Bitcoin

Bitcoin at $55K: Is a ‘Covid crash’ trend the key to a new rally?

Bitcoin’s rapid drop has reminded some of the market crash that happened in March, 2020 after coronavirus cases began to rise across the globe.

- Bitcoin formed an encouraging chart pattern as it did in March 2020.

- The trade volume and fear factor are not the same, but this drop could still be a good buying opportunity.

Bitcoin [BTC] endured another bloodbath over the weekend, falling from $65k on Friday, 2nd August, to $49k in the early hours of Monday, 5th August. This steep fall was initiated by news of Mt Gox and the German government

selling BTC.The news that the Federal Reserve won’t be cutting rates in September was another blow. The latest and strongest hit was on the back of news of the Bank of Japan’s decision to raise rates by 15 basis points to 0.25% last week.

The wave of fear-inducing news reminded some market participants of the market-wide crash that happened in March, 2020 after coronavirus cases began to rise across the globe.

There were similarities and differences between the current crash and the Bitcoin Covid crash.

The chart pattern and recovery implications

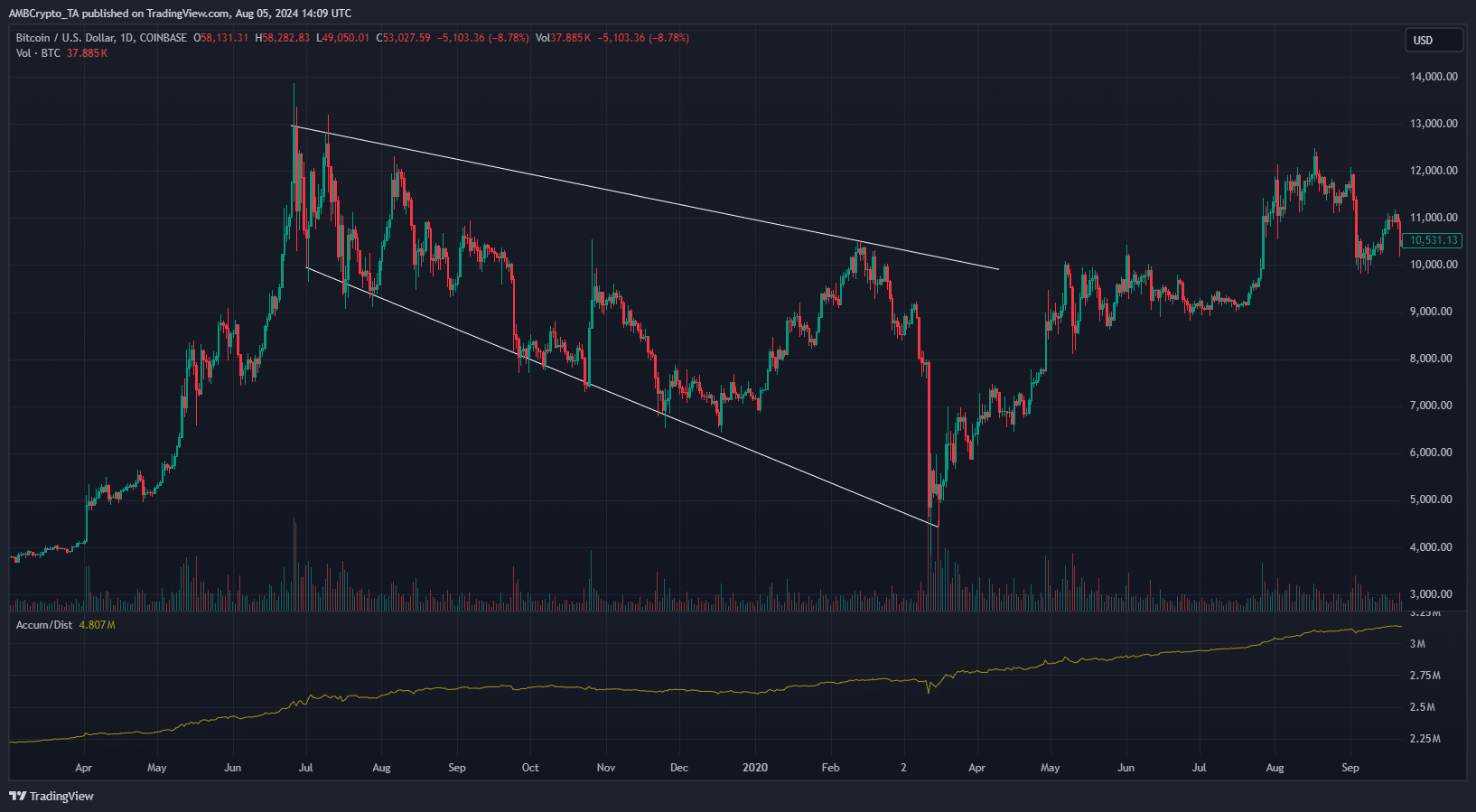

On the 1-day timeframe of both charts, Bitcoin formed a descending broadening wedge formation. The final retest saw BTC climb upward over the next two months and bullishly break out past the $9k mark.

The price action since March has also formed a similar chart pattern, and metrics showed that BTC was cheap.

At press time, the $51.2k is the trendline support that BTC must not close a daily trading session below. If it does, the wedge pattern would be rendered obsolete.

Despite the market-wide panic, the Bitcoin Covid crash was worse

Going by the BTC/USDT trading pair on Binance, the 13th of March, 2020, saw the largest trading volume during the crash. It amounted to 402.2k BTC.

For comparison, trading volume on Monday, the 5th of August stood at 125.5k BTC, although the day’s trading was not yet done.

More importantly, the backing from institutional investors was not present. Neither was retail interest as high as it had been in 2024, with Bitcoin and Ethereum [ETH]

ETFs approved.Is your portfolio green? Check the Bitcoin Profit Calculator

As the veteran crypto trader DonAlt points out, Bitcoin and the crypto industry were fighting for their survival.

This time, the increased adoption meant a drop below $50k, while harsh, still left Bitcoin as a $1 trillion market cap asset.