Bitcoin below $70k: Did miners play a part in the drop?

- Bitcoin rose to $70,000 in the previous trading session.

- Miner reserve has continued to decrease, but BTC’s price has slowed it down.

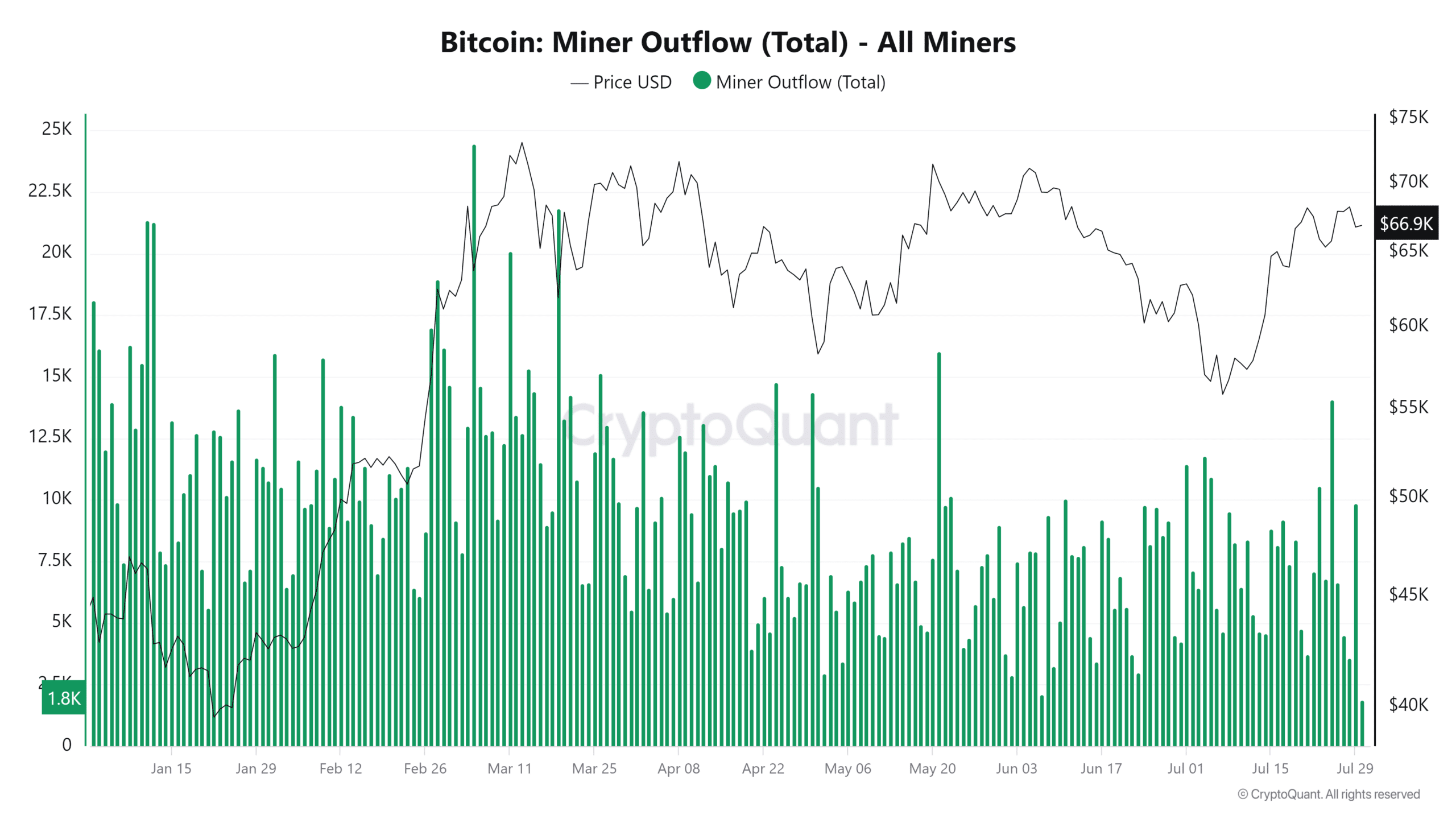

Recently, there has been a slight rise in the outflow from Bitcoin [BTC] miners. Despite this increase, other market indicators suggested that a significant sell-off may not be imminent.

Bitcoin miner reserve declines

A recent report by CryptoQuant highlighted a notable increase in Bitcoin miner outflow. The outflow suggested that a significant amount of BTC was being transferred from miner wallets.

The trend is evidenced by a spike in the miner outflow indicator, which reached over 14,000 BTC on the 25th of July. Notably, this was the highest level observed in over a month and the first time in July.

Although there was a decrease following this peak, another substantial rise occurred on the 29th of July, with outflows reaching over 9,800 BTC.

The BTC miner reserve data supported the trend of increasing outflows. At the start of July, the miner reserve stood at approximately 1.814 million BTC.

As of the latest data, this reserve has slightly decreased to around 1.813 million BTC.

Selling spree in check

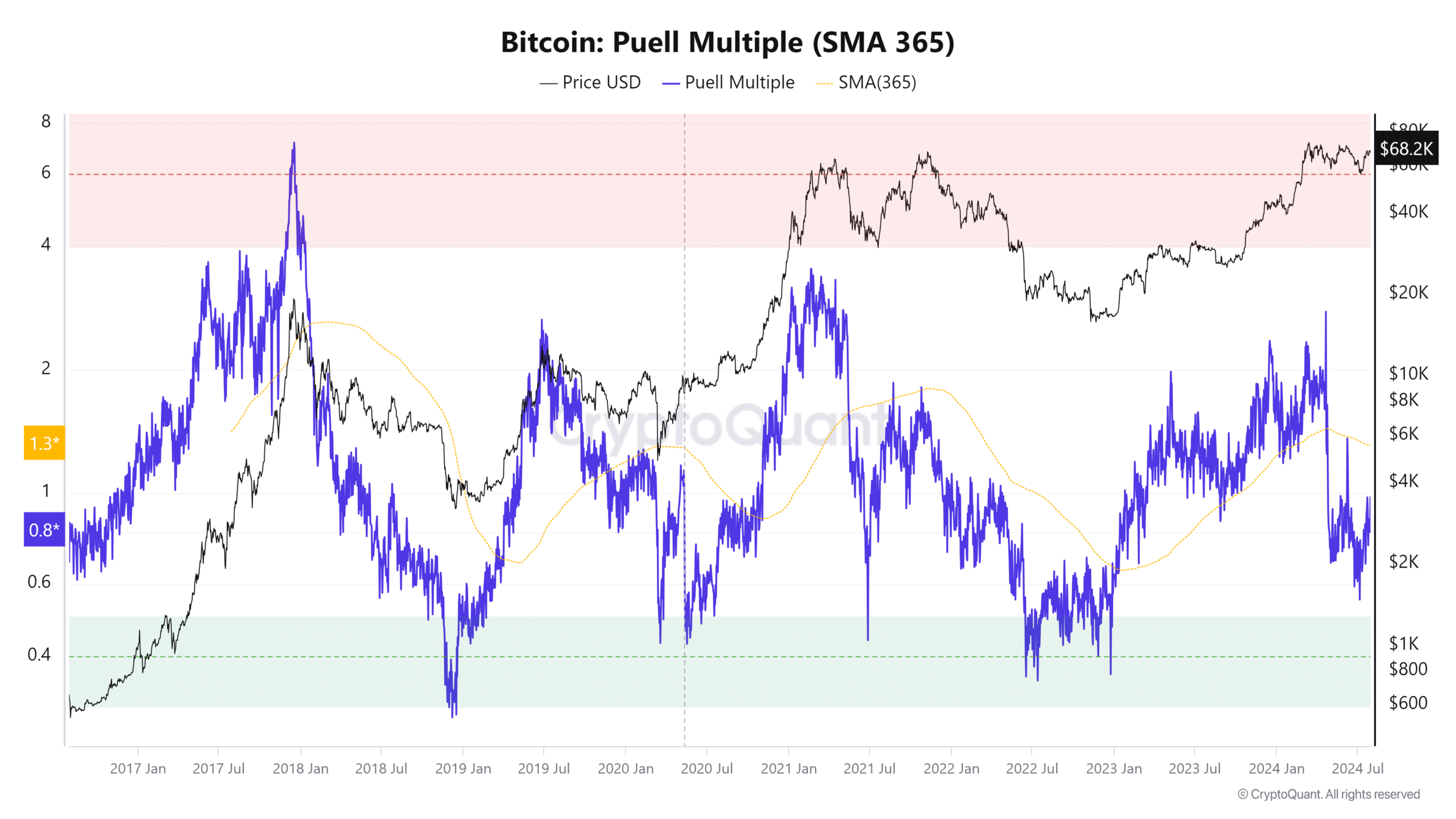

Following the Bitcoin halving event, there was a noticeable decline in miner revenues. This is because the halving reduced miners’ block reward for their computational efforts.

Also, there was a shift in the Puell Multiole. The indicator is used to assess the mining industry’s health and potential future behavior.

It does this by comparing the daily issuance value of BTC (in USD) to the 365-day moving average of the daily issuance value.

A lower Puell Multiple suggests that miners earn less than the historical average. When the Puell value is around 0.5, it typically indicates that miner revenues are significantly reduced, pointing to a potential market bottom.

At press time, the Puell Multiple was 0.9. While this was an increase, it still indicated relatively low earnings for miners compared to the average.

In such situations, miners might hesitate to sell their Bitcoin holdings because the prices may not be sufficiently compensatory, given their production costs.

BTC fails to hit $69K

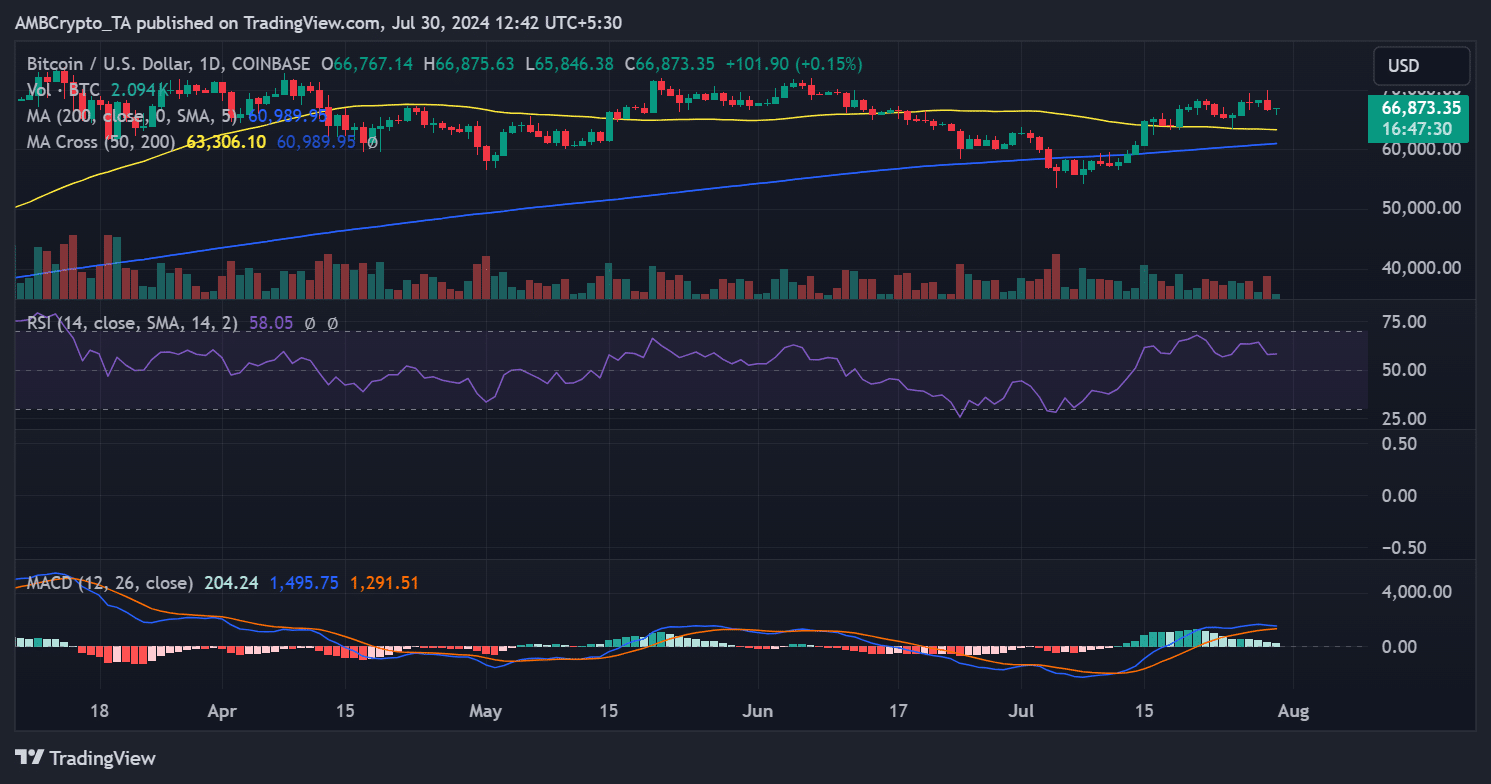

Bitcoin began the trading session on the 29th of July strongly, briefly reaching the $70,000 price range. However, by the end of the day, it had declined, dropping over 2% to close at around $66,771.

Read Bitcoin’s [BTC] Price Prediction 2024-25

This downturn would have affected the value of miner holdings, potentially influencing their decisions on whether to increase outflows.

According to AMBCrypto’s analysis, Bitcoin traded at approximately $66,800 at press time, showing a modest recovery with a less than 1% increase.