Bitcoin [BTC]: Here are a few signals that point to a strong possibility of a recovery

Bitcoin price seems to have found its stable footing at $29,100 after a recent flash crash below it. This quick recovery and retest will be a testament to the bulls’ power and determine the next course of action for BTC.

Bitcoin price to provide temporary gains

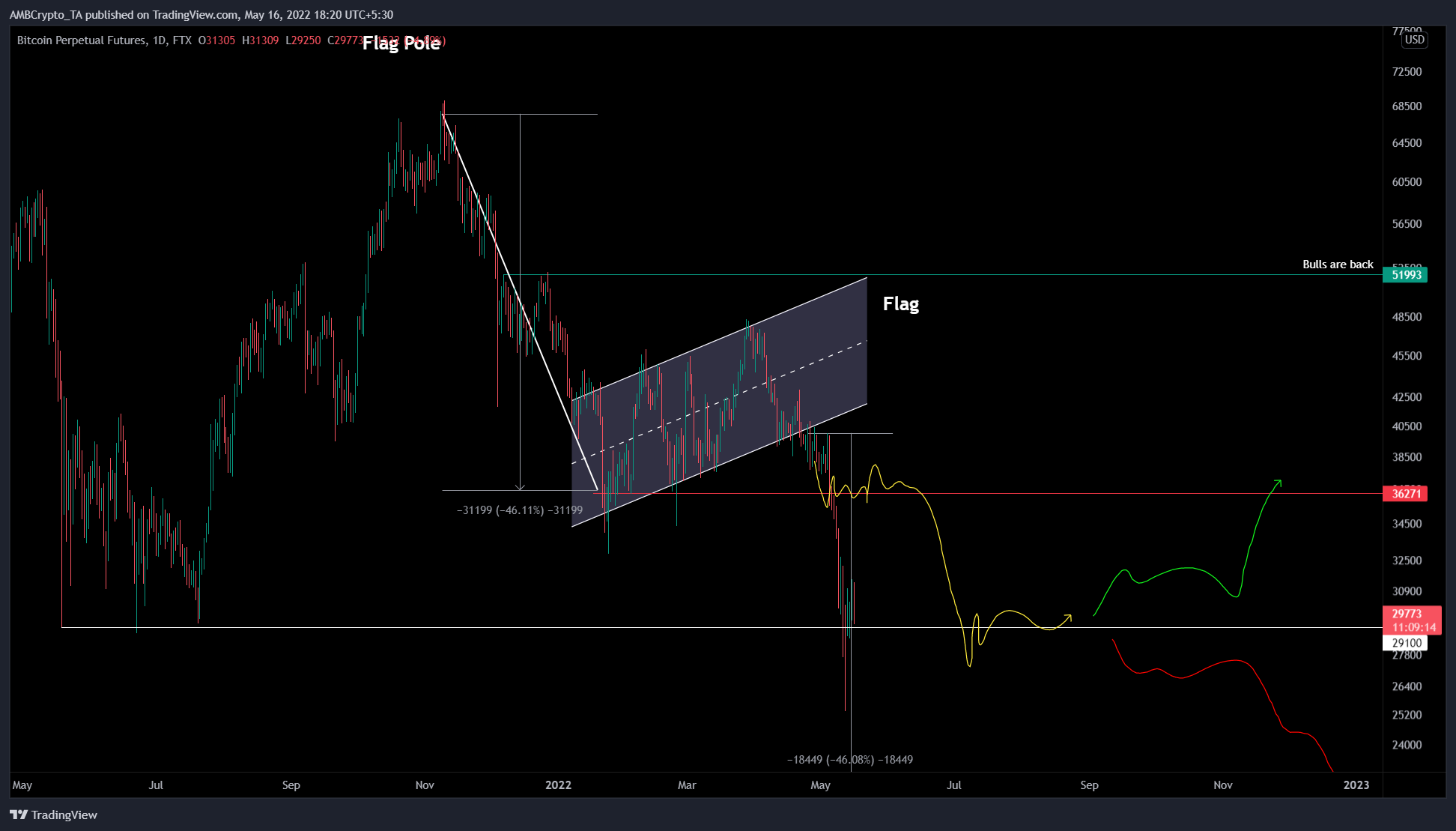

Bitcoin price created a bearish continuation pattern known as a bear flag between November 2021 and April 2022. After a brief consolidation in late April, BTC triggered a breakout from the setup, triggering a massive sell-off.

The pattern contains a massive downswing known as “flagpole” followed by a consolidation phase known as “flag.” A breakout from this coiling-up often results in the price continuing its descent, which is why the setup is referred to as the continuation pattern.

This technical formation forecasts a 46% downswing, determined by adding the flagpole’s height to the breakout point. On April 22, BTC breached the flag’s lower trend line at $40,032, forecasting a target of $21,584.

So far, the post-FOMC volatility combined with the LUNA-UST debacle has stirred the market and caused it to crash violently. As a result, BTC dropped to $25,333, taking altcoins with it. However, the recovery of Bitcoin price seems to be going well as it is back above the $29,100 support level.

If bulls can manage a successful retest, it will reveal that a further uptrend is likely. In such a case, investors can expect a move to $35,100. This uptrend would constitute a total of 17% gain and is likely where the upside is capped.

Further removing the uncertainty for the retail investors’ minds is the recent tweet from the Luna Foundation Guard (LFG). The announcement stated that LFG has sold 80,081BTC from its reserve that held 80,394 BTC.

1/ As of Saturday, May 7, 2022, the Luna Foundation Guard held a reserve consisting of the following assets:

· 80,394 $BTC

· 39,914 $BNB

· 26,281,671 $USDT

· 23,555,590 $USDC

· 1,973,554 $AVAX

· 697,344 $UST

· 1,691,261 $LUNA— LFG | Luna Foundation Guard (@LFG_org) May 16, 2022

This news suggests that a further sell-off seems unlikely, which could push buyers to start bidding.

The tweet further stated,

“The Foundation is looking to use its remaining assets to compensate remaining users of $UST, smallest holders first. We are still debating through various distribution methods, updates to follow soon.”

Supporting this outlook for Bitcoin price is the supply on the exchanges chart. This index tracks the number of BTC held on exchanges, which could be interpreted as a potential sell-side pressure. In case of a sell-off, investors would not think twice and could panic sell, causing a cascade of sell orders that could steepen the downswing.

However, for Bitcoin, the number of tokens held on centralized entities has fallen by 50,000 BTC, denoting an effective decline in the potential sell pressure. This development falls in line with the bullish outlook from a technical perspective

Therefore, investors can expect BTC to rally in the near future.