Bitcoin at $60,000: Why BTC’s rally has just begun

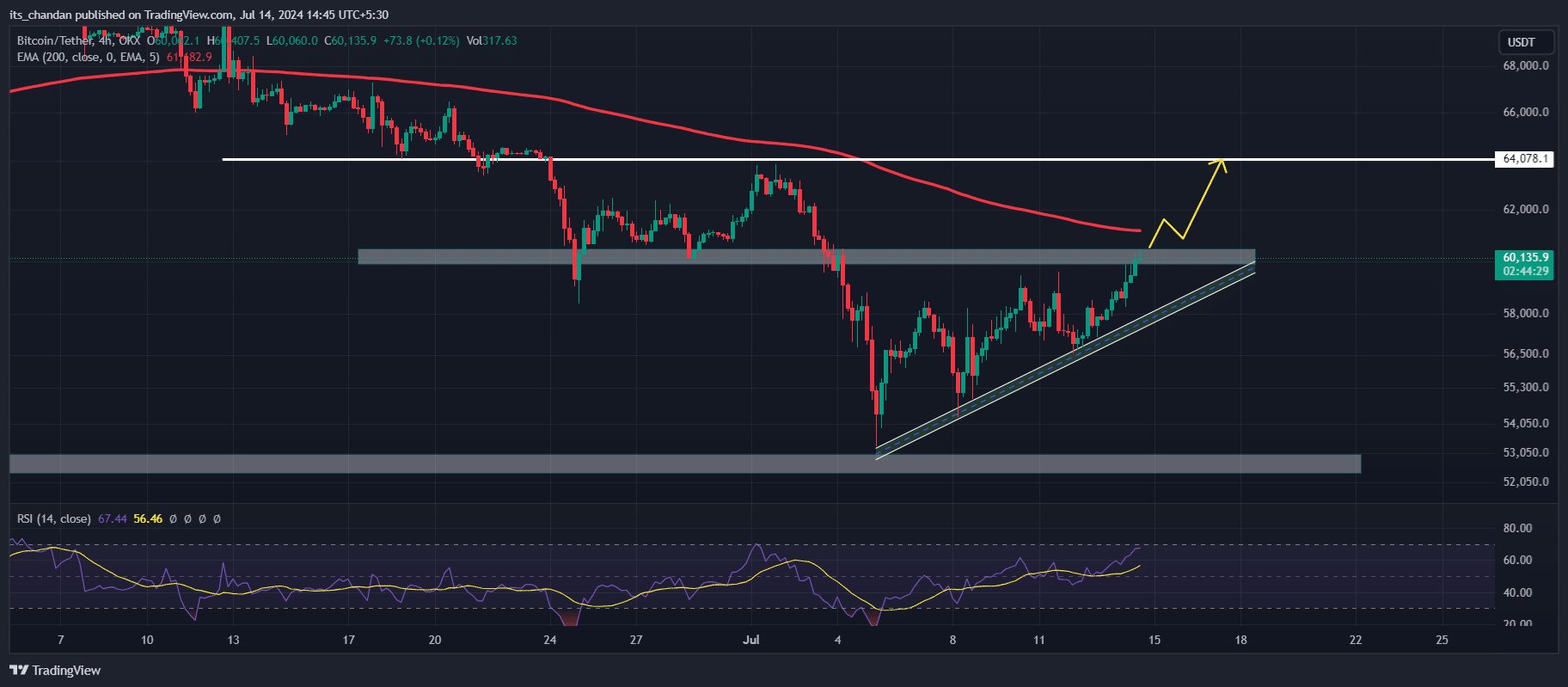

- Bitcoin could hit $64,000 if BTC’s 4-hour candle closes strongly above the $60,700 level.

- Long positions are comparably higher than short positions, signaling upcoming bullishness.

The overall sentiment in the cryptocurrency market shifted after Germany completely sold off its Bitcoin [BTC] holdings. These changes has not only turned overall crypto assets green but also help BTC to breach the $60,000 level.

Bitcoin breaches major resistance level of $60,000

Since 3rd July, 2024, BTC has tried multiple times to breach the $60,000 level but failed. Due to multiple rejections, this level was weakened and easily broke this time.

If it closes with a strong daily candle above the $60,700 mark, there is a high possibility that we may see BTC at the $64,000 level in the coming days.

Apart from the German government’s BTC sell-off, another potential reason that turned market sentiment slightly bullish is the continuous inflow into spot Bitcoin Exchange Traded Funds (ETFs).

During the period, when the overall market was bleeding, ETF traders showed strong confidence and interest in BTC by buying the dip, according to the data from an on-chain analytic firm spotonchain.

Technical analysis of BTC and key levels

According to expert technical analysis, BTC is looking bullish as it is trading above its 200 Exponential Moving Average (EMA) on a daily time frame. A price above 200 EMA signals bullishness in the chart.

Besides this higher time frame bullishness, it also formed a bullish ascending triangle price action pattern in a 4-hour time frame. If it gives a strong candle closing above $60,700 then there is a high chance we may see a bullish move up to $64,000.

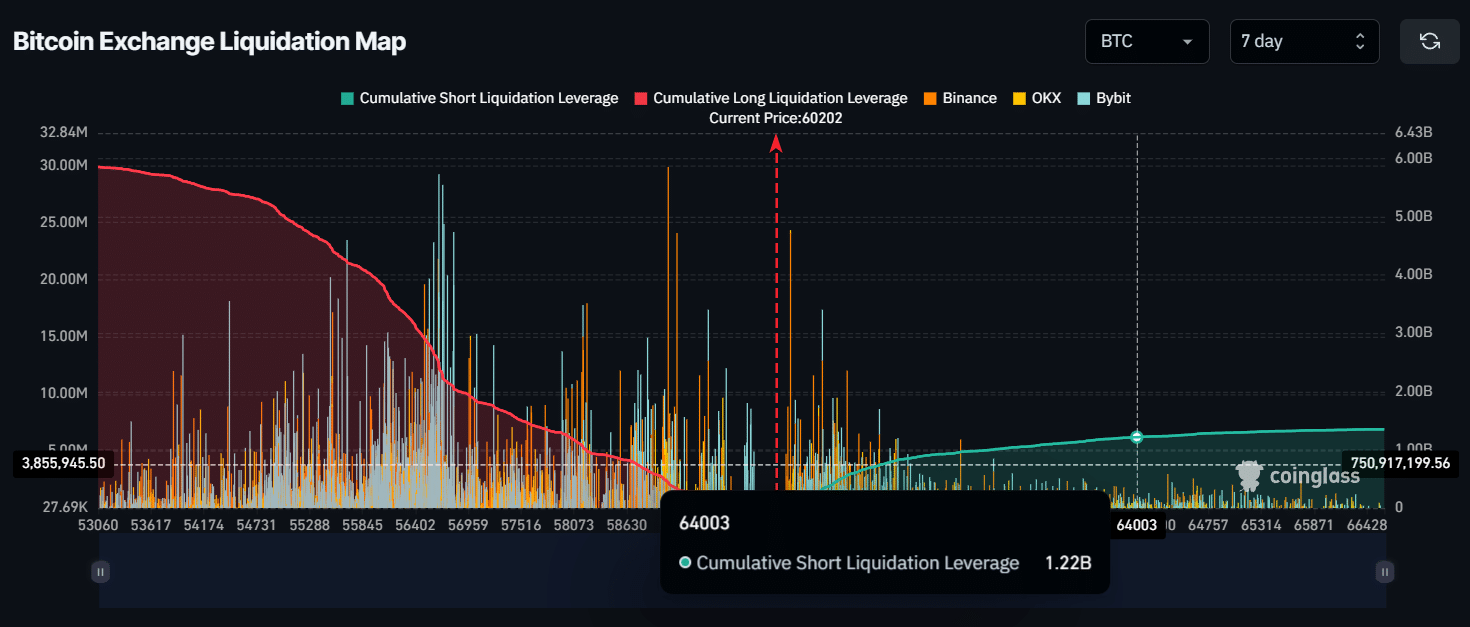

However, if BTC reaches the $64,000 level, nearly $1.22 billion of short positions will be liquidated.

Additionally, data from an on-chain analytic firm CoinGlass indicates that bulls’ long positions have been comparably higher than short-sellers’ over the last seven days.

At the time of writing, BTC was trading near $60,140 and it experienced 3.5% upside moves in the last 24 hours.

Meanwhile, open interest (OI) has surged by 5.3% showing strong confidence and interest among investors and traders. According to coinmarketcap data, BTC has gained a price surge of over 4.6% in the last 7 days.

Altcoins including Ethereum (ETH), Solana (SOL), Cardano (ADA), and XRP (XRP) have also undergone similar upside moves.

![Chainlink [LINK] price prediction - Watch out for a defense of THIS key level!](https://ambcrypto.com/wp-content/uploads/2025/04/Evans-17-min-400x240.png)