Bitcoin [BTC] bears gain edge against the bulls- Is it right time to short

![Bitcoin [BTC] bears gain edge against the bulls- Is it right time to short](https://ambcrypto.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_miner_wearing_mining_gear_at_the_market_2c279ef0-d765-40e7-abfb-7c005fd2d2cb.jpg.webp)

- Bitcoin experienced a net outflow in the last three days; short positions may not be a good idea.

- Bitcoin whales demonstrate mixed reactions that explain the current stalemate.

In the last few days, we have seen Bitcoin [BTC] struggle to sustain its upside. Now the market is showing some bullish weakness and the bears are trying to take advantage. The next few days might bring forth a significant pullback and here’s why.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Recent data suggests that Bitcoin’s failure to continue rallying past the $28,300 resistance level yielded a loss of confidence among investors. The situation was further exasperated by miner outflows which are currently at a monthly high according to the latest glassnode data.

? #Bitcoin $BTC Miners' Outflow Volume (7d MA) just reached a 1-month high of $1,801,563.42

Previous 1-month high of $1,771,798.83 was observed on 23 March 2023

View metric:https://t.co/zngg8o32ix pic.twitter.com/zqdO6P7CSn

— glassnode alerts (@glassnodealerts) March 25, 2023

Bitcoin miner outflows are often considered a confidence indicator. This is because miners often hold on to their BTC when there are bullish expectations and sell when there are bearish expectations.

It is thus not surprising that they are offloading some BTC, right after Bitcoin struggled to push beyond its current resistance level.

Will Bitcoin outflows lend favor to the bears?

The Bitcoin miner observations also align with BTC’s -$119 million net flows in the last 24 hours according to glassnode alerts. This is slightly lower than the -$190.5 million net flow on 24 March and even lower than the -$342 million net flow on 23 March.

? Daily On-Chain Exchange Flow#Bitcoin $BTC

➡️ $729.1M in

⬅️ $848.4M out

? Net flow: -$119.2M#Ethereum $ETH

➡️ $576.6M in

⬅️ $701.4M out

? Net flow: -$124.8M#Tether (ERC20) $USDT

➡️ $1.1B in

⬅️ $1.4B out

? Net flow: -$332.9Mhttps://t.co/dk2HbGwPL4— glassnode alerts (@glassnodealerts) March 25, 2023

It is important to note that the net flows confirm that sell pressure has also been slowing down. In other words, Bitcoin might not necessarily be in for a strong bearish pullback this week contrary to expectations. This will, however, depend on the possibility of market events that may swiftly change the outcome.

How many are 1,10,100 BTCs worth today?

The lower net flows may explain why short sellers may not necessarily be keen on executing leveraged positions. Bitcoin’s estimated leverage ratio is currently down to its lowest level since the start of 2023. Meanwhile, funding rates have leveled out for the most part.

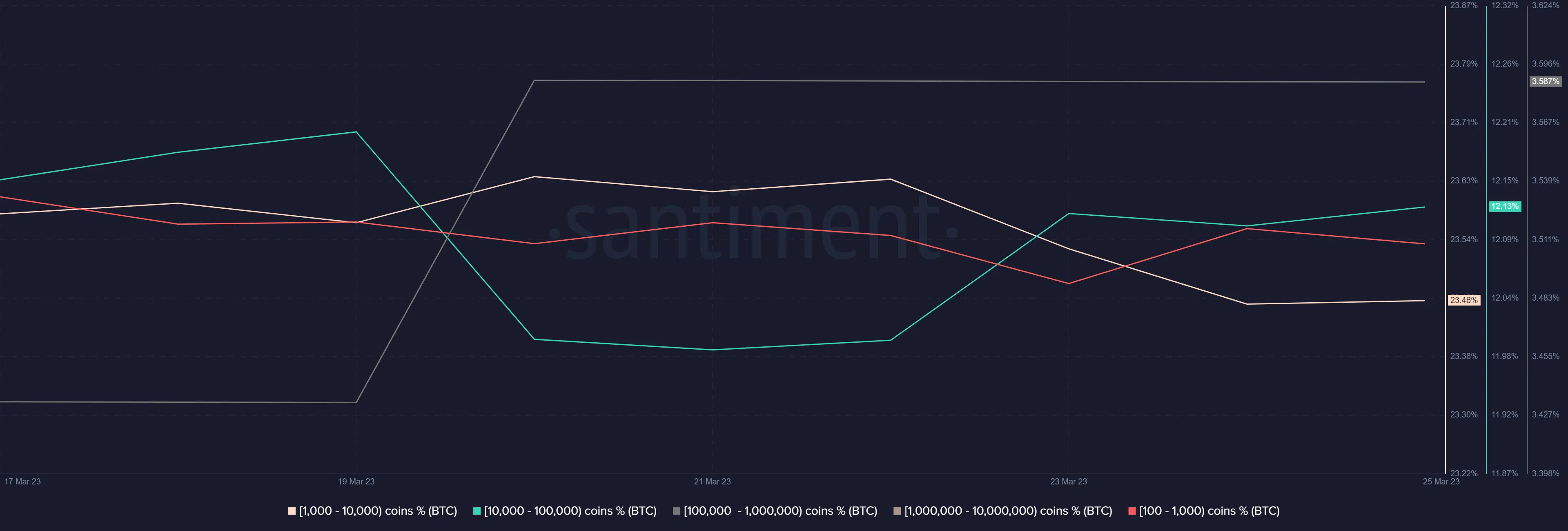

The lack of confidence among short sellers and leverage traders reflects mixed observations with Bitcoin’s supply distribution. For example, addresses holding between 10,000 and 100,000 BTC have been buying in the last three days, hence providing a cushion for the price. The same whale category currently controls 12.13% of the circulating supply.

On the other hand, addresses holding between 1,000 and 10,000 BTC have been selling in the last three days. The same addresses currently control 23% of the total BTC supply, hence their impact is more pronounced.