Bitcoin analyst eyes a rebound based on THIS historical pattern

- Bitcoin experienced a significant decline over the past month.

- The declining short-term Sharpe ratio left analysts eyeing a rebound.

Bitcoin [BTC], the largest cryptocurrency by market cap, has experienced a sustained decline over the past 30 days. However, the last 24 hours have seen the crypto make moderate gains.

As of this writing, it was trading at $58,820 after a 1.10% increase over the past day.

Prior to this, the king coin was in a declining trend, dropping by 6.32% over the past seven days. Equally, it has declined by 4.37% over the past month.

Despite the recent gains on daily charts, BTC remained 20% below its ATH of $73737 recorded earlier this year.

Despite the recent poor performance, key stakeholders including analysts remained optimistic about the crypto’s direction.

For instance, CryptoQuant analyst Kripto Mevsimi eyed a rebound from the recorded downside, citing short-term Sharpe ratios.

Market sentiment

In his analysis, Mevsimi cited the 2023 cycle, arguing that the current short-term Sharpe ratio mirrored the previous year’s cycle.

During the previous cycle, when the short-term Sharpe ratio declined, BTC prices surged from a low of $26675 to a high of $35137.

Based on this historical performance, those who are bullish view it as a possible rebound signal.

However, the analyst provided a contrary view for bearish investors, positing that a bearish interpretation may indicate a sustained volatility.

In totality, a declining short-term Sharpe ratio implied increased volatility without a proportional increase in investment returns, thus making investments less attractive.

If the analysis is purely based on the historical cycle in relation to the short-term Sharpe ratio, BTC might rebound.

Accordingly, this bullish assessment is further strengthened by Santiment’s analysis, which posited that BTC was performing well without relying on S&P 500, suggesting independence from equities.

What BTC’s charts suggest

This analysis provided a positive outlook for future price movement. Therefore, it’s essential to understand what other indicators suggest.

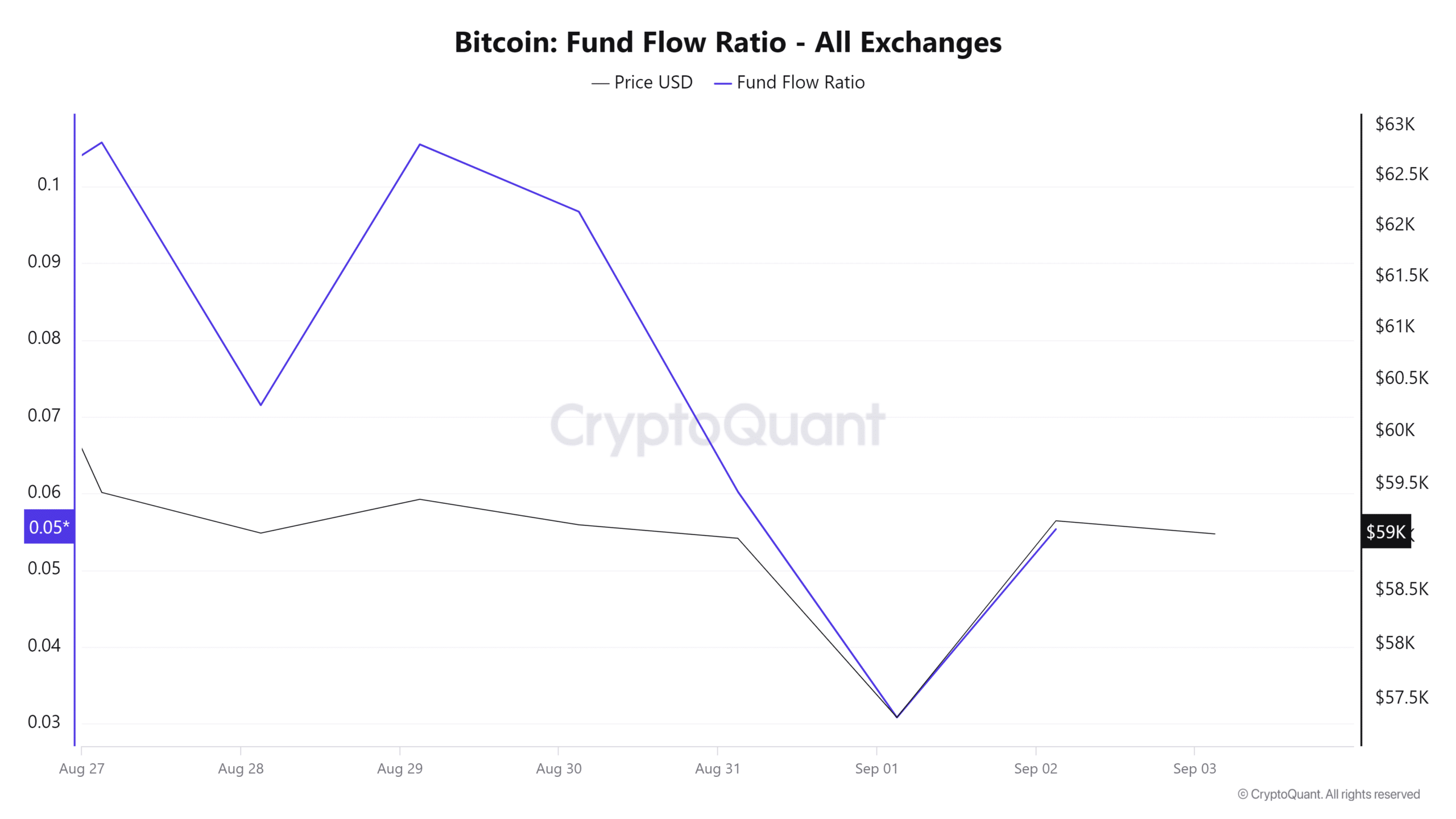

For starters, Bitcoin’s Fund Flow Ratio declined over the past seven days. A decline in the fund flow ratio implied that investors were choosing to HODL their assets rather than sell.

This signaled long-term confidence, with investors keeping their funds in cold storage rather than exchanges. Such market behavior results in accumulation in anticipation of the future price increase.

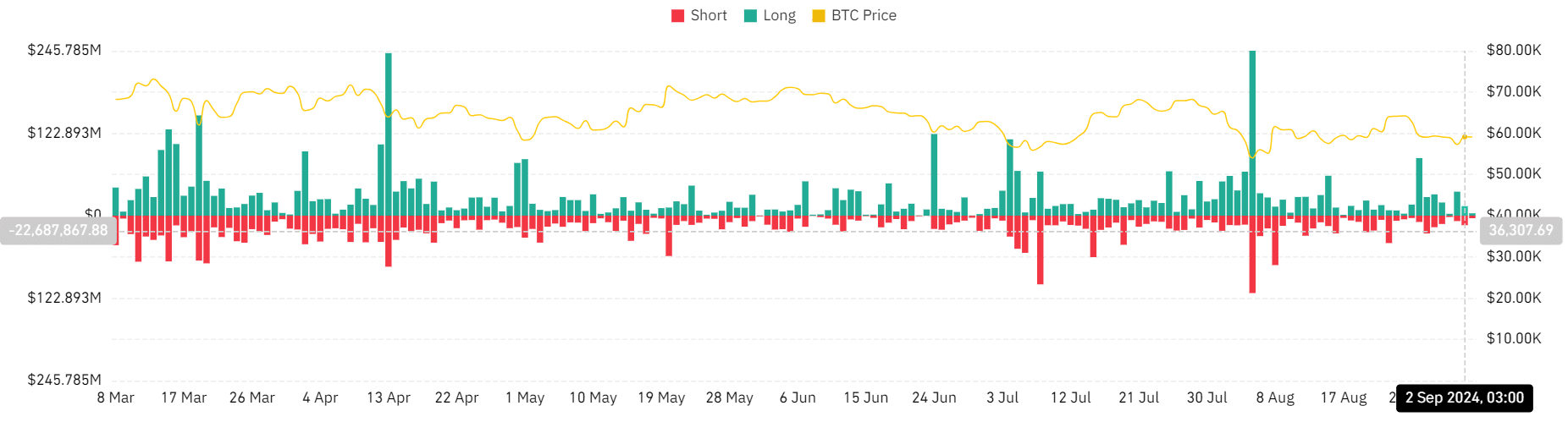

Additionally, BTC’s liquidation has reduced over the past three days. Long position has declined from $35.7 million to $3.4 million at press time.

This showed investor confidence in long-term price increases, as they were willing to pay a premium to hold these positions.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

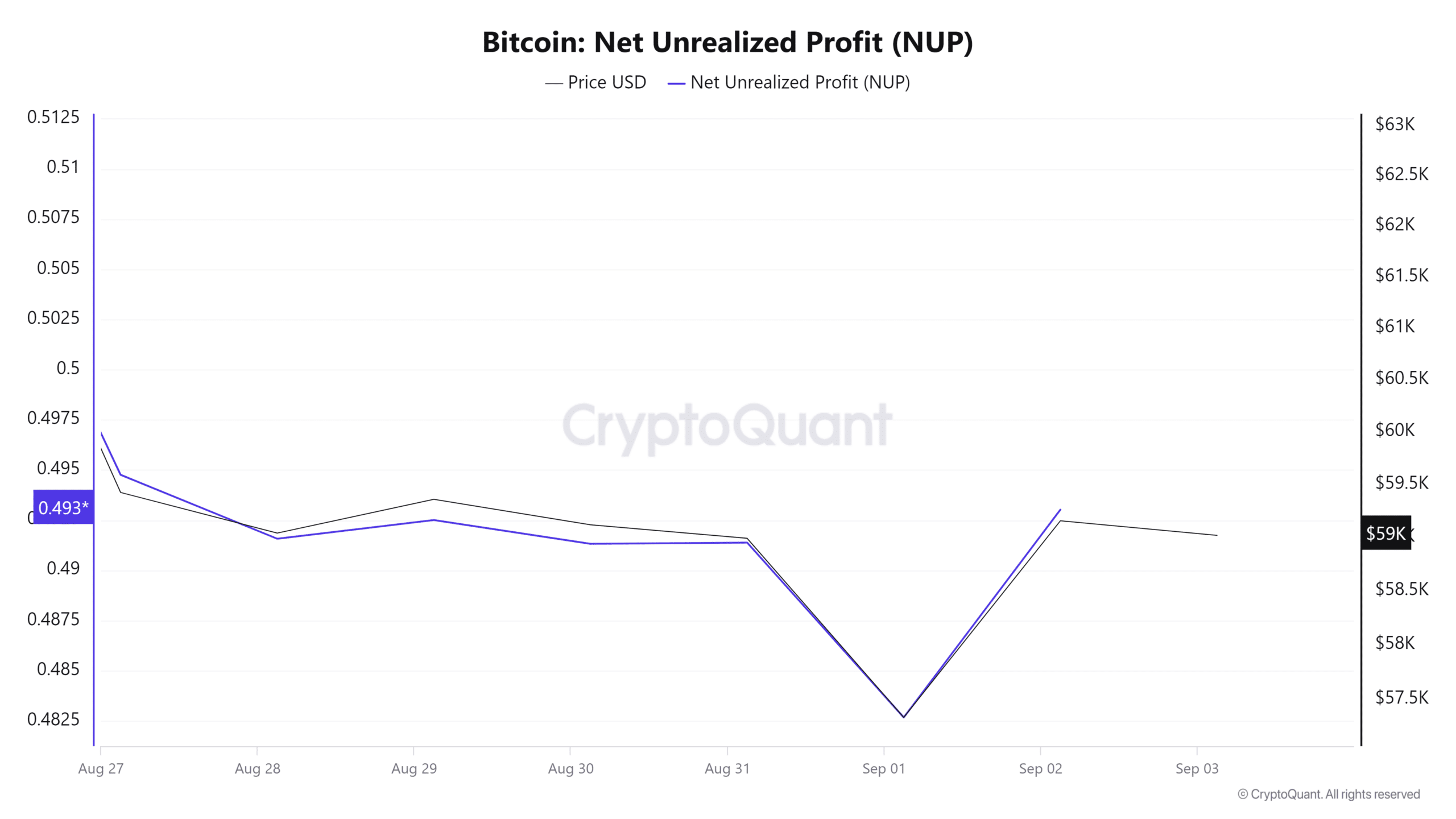

Finally, BTC’s net unrealized profit was at 0.49, indicating that the prevailing market sentiment was optimistic. At this rate, although there was some profit-taking, it was unlikely to result in a major correction.

Therefore, if the prevailing market sentiment holds, BTC is well positioned to break out of the stubborn resistance level around $60k and challenge the $64,752 resistance level.