Bitcoin [BTC] holders anticipating a bear market floor should read this

Bitcoin [BTC] prices have been unusually volatile in recent weeks. This can be considered in contrast with the broader financial markets (equities, credit, and currency markets) that have been significantly volatile within the same period, as per Glassnode’s latest report.

While there were speculations that BTC investors sought to establish a bear market floor, Glassnode, considered some on-chain metrics to drive home this point further.

Learning from the history books

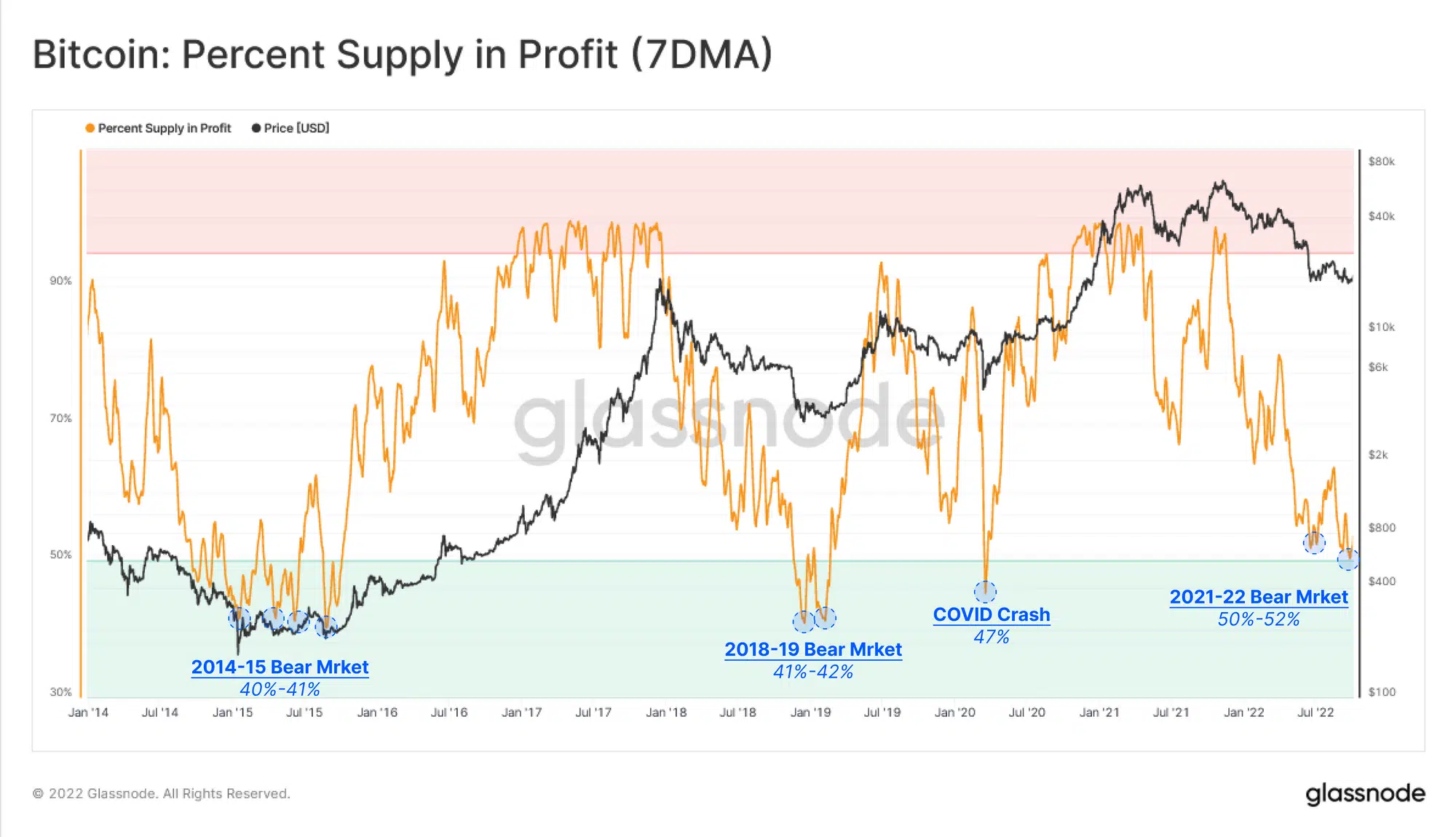

Firstly, Glassnode considered BTC’s Percent Supply in Profit. According to it, tracking the declining supply in profit was a useful tool for identifying “points of elevated financial stress, which have exhausted sellers in previous cycles.”

In previous bear markets, BTC’s percent supply in profit during the bottom formation stages ranged from 40% to 42%. However, in the current bear market, Glassnode found that 50% of BTC’s circulating supply remained as unrealized profit. This, according to the blockchain analytics platform, indicated that,

“Supply profitability remains elevated in relation to historical analogues. This insinuates a full detox in profitability may not have occurred yet.”

Furthermore, Glassnode considered BTC’s relatively unrealized profit metric. Taking a trip down memory lane, the analytics firm discovered that each time the aggregated Unrealized Profit compressed to circa 30% of BTC’s market capitalization, sellers that initially ravaged the market ended up exhausted. In the current market, the price decline since the all-time high of November 2021 caused the metric to decline to 0.37.

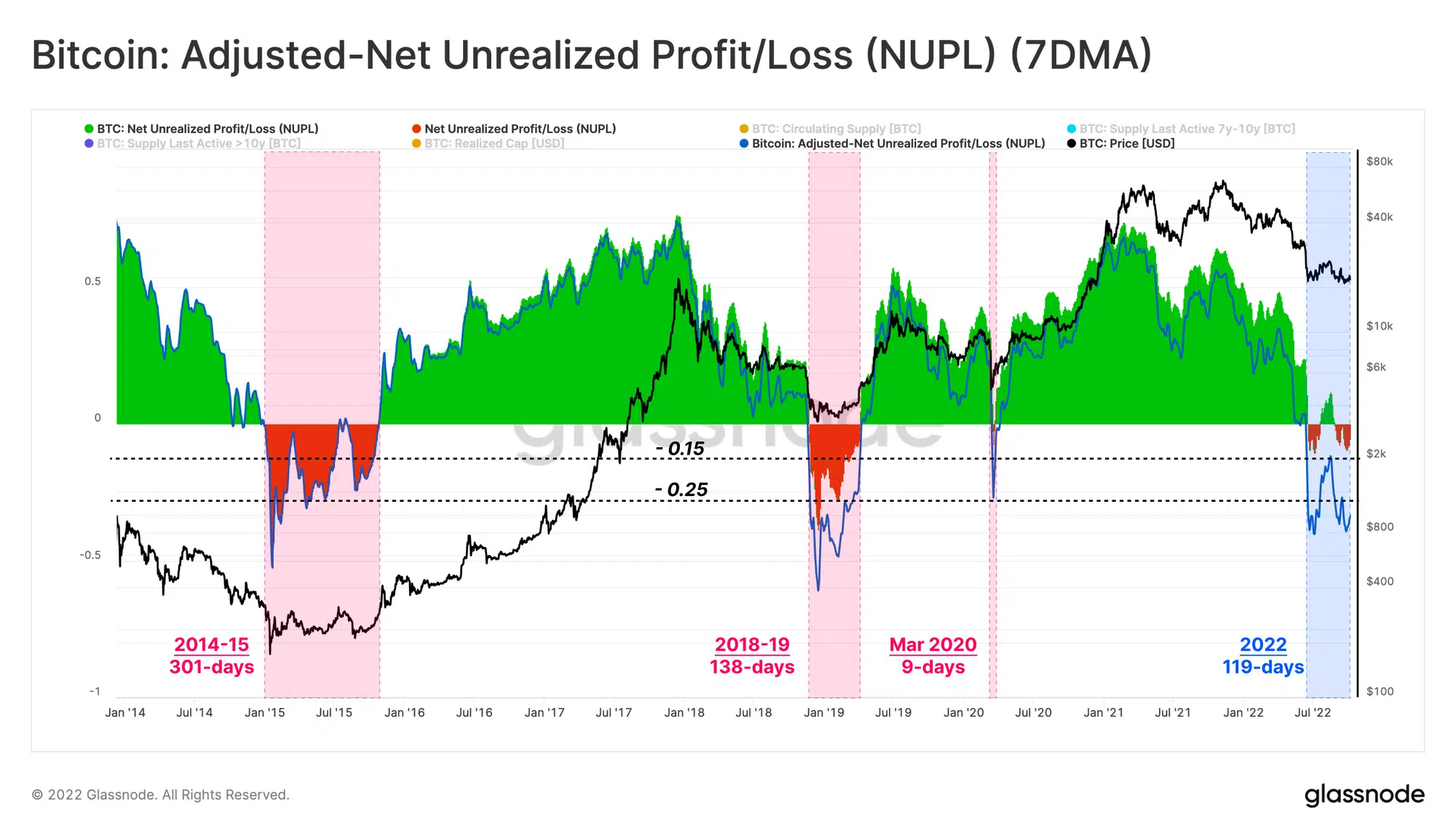

Glassnode also looked further at BTC’s Net Unrealized Profit/Loss metric (NUPL). This was used to assess the difference between unrealized profit and loss of the network as a proportion of the market capitalization.

It found that BTC’s NUPL stood between 0% to -15% since the beginning of June on two separate events, lasting a total of 88 days so far. Furthermore, in previous markets,

“NUPL has traded down to levels lower than -25% in prior cycles and remained negative for between 134-days (2018-19) and 301-days (2014-15).”

Glassnode then assessed BTC’s Adjusted-Net Unrealized Profit/Loss (aNUPL) metric to correct for any contribution from inactive BTC supply. And the intelligence platform found that,

“aNUPL has been trading below zero for the last 119 days, which is comparable with the time length of prior bear markets’ bottom formation phase.”

How has the pain been distributed?

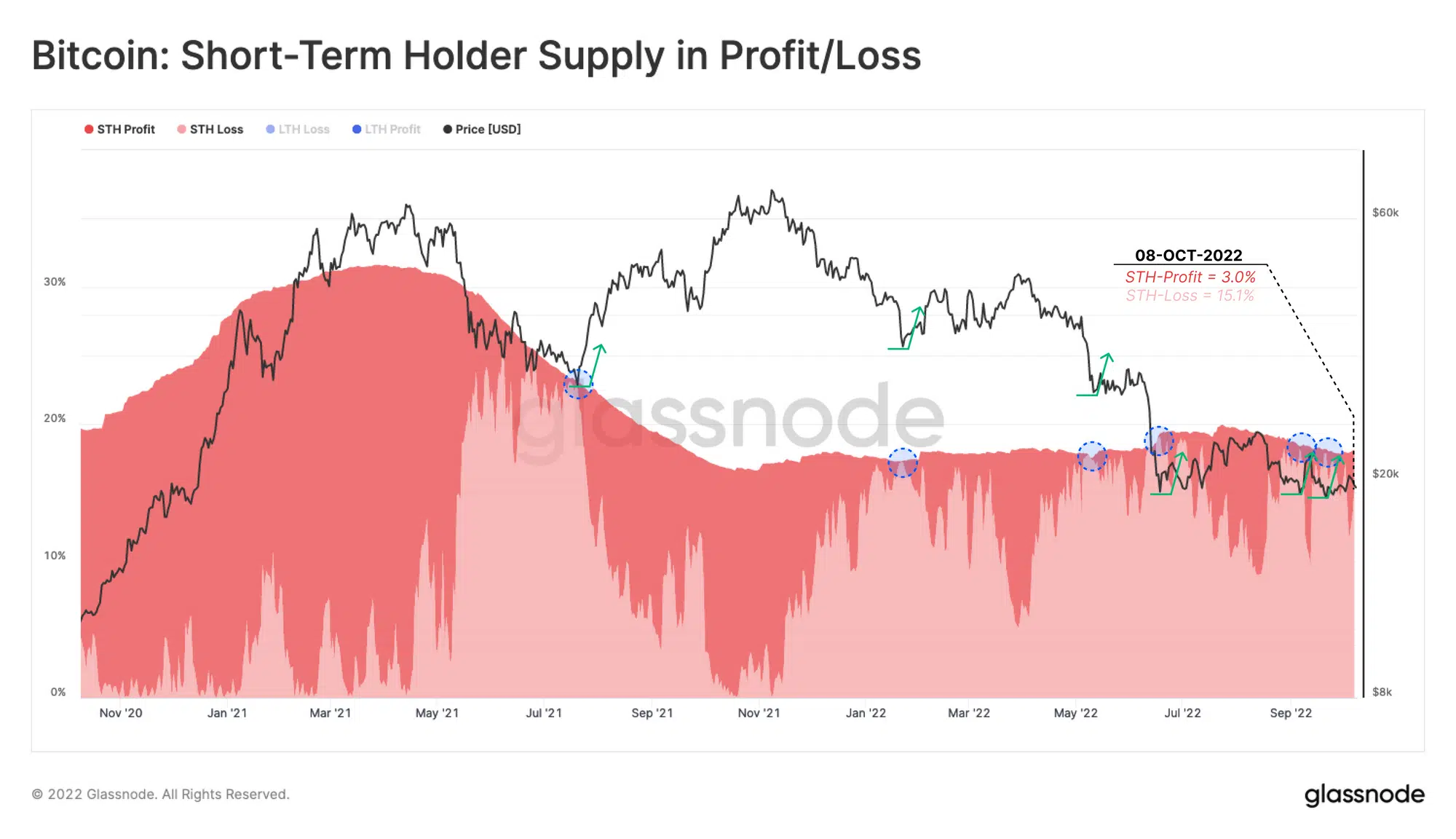

Upon looking at the category of BTC investors that suffered the most “financial stress,” Glassnode looked at BTC’s Short-Term Holder Supply in Profit/Loss and Long-Term Supply in Loss metrics.

Presently, 18% of BTC’s total supply was held by short-term holders. 15% was held at an unrealized loss, while 3% of BTC’s supply held by short-term holders was held in profit.

According to Glassnode, this 3% “is likely approaching a degree of seller exhaustion” following the prolonged decline in BTC’s price.

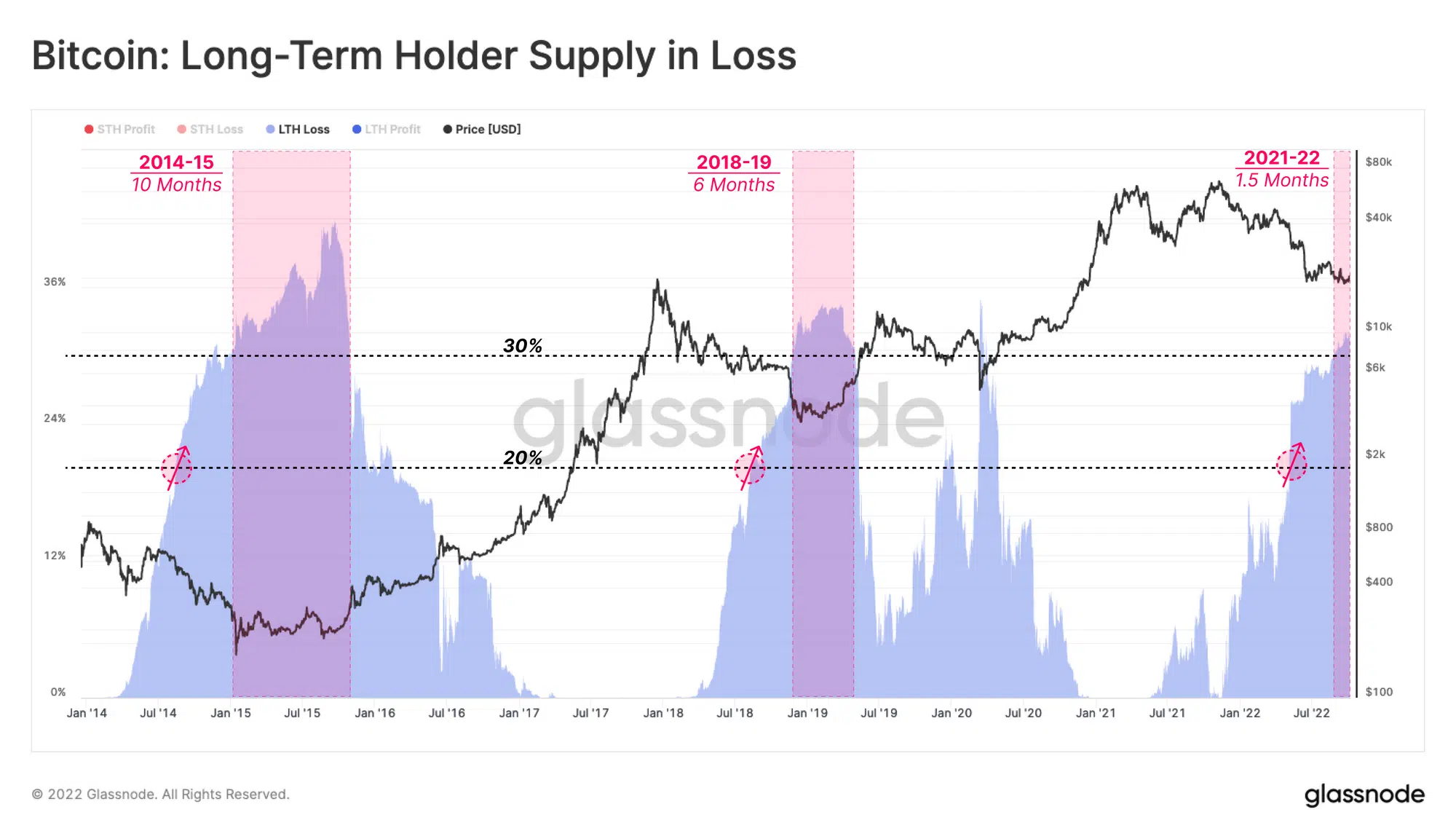

As for BTC long-term holders, 31% of the coin’s total supply was held by this category of investors at a loss. Historically, when BTC’s Long-Term Supply in Loss exceeded 20% of the total supply, the likelihood of capitulation amongst long-term investors heightened.

However, with the metric at 31%, it was possible that the market may have passed this stage. According to Glassnode this scenario,

“Suggests a similar condition to prior bottoming formations. The market has been in this phase for 1.5 months, with a previous cycle duration ranging from 6 to 10 months.”