Bitcoin: Assessing LTH vs. STH trends as BTC trades at $57K

- BTC long-term investors accumulated over 21,000 BTC.

- Long and short-term investors are holding at a loss.

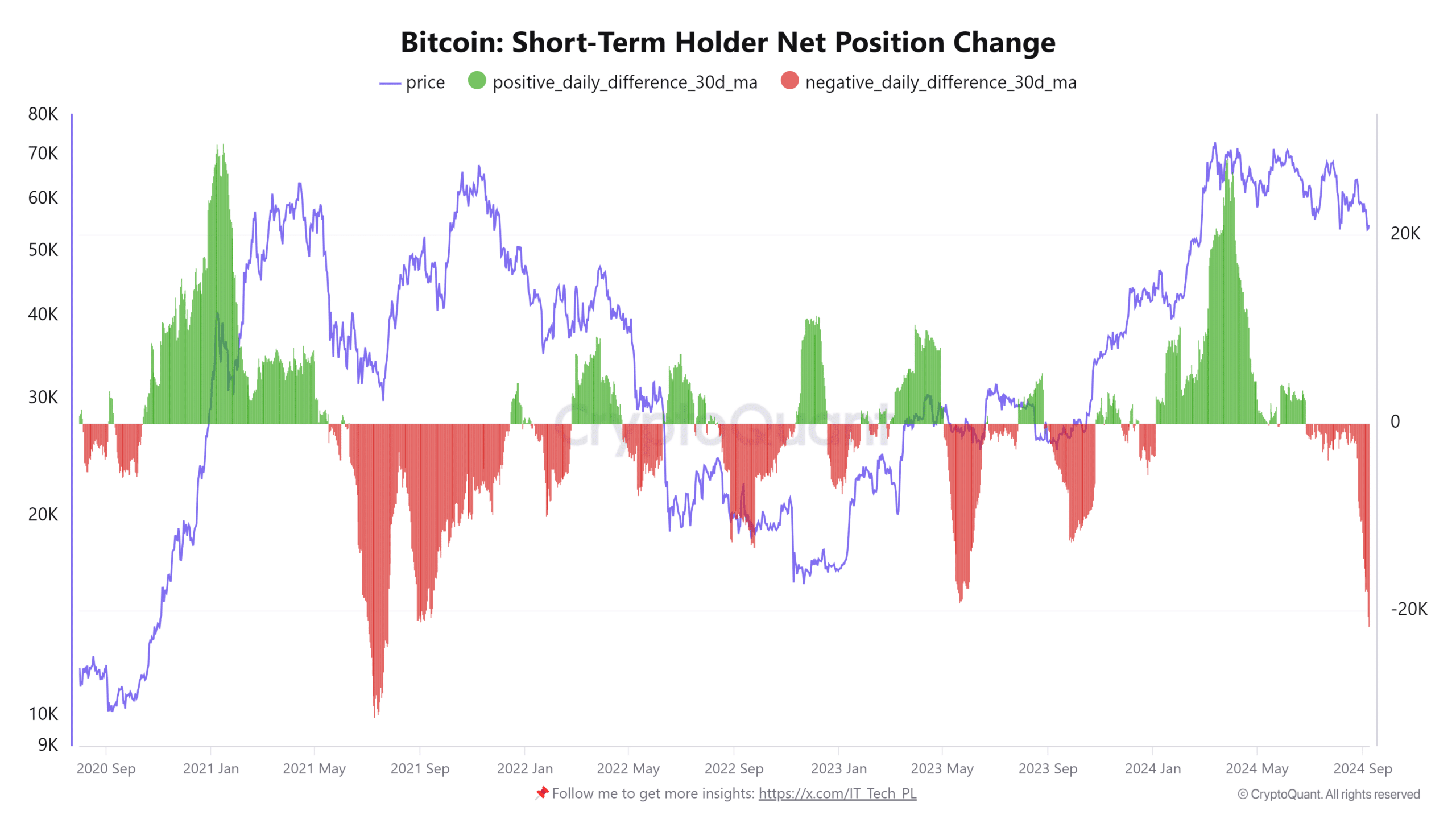

In the last three months, short-term Bitcoin [BTC] holders have shifted their strategy in response to the king coin’s price volatility, with many opting to sell off their holdings.

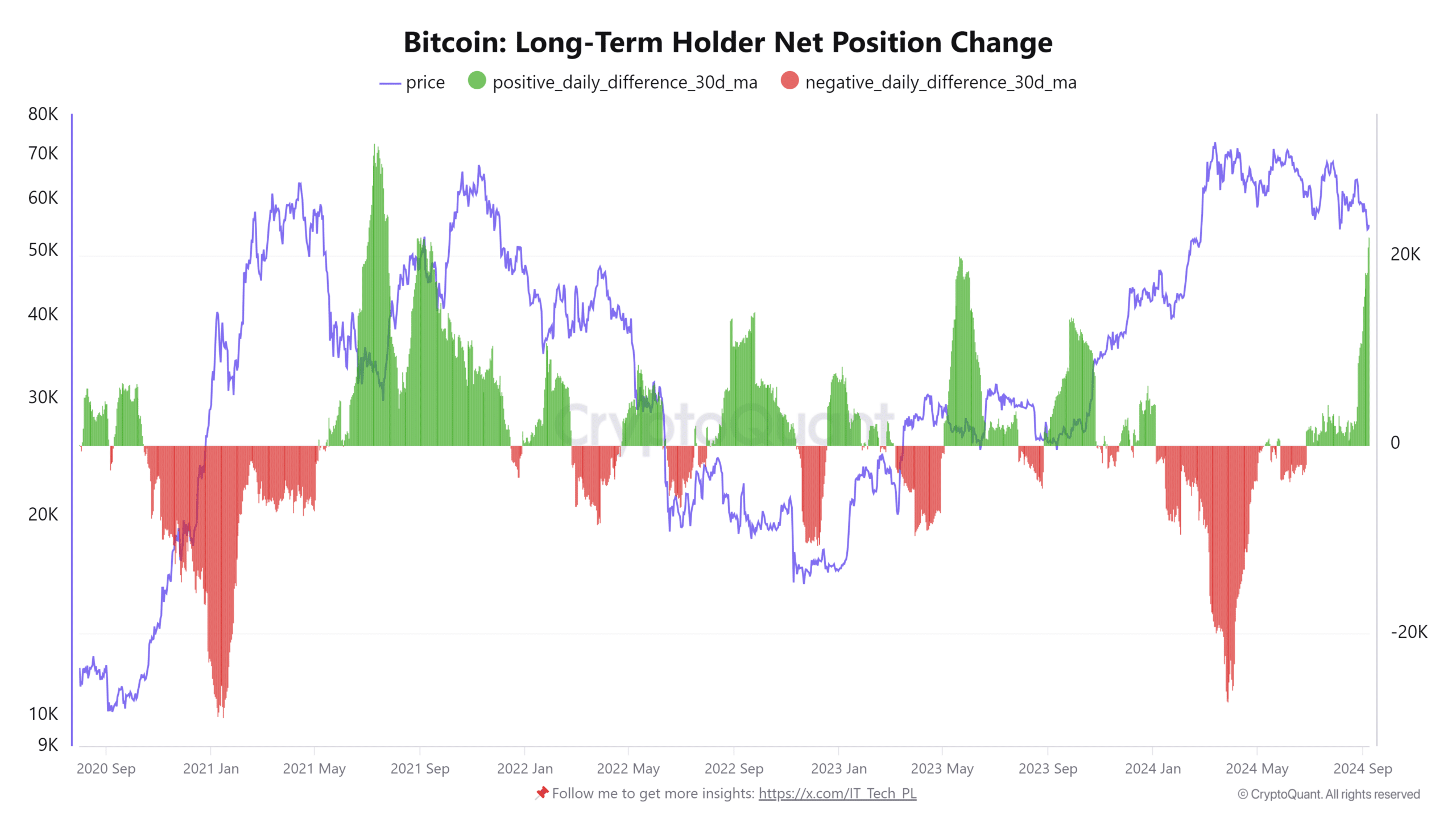

Conversely, long-term holders have increased their accumulation during this period, showing confidence in BTC’s long-term potential.

This increased accumulation by long-term holders has helped to maintain a relative balance in the market, offsetting the sell-offs from short-term holders.

Bitcoin loses almost 10%

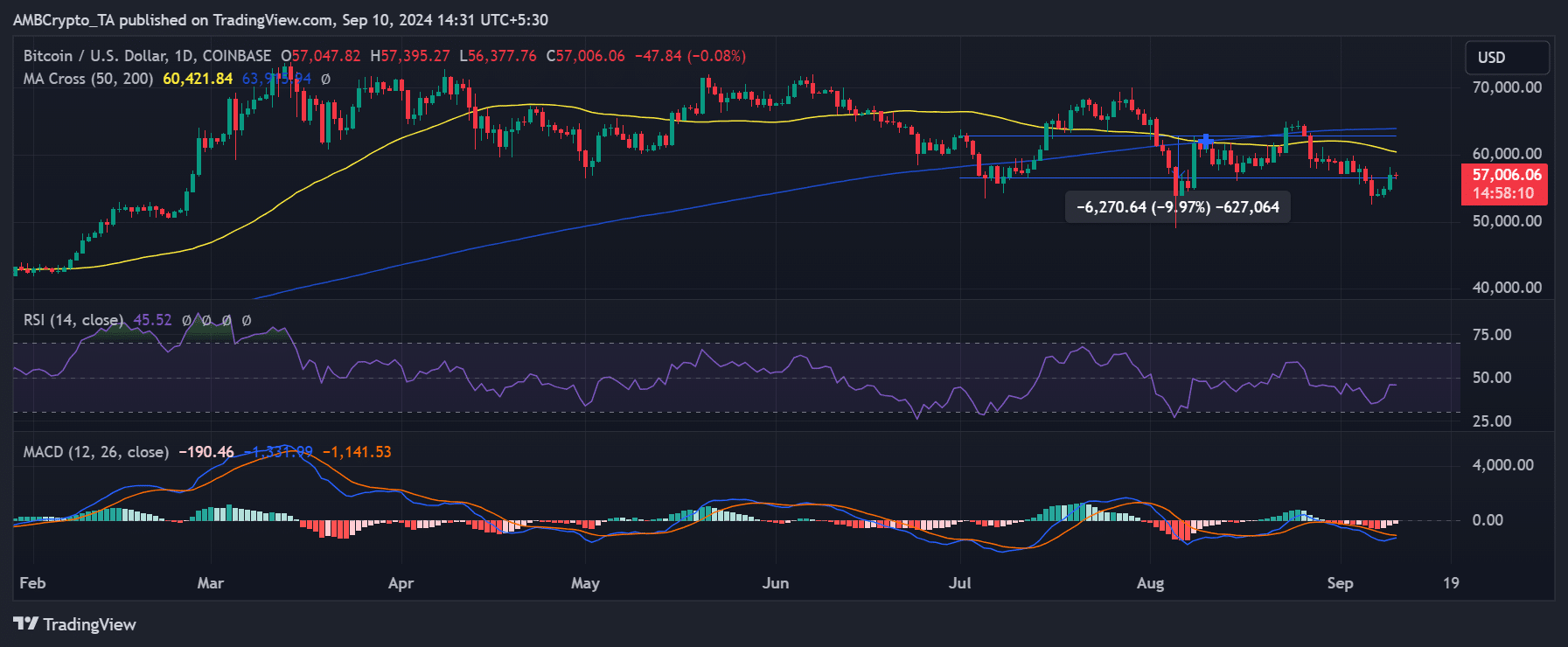

AMBCrypto’s analysis of BTC on a daily time frame showed that from July until press time, Bitcoin lost nearly 10% of its value.

On the 1st of June, BTC was trading around $62,830, and since then, the price has experienced fluctuations, both to the upside and downside.

During this period, the highest price reached was approximately $65,000, while the lowest price dropped to around $53,800.

As of this writing, BTC was trading at around $57,340, showing a less than 1% increase in the current session.

Over this time frame, there have been notable changes in both long-term and short-term positions.

Short-term holders have generally opted to reduce their exposure to BTC during periods of volatility, while long-term holders have increased their accumulation.

Long vs. short Bitcoin investors

AMBCrypto’s look at Bitcoin’s short- and long-term holders’ net position change over the past three months highlighted a stark contrast in behavior.

The short-term net position change chart showed that the trend shifted from positive to negative around the 1st of June. From that point on, the negative trend increased.

As of the last recorded data, it stood at -21,000, indicating that many short-term investors were exiting the market.

In contrast, long-term investors began seeing a positive net position change starting in July. Since then, the trend has continued to grow, and the most recent record showed a net increase of over 22,000.

This indicated that while short-term holders were selling off and exiting, long-term investors were actively buying and accumulating Bitcoin.

This divergence in behavior correlated with Bitcoin’s price volatility during this period. As the price fluctuated, short-term holders, concerned with immediate price movements, moved to cut their losses.

Meanwhile, long-term investors saw the volatility as an opportunity to accumulate BTC at lower prices.

Long and short holders remain at a loss

AMBCrypto’s look at Bitcoin’s 90-day and 180-day Market Value to Realized Value (MVRV) ratio showed that holders were at a loss.

The 90-day MVRV stood at approximately -5.80%. The trend meant that holders from the last three months are experiencing a 5% decline in the value of their holdings.

Also, the 180-day MVRV was around -9.2%, indicating that these investors are facing a 9% decline in their holdings.

Read Bitcoin’s [BTC] Price Prediction 2024-25

These negative MVRV values suggested that Bitcoin was undervalued, with both short- and long-term holders experiencing losses. Historically, such MVRV levels often signal an upcoming market reversal.

As these long-term holders have increased their positions during the downturn, they will likely see more gains when the market rebounds.