Bitcoin below $60K: A magnet for major market players?

- Bitcoin has remained below the $60,000 price range.

- Accumulation has increased after months of distribution.

Bitcoin [BTC] has been persistently trading below the $60,000 mark, and recent data indicated that various entities have started accumulating it during this price consolidation phase.

This strategic accumulation suggested that some investors viewed the current price range as a favorable entry point. Despite this accumulation, there was a noticeable decrease in wallet activity during the same period.

Bitcoin enters the accumulation phase

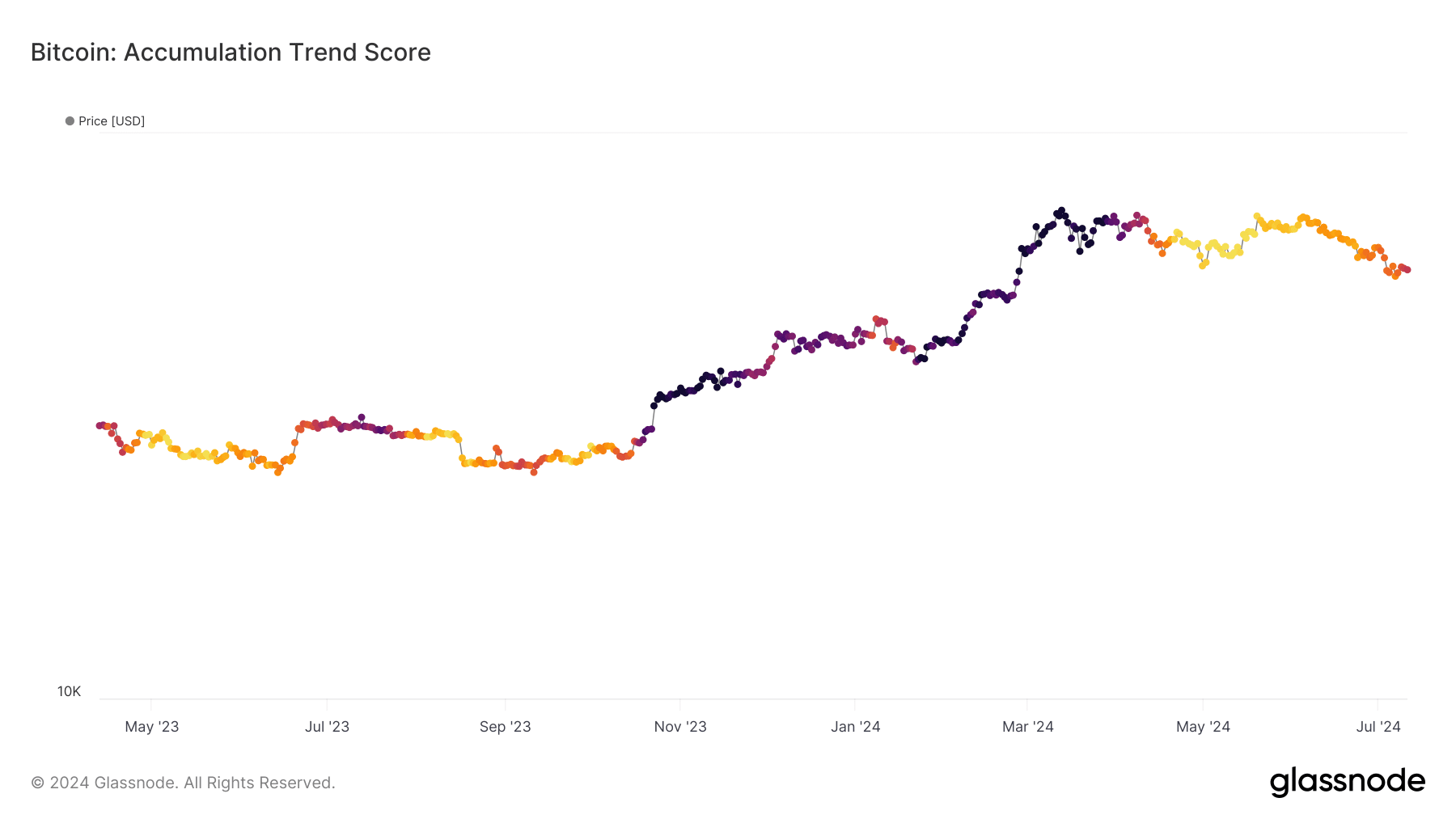

AMBCrypto’s analysis of Bitcoin’s trend score from Glassnode indicated a notable reversal in market behavior.

The trend score, at 0.4 at press time, marked a significant shift, suggesting that entities have begun accumulating BTC after a distribution period.

This increase in the trend score, while not yet at 1, signaled a movement towards more aggressive accumulation. Also, this was the first time since April that the trend score has reached this level.

The Accumulation Trend Score is particularly insightful because it not only considers the amount of BTC that entities are buying or selling, but also the size of the entities’ balances.

A score approaching 1 implies that larger entities are actively accumulating BTC, a bullish signal. Conversely, a score near 0 suggests that these entities are either distributing their holdings or abstaining from further accumulation.

This upward movement in the trend score could potentially indicate growing confidence among larger investors.

Such behavior often precedes broader market recoveries, as significant accumulation phases by large holders can reduce market supply and help establish stronger price support levels.

Active Bitcoin addresses fall

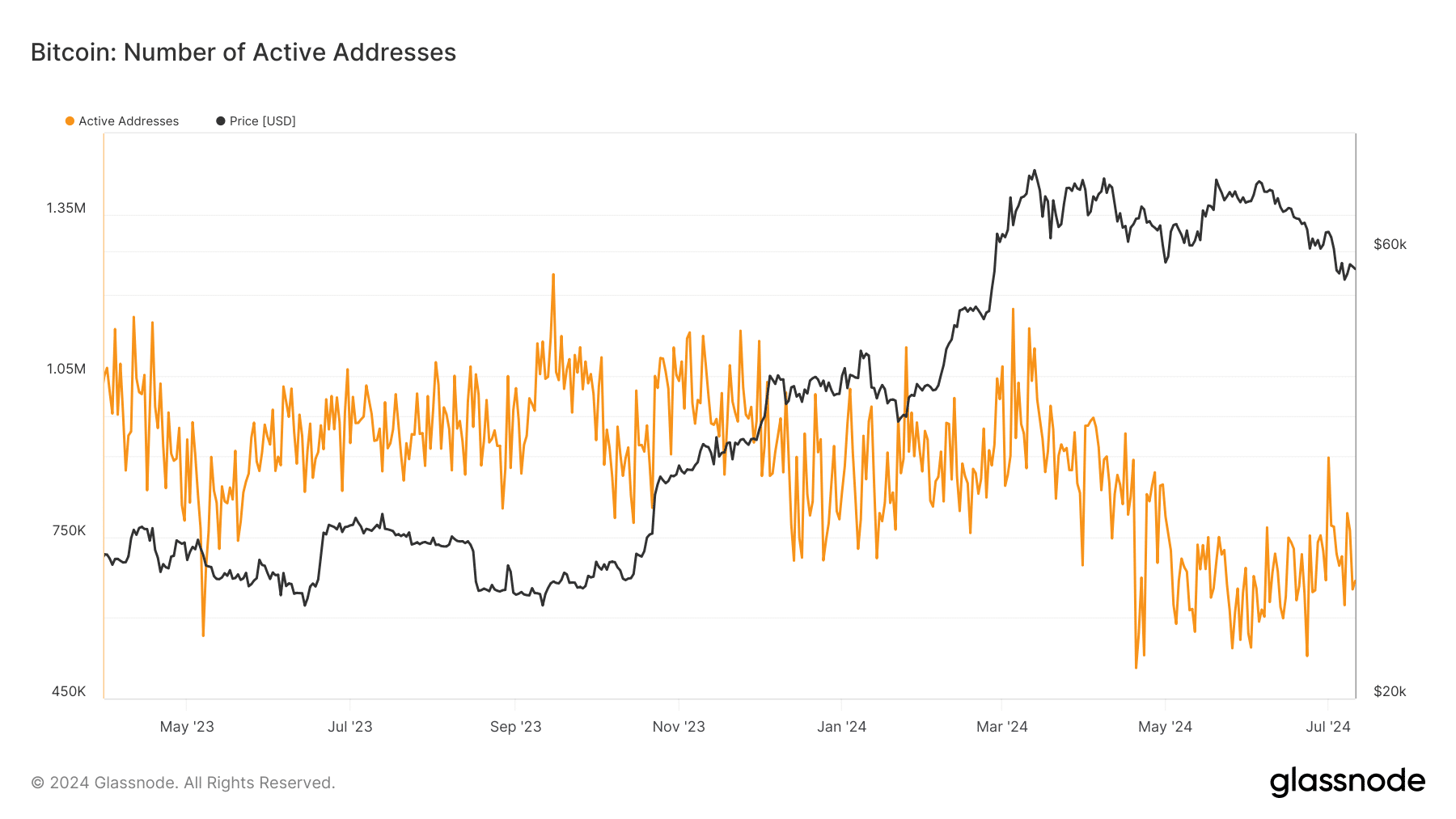

While there is a noticeable uptick in Bitcoin accumulation among larger entities, the number of daily active Bitcoin addresses told a different story.

According to an analysis of the active addresses chart on Glassnode, there has been a sharp decline in activity recently.

However, despite experiencing fluctuations, the number of active addresses has largely remained within the 600,000 range. As of this writing, the number was around 669,000.

This decline in active addresses amidst increasing accumulation might suggest a few potential scenarios. Firstly, larger investors could be holding their BTC for the long term, reducing transaction frequency.

Also, it could indicate a cautious wider market, where fewer individuals and entities are engaging in transactions, possibly waiting for clearer signals before entering or exiting positions.

BTC trading below $60,000

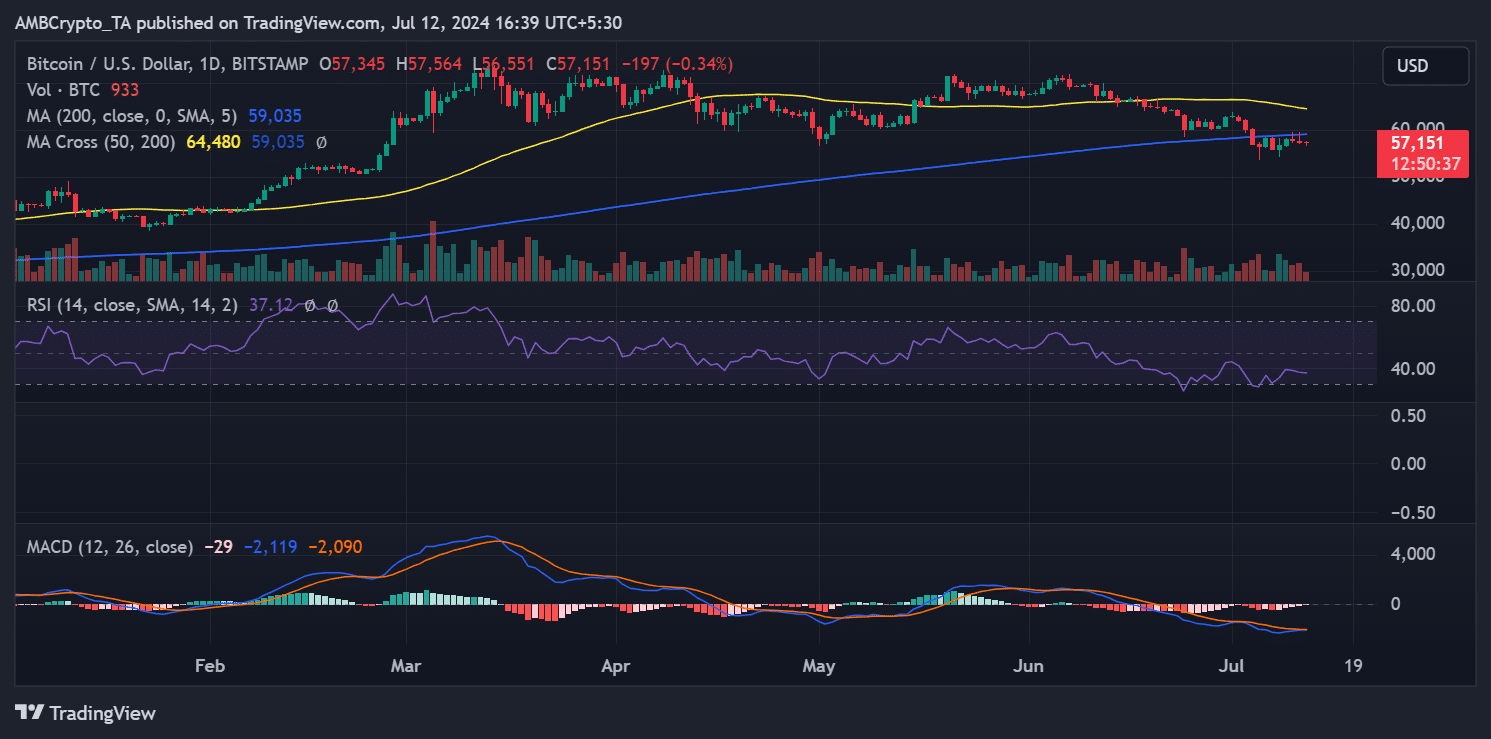

As of the latest data, Bitcoin was trading at approximately $57,151, showing a slight decline of less than 1% on a daily time frame. The price movement on the chart indicated that BTC was in a bearish trend.

Read Bitcoin’s [BTC] Price Prediction 2024-25

This was evidenced by its position below the key moving average (yellow and blue lines).

Bitcoin’s position, relative to the neutral line on the Relative Strength Index (RSI) at press time, further supported this bearish outlook.