Bitcoin breaks $71k: Should you cash in today or HODL?

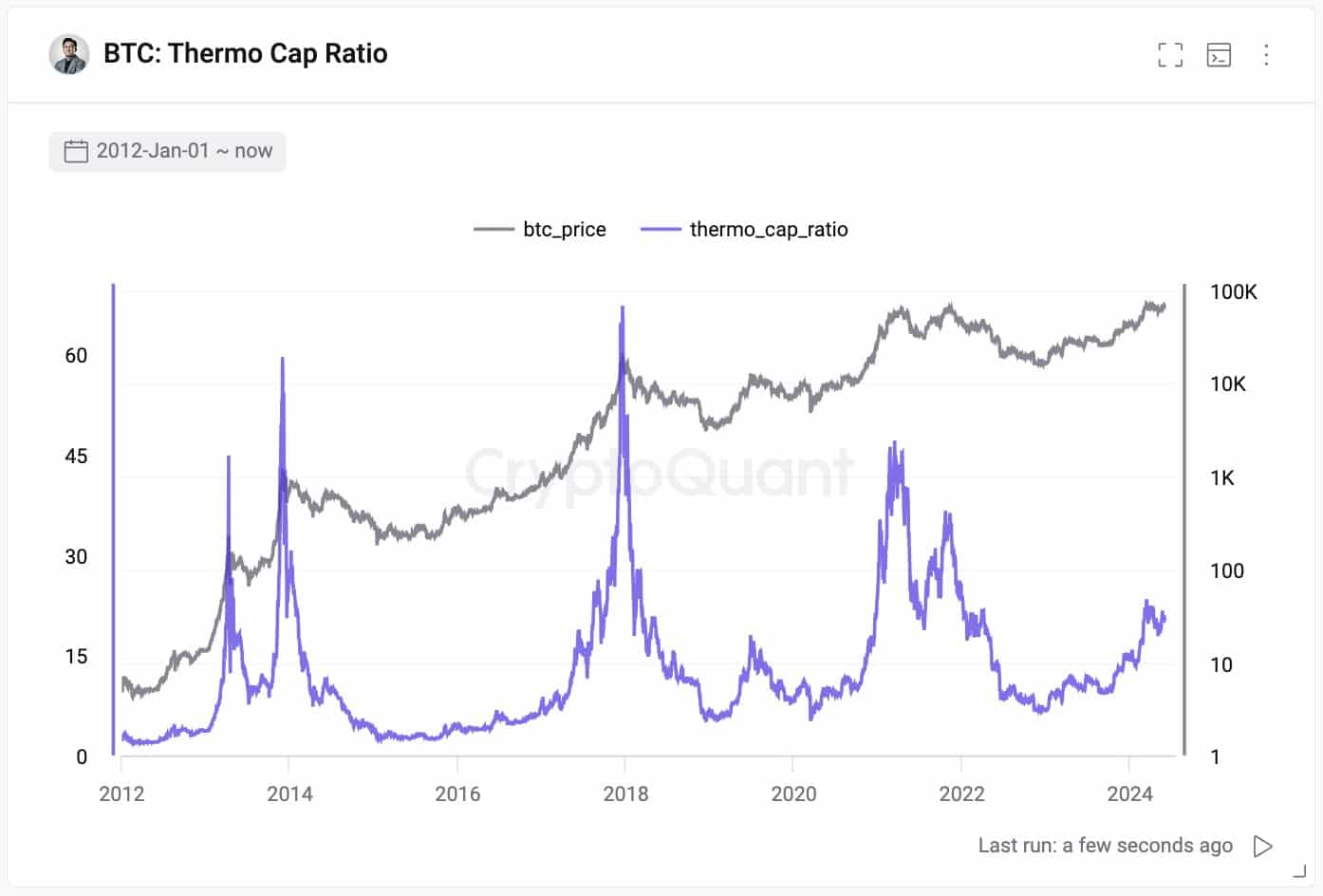

- Bitcoin has a strong thermo cap ratio that underlined strong investments into the network.

- The transaction volume and unrealized profits metrics suggested Bitcoin’s overvaluation and potential correction, respectively.

Bitcoin [BTC] posted strong gains in the hours before press time, gaining 3% in the last 24 hours. It was trading at $71.1k at press time but faces resistance at the $71.4k zone. The lack of trading volume recently meant there’s a chance of another range formation.

While the lower timeframe price action lacked a bullish spark, the higher timeframes were very much bullish still. A set of metrics showed that Bitcoin has strong network fundamentals, but there’s also a question about whether BTC might be overvalued.

Investment in the Bitcoin network has remained strong

In a post on X (formerly Twitter), CEO of CryptoQuant Ki Young Ju stated that Bitcoin was not overvalued based on network fundamentals. The Thermo Cap metric was high, showing strong network fundamentals.

Source: Ki Young Ju on X

The Thermo Cap metric is the cumulative value of all the Bitcoin mined thus far. Hence, it represents the total investment cost into the network. The Thermo Cap ratio divides the market capitalization of Bitcoin by the Thermo Cap.

It has steadily trended higher in the past eight months but was nowhere close to the previous cycle highs. Consequently, it is likely that the current Bitcoin prices might not be the end of the bull run.

Is it time for you to book profits on your holdings?

Source: CryptoQuant

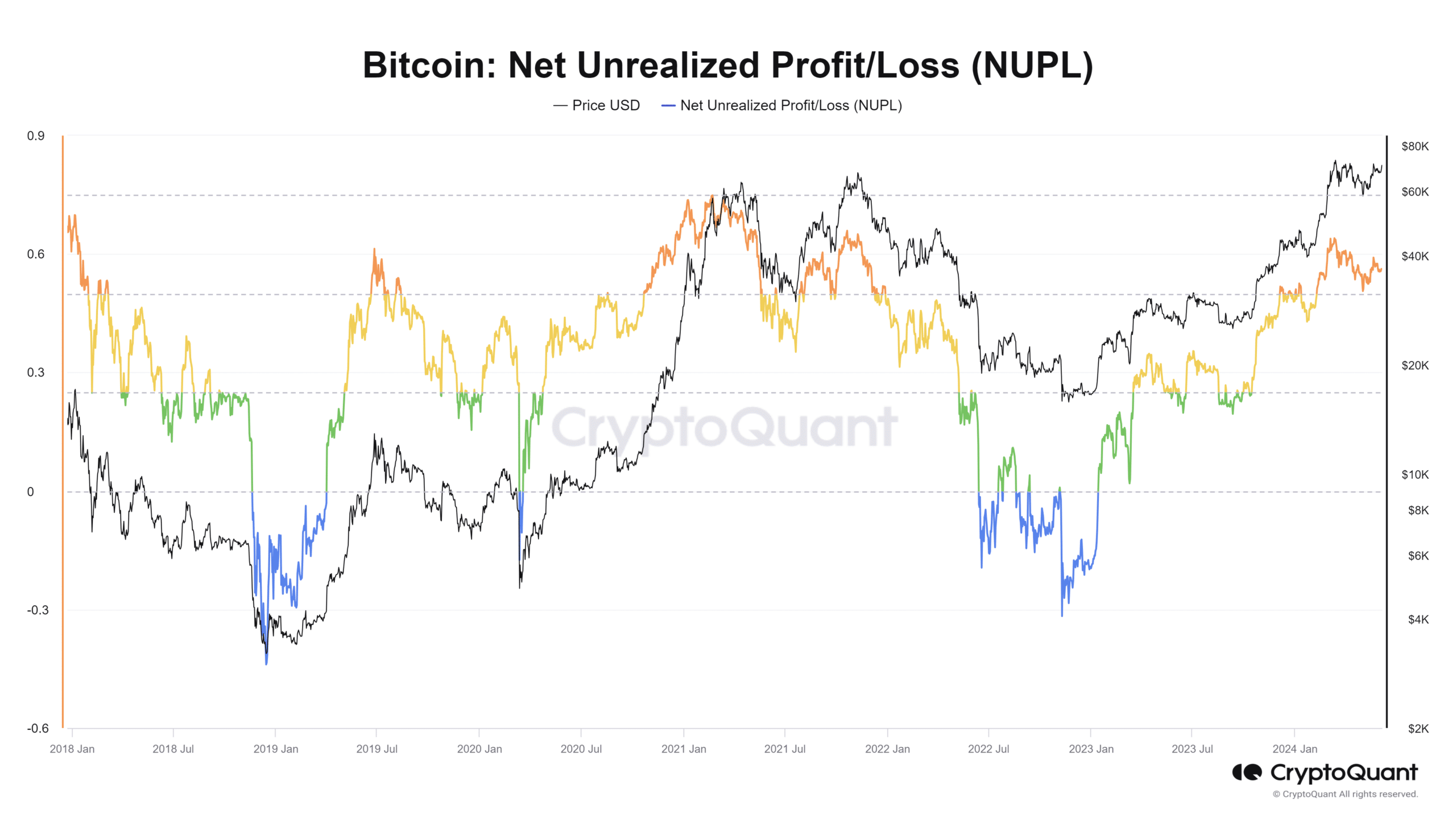

The Net Unrealized Profit/Loss metric was above 0.5 which generally occurs during a bull run. It is the ratio of investors in profit, and with so many holders in the money, it showed that holders have good reason to book profits.

A value above +0.7 usually comes around the cycle top. While Bitcoin is not there yet, there is a chance of a sharp correction. Every bull run in the past has had sharp retracements of 20% or more followed by a quick recovery.

Source: CryptoQuant

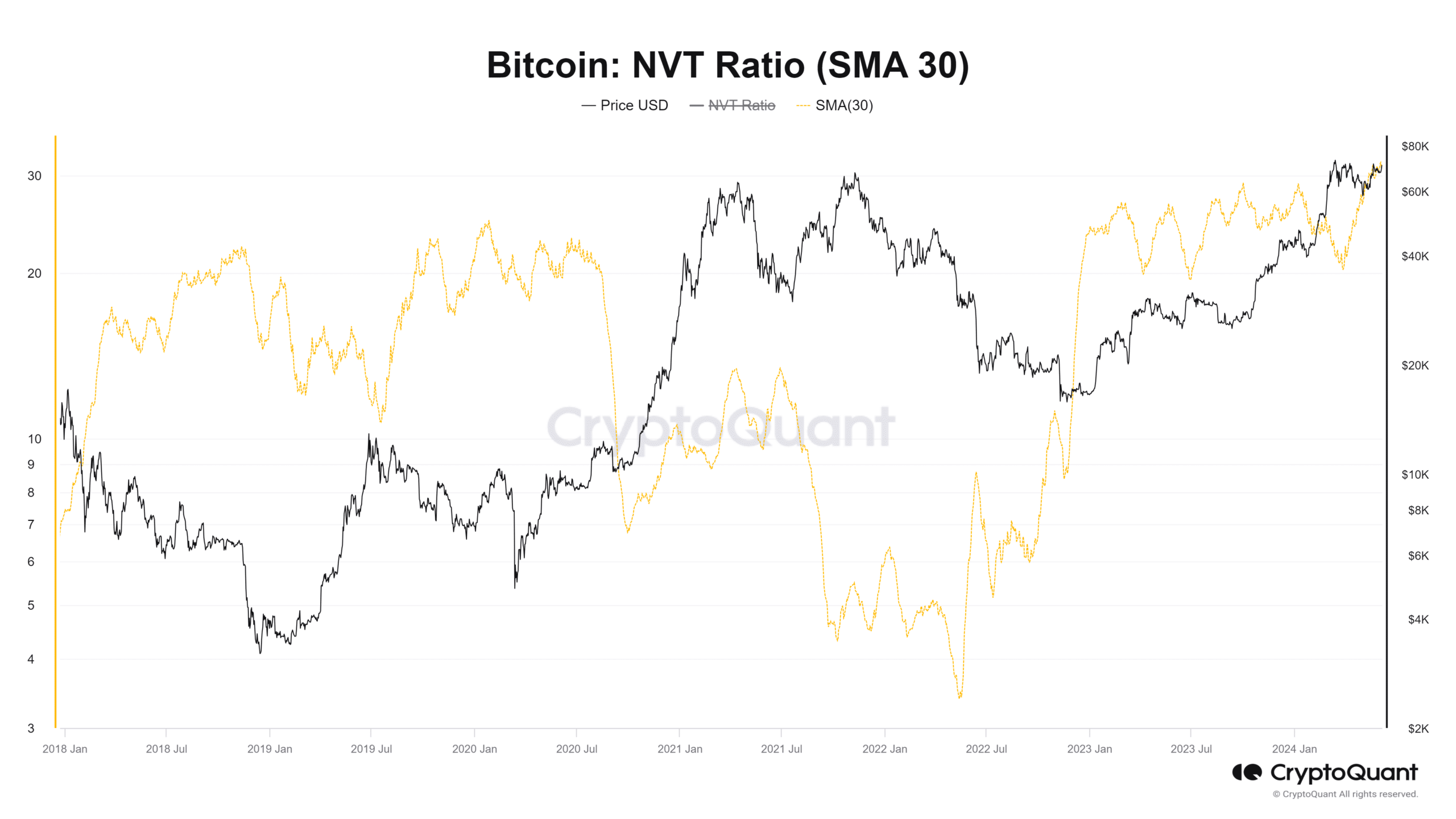

The Network Value to Transactions is the market capitalization divided by the transacted volume. The 30-day simple moving average has trended higher in recent months.

It was a signal that, compared to the network’s ability to transact BTC, it is overvalued. This does not necessarily mean we will see a correction.

Read Bitcoin’s [BTC] Price Prediction 2024-25

In recent years, with the prominent example being Michael Saylor and MicroStrategy, Bitcoin is seen as an inflation hedge as well as a transaction network.

The rising NVT ratio might be reinforcing this idea, instead of demonstrating that BTC is overvalued.