How Bitcoin’s HODLers, miners reacted to BTC crossing $61K, briefly

Update – Since publication, BTC has fallen below $60k on the price charts.

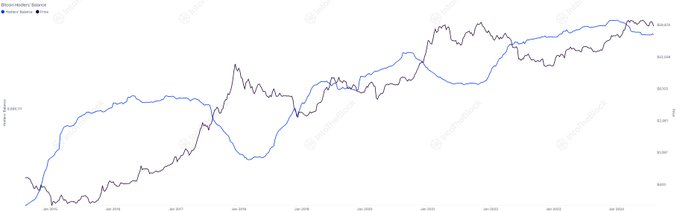

- Bitcoin HODLers controlled 12.87M BTC at press time, shaping market cycles and signaling potential trends.

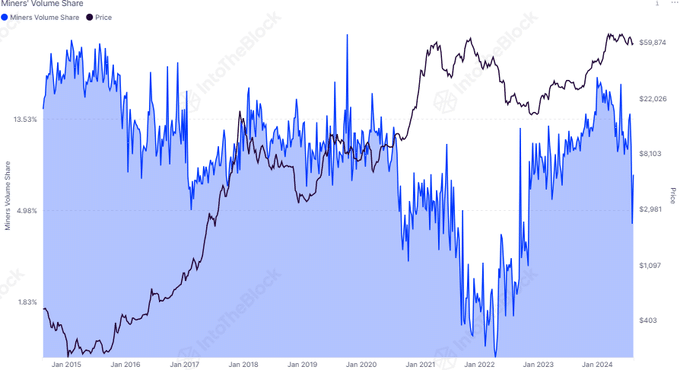

- Miners’ influence on Bitcoin price weakened as their volume share dropped to 7.4%, reducing market volatility.

Bitcoin [BTC] recently surged past $61,000 during early Asian trading hours on Wednesday, recovering from a significant price drop earlier in the month.

As the leading asset in the crypto market, Bitcoin’s performance is often seen as a barometer for broader market trends.

According to IntoTheBlock data, Bitcoin HODLers – long-term investors who hold onto their assets despite market fluctuations – controlled 12.87 million BTC at press time.

This group is known for accumulating Bitcoin during bear markets and strategically selling during bull markets.

The substantial amount of Bitcoin under their control signaled their continued influence in shaping market trends.

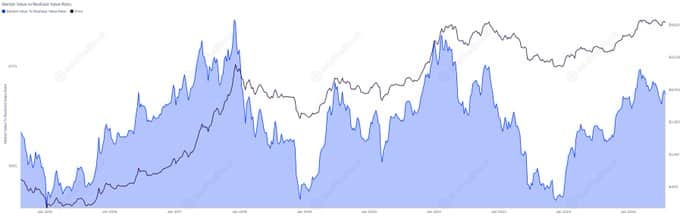

Meanwhile, the current Market Value to Realized Value (MVRV) ratio was 1.86, indicating that Bitcoin’s market value was 86% higher than its realized value.

While this suggested that Bitcoin might be slightly overvalued, it does not point to an extreme overvaluation.

Historical data showed that similar MVRV levels have coincided with market peaks in 2017 and 2021, while lower MVRV ratios were observed during market bottoms in 2018 and 2022.

Miners’ diminishing market influence

In August 2024, Bitcoin miners’ volume share declined to 7.4%, marking a decrease compared to earlier in the year. This reduction in miners’ share indicates that their influence on market prices has diminished.

Miners traditionally sell portions of their mined Bitcoin to cover operational costs, and a lower selling volume can contribute to market stability.

This trend of reduced selling pressure from miners suggested a potential easing of supply-side constraints on Bitcoin’s price.

With miners selling less, the market may experience less volatility, providing a more stable environment for traders and investors.

Market sentiment and network activity

Moreover, 81% of Bitcoin addresses were in profit at press time, reflecting strong market sentiment. However, this percentage is subject to change, illustrating the cyclical nature of the market.

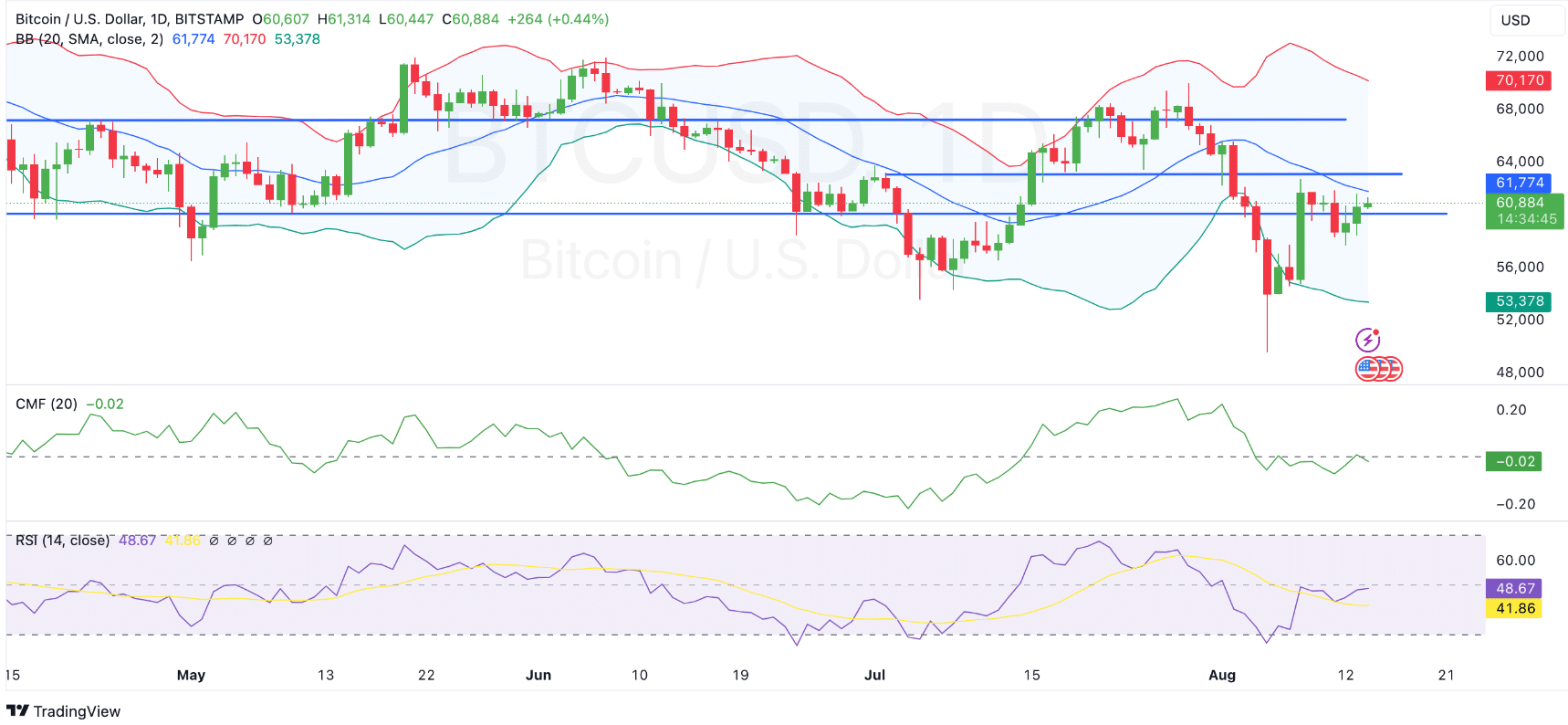

The Bollinger Bands, a technical indicator used to measure market volatility, are narrowing, suggesting a phase of reduced volatility and potential price consolidation.

The Chaikin Money Flow (CMF), which measures buying and selling pressure, is slightly negative at -0.02.

This indicated that selling pressure marginally outweighed buying pressure, pointing to a cautious market sentiment.

At press time, the Relative Strength Index (RSI) was at 48.66, just below the neutral level of 50, signaling neither overbought nor oversold conditions.

The RSI’s recent trends hint at a potential recovery if positive momentum builds.

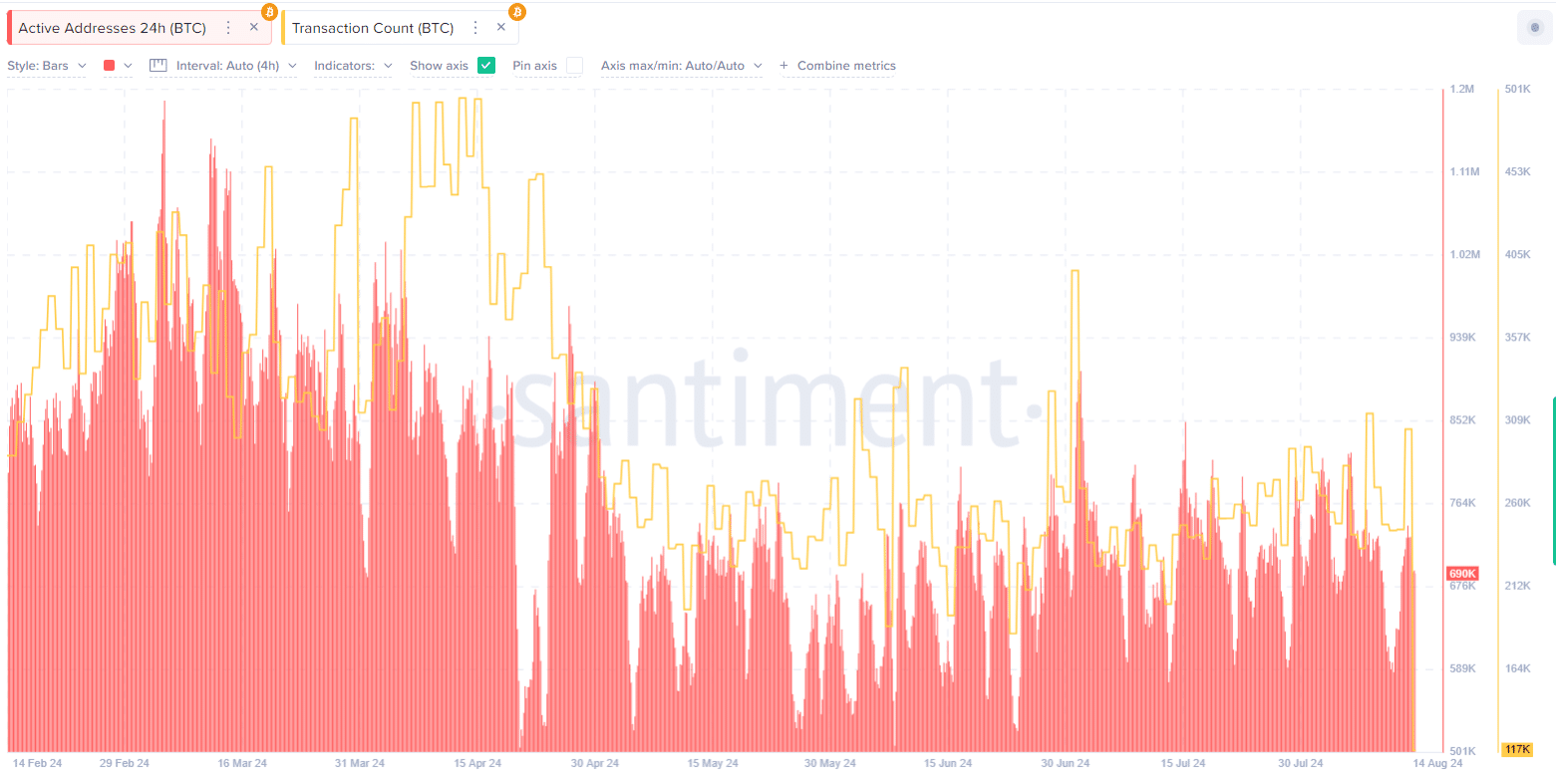

Bitcoin’s network activity remained steady as well, though it was slightly reduced from peak levels earlier in the year.

The number of active addresses was 690.41K, reflecting consistent user engagement, while the transaction count was 117.89K.

Is your portfolio green? Check out the BTC Profit Calculator

Despite the decrease from earlier highs, the transaction count appears to be stabilizing, indicating ongoing, albeit reduced, activity on the network.

This stable activity level is crucial for maintaining the network’s overall health and functionality.