Bitcoin: As Global M2 goes ‘parabolic,’ is BTC ready to explode?

- Bitcoin historically lags M2 spikes, and the current setup hints at a coming breakout.

- Network strength and tightening technical signal that Bitcoin is preparing for a major move.

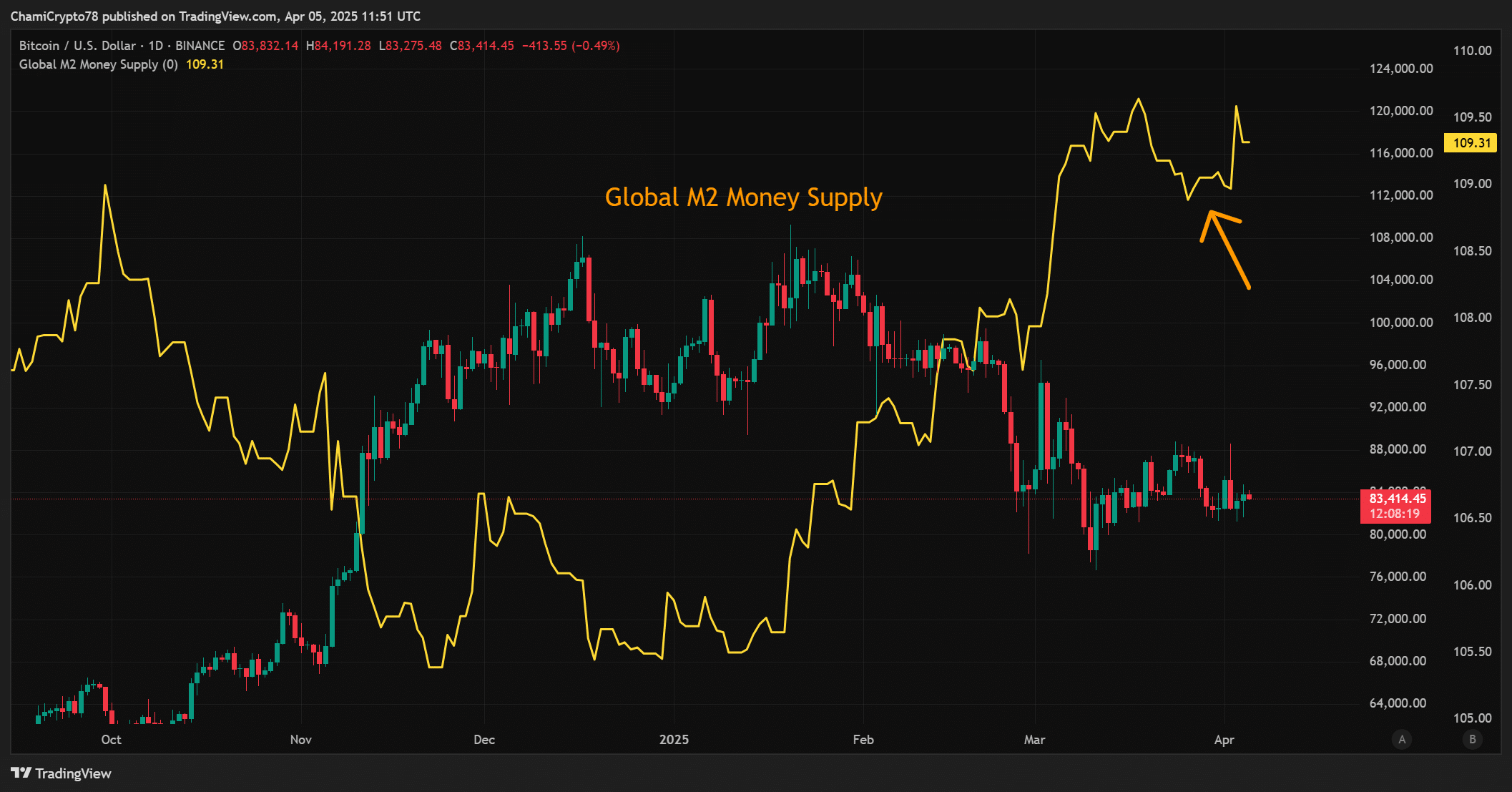

Bitcoin [BTC] is consolidating while global M2 is going parabolic, creating a perfect storm of liquidity that could trigger the asset’s next explosive move.

This expansion includes rising cash, checking deposits, and liquid near-money assets circulating across global economies.

As liquidity increases, fiat currencies weaken, and investors seek alternatives that retain value.

Therefore, Bitcoin—with its limited supply and decentralized structure—emerges as a preferred asset. Despite M2’s sharp rise, BTC remains in consolidation.

However, history shows that such divergences do not last long. Bitcoin has often responded to liquidity surges with delayed but explosive upside moves, and that window may be closing fast.

How does rising liquidity fuel BTC?

Expanding liquidity directly impacts investor behavior, often shifting capital into assets that resist inflation and maintain long-term purchasing power. Bitcoin thrives in this environment because it is programmed to be scarce.

With only 21 million coins to ever exist, its supply remains fixed, unlike fiat currencies that inflate endlessly. Therefore, rising M2 strengthens the long-term bullish case for BTC.

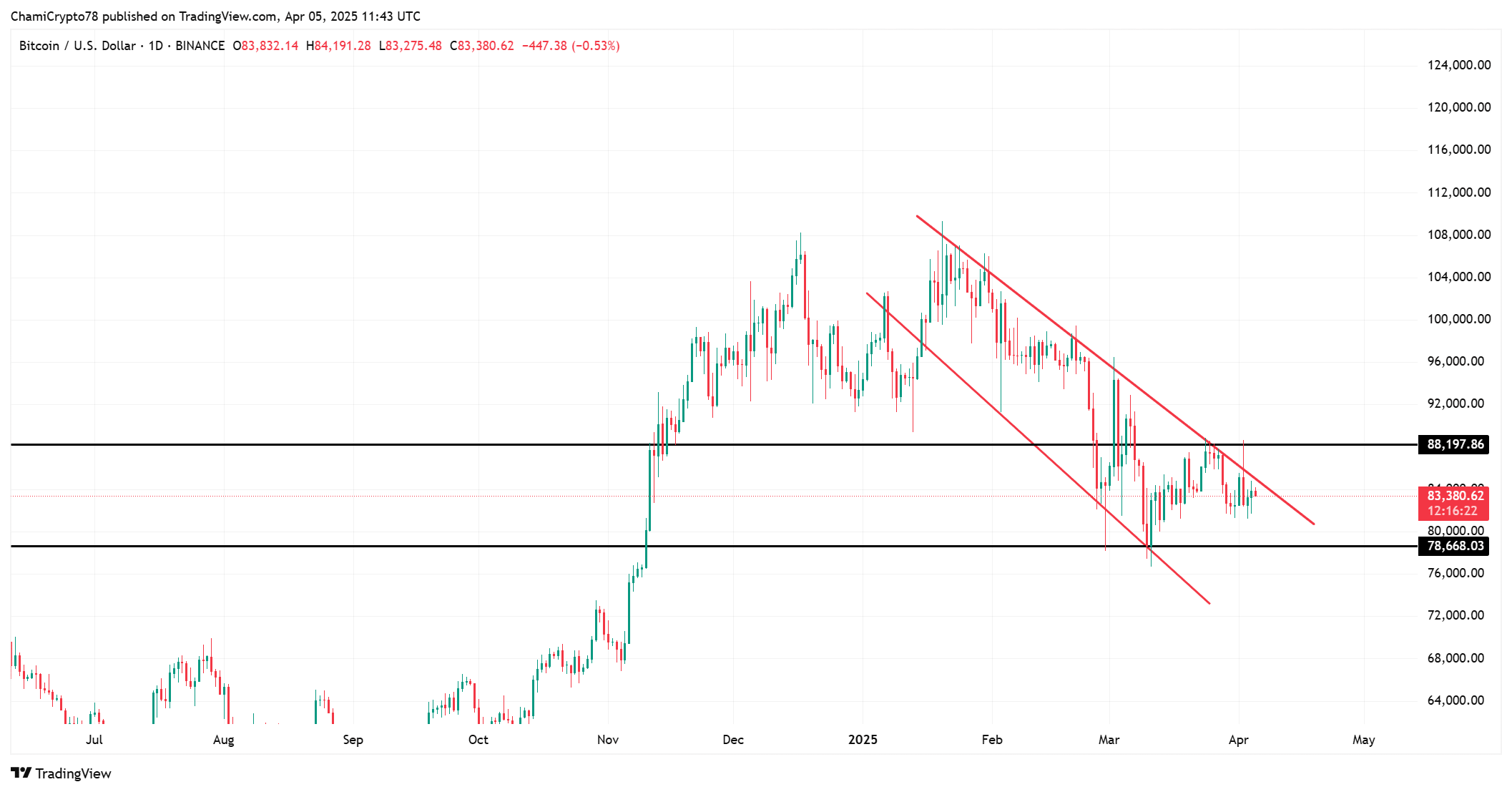

At the time of writing, BTC trades at $83,640, up 1.21% in the past 24 hours. Price continues to compress within a descending channel, facing resistance at $88,197 and holding support at $78,668.

This tightening structure, combined with aggressive monetary expansion, creates the perfect backdrop for a breakout. A move above resistance could align price action with the global liquidity curve.

Is the Bitcoin network showing strength?

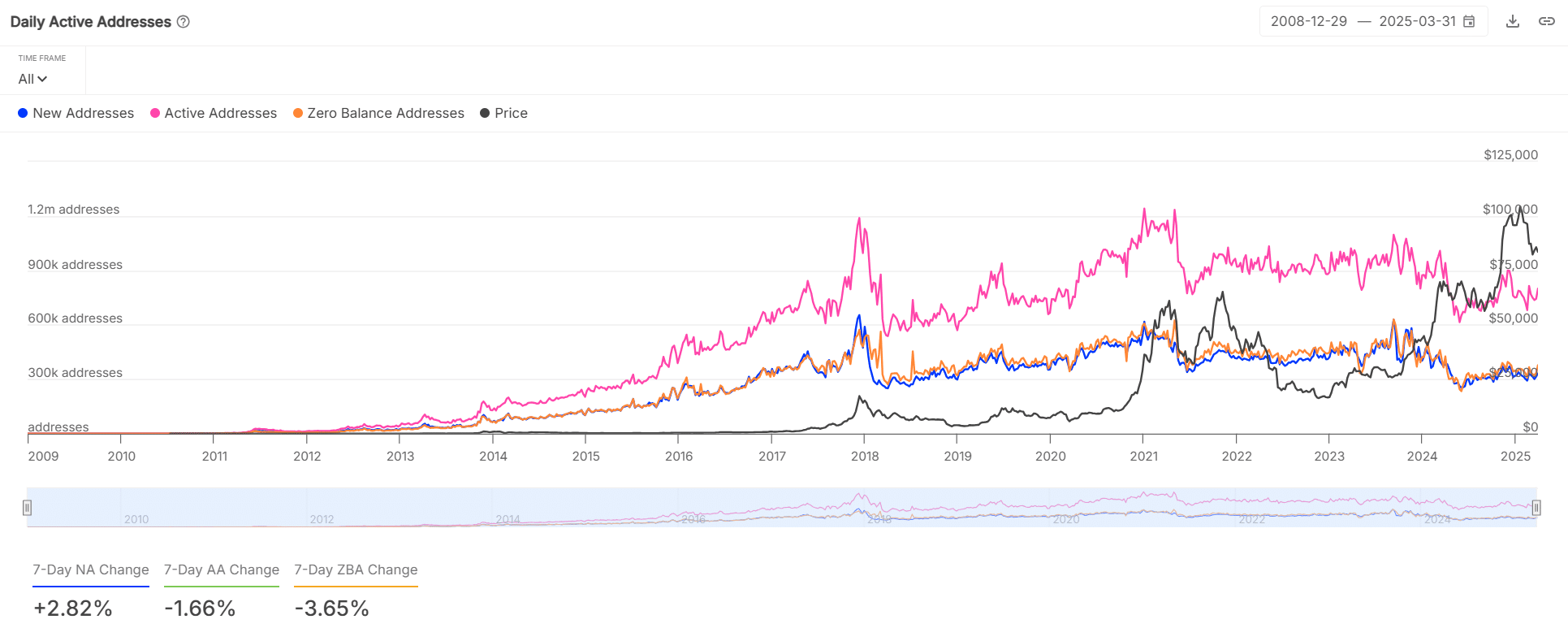

Bitcoin’s network activity remains strong, supporting the macro and technical thesis. New wallet addresses have increased by +2.82% over the past week, reflecting fresh participation.

At the same time, zero-balance addresses declined by -3.65%, suggesting fewer users are exiting. Although active addresses dipped slightly by -1.66%, the count remains near 800,000 daily, showing sustained usage.

These on-chain indicators reflect resilience. BTC’s base remains solid, even during price consolidation—a typical setup before larger moves.

Will Bitcoin wait much longer?

Bitcoin is consolidating while global liquidity goes vertical, creating an increasingly unstable equilibrium. On-chain metrics continue to show strength, and user participation remains steady.

Technical patterns are tightening, suggesting that price is preparing for a decisive move. Therefore, BTC won’t wait much longer—it is primed to respond sharply to the overwhelming monetary expansion.

![Chainlink [LINK] price prediction - Watch out for a defense of THIS key level!](https://ambcrypto.com/wp-content/uploads/2025/04/Evans-17-min-400x240.png)