Bitcoin and Ethereum, are traders buying the dip?

The age-old debate, the dilemma of buying vs HODLing, and the recent price correction were one of the many dips in the extended bull run of 2020. Elevatetrading’s founder Nebraskan Gooner recently tweeted about the dip. His point being, over 90% of crypto Twitter asking traders if they bought the dip are likely the same ones that were telling everyone to buy Bitcoin at $60000.

Bitcoin is now trading at the $50000 level and buying the dip as a strategy hasn’t worked out as anticipated for most traders in the current bull season, back in 2017 the market capitalization was largely wiped out. It is a popular strategy with institutions and has emerged as a trend. Based on Grayscale’s institutional buying data from bybt.com, institutions like Grayscale are buying the dip.

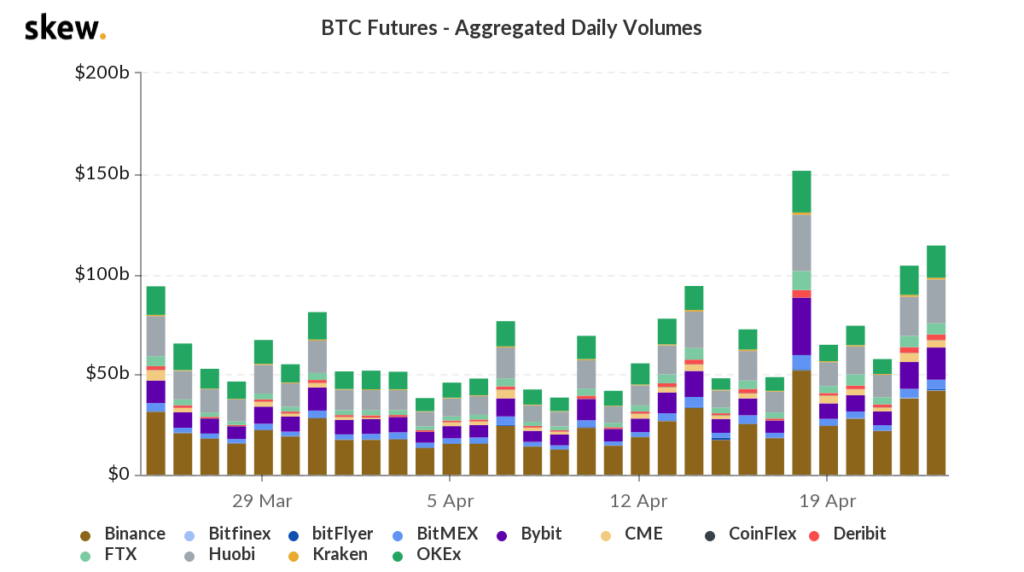

Short sellers have turned to futures markets on most instances of buying the dip. At the current price level, with Bitcoin at $50000 level, Bitcoin futures volume is at $114 Billion.

Bitcoin futures chart || Source: Skew

The highest volume in Bitcoin futures was observed on April 18 when the volume crossed $150 Billion. Despite the numbers on the chart, short-sellers are currently dominating the futures market. There are five times more short sellers in the current Bitcoin futures market. Buying the dip, therefore, is not the strategy that offers higher returns through the dip.

One metric that offers insight on altcoin’s performance in both cases, buying the dip vs HODLing is the concentration by HODLers and short-term ROI. For top altcoins, ETH, XRP, LTC, ADA, and LINK, the price has recovered nearly 10% since the price drop. The concentration by HODLers hasn’t changed significantly, and this means that HODLers haven’t accumulated further or even sold during the dip. This is a bullish sign for altcoins, as there is scope for a price rally following the correction.

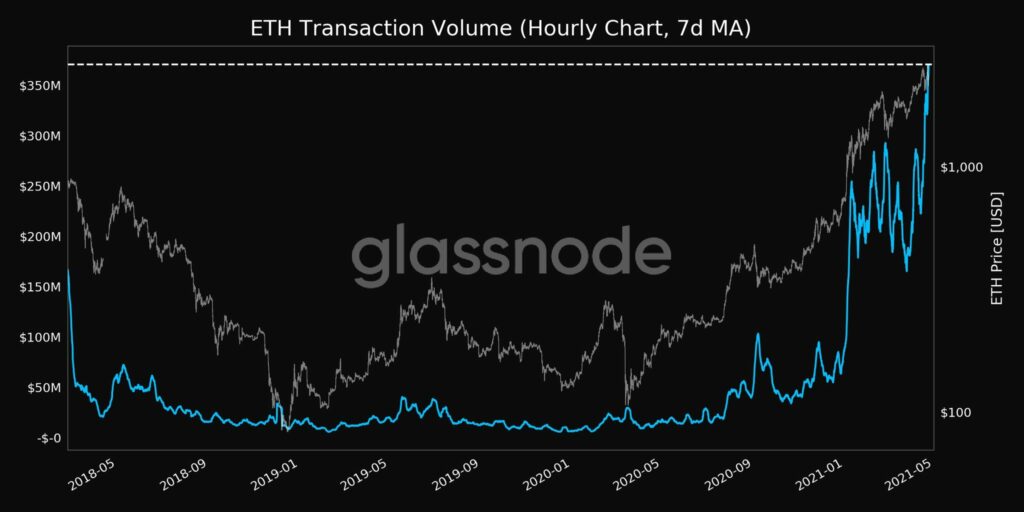

The recent dip has emerged as a real liquidity run, given that it continued through Friday, ended right before the weekend started. Selling is consistent before the price rally is over, and the buy the dip narrative is a cliche, but not in the case of ETH. Post the dip and correction in ETH’s price, ETH’s transaction volume has hit a 3-year high based on data from Glassnode.

ETH Transaction Volume || Source: Twitter

ETH has emerged as the dominant altcoin when it comes to holding trader’s interest and inflow of investment. The fact that transaction volume hit a high following the dip validates the narrative that ETH traders may have actually bought the dip. Buying the dip may have worked out for top alts differently than it did for BTC.