Bitcoin [BTC] attempts another resistance breakout: Will it crack $30,000

![Bitcoin [BTC] attempts another resistance breakout: Will it crack $30,000](https://ambcrypto.com/wp-content/uploads/2023/03/BTC-michael-AMBCrypto_bulls_running_while_bitcoin_lurks_in_the_background_cc2f6f61-f2bf-4ded-992e-7660dccb3f48.png.webp)

- Bitcoin saw a higher net outflow despite large exchange outflows.

- Support retest yielded some sell pressure, but long-term holders were still going strong.

Bitcoin [BTC] peaked at $29,380 on 24 March before experiencing a resurgence of sell pressure. Fast forward almost one week later, and the bulls are showing their strength once again.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Bitcoin crossed back above the $29,000 price point within the last 24 hours, raising bullish hopes that it will soon cross the $30,000 mark. But how likely is this outcome before the end of the week, especially now that the price has to contend with resistance?

Recent market observations may offer some insights into what to expect. For example, on 30 March, Glassnode revealed that Bitcoin’s Percent Supply Last Active 1+ Years was at a new ATH.

? #Bitcoin $BTC Percent Supply Last Active 1+ Years just reached an ATH of 68.090%

View metric:https://t.co/1j255TMTVz pic.twitter.com/cpiDmxXEjT

— glassnode alerts (@glassnodealerts) March 30, 2023

The Glassnode observation suggested that the amount of HODLed Bitcoin was still growing. However, there was also a surge in sell pressure over the last few days. Bitcoin’s daily on-chain exchange outflow peaked at $1.1 billion while inflows were lower at $921 million. The cryptocurrency has thus been experiencing more sell pressure.

? Daily On-Chain Exchange Flow#Bitcoin $BTC

➡️ $921.0M in

⬅️ $1.1B out

? Net flow: -$148.1M#Ethereum $ETH

➡️ $580.6M in

⬅️ $444.9M out

? Net flow: +$135.7M#Tether (ERC20) $USDT

➡️ $646.1M in

⬅️ $851.7M out

? Net flow: -$205.6Mhttps://t.co/dk2HbGwhVw— glassnode alerts (@glassnodealerts) March 30, 2023

Will Bitcoin bulls yield to prevailing sell pressure?

A look at Bitcoin’s press time position explained why it had been experiencing sell pressure. The upside, especially within the last 24 hours at press time, pushed back into the ascending resistance line. As such, many investors have been taking profits, thus triggering the pullback to the $28753 press time price.

Bitcoin was likely to experience sell pressure with the resistance line retest. Enough sell pressure may trigger more downside, while a bullish dominance may push past resistance and possibly above $30,000.

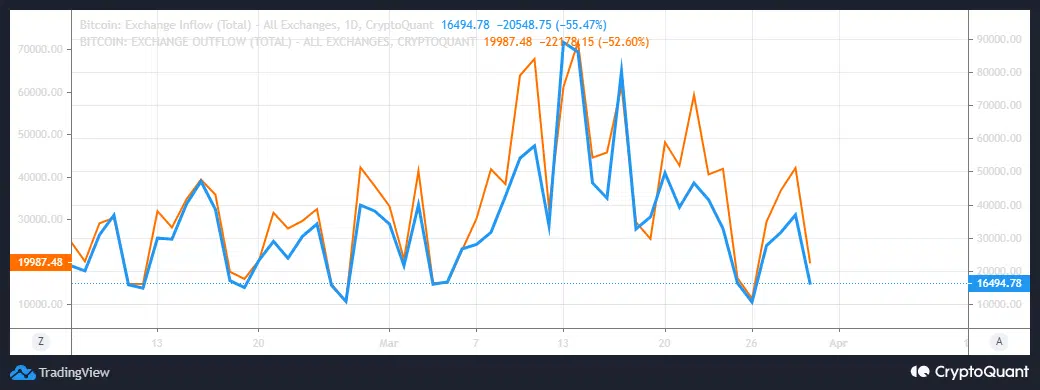

A look at exchange data revealed that both inflows and outflows were down notably in the last 24 hours. However, exchange outflows slightly dominated at 22,178 BTC, compared to exchange inflows at 20,548 at the time of writing.

How many are 1,10,100 BTCs worth today?

Investors should also note that Bitcoin open interest in the derivatives market is back to its two-month highs, an indication that there was strong demand for BTC in the derivatives market. This surge was accompanied by an uptick in the demand for leverage, as indicated by the estimated leverage ratio.

The last time that both metrics peaked at the same level was on 19 March. This was followed by a bit of sell pressure, but it was not enough to trigger a large pullback. The fact that the same metrics are back at the same level confirmed relative strength, but the bears may not be far behind.