Bitcoin

Bitcoin at $104K: Market sees increase in short positions amid ATH push

Bitcoin holds strong at $104,500 despite 60% of traders betting against it. Rising short liquidations and bullish technicals suggest upward momentum.

- BTC is about to hit another ATH.

- More traders have taken short positions despite this trend.

Despite Bitcoin [BTC] trading at $104,500 and maintaining a strong upward trend, the long/short ratio on Binance reveals nearly 60% of traders holding short positions. With BTC trading above key moving averages, bulls remain in control, poised to push prices higher if resistance at $105,000 is breached.

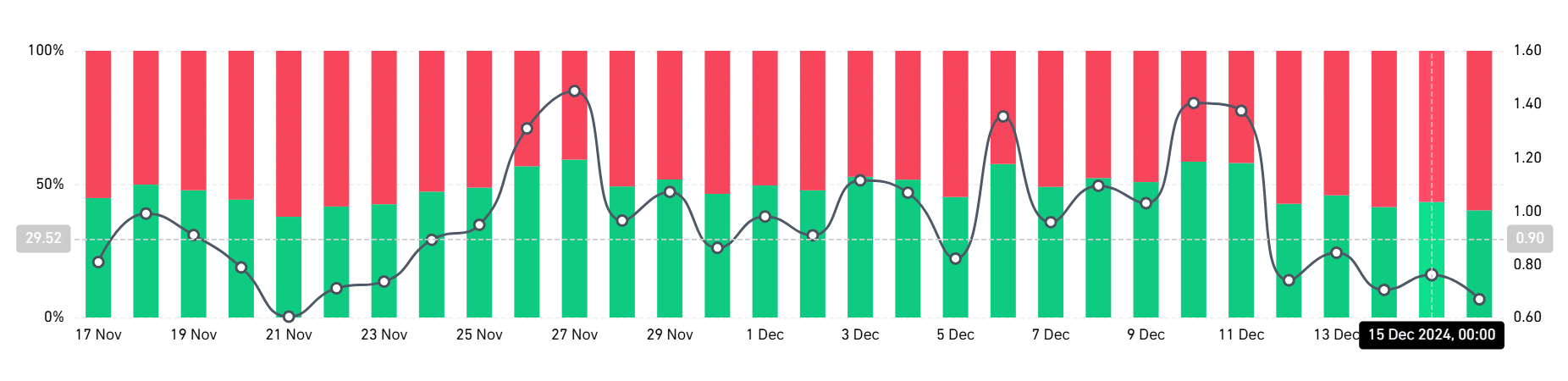

Long/short ratio signals growing bearish bias

The latest long/short ratio data analysis on Coinglass highlights that nearly 60% of traders on Binance are holding short positions against Bitcoin. This significant skew toward bearish sentiment reflects cautious sentiment among market participants, even as BTC continues its upward trend.

The long/short ratio charts depict a consistent dominance of short positions over the last two trading sessions. The trend suggests that many traders are hedging against a possible correction or overbought conditions.

Interestingly, this bearish sentiment comes at a time when Bitcoin has maintained a strong price trajectory, trading around $104,500.

Such a divergence between sentiment and price performance may hint at underlying market strength, with bears potentially setting themselves up for liquidation in the event of further upside momentum.

Liquidation trends: Shorts face increasing risk

Over the past two trading sessions, the liquidation data reveals that short positions have faced heavier liquidations than longs. The most recent trading session saw a notable spike in short liquidations, with 68.78 million for shorts and $13 million for longs.

This surge indicates that bearish traders, anticipating a pullback, have been caught off-guard by Bitcoin’s resilience above key psychological levels.

When combining this liquidation trend with the high percentage of short positions, it becomes evident that BTC’s upward momentum has placed significant pressure on leveraged bears.

Traders will need to closely watch the liquidation levels, as further price increases could trigger additional short squeezes, potentially propelling BTC higher.

Bitcoin bulls in control amid RSI and moving average signals

Bitcoin’s price action remains bullish on the daily timeframe, supported by technical indicators signaling strong upward momentum. The Relative Strength Index (RSI) currently sits at 67.65, indicating that BTC is approaching overbought territory but still has room for further upside.

Historically, RSI levels near 70 have been accompanied by short-term corrections; however, Bitcoin’s ability to sustain current levels could invalidate immediate bearish concerns.

Additionally, BTC’s price is trading well above its 50-day and 200-day moving averages, further reinforcing the bullish outlook. The Golden Cross continues to act as a strong support for the ongoing rally.

A close above $105,000 could open the door to testing $110,000, while immediate support lies around $100,000.

Can bears withstand BTC’s momentum?

The current bearish positioning among traders appears misaligned with Bitcoin’s strong upward momentum. With short liquidations piling up and BTC maintaining key support levels, the market could be primed for further gains if short traders capitulate.

Read Bitcoin (BTC) Price Prediction 2024-25

The interplay between the long/short ratio, liquidations, and price action suggests that Bitcoin bulls remain firmly in control for now.

As traders assess the risks, the market’s ability to absorb selling pressure and sustain its upward trajectory will be crucial. Investors should monitor Bitcoin’s resistance at $105,000 and support at $100,000 for signals of the next directional move.