Bitcoin [BTC]: Of Epoch drawbacks and surging adoption

- Bitcoin user adoption increased despite the decline in address growth.

- More BTC transactions have taken place since the last halving.

Despite its occasional hurdles, Bitcoin [BTC] has gained significant traction as the number of non-zero addresses reached an All-Time High (ATH). According to Glassnode, the metric was at 46.1 million at press time.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

This surge in adoption could be linked to a number of factors such as its growing recognition. And this year, the cryptocurrency has shown that it could be a hedge against inflation. This was after the coin’s reaction amid the collapse of several traditional financial institutions.

New entrants have their eyes on the prize

Although this growth might be considered impressive, there has also been a decline in another aspect — the Epoch. The Bitcoin Epoch keeps track of market patterns in terms of address growth between one four-year halving cycle and the following one.

According to Glassnode, the Epoch, at the time of writing, increased by 4.54%. However, the number of addresses added was 16 million, less than the previous cycle, which was 21 million.

#Bitcoin adoption continues to soar as the number of Non-Zero Addresses reaches an ATH of ~46.1M.

When comparing for growth across Epochs, we note a decline in relative growth, but an increase in absolute growth as the number of Non-Zero Addresses continues to expand:

?Epoch… pic.twitter.com/iXFw52Y5eD

— glassnode (@glassnode) May 6, 2023

From Bitcoin’s genesis to the first halving cycle, addresses increased by one million. The second Epoch recorded 8x the first, while the third cycle added another 3x. However, with approximately 368 days till the halving, there was still time for the fourth to follow the same pattern.

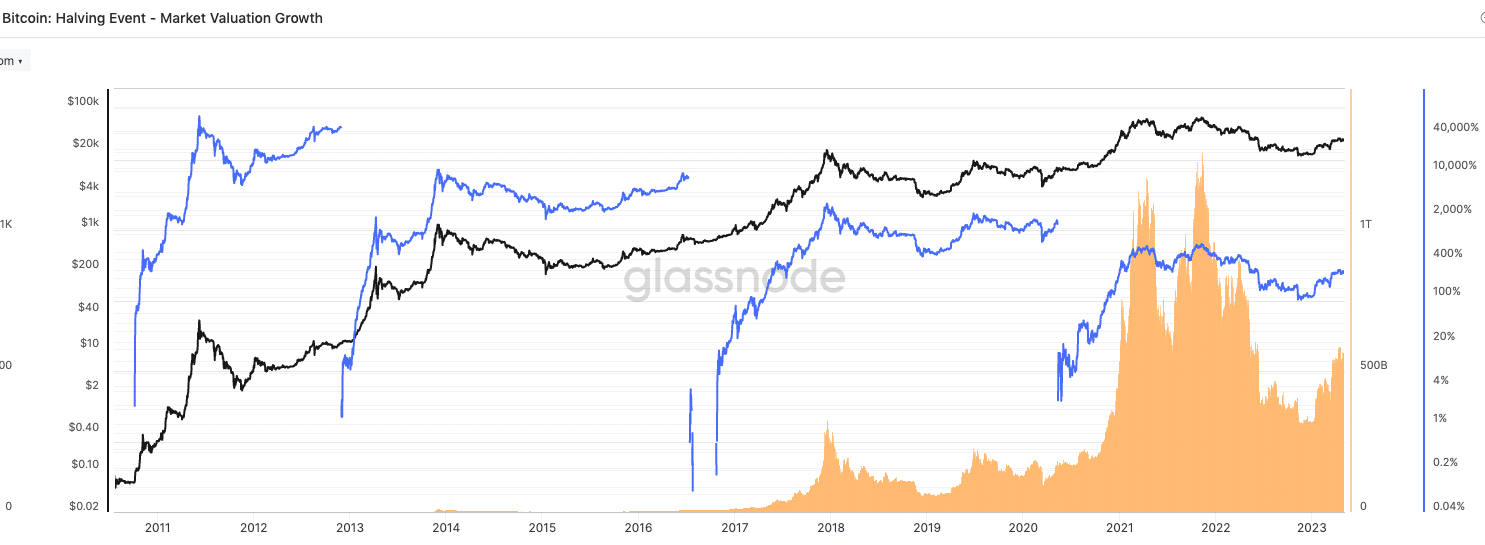

Meanwhile, there has been a notable revival in the Bitcoin market valuation growth since the unfortunate capitulation in 2022. For the unfamiliar, the Bitcoin demand and supply rate determine the market value.

With an indexed growth of 271% since the last halving, the market valuation had increased to $558 billion. This reflects an increase in the demand for the coin and its popularity over a longer period.

BTC building up the hash

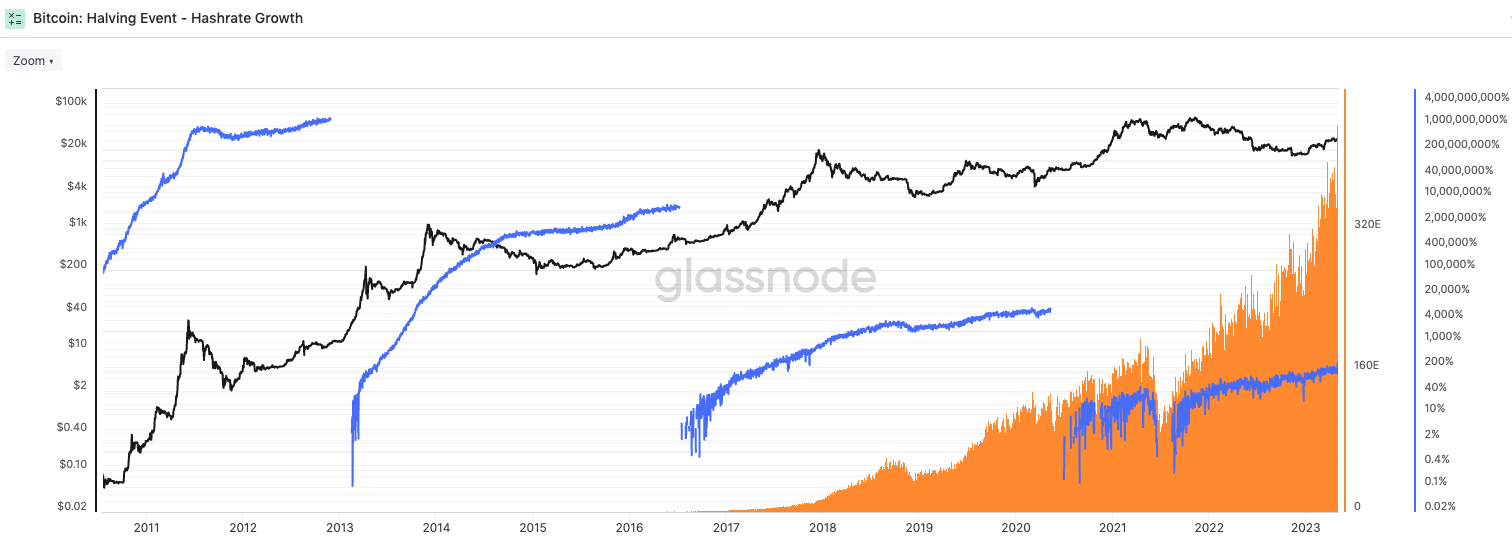

Besides the indexed growth, one metric that has sustainably increased over the last halving period is the hashrate. The Bitcoin hashrate acts as a measure of computational power, and is used to determine the health, mining difficulty, and security within the Bitcoin network.

At press time, the hashrate had grown exponentially by 184.59% as it rose to 439.23 Exahash per second (EH/s).

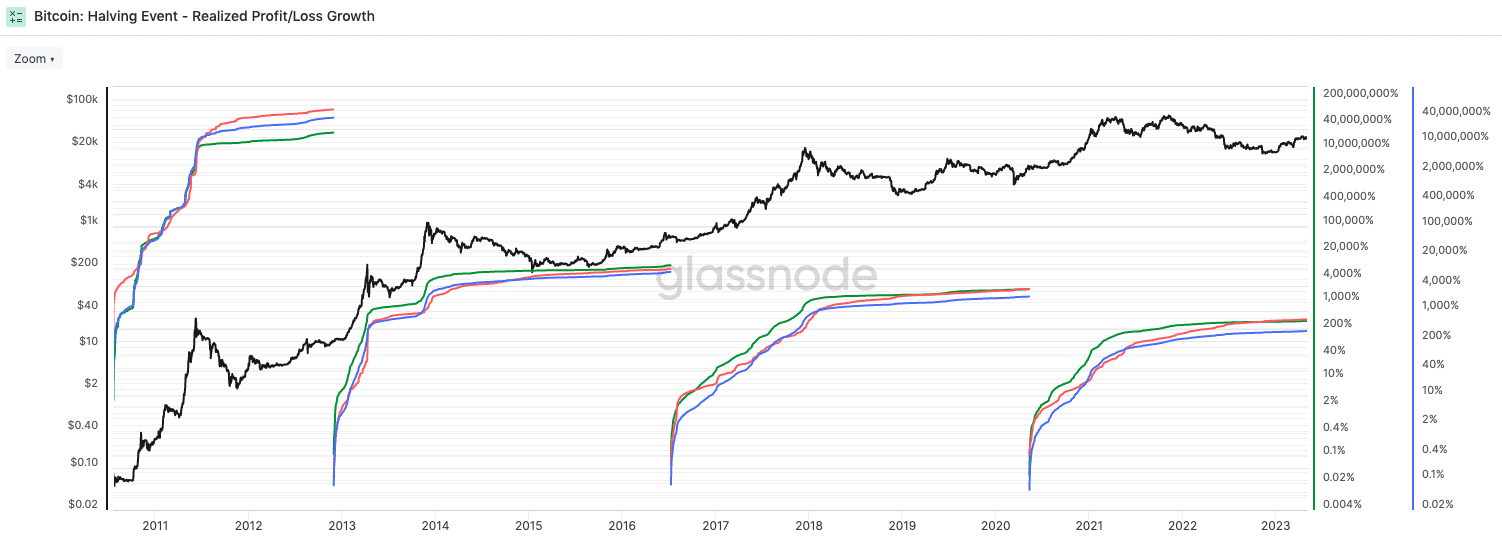

Despite the unfortunate events that rocked the crypto economy over the majority of the quarters in 2022, the realized profit/loss growth improved from the last halving.

Is your portfolio green? Check the Bitcoin Profit Calculator

At the time of writing, on-chain data showed that both realized profits and losses had increased by over 300%. This confirms the notion that demand had subsequently increased, and a lot of coins were used in transactions during the period.

As the halving nears, increased adoption could be bolstered, especially as institutions have been gradually embracing Bitcoin and allocating a portion of their treasury reserves to BTC. Additionally, more retail investors have also been recognizing the potential of Bitcoin as a potential investment tool.