Bitcoin breaks $60k: Will $88k by September be the next BTC milestone?

- BTC’s price increased by more than 3% in the last 24 hours.

- Most metrics and indicators were bullish on the coin.

Bitcoin [BTC] has, after several weeks, shown signs of recovery as it crossed the $60k mark. While this development looked optimistic, the latest analysis suggested that BTC might reach new highs in 2024. Let’s have a look at BTC’s metrics to see whether that’s likely to happen.

Bitcoin’s road to new highs

CoinMarketCap’s data revealed that in the last 24 hours, the king of crypto’s price increased by more than 3%, allowing it to cross $60k once again. At the time of writing, BTC was trading at $60,172 with a market capitalization of over $1.17 trillion.

Thanks to that, more than 83% of BTC investors were in profit.

Things might get even better in the coming days, as Titan of Cryptos, a popular crypto analyst, posted a tweet pointing out an interesting development. As per the tweet, a right-angled descending broadening wedge pattern appeared on BTC’s chart.

If BTC tests the pattern, then the recent price rise might just be the beginning of a massive rally. In fact, the upcoming rally might push BTC to $88k in September. If that actually happens, then 100% of BTC investors will be in profit.

Is Bitcoin ready for a pump?

Since the analysis revealed the possibility of a massive bull rally, AMBCrypto planned to have a look at its metrics to find out what they suggest.

Our analysis of CryptoQuant’s data revealed that BTC’s net deposit on exchanges was lower compared to the average of the last seven days. This means that the buying pressure on the coin was high.

Its binary CDD was green, indicating that long-term holders’ movements in the last 7sevendays were lower than average. They have a motive to hold their coins.

Additionally, the miners were also showing confidence in BTC. This was evident from the fact that its Miners’ Position Index (MPI) was green, hinting that miners were selling fewer holdings compared to its one-year average.

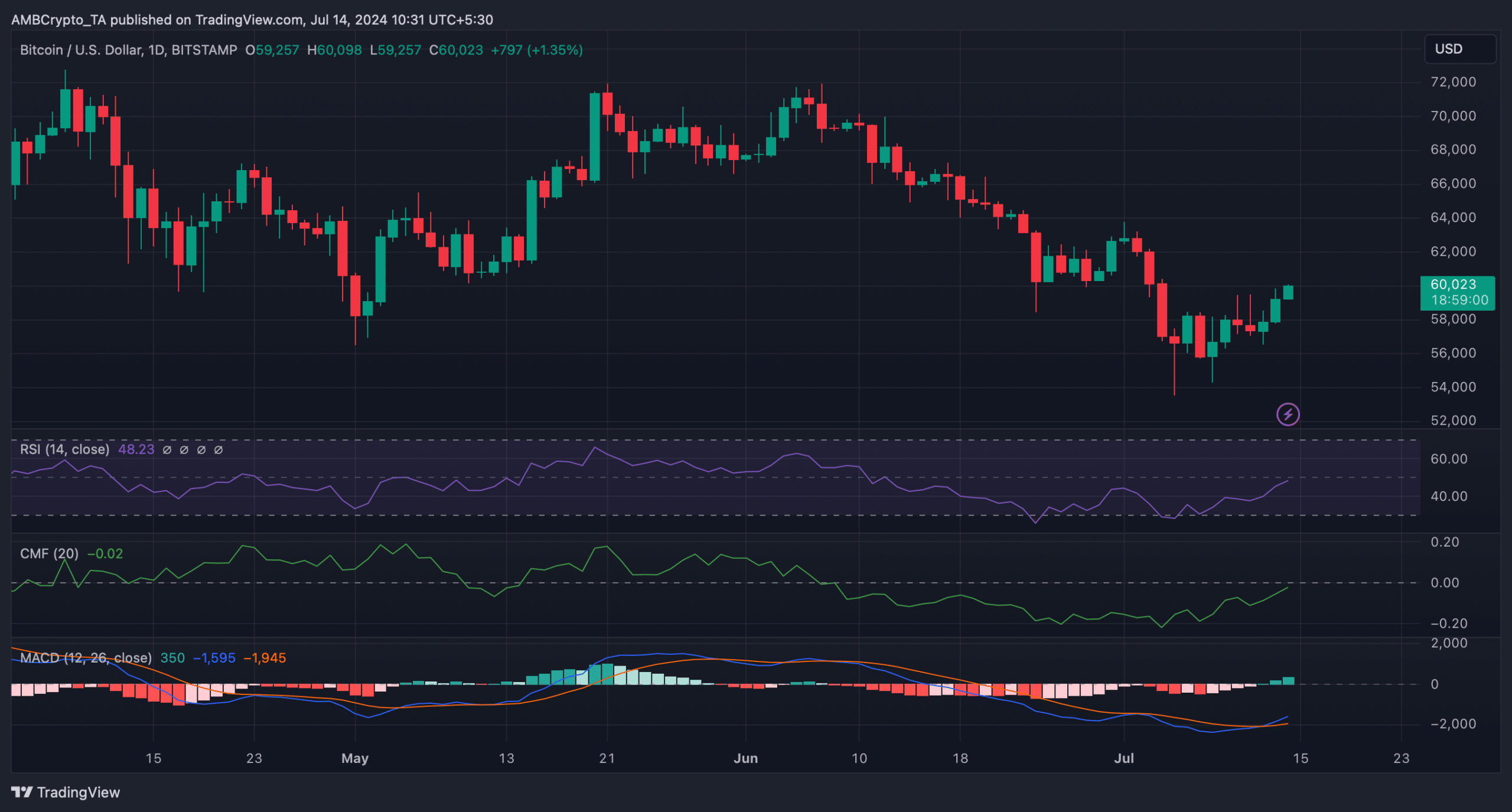

We then took a look at the coin’s daily chart to see what market indicators suggested. We found that most of the indicators were in the bulls’ favor and hinted at a continued price rise.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

For instance, the MACD displayed a bullish crossover. Its Relative Strength Index (RSI) registered an uptick.

A similar increasing trend was also noted on the coin’s Chaikin Money Flow (CMF) chart, suggesting that BTC might continue to increase its value and reach a new high by September.