delays.

In fact, some companies could end waiting until March 2024 for clearances on applications submitted in July 2023. Note that the regulator has the authority to postpone all of these ETF applications for up to 240 days.

The U.S. is home to some of the biggest TradFi institutions on the planet. The crash was thus a reflection of the market’s insecurity that approvals in the United States might not be immediate.

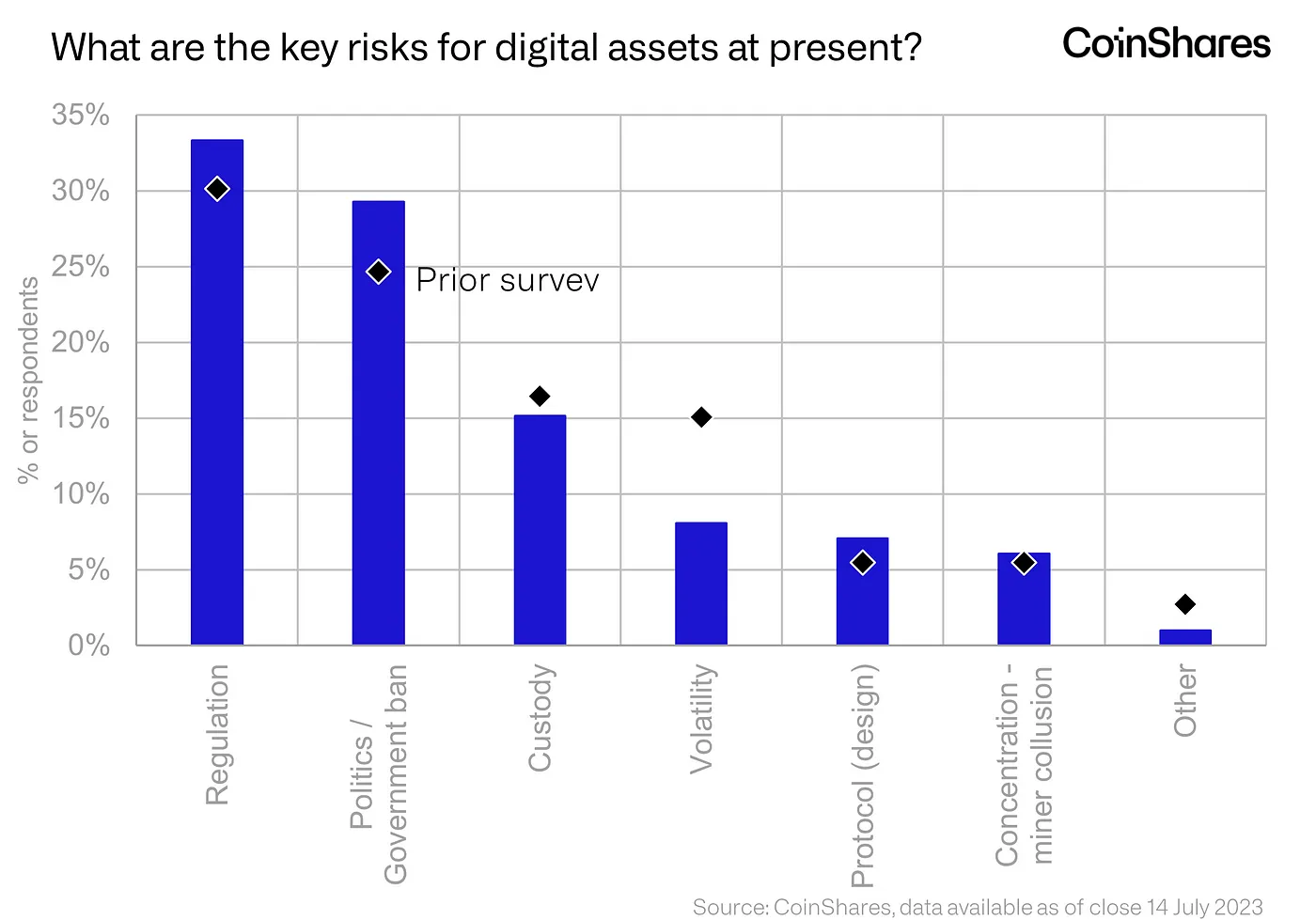

Regulatory bottlenecks in the country cast a big shadow on the movements in the crypto market. According to a CoinShares survey, regulatory decisions were the topmost concern for investors.

The Dragon running out of fire?

China, being the second-largest economy in the world and the largest exporter, is tightly coupled to the global economy.

Over the last few years, China’s once-famed property sector has been caught in a debt crisis. As per a recent report by Reuters, Chinese property giant Evergrande filed for bankruptcy protection in the U.S., the latest in a string of payment defaults by big developers.

These developments have spurred worries about the health of the Chinese economy, given that the property sector alone contributes to nearly a quarter of the country’s GDP. In turn, contagion risks to the global financial system became rife, prompting investors to draw back funds from riskier assets like Bitcoin.

However, the report underlined that if a full-scale economic meltdown were to happen, it could ultimately be beneficial for Bitcoin in the long run.

Wider market crash on the cards?

Yields on long-term U.S. government debt touched their 16-year highs over investor bets that the U.S. Federal Reserve would continue hiking interest rates. Higher yields on bonds generally cast a negative effect on riskier assets like stocks and cryptos.

Hence, Bitcoin’s decline could be seen as the beginning of a broader crash in other asset classes, the report noted.

How much are 1,10,100 BTCs worth today?

It remains to be seen how the crypto market would navigate the aforementioned headwinds. The Fed’s anticipated move to refrain from bumping interest rates in September could act as a bullish trigger.

Moreover, decisions on BlackRock’s and Grayscale’s ETF applications next month would be critical in determining market direction.