A new Bitcoin all-time high? Here’s your June price forecast…

- Bitcoin is only entering the second, more aggressively bullish phase of the cycle, according to one metric.

- The security and network fundamentals remained intact, bolstering confidence.

Bitcoin [BTC] reached its all-time high against the U.S. Dollar on the 14th of March, 2024, reaching $73,777. Previously, the Bitcoin all-time high was at $69,000, set on the 10th of November.

Against other fiat currencies, Bitcoin has already established an all-time high. The Turkish Lira, the Argentine and Philippine Peso, and the Indian Rupee are just a few.

This showed that USD faced a lower inflation rate than these currencies, but also meant that Bitcoin is increasingly likely to be seen as an inflation hedge.

The reason behind the belief in Bitcoin

In a recent AMBCrypto report, the Thermo Cap ratio metric was explored. The findings were that the network fundamentals were strong and the value invested into the network was growing steadily.

However, it was also noted that the Network Value to Transactions metric was dropping. This meant users were not transacting enough volume to justify the BTC prices. The growing investor confidence and the rise of the “inflation hedge” argument.

Another report showed that the futures market participants remained sidelined and the funding rate was subdued.

A strongly bullish piece of news was needed to shake Bitcoin out of its lethargy. The $886 million inflow into U.S. Bitcoin ETFs on Tuesday, the 4th of June, did just that.

Examining on-chain metrics to understand the bull run

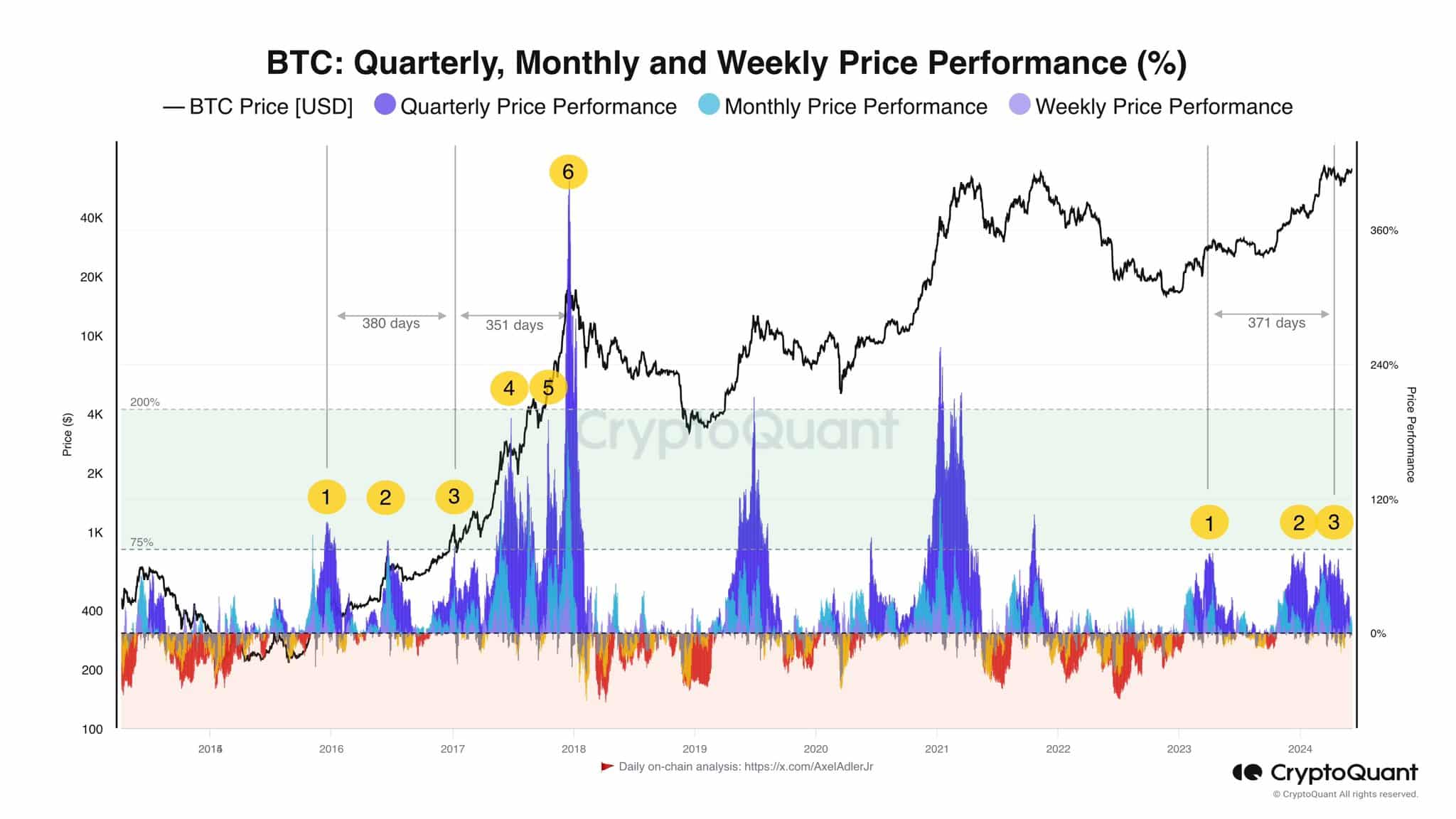

Source: Axel Adler on X

In a post on X (formerly Twitter), crypto analyst Axel Adler pointed out that the price performance of Bitcoin on the higher timeframes has not yet gone parabolic.

In the 2017-18 run, 380 days of steady gains were followed by another 351 days of parabolic uptrend.

If it repeats, BTC could see another 12 months of uptrend.

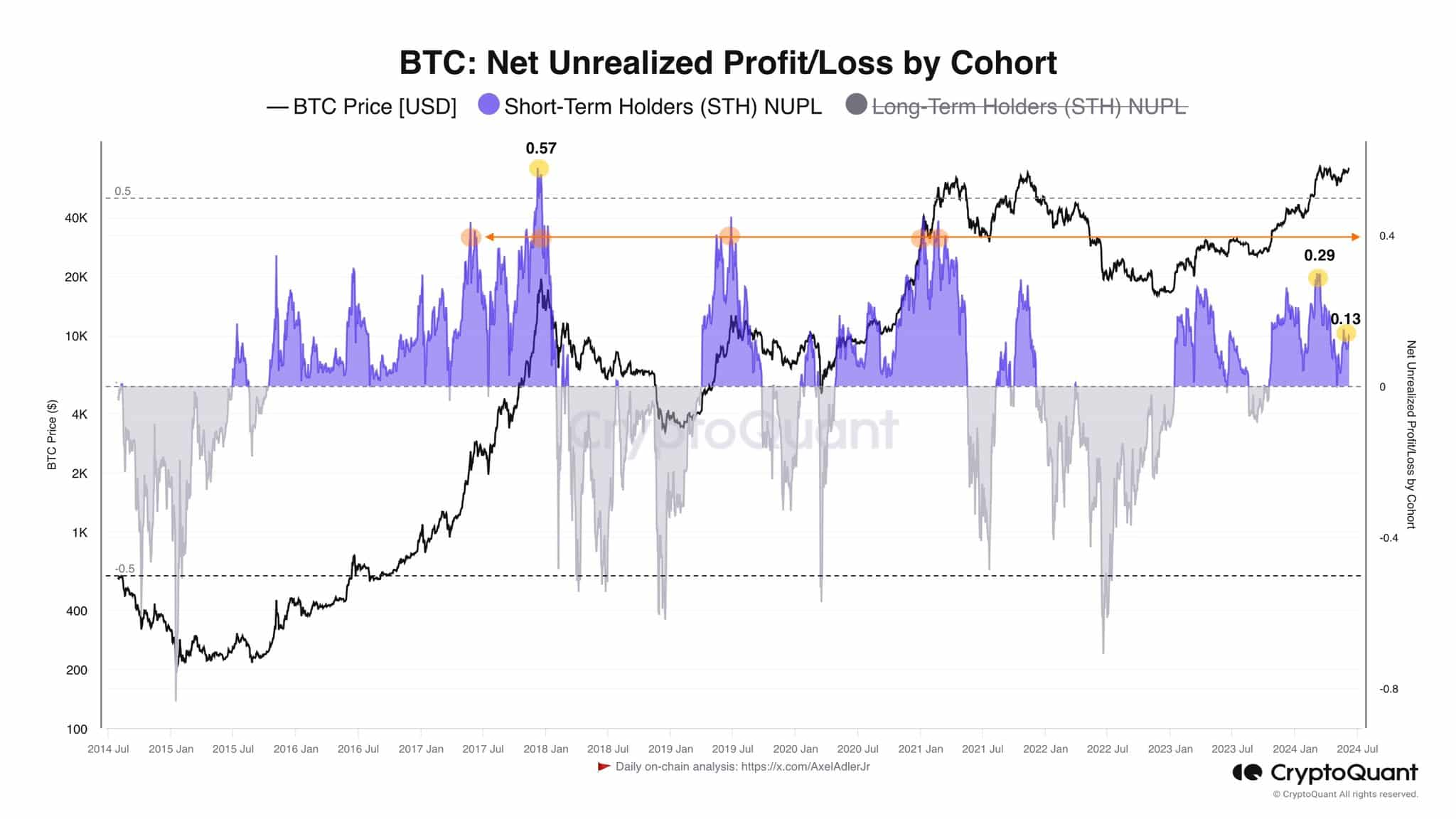

Source: Axel Adler on X

The short-term holder (STH) Net Unrealized Profit/Loss (NUPL) has not peaked either. According to the analyst, it would need to climb above 0.4 to mark the end of the current bull run.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The highest it has gone was 0.29 in March which was followed by a large correction as BTC consolidated over the past two months.

Therefore, the Bitcoin all-time high is very likely only a matter of time from here on.