Bitcoin bounces back after brief dip below $60K: What’s next?

- Increased calls for a market bottom online helped BTC bounce back after a dip below $60,000.

- The next target for Bitcoin could be $64,600 or $58,150, depending on upward or downward pressure.

Bitcoin [BTC], the cryptocurrency with the largest market capitalization, briefly dropped below $60,000 on the 24th of June. This was the first time the coin hit such levels since the 3rd of May.

However, it did not take long for BTC to recover. At some point, AMBCrypto discovered that Bitcoin reached $62,814, with the broader market expecting higher prices.

But that did not happen as the value changed hands at $61,107 at press time. Before Bitcoin’s price fell to $58,890, traders in the derivatives market had expected the move.

Strong hands send BTC back up

Reason being that the coin experienced heavy sell-offs from the German Government on the 19th of June.

The negative sentiment became worse after it was confirmed that Mt.Gox, the erstwhile crypto exchange would begin distributing $8.6 billion worth of BTC to its creditors by July.

This development sent shockwaves down the spine of market participants with many suggesting weaker conditions for BTC.

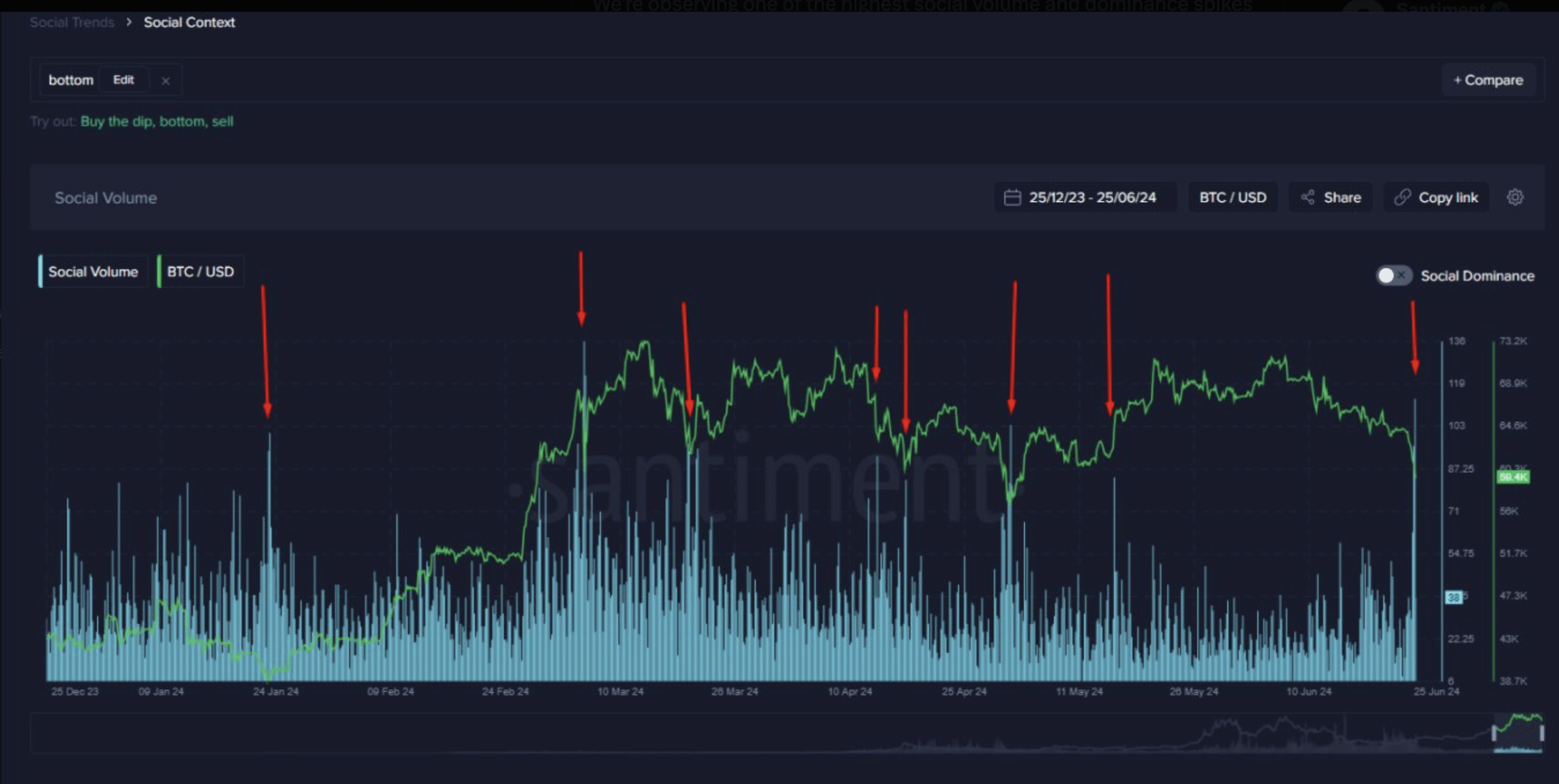

Meanwhile, AMBCrypto found that increased calls for the “bottom” across social media was part of the reasons Bitcoin bounced. The image below obtained from Santiment confirmed this.

Historically, when social volume and dominance of bottom calls spike, it leads to a significant rebound. That was what happened with BTC earlier.

But with the coin erasing some of those gains, will it jump again? Let’s find out.

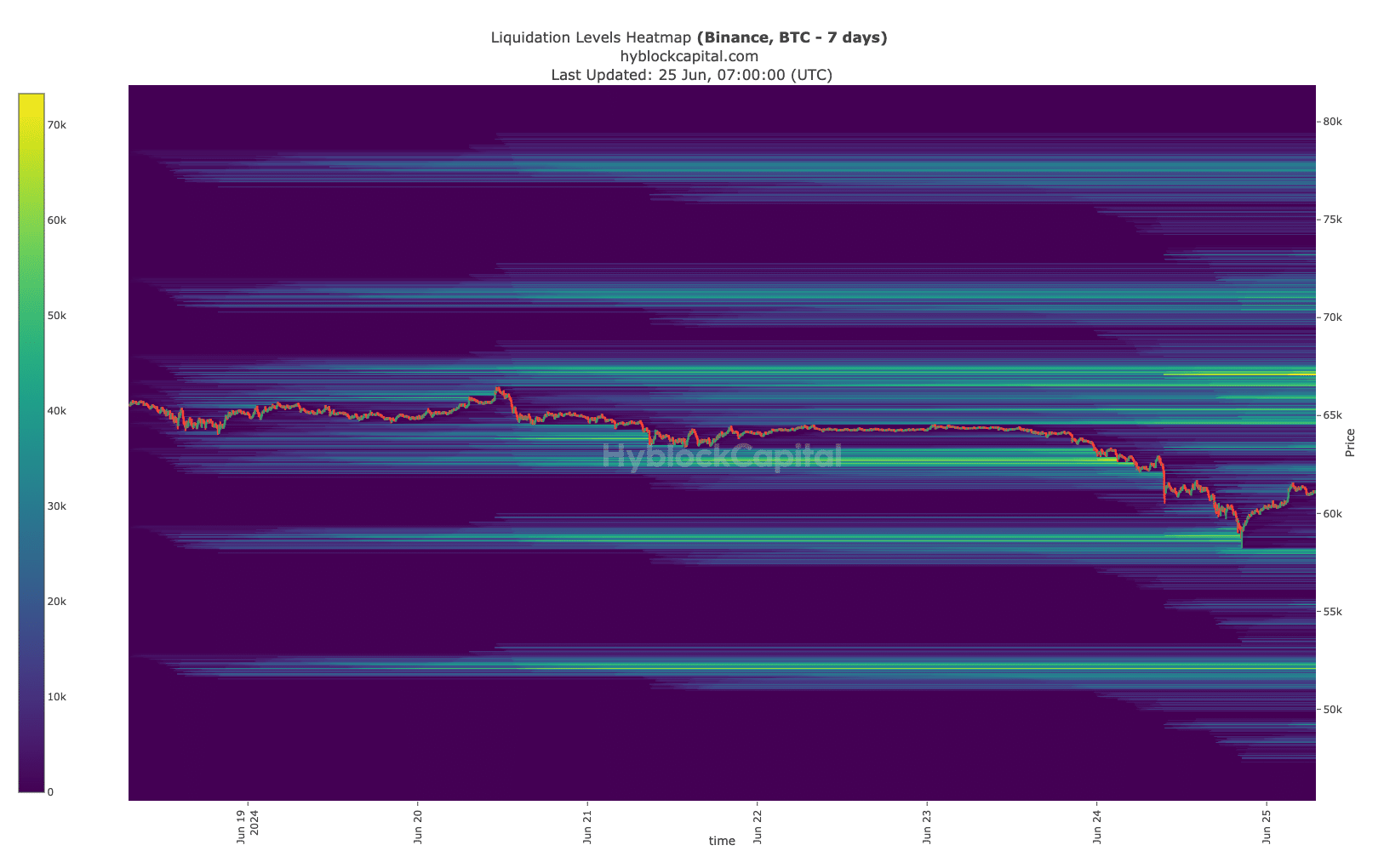

To do this, AMBCrypto examined Bitcoin’s Liquidation Heatmap. This indicator predicts prices where severe liquidations might occur.

Data suggests volatility is not over

Also, the high areas of liquidity suggests that prices could move in that direction. At press time, using data from Hyblock, we observed high liquidity at $64,600. Therefore, if spot buying pressure increases, BTC could hit this level.

Should that happen, many short positions in the market could be liquidated. To the downside, another cluster of liquidity existed at $58,150. This means that if selling pressure increases, Bitcoin could fall below $60,000 again.

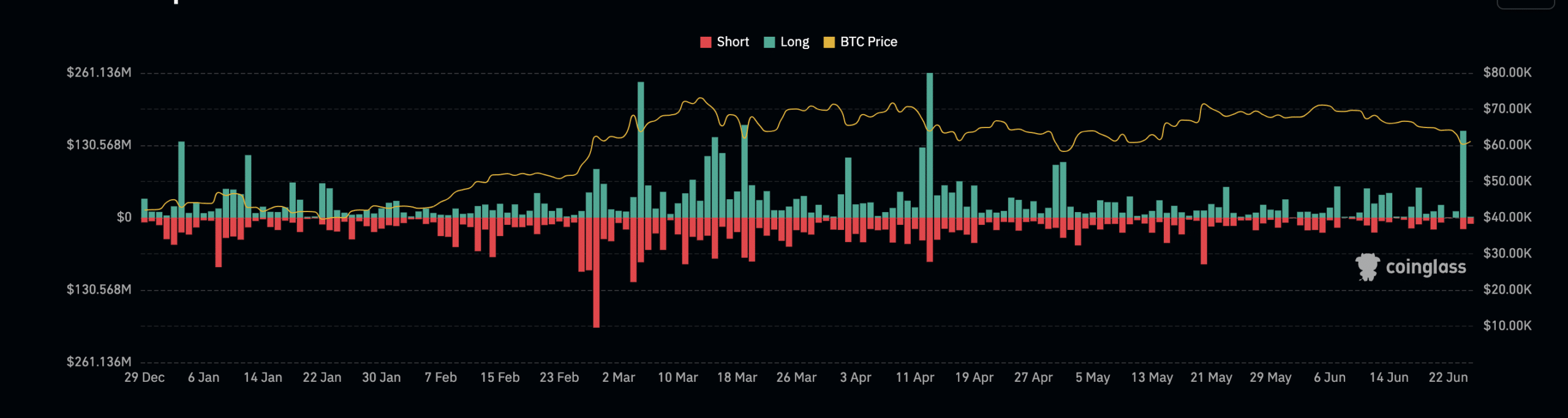

In addition, BTC contracts liquidated in the last 24 hours reached $152.71 million, according to data from Coinglass. Liquidation occurs when a trader can no longer fulfill the margin requirements to keep a position open.

As a result, an exchange closes the position to prevent further losses. For Bitcoin, the high volatility in the market caused the cascade of liquidations.

Notably, long position were the top casualty with $121.65 million wiped out in 24 hours. Shorts, on the other hand, accounted for $31.06 million.

Is your portfolio green? Check the Bitcoin Profit Calculator

Shorts are traders predicting prices to decrease. Long are, however, traders, betting on prices to rise.

Moving on, traders might need to apply caution considering that BTC”s direction in the short term remains a dicey one.

![Ethereum's [ETH] 11% rebound - Is greed fueling a bottom or is fear driving a trap?](https://ambcrypto.com/wp-content/uploads/2025/04/Ritika-8-400x240.webp)

![Will Chainlink's [LINK] retest flip support into resistance?](https://ambcrypto.com/wp-content/uploads/2025/04/Renuka-57-400x240.webp)