Bitcoin: Are traders hoping for a sustained BTC rally?

- BTC options trading volume has grown significantly in December.

- Despite the minor price decline, BTC accumulation remains strong.

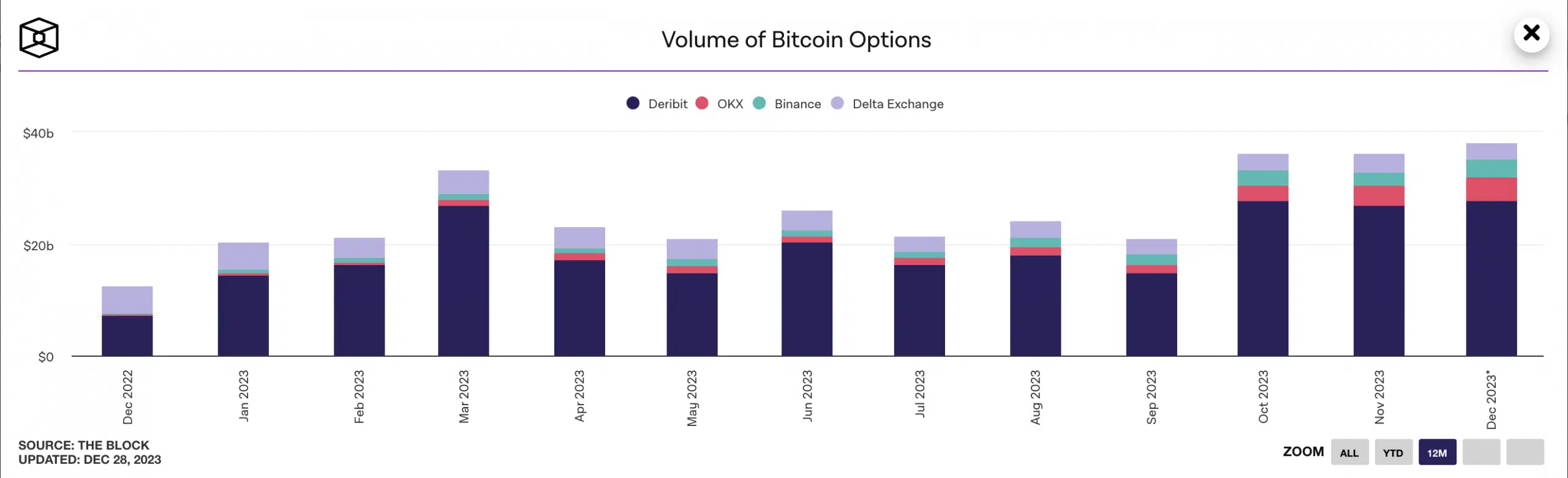

The Bitcoin [BTC] options market is experiencing a surge in activity, with monthly trading volume reaching an all-time high across major crypto derivatives exchanges, data from The Block’s Data dashboard has shown.

Standing at an all-time high, BTC’s monthly options trading volume currently totals $38 billion, marking a 5% increase from the $36 billion recorded in November. On a year-to-date basis, the coin’s monthly options trading volume has increased by 89%.

Deribit’s $28 billion constitutes 8% of the total monthly trading volume. It is followed by OKX, which has seen a trading volume of $4.35 billion. Binance comes in third place with a monthly trading volume of $3.23 billion.

What does this mean?

The rise in BTC’s options trading volume in the last month suggests the entry of new traders into the market. These new entrants are opening positions through option contracts, confirming increased market activity and the presence of high liquidity.

At press time, BTC exchanged hands at $42,696. According to data from CoinMarketCap, its value has risen by 12% in the last month.

The rise in the coin’s options trading volume, alongside the growth in its price, reinforces the current momentum. This suggests that traders are placing bets in favor of a sustained price rally.

In the coin’s futures market, similar sentiments lingered, AMBCrypto found.

According to data from Coinglass, BTC futures open interest has rallied by 12% since the month began. An assessment of the funding rates across exchanges showed that traders have only placed bets in favor of continued price growth since the general market rally began in October.

BTC on a weekly chart

Despite the 3% price retraction observed in the last week, coin accumulation persists strongly, according to readings from BTC’s price movements on a weekly chart.

Read Bitcoin’s [BTC] Price Prediction 2023-24

For example, the coin’s key momentum indicator Relative Strength Index (RSI), was 72.46. Likewise, its Money Flow Index (MFI) was 83.2. At these values, BTC buying pressure outpaced coin sell-offs.

Also, the coin’s Chaikin Money Flow (CMF) confirmed the steady inflow of liquidity into the BTC market. At press time, this indicator was 0.13.