Bitcoin at $21,000? Is a buying opportunity coming soon?

A series of on-chain metrics registered corrections when Bitcoin fell on the charts last week. In fact, BTC dropped down to as low as $43,000 briefly, with significant reshuffling seen after Futures Open Interest dipped by $4 billion too.

Other factors such as the Bitcoin funding rate experienced a reset as well, with Grayscale’s premium registering a low of -3.77%. AMBCrypto had previously reported about the positive reboot for the aSOPR, wherein it was identified that weak hands were getting washed out.

However, one particular metric carrying historical importance did not correct much. Interestingly, it could possibly alter the course of the rally going forward.

Bitcoin NUPL continues to avoid 0.5 reset

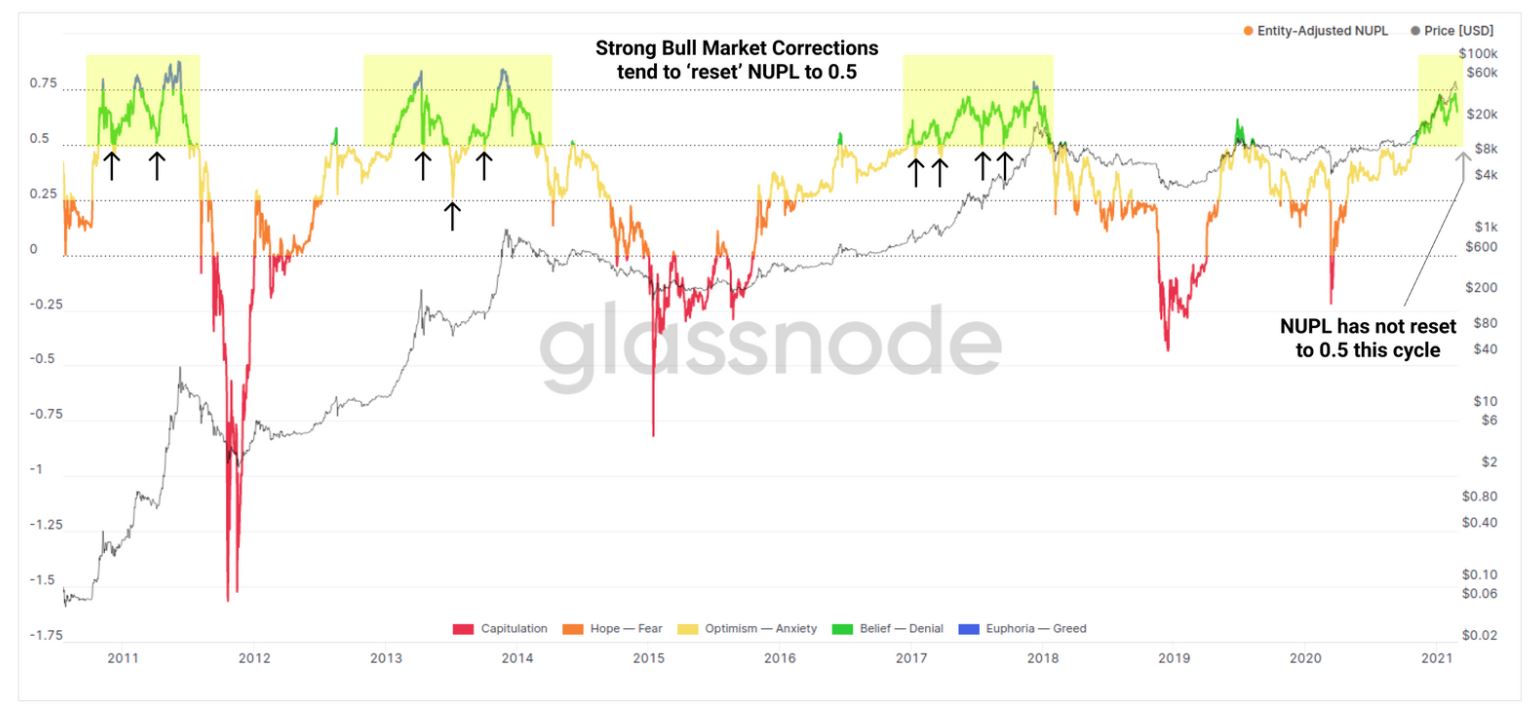

According to Glassnode’s latest report, the strength of the current Bitcoin rally can be illustrated by BTC’s Net Unrealized Profit and Loss or NUPL. In the past, the NUPL has regularly retested the 0.5-mark during bull market corrections. While a 0.5 re-test was seen multiple times during both the 2013 and 2017 rallies, the same is yet to be identified in the current market.

Here, it’s worth noting that market dynamics have definitely altered over the years with respect to user profitability and hodling sentiment, with selling pressure not fueling massive outflows for Bitcoin.

Further, data from CryptoQuant seemed to suggest that Bitcoin outflows from exchanges have continued to maintain their low levels over the week, with long-term hodlers unfazed by the 21% decline in cryptocurrency’s price.

The resilience exhibited by investors was coming to fruition at press time since Bitcoin had managed to establish a position above its immediate resistance of $47,400 over the last 24 hours.

While it is still a little early to predict the start of a new bullish leg for Bitcoin, according to Willy Woo, consolidation above $45,000 is a strong sign of stability.

If history repeats itself, does NUPL reset carry a damaging outcome?

While the NUPL has not registered a reset at 0.5 during this rally, historically, it has happened during every bull cycle. According to data, the realized price trading is currently $14,511, and if the NUPL drops down to 0.5, it would mean Bitcoin would possibly drop down to a floor price of $21,766.

That would mean a 55.76% drop from BTC’s press time position, a drop that will completely take away all of BTC’s gains since 15 December 2020.

While historical probabilities are worth pondering over, it is also important to consider the macro-difference between previous rallies and the current one, with Bitcoin at the receiving end of more adoption than ever before.

For instance, the average weekly investment into Grayscale’s Bitcoin Trust during Q4 of 2018 was $2 million. The average investment in GBTC for Q4 of 2020 was $217.1 million. Needless to say, the course of history for Bitcoin is indeed changing.