Bitcoin at $67k: Should you grab BTC today or wait?

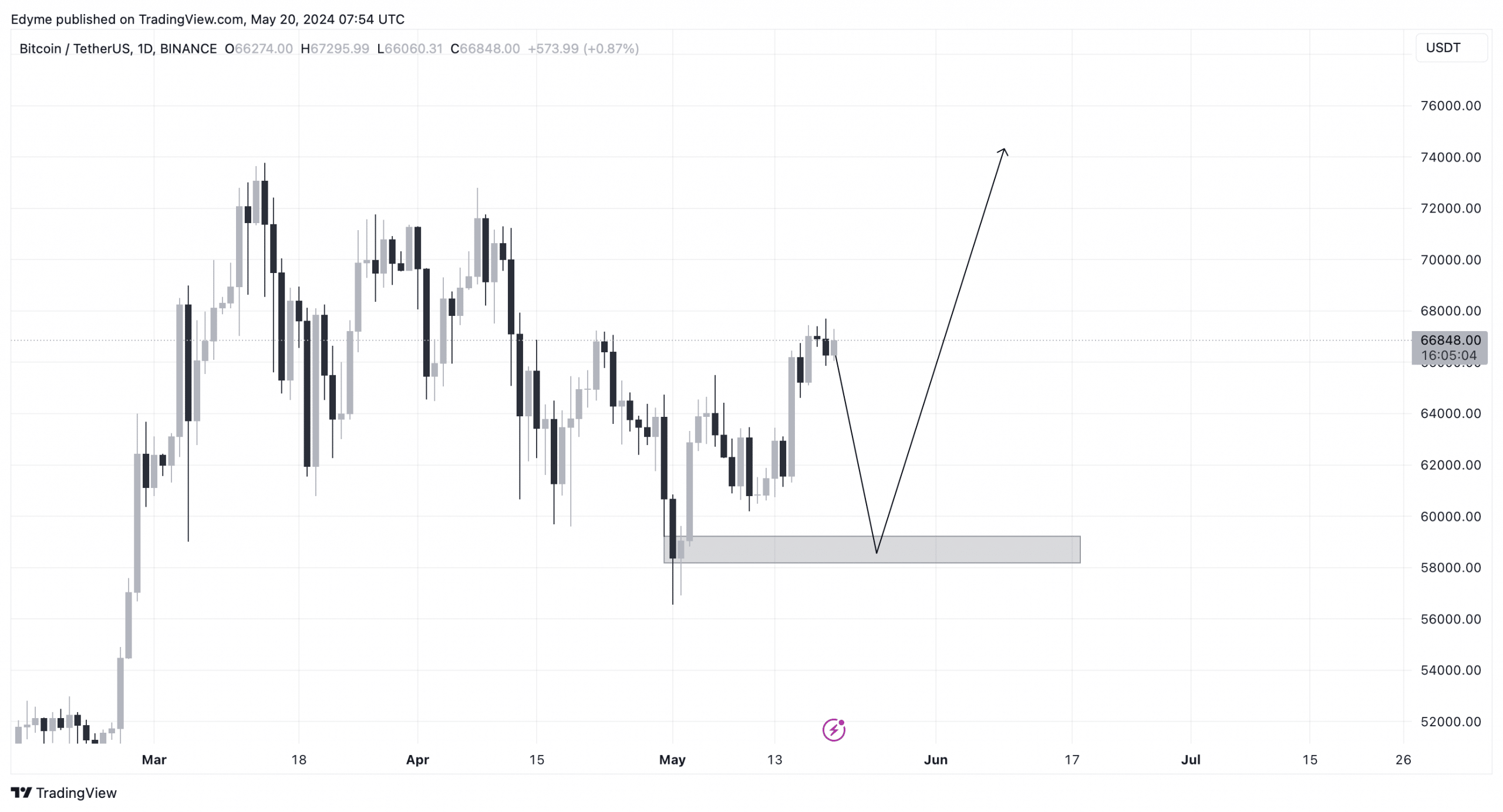

- Technical analysis suggested BTC may soon dip to $60k to gather liquidity before launching into a major rally.

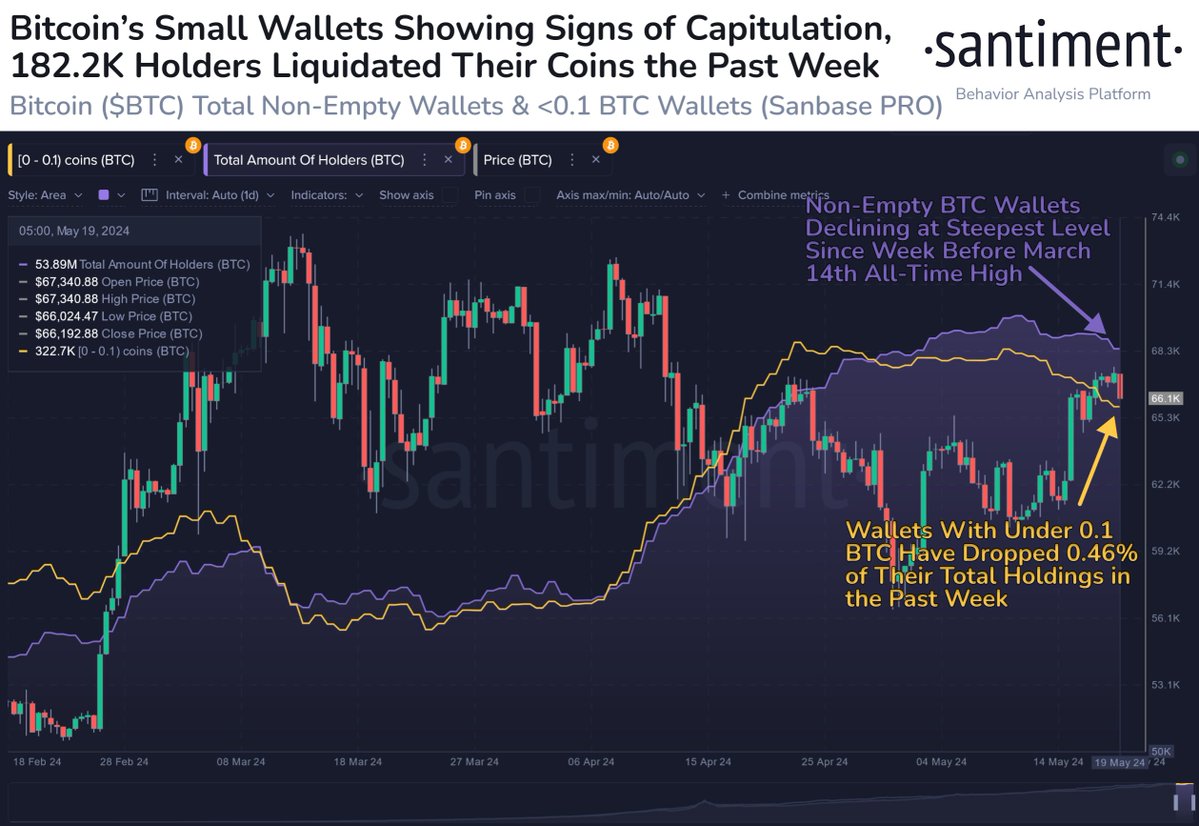

- Data trends indicated that the selling of BTC by smaller wallets to larger ones is a bullish sign.

As Bitcoin [BTC] continues to dominate the cryptocurrency market, its recent price movements have caught the attention of investors and analysts alike. Over the past few months, Bitcoin has shown a significant increase, with a surge of over 100% year to date, and a notable rise of 9.8% in just the past week.

Despite reaching a new peak above $73,000 in March, Bitcoin is currently facing challenges in surpassing the $67,000 resistance level. Recently, after hitting a 24-hour high of $67,697, it slightly retracted by 0.7%, bringing its current trading price to around $66,800.

This price action occurs amid broader market trends, where analysts are closely observing Bitcoin’s performance.

Rekt Capital, a well-known crypto analyst, has pointed out that Bitcoin is in its final halving retrace before it is expected to resume an upward trend.

The analyst highlighted that this year, the Halving Retrace reached -23.6%, the deepest retrace of the current cycle, signaling what many consider the “final bargain-buying opportunity” before a significant rally post-halving.

Understanding the re-accumulation phase and predicting future movements

According to Rekt Capital, the completion of the Halving Retrace has set the stage for the Re-Accumulation Range, a critical phase in Bitcoin’s market cycle. This range typically forms a few weeks before the halving and concludes with a breakout a few weeks afterward.

The price during this phase is expected to fluctuate between approximately $60,000 and $70,000, with potential extensions beyond these limits. The duration of this Re-Accumulation phase can last up to 150 days (or about 5 months), after which Bitcoin might enter a “parabolic uptrend,” marked by a notable spike in price.

Historical data from 2020 shows a similar pattern, where Bitcoin underwent a -19% retracement around its halving event, followed by a 160-day consolidation period before entering a rapid growth phase.

In 2024, Bitcoin’s nearly -24% retracement around its halving suggests that, if history repeats, then Bitcoin would consolidate for a similar period before breaking into a significant uptrend.

This potential for a substantial price increase after a period of stability offers insight into Bitcoin’s behavior following halving events.

Signs point to a Bitcoin rally

Adding to this analysis, data from Santiment indicates that Bitcoin is hovering just above $66,100 as smaller traders liquidate their holdings amid a general market rebound over the past week.

Historically, this trend of smaller wallets selling to larger ones has been viewed as a bullish indicator for Bitcoin.

Moreover, technical analysis of BTC’s daily chart indicates a potential retracement to the $60,000 levels to gather more liquidity before a parabolic rise.

Should Bitcoin reach this retracement level, it could pave the way for a strong rally, enabling the cryptocurrency to break through the $67,000 resistance with ease.

AMBCrypto’s recent report adds another layer of insight, noting that the stablecoin supply ratio was below the 200-period Simple Moving Average but above the lower Bollinger Band.

When Bitcoin’s price hit $56k in early May and rebounded, it was a key moment of interest. The oscillator remains in the lower band, suggesting further gains are likely, and the stablecoin supply ratio has seen a downtrend over the past month.

Is your portfolio green? Check out the BTC Profit Calculator

This aggressive trend higher since October 2023, along with periods of “stasis or pullback” like those seen in early January and mid-May, precede significant price movements.

Following the January pullback, Bitcoin prices soared past the $46k resistance effortlessly. In the coming 2–4 weeks, a similar rally could potentially push Bitcoin well beyond the $73k mark, as suggested by market trends and analytical forecasts.