Bitcoin

Bitcoin: As global liquidity reaches 2022 levels, what’s next for BTC?

Bitcoin set for higher prices due to rising global liquidity and bullish trends.

- Bitcoin price set to surge as global liquidity rises.

- Assessing next liquidity clusters for Bitcoin.

Bitcoin [BTC] continues to show strength, driven by rising global liquidity and favorable macroeconomic conditions.

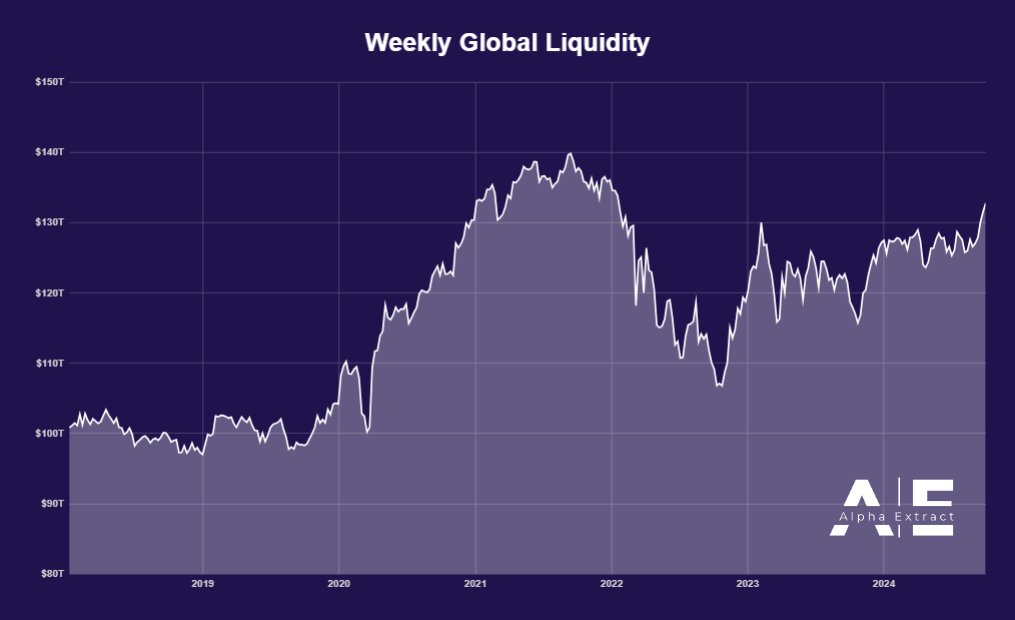

With global liquidity increasing by 0.92% to $132.8 trillion, the highest since early 2022, Bitcoin is expected to benefit from this trend.

Improved collateral values and actions by China’s central bank have contributed to this rise. Though the Federal Reserve has not yet implemented a stimulus, markets are optimistic about future rate cuts.

These factors suggest that Bitcoin could see higher prices, making the final quarter of the year particularly bullish for the broader crypto market.

Bitcoin’s price action and key levels

Bitcoin’s price recently bounced off the critical 0.786 Fibonacci retracement level, currently trading at $66,000. This level has consistently acted as a key indicator for both upward and downward movements this year.

The pattern of respecting this level shows that Bitcoin remains aligned with global liquidity trends. As liquidity continues to rise, it is expected to move higher, with the next major target being new highs above $66,700.

The global liquidity boost will likely benefit Bitcoin as it remains a primary hedge against monetary inflation, alongside gold.

Impact of September’s bullish close

This month closed with a 7.35% increase, making it the best-performing September in BTC’s history. This bullish sentiment is supported by Bitcoin’s ability to withstand recent corrections and maintain upward momentum.

Despite market expectations of a decline, AI models from Spot On Chain accurately predicted a bullish month, noting,

“There’s a 69% chance of a new all-time high this month and a 54% chance of Bitcoin reaching $100K by year-end.”

The broader crypto market is also expected to benefit from favorable macroeconomic factors, particularly potential rate cuts from the Federal Reserve and the European Central Bank.

The Fed has shifted its focus from inflation to employment, with a 42% probability of a 50 basis point rate cut in November.

If upcoming U.S. unemployment data comes in lower than expected, this probability could increase further. Rate cuts generally signal a more favorable environment for risk assets like Bitcoin, pushing its price higher.

Liquidity clusters to watch

Key liquidity clusters for Bitcoin are emerging as the price climbs. Recent retraces towards $63,225 allowed Bitcoin to grab liquidity, setting the stage for the next move.

The next high-liquidity clusters sit between $66,700 and $66,750, while lower clusters around $62,050 to $62,120 provide support.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

These levels will be important to monitor as Bitcoin continues its upward trend, potentially leading to a breakout to higher prices.

Rising global liquidity, bullish technical patterns, and positive macroeconomic signals position Bitcoin for higher prices soon.