Bitcoin backlog surges, BTC touches $28k, miners thrive: Unraveling all the chaos

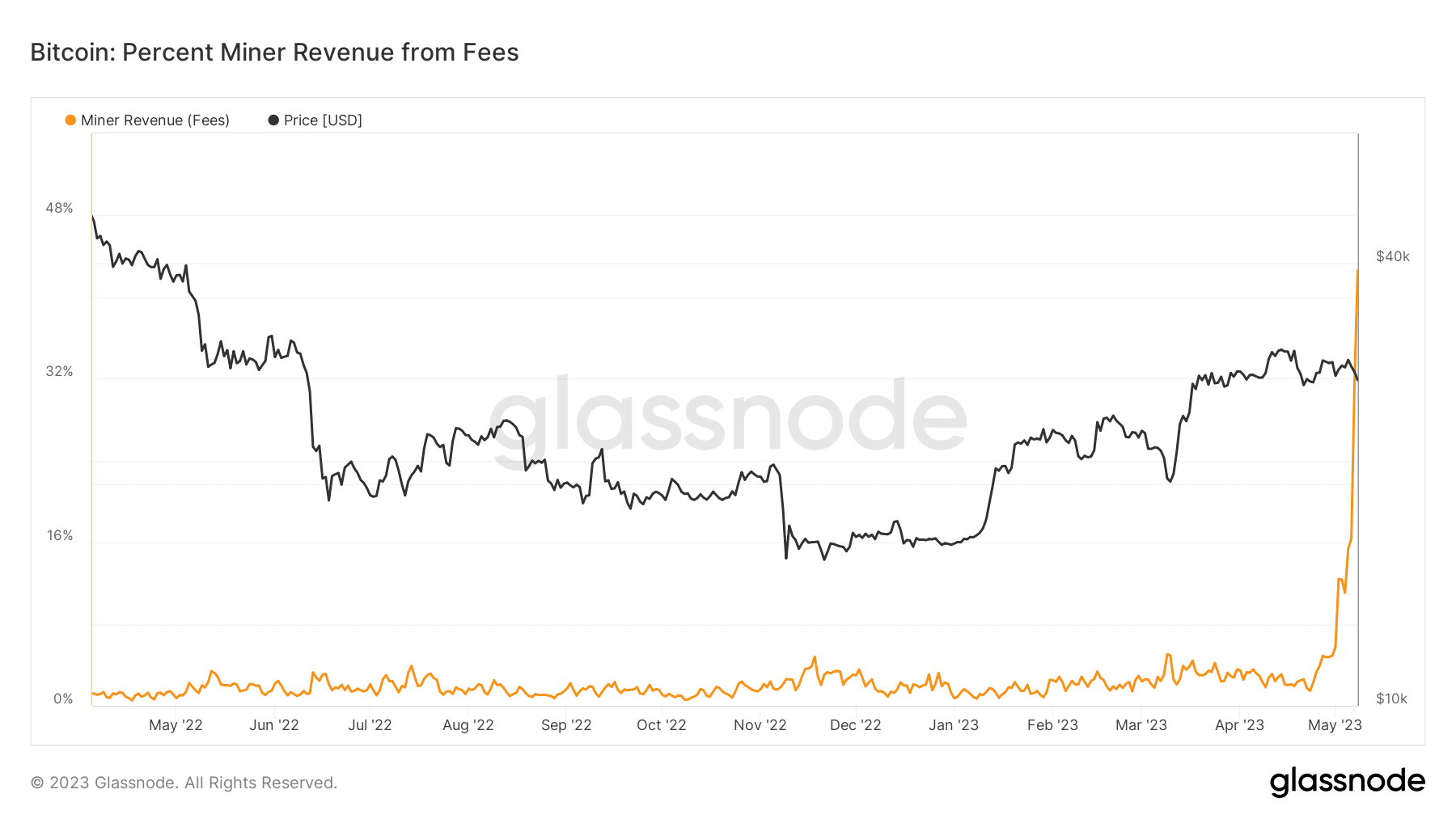

- The percentage of Bitcoin miner revenue derived from fees soared to 42% in the last 24 hours.

- Because of the backlog surge, the number of unconfirmed transactions on Bitcoin hit a whopping 402,071.

The Bitcoin [BTC] network is getting more congested by the day, with the number of transactions shooting up to unprecedented levels. An average of 537,500 daily transactions have been reported since the beginning of May. On 8 May, 574,914 transactions were processed on the chain, as per Glassnode’s data.

Surprisingly, as pointed out by a data scientist from Glassnode, the active addresses on the chain declined significantly, establishing a negative correlation with the transaction count. At the time of the tweet, the correlation coefficient was at its lowest point in history.

Compelling negative correlation between #Bitcoin active addresses and transaction count.

It's currently sitting at its lowest value in history.

A flurry of transactions, yet addresses lag behind.

?https://t.co/UtNO3oPzPa pic.twitter.com/mPuGienV2M

— Rafael Schultze-Kraft (@n3ocortex) May 8, 2023

Due to the growing transaction jam, the king coin dipped below $28k, going as low as $27.3k on 8 May. However, the coin recovered to $27.6 at the time of writing, although still marking a fall of 1% in the 24-hour period, data from CoinMarketCap showed.

Read Bitcoin’s [BTC] Price Prediction 2023-24

Bitcoin gets clogged

At the time of writing, memory consumption per block exceeded the 300 MB limit by 700 MB, leading the blockchain to discard any transaction worth less than 29.02 sats/vB, or Satoshi per byte, as per data from Bitcoin explorer Mempool. Transaction fees spiked above 175 sats/vB, or $6.76 for high-priority transactions. At the peak of the congestion on Monday, it soared to $23.

Because of the backlog surge, the number of unconfirmed transactions hit a whopping 402,071 at press time.

The world’s largest centralized crypto exchange, Binance, had to pause BTC withdrawals twice in a span of 48 hours, due to high gas fees emanating from network congestion. Due to the increased transaction fees, miners made a killing as the percentage of Bitcoin miner revenue derived from fees soared to 42% in the last 24 hours, as per Santiment.

Reasons behind the traffic

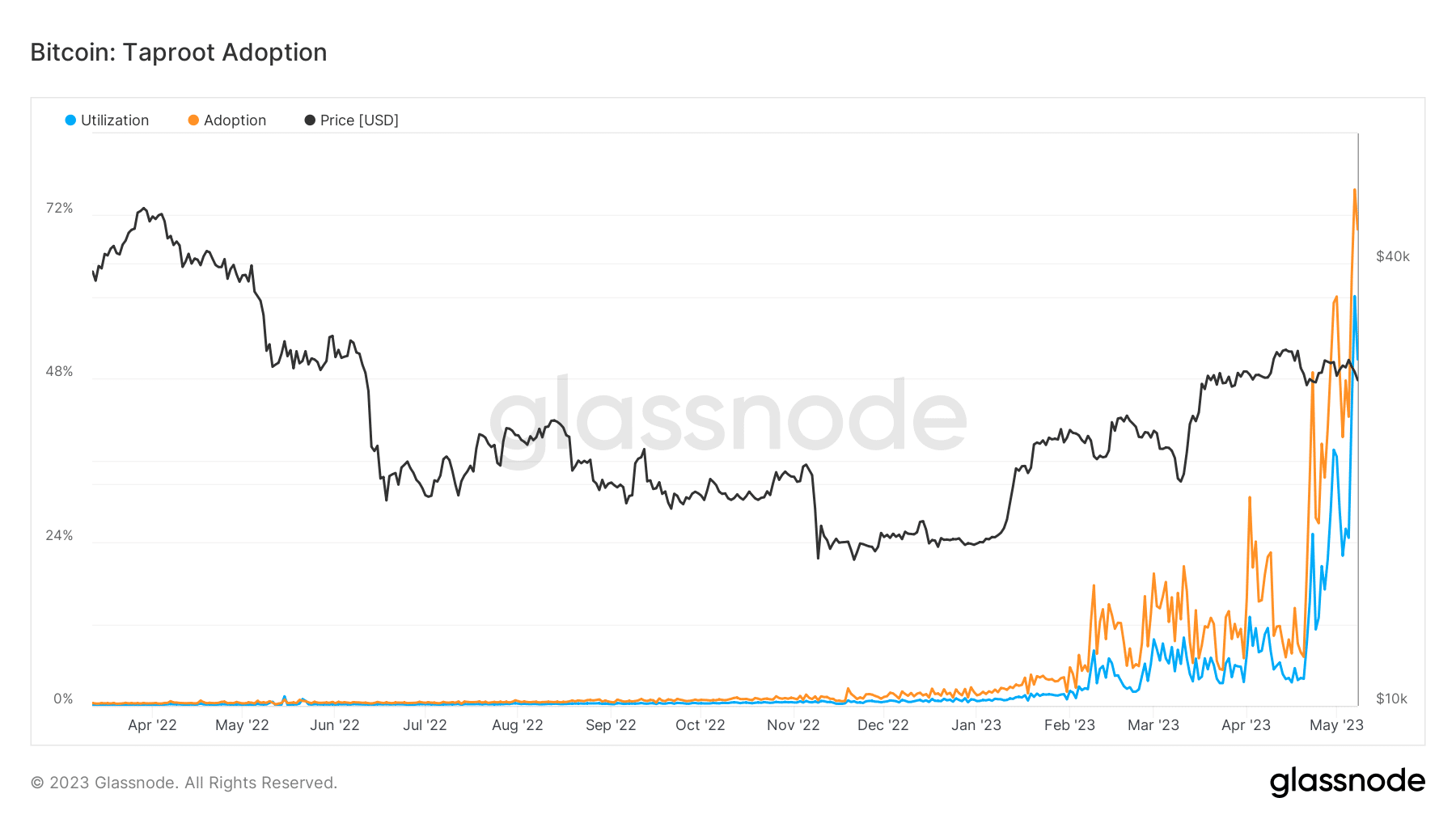

Network traffic increased mostly due to transactions using Taproot addresses. The demand for Taproot was also reflected through the adoption and utilization metrics.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Taproot’s adoption grew sharply over the last month and nearly 70% of all transactions on Bitcoin used Taproot in the last 24 hours, as per Santiment’s data.

With the Taproot upgrade, Bitcoin has positioned itself like other conventional layer-1 blockchains, enabling deployment of smart contracts on the chain and minting of Ordinals NFTs. As per Dune‘s data, May has seen a flurry of new inscriptions, recording a growth of 85% on a month-to-date (MTD) basis.