Bitcoin analysis: Will rising high-yield credit rates boost BTC above $60K?

- High-yield credit rates turn bullish after breakout.

- Bitcoin price action sitting on crucial support.

Bitcoin [BTC] has become a focal point in discussions, particularly after yesterday’s, the 28th of August, downturn.

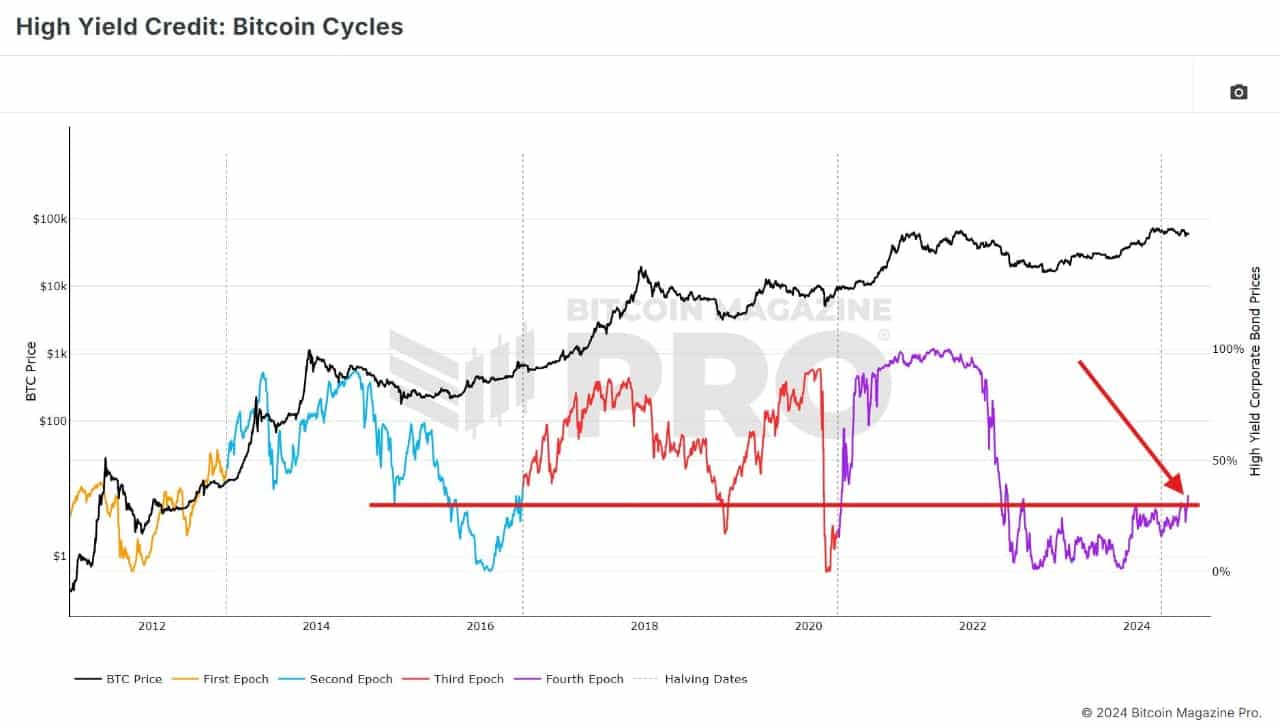

Analyzing high-yield credit rates reveals a bullish breakout from the lows, signaling increased investor optimism toward the global economy.

This shift in sentiment is contributing to a growing risk-on appetite for risk assets, including Bitcoin. This trend is expected to positively influence Bitcoin price, potentially driving it higher.

The movements in high-yield credit rates could play a significant role in shaping market dynamics, making it essential to monitor how these developments impact Bitcoin and other assets.

As BTC currently sits on crucial 4-hour support, the question arises: Will this renewed risk-on appetite help Bitcoin recover its recent losses?

Critical support holding

Focusing on Bitcoin price action, the BTC/USDT pair is currently consolidating within the $59K – $60K range on the 4-hour timeframe.

Nine consecutive 4-hour candles have failed to break below this critical support level, leading to speculation that BTC may have gathered the necessary liquidity around this range. However, the weekly candle still presents a concerning outlook.

Given the growing risk-on appetite and the potential for upcoming rate cuts, closely monitoring Bitcoin performance in September will be vital as it could set the direction for BTC in the coming months.

Bitcoin RSI approaches extremely oversold levels

Moreover, BTC’s Relative Strength Index (RSI) is nearing extremely oversold levels. While an immediate rebound may not occur, historically, such RSI levels have often preceded significant price reversals.

With the indicator approaching the flip zone, the increasing risk-on appetite could help BTC reverse its recent losses and potentially aim for the $70K price level.

Liquidity analysis

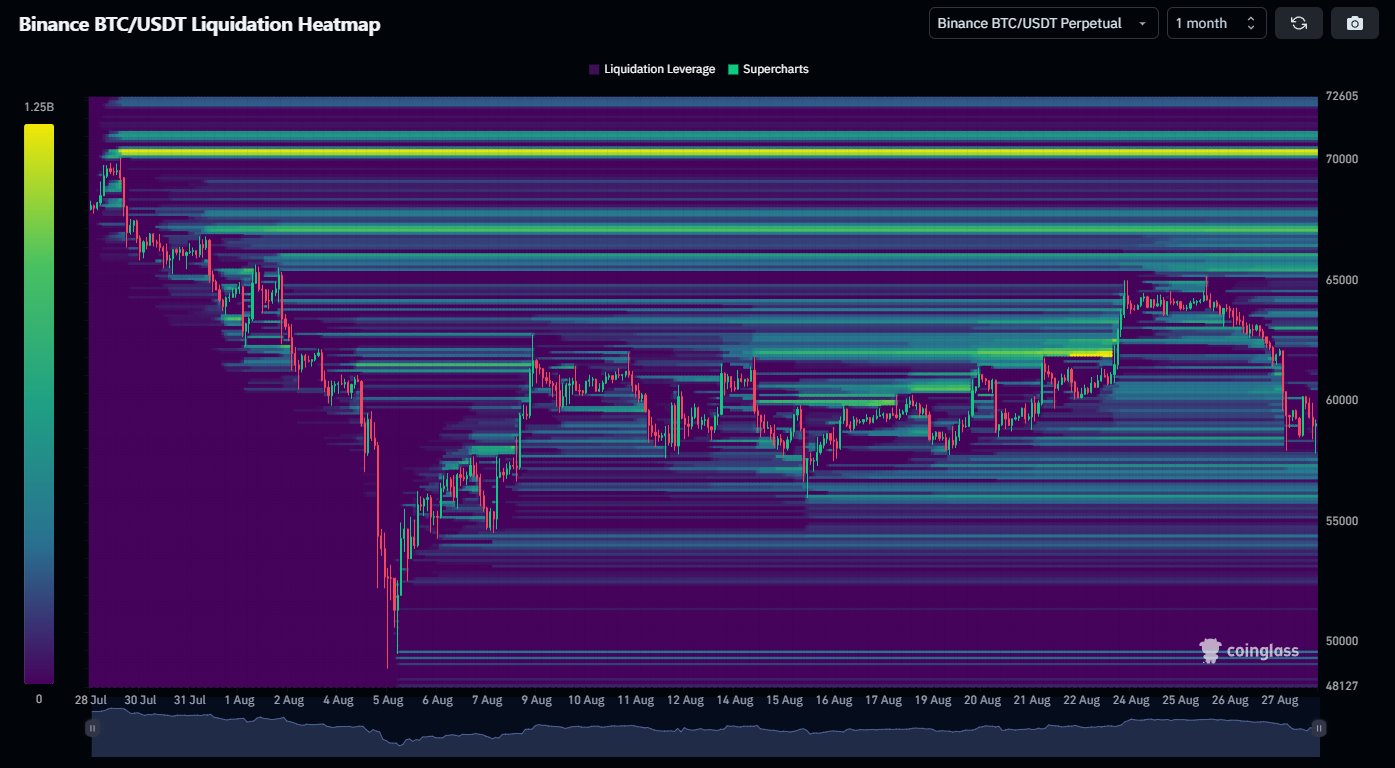

Liquidity analysis also shows that Bitcoin recently absorbed substantial liquidity below the $60K mark, with prices briefly dipping below $58K.

However, a significant liquidity zone awaits above $70K. If BTC fails to break below its current support level, there’s a strong expectation that the price will revisit this higher zone.

Although it’s too early to fixate on this target, if Bitcoin price starts trading within a few percent of this level, it becomes more likely that the liquidity will be taken out.

Read Bitcoin’s [BTC] Price Prediction 2024-25

For now, BTC remains near the lower end of this range, so vigilance is necessary. Bitcoins price action, influenced by the growing risk-on appetite, could see a recovery from recent losses, especially if critical support levels hold.

The potential for BTC to move higher is evident, but it requires careful observation of key indicators and market dynamics.